Capital Gains Tax India Guide for Shares & Property

By Filing Buddy . 31 Jan 26

Tiger Global’s $1.6B Gain That Still Got Taxed

Ever sold a stock, mutual fund, or property thinking it was an easy win, only to watch tax season quietly eat into your profit? It happens more often than you think and not just to small investors. Even Tiger Global, one of the world’s largest investment funds, faced it. When they exited Flipkart, the deal generated nearly $1.6 billion in gains, but what looked like a blockbuster payday quickly turned into a tax battle. India’s Supreme Court ruled those gains were taxable in India, exposing them to ₹14,500+ crore in capital gains liabilities and wiping out a big chunk of the upside.

If billion-dollar funds with elite advisors can’t escape capital gains tax, regular investors and founders definitely can’t. The real issue isn’t high tax rates, it’s confusion. Short-term or long-term? 12.5% or 20%? Do you even report it in your ITR? One small mistake can cost lakhs.

That’s exactly why this guide exists, to break capital gains tax in India down into simple, practical rules so you can sell smart, not sorry.

Capital Gains Tax: STCG vs LTCG Made Simple

Before you calculate profits, celebrate exits, or reinvest money, there’s one thing you must decode first:

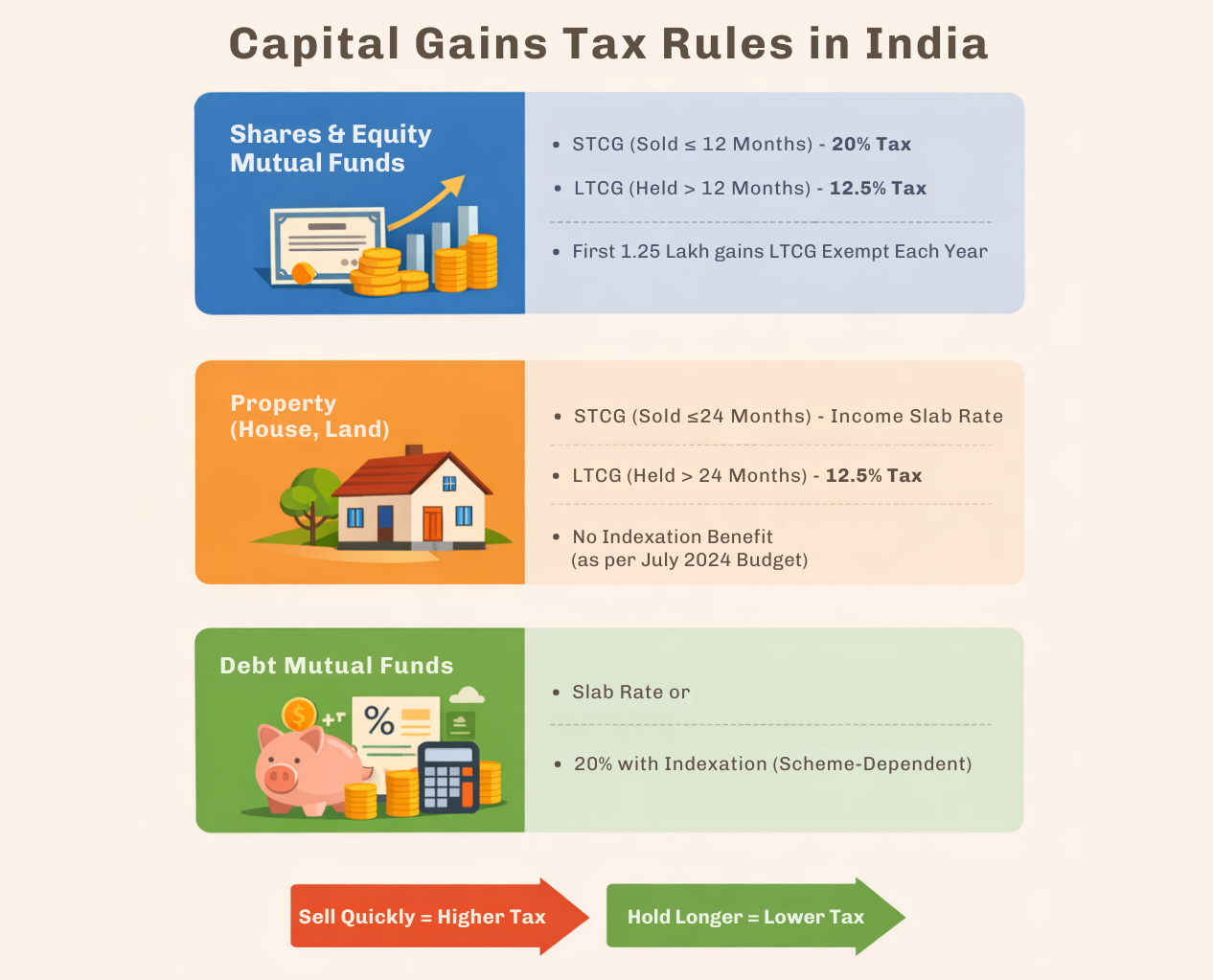

Because in India, your tax doesn’t depend on how much you earned, it depends on how long you held the asset.

Hold longer = lower tax.

Sell quickly = higher tax.

Simple rule. Huge impact.

Let’s break it down without the CA textbook headache.

What Counts as Capital Gains

Anytime you sell an asset for more than you bought it, the profit is called capital gain.

That’s it. No fancy definition.

This applies to almost everything investors touch:

Formula:

Selling Price – Purchase Price – Expenses = Capital Gain

So if you bought shares for ₹5 lakh and sold for ₹7 lakh,

your gain = ₹2 lakh (and yes, tax applies on this)

Many people think: “It’s just profit, not income.”

But the tax department sees it as income from capital gains, and it must be reported in your ITR.

Ignore it, and you’re basically inviting a notice.

Short-Term vs Long-Term (Holding Period Rules)

This is the one rule that controls everything.

Not the size of your profit.

Not how risky the investment was.

Not even how “smart” the deal felt.

Just time.

How long you hold the asset decides how much tax you pay. And a few months’ difference can cost you lakhs.

Here’s the rulebook (save this):

Which is why smart investors don’t just chase returns…they plan exits.

Because post-tax profit > headline profit.

Now that the rules are clear, let’s see how this plays out across different assets in the real world.

Capital Gains Tax Traps That Burn Profits

Here’s the uncomfortable truth: most investors don’t lose money because tax rates are high.

They lose money because of small, avoidable mistakes.

A missed entry.

A wrong ITR form.

One misunderstanding about what counts as a “sale.”

And suddenly your ₹5 lakh profit turns into a tax notice.

The Income Tax Department today already has your broker data, mutual fund redemptions, and property transactions through AIS. If your return doesn’t match their system, you don’t get a reminder, you get a demand.

Let’s look at where people usually mess up.

Common Mistakes You Must Avoid

These are the most frequent capital gains errors we see every filing season:

- Not reporting small trades or SIP redemptions (“too small to matter” mindset)

- Filing ITR-1 instead of ITR-2/ITR-3 for capital gains

- AIS data not matching broker statements

- Forgetting to include ESOP or unlisted share sales

- Missing purchase proofs: department assumes higher gains

- Wrong holding period calculation: STCG taxed instead of LTCG

- Ignoring TDS entries for NRIs or property transactions

- Assuming “no tax payable” means “no reporting required”

Even one of these can trigger scrutiny.

And sometimes, the issue isn’t even a sale, it’s just how the department interprets a transaction.

Even worse, sometimes you can get a tax demand without selling anything.

In ITO vs. Sunita Sanjeev Aeren (ITAT Delhi), her shareholding percentage fell after fresh shares were issued during restructuring. She didn’t sell shares or receive any money. Still, the tax department treated the dilution as a “transfer” and raised a ₹2.53 crore short-term capital gains demand.

ITAT cancelled it, ruling that mere dilution isn’t a taxable transfer.

But imagine the stress and litigation just to prove you owed zero tax.

That’s how aggressive and technical capital gains assessments can get.

Timing & Holding Period Errors Investors Make

The second big trap is poor timing.

Many investors focus only on price and completely ignore the holding period, which directly changes the tax rate.

Common timing mistakes:

- Selling shares at 11 months instead of waiting 12

- Selling property a few months before crossing 24 months

- Frequent buy/sell trades without tracking which lot qualifies as long-term

- Not using FIFO correctly for mutual funds

- Exiting in March without planning tax impact for the year

These small timing errors can mean paying double the tax for the same profit.

Smart investors don’t just plan the entry, they plan the exit date just as carefully.

Because once you sell, the tax is locked in.

Smart Moves & Filing Checklist Before You Sell

Let’s face it: capital gains tax isn’t something you want to learn after your profit hits your bank account. Smart investors think before they sell, not after.

Whether you’re cashing out stocks, redeeming mutual funds, or selling property, a bit of foresight can dramatically reduce your tax bill and eliminate scary notices later. Below are legal planning moves plus a practical checklist to help you stay on the right side of compliance.

Legal Ways to Reduce Capital Gains Tax

Capital gains tax isn’t always fixed. With a bit of planning, you can legally reduce, sometimes even eliminate what you owe. Here are smart, perfectly legal strategies seasoned investors use:

1. Use the ₹1.25 lakh LTCG exemption on equity gains

If your total long-term gains from shares and equity mutual funds in a financial year are below ₹1.25 lakh, you pay zero capital gains tax. Plan redemptions year-wise to stay within this.

2. Time your exits wisely

We already discussed holding periods, but timing a sale so that it qualifies as long-term rather than short-term can make a huge tax difference. Even a few weeks can matter.

3. Consider structured investments or transfers

Sometimes, the way ownership is structured can change tax outcomes.

In an ITAT Mumbai (2023) ruling, a woman sold two gifted flats worth ₹5.98 crore, resulting in ~₹4.21 crore long-term capital gains. Since the flats were transferred through a valid registered gift deed and she reinvested the entire gain into another residential property under Section 54 within the timeline, the tribunal allowed 100% exemption, zero capital gains tax.

Lesson: smart structuring + proper documentation can save crores, completely legally.

4. Set off losses before filing

If you have capital losses (from equity or debt funds, or even property), you can carry them forward and set them off against future gains. Don’t let losses go unclaimed.

5. Use exemptions under Sections 54 / 54F (for property)

If you’re selling residential property and reinvesting in another residential property or certain bonds, you may be eligible for an exemption. Talk to a tax expert to apply these correctly.

These are smart moves, not hacks. They work because they’re in the law, not around it.

7-Point Filing Checklist to Avoid Notices

Even the smartest planning can go sideways if you file incorrectly. Here’s a quick checklist to keep you safe:

- Match your broker statements with AIS before filing: Don’t let mismatches trigger automatic demands.

- Choose the correct ITR form (usually ITR-2/ITR-3): Capital gains don’t belong in ITR-1.

- Include proof of purchase and sale: Dates and costs matter, especially for the holding period.

- Declare each sale under the correct asset category: Shares, mutual funds, property, tick the right boxes.

- Report long-term gains separately with exemption details: If you’re claiming an exemption, provide a schedule and proof.

- Verify TDS entries (especially for property/NRIs): Sometimes the department already has TDS data, match it.

- File before the due date and respond to notices promptly: Delays can mean interest and penalties.

Think of this checklist as your pre-flight safety routine for tax season. Skip one step, and you’re inviting trouble or at best, extra work and stress.

Smart tax planning isn’t about paying less illegally, it’s about paying only what you owe and not a rupee more.

And when you combine smart exits with careful filing, you keep more of your profits and avoid the headaches most investors deal with each year.

Pay Less Tax, Not More Penalties

Capital gains tax isn’t designed to punish you.

But poor planning definitely does.

By now, three things should be clear:

- Know your holding period: STCG vs LTCG alone can change your tax from 20% to 12.5%

- Match the right rule to the right asset: shares, mutual funds, and property are all taxed differently

- Plan before you sell, not after: exemptions, reinvestments, and clean reporting can save lakhs (sometimes crores)

Capital gains tax isn’t designed to punish you, but poor planning definitely does.

Know your holding period. Match the rule to the asset. Plan before you sell.

Do that, and you keep more of your profits instead of paying penalties.

And if you’d rather skip the guesswork, Filing Buddy’s experts can handle your capital gains reporting and ITR filing end-to-end, so you stay focused on growing wealth, not decoding tax rules.

Stay compliant. File smart. Keep more of what you earn.

FAQs: Capital Gains Tax

1. What is capital gains tax in India?

Capital gains tax is the tax you pay on profit earned from selling assets like shares, mutual funds, or property. If you sell for more than you bought, the profit is taxable and must be reported in your ITR.

2. How is capital gain calculated?

Simple formula:

Selling Price – Purchase Price – Expenses = Capital Gain

Expenses can include brokerage, stamp duty, and transfer costs. Tax applies only on the profit, not the full sale value.

3. What is the difference between STCG and LTCG?

Short-Term Capital Gain (STCG) applies when you sell quickly. Long-Term Capital Gain (LTCG) applies after holding longer. LTCG usually has lower tax rates, which means higher post-tax profits.

4. What is the capital gains tax on shares in India?

- Sold within 12 months → 20% STCG

- Held over 12 months → 12.5% LTCG

- First ₹1.25 lakh LTCG each year is tax-free

5. How are equity mutual funds taxed?

Equity mutual funds follow the same rules as shares. Gains are taxed at 20% if short-term and 12.5% if long-term, with a ₹1.25 lakh annual exemption on LTCG.

6. What is the tax on debt mutual funds?

Debt fund gains are usually taxed at your income slab rate. Some older investments may qualify for 20% with indexation, depending on purchase date and scheme type.

7. What is capital gains tax on property in India?

- Sold within 24 months → taxed as per your slab (STCG)

- Held over 24 months → 12.5% LTCG

Indexation benefit has been removed as per the July 2024 Budget.

8. Do I need to report capital gains in my ITR even if tax is zero?

Yes. Even if your gains fall under exemptions or losses, you must report them in Schedule CG. Non-reporting can trigger notices due to AIS mismatch.

9. Which ITR form should I use for capital gains?

Use ITR-2 or ITR-3. ITR-1 does not allow capital gains reporting. Filing the wrong form can lead to defective return notices.

10. How much LTCG is tax-free on shares?

Up to ₹1.25 lakh per financial year of long-term gains from shares and equity mutual funds is exempt. Plan redemptions across years to use this benefit efficiently.

11. Can I reduce capital gains tax legally?

Yes. Use strategies like holding assets longer, setting off losses, reinvesting in property under Sections 54/54F, and timing sales smartly. Proper structuring and documentation can significantly lower tax.

12. What are common capital gains tax mistakes?

Typical errors include AIS mismatches, using the wrong ITR form, ignoring small trades, missing purchase proofs, and miscalculating holding periods. These often trigger tax notices.

13. How does AIS affect capital gains reporting?

AIS already shows your trades, redemptions, and property sales. If your ITR doesn’t match AIS data, the system may automatically flag it and send a notice or demand.

14. Is share dilution or ESOP change taxable as capital gains?

Not always. Courts have ruled that pure dilution without an actual sale isn’t a transfer. However, ESOP sales or transfers can be taxable. Always check transaction type carefully.

15. When should I plan capital gains tax, before or after selling?

Always before. Once you sell, the tax is locked in. Planning holding periods, exemptions, and set-offs beforehand can save lakhs compared to fixing things during filing season.

Contact Us

An expert will call you within 24 hours. No payment required to get started.

Related Post

How should a start-up complete ITR filing

Business entities must file their ITR annually to comply with the tax laws of their respective countries. It helps the government assess and collect the appropriate amount of income tax from taxpayers and ensures proper accountability of financial activities.

. 3 Mins.png)

5 step checklist for GST compliance in Indian Startups

Learn about how GST works. The basics of GST along with its compliances. Uncover what your business needs to keep in mind concerning GST rules and GST compliance.

. 3 min read.png)

₹20 Lakhs and Beyond: Understanding GST for Freelancers in India

Are you a freelancer or aspiring to be one? In this blog, uncover the basics of freelancing and requirements involving GST. Learn about all the exemptions, obligations, and compliances of GST for freelancers in india.

. 5 min read