GST Composition vs Regular Scheme: Which Is Best for You?

By CA Mohit Chotia . 19 Sep 25

Choosing Your GST Path: A Critical Business Decision

Choosing between the GST Regular and Composition schemes is a pivotal decision for any business, directly influencing your tax liability, cash flow, and day-to-day compliance burden. Getting this choice right isn't just about following the rules; it's about setting up your business for financial efficiency and operational simplicity.

Think of it like choosing a mobile plan. Are you a power user who needs a feature-packed postpaid plan with lots of data-sharing and international calling (the Regular Scheme)? Or do you prefer a simple, no-fuss prepaid plan with a fixed monthly cost that just works (the Composition Scheme)? Both are valid GST Schemes, but picking the one that doesn't fit your usage pattern can lead to either paying for features you don't need or hitting a wall when you try to expand.

The wrong choice can mean losing out on valuable tax credits or getting tangled in a web of monthly filings you're not prepared for. The right one, however, can feel like putting your financial compliance on autopilot.

In this guide, we'll act as your business advisor, breaking down exactly what each scheme offers. We'll compare them on the factors that matter most tax rates, input tax credits, invoicing, and filing frequency to help you confidently decide which path is the right one for your business journey.

What is the Regular GST Scheme?

The Regular GST Scheme is the standard, full-featured system of GST compliance in India. Think of it as the default setting for the vast majority of businesses. It operates on a transactional basis, where tax is calculated on every sale, and its single greatest advantage is the ability to claim Input Tax Credit (ITC).

At its core, the Regular Scheme is designed to create a seamless and transparent tax chain. Its primary goal is to prevent the "tax-on-tax" cascade that used to plague the old tax system. The mechanism that makes this possible is ITC.

So, what exactly is this "crown jewel" of the GST world?

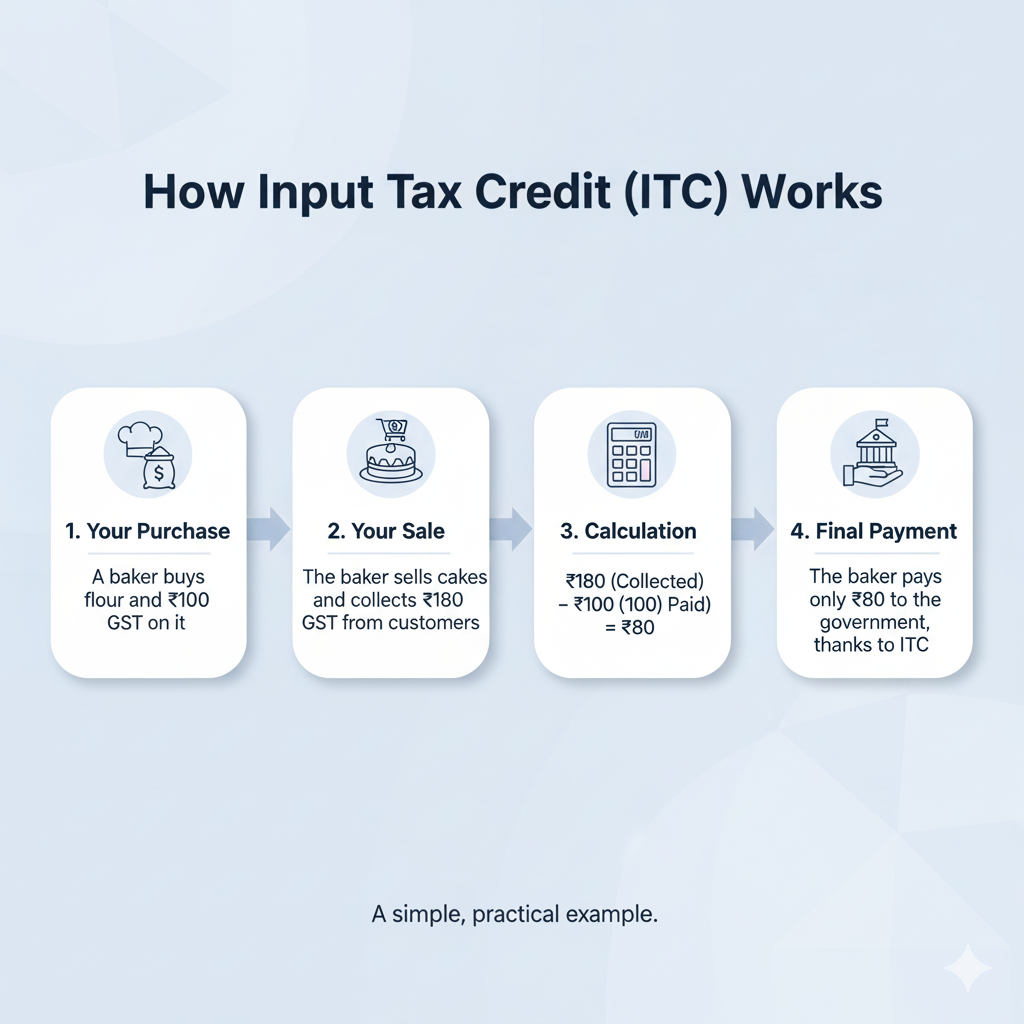

Input Tax Credit (ITC): The Game-Changer

Imagine ITC as a professional rebate system. As a business owner, you pay GST on your purchases (like raw materials, office supplies, or professional services). When you sell your final product or service, you collect GST from your customers. ITC allows you to subtract the GST you already paid from the GST you collected. You only owe the government the difference.

Essentially:

GST Collected on Sales - GST Paid on Purchases = Your Final Tax Liability

This single feature can significantly lower your overall tax outgo, making it indispensable for businesses with substantial input costs.

Who Should Register Under the Regular GST Scheme?

This scheme is the mandatory or logical choice for:

- Larger Businesses: Any business whose annual turnover exceeds the threshold limit (currently ₹40 lakhs for goods and ₹20 lakhs for services) must register under this scheme.

- Interstate Sellers: If you sell goods or services outside your state—even a single rupee's worth—the interstate trade rules mandate that you must be under the Regular Scheme.

- E-commerce Operators: Businesses that sell goods through an e-commerce platform (like Amazon or Flipkart) are required to register under the Regular Scheme.

- Businesses Focused on B2B: If your customers are other businesses, they will need a proper tax invoice from you to claim their own ITC. This is only possible under the Regular Scheme.

- Anyone Wanting to Claim ITC: If your business has significant expenses, forgoing ITC would mean letting go of substantial savings. The Regular Scheme is the only way to claim it.

What is the GST Composition Scheme?

The GST Composition Scheme is a simplified, hassle-free alternative designed specifically for small businesses. It's an opt-in program that allows eligible taxpayers to sidestep the detailed formalities of the standard system and instead pay a fixed, low-percentage tax rate on their turnover.

Think of this scheme as the express checkout lane for GST. It was created with a clear objective: to reduce the compliance burden for small entrepreneurs who might not have the resources for dedicated accounting teams. The entire premise is a trade-off: you voluntarily give up a major benefit (ITC) in exchange for radical simplicity.

The Main Attraction: Simplicity and a Fixed Tax Rate

Instead of tracking every transaction and applying different GST rates (5%, 12%, 18%), a composition dealer simply pays a small, fixed percentage of their total turnover. For example:

- Traders and Manufacturers: Typically pay 1%

- Restaurants (not serving alcohol): Typically pay 5%

- Service Providers: Typically pay 6%

This makes tax calculation and filing incredibly straightforward. However, this simplicity comes with a very important catch: you cannot claim any Input Tax Credit (ITC) on your business purchases. Furthermore, you cannot issue a "Tax Invoice" or collect any tax from your customers.

Who is the GST Composition Scheme For?

This simplified path is ideal for:

- Small Businesses: Specifically, businesses whose aggregate annual turnover is below the prescribed turnover limit (generally up to ₹1.5 crore for goods and ₹50 lakhs for specific services, though it's ₹75 lakh in North-Eastern states).

- Local, B2C Businesses: It's perfect for retailers, small eateries, and local service providers whose customers are end-consumers. These customers don't need to claim ITC, so the inability to issue a tax invoice isn't a deal-breaker.

- Operators within a Single State: The scheme is only available to businesses that conduct intra-state trade (within their state's borders).

- Entrepreneurs Prioritizing Ease-of-Business: If your primary goal is to minimize bookkeeping, reduce compliance tasks, and have a predictable tax outgo, the Composition Scheme is a powerful tool.

GST Regular vs Composition Scheme: A Detailed Comparison

While both the Regular and Composition schemes operate under the GST umbrella, they differ fundamentally in how they handle tax credits, compliance, invoicing, and overall business scope. This isn't a minor difference in paperwork; it's a tale of two distinct operational philosophies. One is built for flexibility and growth, the other for simplicity and ease.

Let's put them head-to-head on the parameters that matter most.

Key Differences at a Glance

For a direct, side-by-side comparison, here is a breakdown of the most critical differences between the Regular and Composition GST schemes.

| Parameter | Regular GST Scheme | Composition GST Scheme |

| Eligibility/Turnover | Mandatory for businesses with turnover > ₹40/20 Lakhs. Open to any business voluntarily. | Optional scheme for businesses with an aggregate Turnover Limit generally up to ₹1.5 Crore. |

| Input Tax Credit (ITC) | Allowed. This is the core benefit. You can claim credit on the GST paid on your inputs. | Not Allowed. You cannot claim any ITC. The GST paid on purchases becomes a business cost. |

| Tax Rate | Standard GST slabs apply (5%, 12%, 18%, 28%) on a transactional basis. | A low, fixed Tax Rate on total turnover (e.g., 1% for traders, 5% for restaurants). Paid out-of-pocket. |

| Invoicing | Must issue a Tax Invoice, showing the GST amount charged to the customer. | Must issue a Bill of Supply. You cannot collect tax from the customer on the bill. |

| Scope of Business | No restrictions. You can conduct Interstate Trade (sales outside your state) and intra-state trade. | Restricted to intra-state trade only. You cannot sell goods to customers in other states. |

| Filing Frequency | Higher. Requires filing of monthly GSTR-3B and monthly/quarterly GSTR-1. | Lower. Requires payment via quarterly statement CMP-08 and one Annual Return GSTR-4. |

| E-commerce Sales | Allowed. You can sell goods through e-commerce platforms like Amazon, Flipkart, etc. | Not Allowed for sellers of goods. You cannot sell goods through an e-commerce platform. |

The Deciding Factor: Input Tax Credit (ITC) Explained

The single most significant financial difference between the Regular and Composition schemes is the treatment of Input Tax Credit (ITC), which directly impacts a business's final tax liability.

Under the Regular Scheme, ITC is your financial advantage.

As we touched on earlier, the ability to claim ITC means you effectively get a refund on the GST you pay for your business expenses. The formula Output Tax - Input Tax is the engine of this scheme. For B2B businesses, this is non-negotiable. Your business customers need you to issue a Tax Invoice so they can claim ITC on their purchase from you. Without it, you break the credit chain, and they'll likely find a supplier who is on the Regular Scheme.

Under the Composition Scheme, ITC is the price of simplicity.

Here, you give up the right to claim any ITC. The GST you pay on your inward supplies—be it raw materials, rent, or professional fees—becomes a direct cost to your business, eating into your profit margin. The tax you pay is calculated as a flat percentage of your turnover, and it comes entirely out of your own pocket. This is a critical calculation to make: will the money saved from simplified compliance and a low tax rate be more than the ITC you are giving up? For businesses with low input costs and high turnover, it might be. For most others, it's a significant financial sacrifice.

Compliance Burden: Filing Returns under Each Scheme

The operational Compliance Burden varies drastically between the two schemes, defined by the number and frequency of required tax filings. This is where you decide how much time you want to spend on administrative tasks each month.

The Regular Scheme: The Monthly Check-in

This scheme requires disciplined, frequent reporting. The Filing Frequency is high, and the key forms are:

- GSTR-1: A detailed statement of all your sales (outward supplies), filed either monthly or quarterly (for those in the QRMP scheme).

- GSTR-3B: A monthly summary return used to report your total sales, ITC claimed, and pay the final tax liability. This is a mandatory monthly commitment.

- Result: You are looking at a minimum of 13 returns annually (12 monthly GSTR-3B + at least 1 GSTR-1), keeping you on a short leash with compliance deadlines.

The Composition Scheme: The Quarterly Update

This scheme is designed to free you from the monthly filing cycle. The process is much simpler:

- CMP-08: This is a simple statement for making your tax payment, filed once every three months. These Quarterly Returns are straightforward.

- GSTR-4: This is an Annual Return that consolidates your financial information for the entire year, filed once after the financial year ends.

Result: Your total compliance workload drops to just 5 filings a year (4 x CMP-08 + 1 x GSTR-4). This significant reduction in the Compliance Burden is the scheme's primary operational appeal.

How to Choose: Is the Regular or Composition GST Scheme Best for You?

Ultimately, the best GST scheme isn't about which is "better" in a vacuum, but which is strategically aligned with your specific business model, customer base, and growth ambitions. We’ve reviewed the technical specifications; now it's time to apply that knowledge directly to your business.

Think of this section as a checklist. By the end, you won't be guessing—you'll have a clear, confident answer based on how your business actually operates.

Choose the Regular GST Scheme If...

You should opt for the Regular GST Scheme if your business model relies on claiming tax credits, operates across state lines, or primarily serves other businesses. It’s the default choice for a reason—it’s built for flexibility and growth.

The Regular Scheme is your go-to choice if you find yourself nodding 'yes' to any of these points:

- Your Input Costs are Significant: If you spend a considerable amount on raw materials, stock, or services, the ability to make ITC claims is essential for your profitability. Forgoing this is like voluntarily leaving money on the table each month.

- You Plan to Sell Beyond Your State: If your business vision includes selling to customers anywhere in India, you must choose the Regular Scheme. The rules for interstate trade are black and white: it's not permitted under the Composition Scheme.

- You're an Online Seller of Goods: Planning to list your products on platforms like Amazon, Flipkart, or Myntra? The law requires sellers of goods on e-commerce portals to be registered under the Regular Scheme.

- Your Clients are Other Businesses (B2B): If you are a B2B supplier, your clients will depend on you for a proper Tax Invoice to claim their own ITC. The Regular Scheme is the only way to provide this, making you a viable and attractive partner in the supply chain.

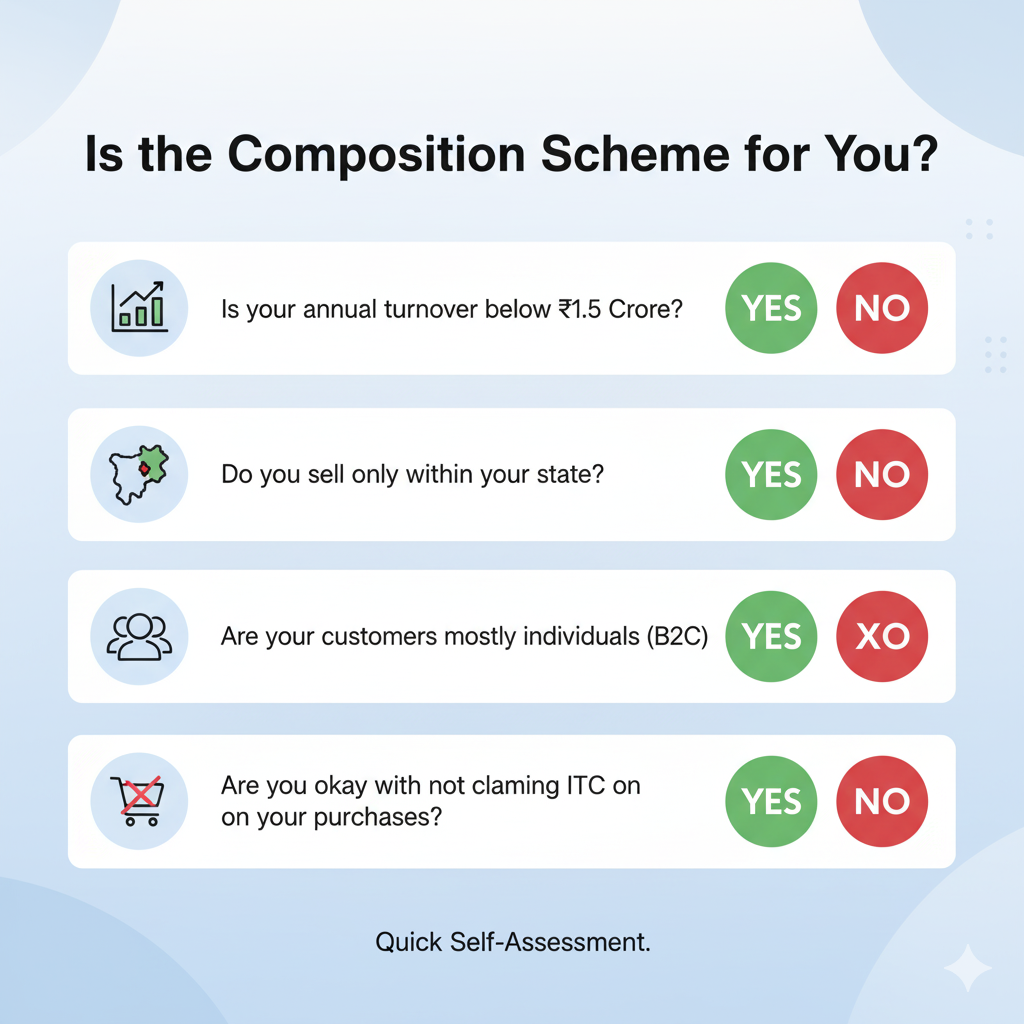

Choose the GST Composition Scheme If...

The GST Composition Scheme is the ideal choice for small, local businesses with low turnover that primarily serve end-consumers and prioritize operational simplicity above all else.

The Composition Scheme will feel like a perfect fit if your business profile looks like this:

- Your Annual Turnover is Modest: Your total sales are well below the turnover limit (generally up to ₹1.5 crore, or ₹75 lakh in some states). The scheme is designed specifically to support businesses of your scale.

- Your Customers are Local Consumers (B2C): The majority of your sales are to direct customers (B2C businesses) who don't need a tax invoice to claim ITC. This is perfect for local retail shops, cafes, salons, or small service providers.

- You Prioritize Simplicity Over Savings: As a business owner, you want to spend less time on complex accounting and more time serving your customers. The promise of simplified compliance with just a few easy returns a year is more valuable to you than the potential savings from ITC.

- Your Input Tax is Negligible: Your business model doesn't involve high-cost inputs or raw materials. The amount of ITC you'd be forgoing is small enough that the low, fixed tax rate and reduced administrative costs offer a better overall financial deal.

Who is NOT Eligible for the Composition Scheme?

Before you opt for the Composition GST Scheme, it's crucial to run through this final checklist. These are not recommendations; they are hard rules based on the official Eligibility Criteria. If your business falls into any of these categories, the decision is made for you—you must register under the Regular Scheme.

You are NOT ELIGIBLE for the Composition Scheme if you are:

- A business engaged in making any inter-state outward supplies of goods or services.

- A business selling goods through an e-commerce operator who is required to collect tax at source (TCS).

- A manufacturer of certain notified goods like ice cream, pan masala, or tobacco products.

- A casual taxable person or a non-resident taxable person.

- A business supplying goods that are not taxable under GST, such as alcohol for human consumption.

Frequently Asked Questions (FAQ)

What is the primary difference between GST Regular and Composition schemes?

The primary difference lies in two key areas: the ability to claim Input Tax Credit (ITC) and the level of compliance complexity. The Regular Scheme allows for full ITC benefits but requires frequent, detailed filings. In contrast, the Composition Scheme offers simplified compliance with fewer returns but completely disallows any ITC claims.

How does the difference between schemes influence Input Tax Credit (ITC)?

It's a night-and-day difference. Under the Regular Scheme, businesses can claim ITC on their purchases, which reduces their final tax liability. Under the Composition Scheme, businesses are strictly prohibited from claiming ITC, meaning the GST paid on their inputs becomes a direct business cost.

What is the turnover limit for the Composition Scheme?

The standard turnover limit for the Composition Scheme is ₹1.5 crore in annual aggregate turnover in the preceding financial year.For several special category states (North-Eastern states and others), this limit is reduced to ₹75 lakh.

Can a Composition Dealer switch to the Regular Scheme?

Yes, a Composition Dealer can switch to the Regular Scheme at any time during the financial year. They must file Form GST CMP-04 to withdraw from the Composition Scheme and will then be able to claim ITC on their stock and capital goods from that point forward.

Can a Composition Dealer collect GST from customers?

No, absolutely not. A Composition Dealer is forbidden from collecting any tax from their customers. They pay a fixed percentage of their turnover as tax out of their own pocket and must issue a Bill of Supply, not a Tax Invoice.

What is the difference between a Tax Invoice and a Bill of Supply?

A Tax Invoice, issued by a Regular Dealer, shows the breakdown of the taxable value and the GST amount charged. It is the essential document for the buyer to claim ITC. A Bill of Supply, issued by a Composition Dealer, is a simpler document that shows only the final price, as the seller cannot charge GST on it.

How many GST returns does a regular taxpayer file in a year?

A regular taxpayer typically files a minimum of 13 returns annually (12 monthly GSTR-3B summary returns + at least 1 GSTR-1 sales return). If they do not opt for the QRMP scheme, the number of GSTR-1 filings increases, leading to 25 returns a year.

How often does a Composition Dealer need to pay tax?

A Composition Dealer needs to pay their tax on a quarterly basis. The payment is made using the simple statement form CMP-08, which is due by the 18th of the month following the end of each quarter.

Can a regular taxpayer switch to the Composition Scheme?

Yes, a regular taxpayer can switch to the Composition Scheme, but only at the beginning of a financial year. They must file an intimation in Form GST CMP-02 before the financial year commences to opt into the scheme.

Are service providers eligible for the Composition Scheme?

Yes, certain service providers are eligible. A specific scheme allows providers of services (or mixed suppliers) with an aggregate turnover of up to ₹50 lakh to opt for a composition scheme where they pay a fixed GST rate of 6%.

If I have multiple businesses under one PAN, can I choose different schemes?

No, you cannot. GST registration is PAN-based. If you opt for the Composition Scheme for one of your businesses, all other businesses registered under the same PAN will automatically be brought under the Composition Scheme.

What happens if a Composition Dealer's turnover crosses the limit?

The moment a Composition Dealer's turnover crosses the prescribed limit (e.g., ₹1.5 crore) during a financial year, they become ineligible to continue in the scheme. They must immediately start paying tax under the Regular Scheme and begin issuing tax invoices.

Is the Composition Scheme always the better choice for small businesses?

Not necessarily. It's a strategic choice. If a small business has high-cost inputs or deals primarily with other businesses (B2B), the inability to claim ITC and issue a Tax Invoice under the Composition Scheme can be a significant disadvantage that outweighs the benefit of simplified compliance.

How can I check if a supplier is a regular or composition dealer?

You can easily verify a supplier's taxpayer type on the official GST portal. Use the "Search Taxpayer" tool, enter their GSTIN, and the portal will display their status, confirming whether they are a "Regular" or "Composition" taxpayer.

What are the main disadvantages of the Composition Scheme?

The main disadvantages are:

- No Input Tax Credit (ITC): This is the biggest financial drawback.

- Restricted Territory: Business is limited to intra-state (within the state) sales only.

- Ineligibility for E-commerce Sales: You cannot sell goods through major e-commerce platforms.

- No Tax Collection: The tax burden falls entirely on the business owner's pocket.

Final Verdict: Aligning Your GST Choice with Your Business Goals

The choice between the Regular and Composition GST Schemes is not about finding a single 'best' option, but about selecting the framework that best serves your specific business goals. There is no universal right answer, only the answer that is right for your business, right now.

As we've explored, the decision boils down to a fundamental trade-off:

- The Regular Scheme offers flexibility, growth potential, and the powerful financial benefit of Input Tax Credit (ITC). It's the highway for businesses planning to scale, trade interstate, and integrate deeply into the B2B supply chain.

- The Composition Scheme offers simplicity, predictability, and a significantly lower compliance burden. It's the quiet, efficient local road for small-scale businesses focused on their direct-to-consumer community.

Ultimately, your choice should be a strategic one. Look at your business plan, consider your customer base, and anticipate your growth trajectory. The right GST scheme will feel less like a tax obligation and more like a tool that supports your operational model. Choose the path that empowers you to focus on what truly matters building your business.

Contact Us

An expert will call you within 24 hours. No payment required to get started.

Related Post

How should a start-up complete ITR filing

Business entities must file their ITR annually to comply with the tax laws of their respective countries. It helps the government assess and collect the appropriate amount of income tax from taxpayers and ensures proper accountability of financial activities.

. 3 Mins.png)

5 step checklist for GST compliance in Indian Startups

Learn about how GST works. The basics of GST along with its compliances. Uncover what your business needs to keep in mind concerning GST rules and GST compliance.

. 3 min read.png)

₹20 Lakhs and Beyond: Understanding GST for Freelancers in India

Are you a freelancer or aspiring to be one? In this blog, uncover the basics of freelancing and requirements involving GST. Learn about all the exemptions, obligations, and compliances of GST for freelancers in india.

. 5 min read