Private Company Registration Online in India

Register your private limited company hassle-free with Filing Buddy. Get expert CA guidance, transparent pricing, and fast MCA approval. Start your business journey today!

Pvt Ltd Registration Price

Market Price

14,999Our Price

9,999You save

5,000*Prices excluding GST and Government fees

Market Price

24,999Our Price

17,999You Save

7,000*Prices excluding GST and Government fees

Market Price

35,999Our Price

27,999You Save

8,000*Prices excluding GST and Government fees

Contact Us

An expert will call you within 24 hours. No payment required to get started.

Why Choose Us?

Register your private limited company hassle-free with Filing Buddy. Get expert CA guidance, transparent pricing, and fast MCA approval. Start your business journey today!

EXPERTISE & RELIABILITY

Trusted industry professionals ensuring compliance, accurate tax filing, and comprehensive services for your business needs.

TAILORED SOLUTIONS

Customized services to meet your specific requirements, including business incorporation, trademarks, patents, and seamless GST return filing.

TIMELY SUPPORT

Dedicated support team committed to providing prompt assistance, resolving queries, and ensuring smooth operations for your business.

COMPETITIVE ADVANTAGE

Gain a competitive edge with our comprehensive suite of services, enabling you to focus on growth while we handle your compliance and taxation needs.

Private Company Registration in India – A Hassle-Free Online Process

Starting your new venture is exciting but navigating the legal requirements for private company registration in India can often feel overwhelming. From filing the SPICe+ forms to obtaining the necessary approvals from the MCA, missing a step can delay your business launch.

That’s where Filing Buddy comes in. As your trusted “Dhandhe Ka Saathi,” we simplify the entire online private limited company registration process, ensuring every document and form is handled accurately and efficiently. Our team of expert Chartered Accountants manages all MCA formalities, so you can focus on growing your business rather than paperwork.

With Filing Buddy, you can:

- Register your company online quickly and securely

- Start your business without legal hassles

- Get expert guidance from professionals who understand your business needs

Whether you’re a first-time entrepreneur or an experienced founder, we make company formation online fast, transparent, and hassle-free helping you set up your business the right way from day one.

Why Register a Private Limited Company?

Choosing the right business structure is one of the most important decisions when starting or scaling your venture. For startups and growing businesses in India, a Private Limited Company stands out as the most trusted and widely preferred structure. It combines legal protection, credibility, and growth potential, giving you a solid foundation for long-term success.

Here’s why registering a private limited company is a smart choice:

- Limited Liability Protection

Your personal assets remain protected from business debts and financial liabilities. This separation ensures that your personal finances are safe, even if your business faces challenges. - Enhanced Credibility

A private limited company is perceived as more professional and trustworthy by clients, suppliers, and banks. It signals stability and reliability, helping you win contracts and establish strong business relationships. - Easier to Secure Funding

Investors, including venture capitalists and angel investors, prefer funding private limited companies because of their clear legal framework, shareholder structure, and transparent governance. This structure significantly increases your chances of raising capital. - Separate Legal Entity

A private limited company has its own legal identity, independent of its owners. This ensures perpetual succession, meaning the company continues even if shareholders change or exit. - Scalability and Growth

With a private limited company, scaling your business—adding shareholders, expanding operations, or entering new markets—is simpler and legally structured, giving your venture the foundation to grow confidently.

Registering a private limited company is not just about compliance—it’s about building credibility, protecting your interests, and preparing your business for long-term success.

The Filing Buddy Advantage: Your Dhandhe Ka Saathi

When it comes to company registration services in India, you need more than just a service provider—you need a trusted partner who guides you through every step. At Filing Buddy, we are your “Dhandhe Ka Saathi,” simplifying complex regulations and ensuring your private limited company registration is completed efficiently and correctly.

Here’s why entrepreneurs and startups choose Filing Buddy over other service providers:

- Expert CA-Led Team

Our experienced Chartered Accountants handle your company registration application from start to finish, ensuring 100% accuracy and compliance with MCA regulations.

- Transparent Pricing

With Filing Buddy, there are no hidden charges. Our private limited company registration fees are all-inclusive, giving you complete clarity and peace of mind.

- Fast-Track Process

We follow a structured and fast-track company registration process to get your business incorporated quickly. From DSC & DIN filing to SPICe+ submission, we manage every step efficiently.

- Dedicated Support

Every client is assigned a single point of contact who provides ongoing guidance and support. Our partners in compliance approach ensures your questions are answered promptly and accurately.

- Trust & Credibility

- MCA Registered Agent – fully recognized by the Ministry of Corporate Affairs

- ISO Certified Processes – ensuring consistent quality

- 2500+ Companies Registered – proven track record in company formation services

Choosing Filing Buddy means choosing one of the best consultants for company registration in India. Our focus is not just on completing the paperwork—it’s on helping you register your private limited company online with confidence, speed, and total compliance.

Our Simple 4-Step Private Company Registration Process

Starting your business should be exciting not confusing. That’s why we’ve simplified the entire private company registration process into four easy steps, making it straightforward for startups and entrepreneurs to get their company registered online quickly and efficiently.

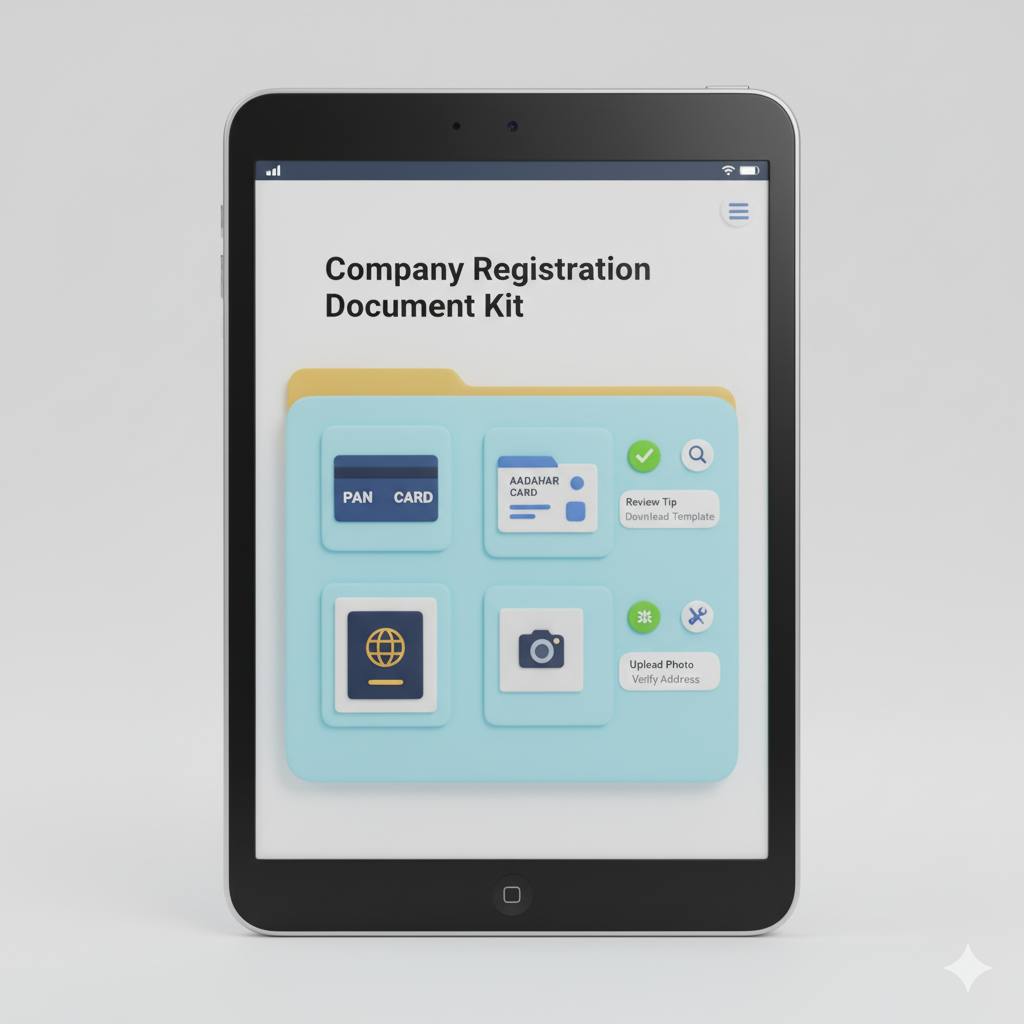

Step 1: Document Submission

Securely upload the required director and registered office documents through our online portal. Our team reviews all submissions to ensure they meet MCA compliance standards. This first step kickstarts your online company registration steps efficiently.

Step 2: Name Approval & Digital Signature (DSC)

We apply for your Director’s Digital Signature (DSC) and file your company name for approval with the MCA. Choosing the right name and completing DSC registration correctly is critical to ensure smooth processing of your incorporation.

Step 3: Filing of SPICe+ Forms

Our expert CAs prepare all legal documents, including the Memorandum of Association (MOA) and Articles of Association (AOA). We then file the SPICe+ incorporation forms on your behalf, handling every detail to ensure 100% MCA approval compliance.

Step 4: Receive Your Certificate

Once approved, you receive your Certificate of Incorporation, along with your PAN and TAN. Your private limited company is now legally registered and ready to operate. With Filing Buddy, this incorporation journey is smooth, fast, and fully transparent.

Frequently Asked Questions (FAQs)

Q1: How long does private company registration take in India?

Typically, the process takes 7–10 working days, provided all documents are correct and MCA processing times are normal. Delays can occur if additional verifications are required.

Q2: What is the total government fees for Pvt Ltd registration?

Government fees vary based on authorized capital and the state of registration. Our all-inclusive packages cover stamp duty, MCA filing fees, and other mandatory charges.

Q3: Can an NRI or foreign national register a private limited company in India?

Yes, NRIs and foreign nationals can be directors or shareholders. However, at least one director must be a resident of India to comply with MCA regulations.

Q4: What are the mandatory compliances after company incorporation?

After registration, you must:

- Appoint an auditor within 30 days

- Open a company bank account

- File annual returns and income tax filings with the MCA and IT department

We provide Company Compliance Services to simplify this process. (Internal link)

Q5: Is a physical office mandatory for online company registration?

No, you can register a company using a virtual office for correspondence. However, a registered office address in India is mandatory for legal purposes.

Q6: What is the minimum capital required for a private limited company in India?

The minimum authorized capital is ₹1 lakh, though higher capital may be advisable for certain business operations.

Q7: What documents are required for company registration?

Essential documents include PAN card, Aadhaar card, proof of address, and DSC/DIN for directors. Additional documents may be needed based on company structure.

Q8: Can I reserve my company name before registration?

Yes, you can apply for name approval through the MCA portal. Once approved, the name is valid for 60 days to complete incorporation.

Q9: What is a Director Identification Number (DIN) and how to obtain it?

A DIN is a unique identifier for directors. It can be applied for during registration or beforehand through the MCA portal.

Q10: How much does professional service for Pvt Ltd registration cost?

Our transparent pricing packages start at [₹X,XXX]* and cover all statutory fees, documentation, and filing services.

Q11: Can a company be registered with just one director and one shareholder?

Yes, the minimum requirement is one director and one shareholder. Directors and shareholders can be the same person.

Q12: How do I open a company bank account after incorporation?

Once your Certificate of Incorporation is issued, you can open a corporate account with any bank. We assist with document preparation and submission.

Q13: How can I apply for GST after company registration?

After incorporation, you can apply for GST registration online. We provide step-by-step guidance and filing services.

Q14: What are the penalties for non-compliance after incorporation?

Failure to file annual returns, income tax, or audit reports can result in penalties, fines, and disqualification of directors.

Q15: Can I convert a sole proprietorship or LLP into a Pvt Ltd company?

Yes, existing businesses can be converted into a private limited company following MCA guidelines.

Q16: Can foreign companies register a branch in India?

Yes, foreign companies can establish a branch office, liaison office, or project office in India under RBI and MCA regulations.

Q17: How often do I need to file annual returns with the MCA?

Annual returns and financial statements must be filed once a year. Timely filing ensures compliance and avoids penalties.

Q18: What is the difference between authorized capital and paid-up capital?

- Authorized Capital: Maximum capital a company can raise

- Paid-up Capital: Actual amount invested by shareholders

Q19: Do startups get any special registration benefits?

Yes, startups in Pimpri-Chinchwad and Pune may be eligible for subsidies, tax exemptions, and government startup recognition.

Q20: How can Filing Buddy help with company registration and compliance?

We provide end-to-end services, from company formation to compliance management, ensuring a smooth, hassle-free experience.

Contact Us

An expert will call you within 24 hours. No payment required to get started.

.png)

.png)

.png)

.png)

.png)

.png)

.png)

.png)

.png)

.png)

.png)

.png)

.png)

.png)

.png)

.png)

.webp)

.webp)

.webp)