GST Portal Login Guide: Step-by-Step Access to Your Dashboard

By Filing Buddy . 05 Aug 25

Introduction

GST Portal Login

It sounds simple, but let’s be real if you’ve ever stared at the www.gst.gov.in login page wondering “Now where did I keep my password again?”, you’re not alone.

Whether you’re a first-time taxpayer nervously registering your new business or a veteran CA who’s logged in a hundred times this month (and yelled at the OTP delay each time), GST login is step zero in your tax compliance journey.

From filing returns and paying taxes to replying to scary-looking notices, everything begins with your GST login.

This blog is your no-fluff, no-jargon, step-by-step guide to mastering the Goods and Services Tax login portal.

You’ll learn:

- How to login for the first time (without panic)

- What to do if the login isn’t working

- And what the heck to do once you’re in!

So take a deep breath, bookmark this tab, and let’s log in like a boss.

What is the GST Portal? [www.gst.gov.in]

If India had a headquarters for indirect tax compliance, it would be the GST Portal a.k.a. www.gst.gov.in.

Think of it as your digital command center for all things Goods and Services Tax. From registering your business to filing your monthly GSTRs to checking if your refunds are actually refunding, the GST portal login is the gateway to it all.

But let’s break it down properly.

What is the GST Portal, Really?

It’s an official website launched by the Goods and Services Tax Network (GSTN), designed to help taxpayers, businesses, and professionals comply with India’s indirect tax system all online, no paper-pushing required.

Official link: https://www.gst.gov.in

Pro tip: Bookmark it. Fake lookalikes exist.

What Can You Actually Do on the GST Portal?

Whether you’re a startup founder, a freelancer who crossed ₹20 lakh in revenue, or a tax consultant juggling 10 GSTINs, the portal serves as your:

I. Registration Hub

- Apply for GSTIN

- Check application status

- Amend business details

II. Return Filing Center

- File GSTR-1, GSTR-3B, GSTR-9 etc.

- View filing history

- Get system-generated summaries

III. Payment Tracker

- Generate challans

- Pay taxes online

- Access electronic ledgers

IV .Refund Station

- Apply for refunds

- Track refund status

- View deficiency memos

V. Communication Hub

- View system-generated notices

- Respond to show-cause notices (SCNs)

- Submit clarification letters

VI. Legal Resource Library

- Browse GST laws, amendments, circulars

- Download FAQs, manuals, offline tools

In short, gst.gov.in login isn’t just about typing a password it’s about unlocking your complete GST dashboard.

Why It Matters:

Still wondering “Can’t I just hire someone to deal with this?”

Sure, but even then, you’ll need to log in, approve filings, check alerts, or fix errors. And if you’re doing it yourself? All the more reason to know your way around the portal.

Who Needs to Use the GST Portal?

Short answer? Pretty much anyone who does business in India.

Long answer? Let’s break it down.

1. Individual Taxpayers & Freelancers

Got clients? Raising invoices? Crossing ₹20 lakh (or ₹10 lakh in some states)?

You're officially on the GST radar. Whether you’re a freelance designer, consultant, or Instagram shop-owner, if you’re offering taxable services above the threshold you'll need a GST login ID and access to your gst account login dashboard.

2. Registered Businesses & Startups

If you’ve got a GSTIN stuck on your office wall or website footer, congratulations the GST Portal is your daily workspace.

You'll use it to:

- File GSTRs

- Claim Input Tax Credit (ITC)

- Respond to notices

- Track refunds

In short, this is your GST command center.

3. Tax Consultants, Accountants & CAs

Handling logins for 20+ clients and drinking coffee at midnight? Welcome to the club.

Professionals in finance need to access multiple GST user login dashboards, manage returns, and troubleshoot filings often all at once.

4. Input Service Distributors (ISD)

If you're a head office distributing ITC across branches, you're also on the portal.

Your login helps you file ISD returns, allocate credits, and maintain clean compliance.

5. Casual Taxable Persons

Hosting a stall at an exhibition or selling seasonally across states?

Even for short-term business, you need a temporary GST registration and therefore you guessed it-a GST login.

GST Registration Thresholds (Quick Glance):

To know if you must register:

- ₹40 lakh: For supply of goods (normal states)

- ₹20 lakh: For supply of services

- ₹10 lakh: For special category states

Pro tip: Even if you're below the threshold, you can register voluntarily and claim ITC. But once registered, GST compliance becomes mandatory starting with your gst user login.

Bottom Line:

If you’re doing business, offering services, or earning income in a GST-applicable category the portal isn’t optional. It’s your digital identity in India’s indirect tax system.

How to Register on the GST Portal (Prerequisite to Login)

Before you even think about gst login, you need the golden ticket: a GSTIN (Goods and Services Tax Identification Number).

But who needs to register? How? What documents? And what’s this ARN they keep talking about?

A. Who Needs to Register for GST?

You must register under GST if any of these apply to you:

- Your annual turnover exceeds:

- ₹40 lakh for goods (₹20 lakh for special category states)

- ₹20 lakh for services (₹10 lakh in special category states)

- You’re doing interstate supply of goods or services

- You’re an e-commerce seller (even small ones!)

- You’re a casual taxable person or a non-resident taxable person

- You want to claim Input Tax Credit (ITC) on business purchases

- You register voluntarily to become tax-compliant — even below the threshold

If you meet any of the above, it’s time to visit the online GST portal and complete your gst login registration.

B. Step-by-Step: How to Register on the GST Portal

Step 1: Visit the Official GST Portal

Head to: ???? www.gst.gov.in

Click on ‘Services’ → ‘Registration’ → ‘New Registration’

Step 2: Fill in Part A (Basic Details)

Enter:

- Your legal name (as per PAN)

- PAN number

- Email address & mobile number (used for OTP)

- State and district

Once verified via OTP, you'll get a Temporary Reference Number (TRN).

Step 3: Fill in Part B (Business Info)

Using your TRN, log in and complete the second part. You'll need to upload:

- Proof of business registration (Partnership Deed / COI)

- Photographs of promoters/directors

- Identity and address proofs (PAN, Aadhaar, etc.)

- Business address proof

- Bank account details (for refunds, transactions)

This is where most users panic. Breathe it’s a one-time process.

Step 4: Submit the Application

Once all documents are uploaded and verified:

- Submit using DSC (for companies/LLPs)

- Or EVC (OTP-based) for others

- You’ll receive an Application Reference Number (ARN) to track the status.

Step 5: Get Your GSTIN & Login Credentials

Once approved:

- You’ll get a 15-digit GSTIN

- Login credentials (temporary ID & password) are sent to your registered email

You’ll now be able to access your gst number login page and create your permanent user ID.

Pro Tips:

- Use Google Chrome or Mozilla Firefox for best portal compatibility

- Save the TRN and ARN safely they’re like your GST "tracking IDs"

Once you create your user ID and password, never share them with anyone

Services Available on GST Portal Before Login

No GST login? No problem yet.

Turns out, the GST Portal isn’t a locked box. Even before logging in, you can access a surprising number of features from checking registration status to downloading offline tools.

Let’s explore what’s on the menu, no password required.

1. Registration Tab: Get Yourself GST-Ready

New to GST? You can start your registration journey right from the homepage.

Services → Registration

- New Registration (for obtaining GSTIN)

- Application for Revocation of Cancelled Registration

- Track Application Status using ARN/TRN

Useful for: First-time users, businesses reapplying, or checking progress

2. Track Application: Check Status Without Logging In

Lost your TRN or ARN email? You can still track your GST registration or refund status directly.

Just click “Track Application Status” under the Services tab.

- Track by: ARN, TRN, or Submission Date

- Works for: Registration, Refunds, Amendments

No login, no OTP, just instant status visibility.

3. e-Way Bill Resources: Know Before You Ship

The e-Way Bill System isn’t part of the main GST login but the portal links you there.

Go to ‘e-Way Bill System’ from the homepage menu.

Here you’ll find:

- Portal link to generate/manage e-Way Bills

- User manuals & how-to guides

- FAQs for transporters and suppliers

Perfect for businesses transporting goods across state lines.

4. Refund Tracking: Where’s My Money?

If you’ve applied for a GST refund and want to check if it's finally been processed, you don’t need to log in.

Under Services → Refunds → Track Status, just enter your ARN.

- You’ll see: Status, Deficiency memos, Payment details

- Tip: Keep your ARN handy

One less reason to dig through your email inbox.

5. Help, FAQs & User Manuals: Your Compliance Survival Kit

Let’s admit it government portals aren’t always user-friendly. But this one tries!

Go to Help → Help & Taxpayer Facilities, where you’ll find:

- Videos, PDF guides, FAQs, and System Requirements

- Grievance redressal options

- GSP (GST Suvidha Providers) list and free tools

Bonus: There’s even a holiday list yes, seriously.

6. GST Law, Notifications & Downloads: Stay Updated Like a Pro

Stay ahead of the compliance curve with these resources no login needed.

GST Law tab includes:

- CGST, SGST, IGST Acts

- Rules, circulars, latest amendments

Downloads tab provides:

- Offline return filing tools

- Utility software

- GST rate lists and form templates

Pro tip: Use these resources for bulk uploads or to stay compliant with rule changes.

The Portal Isn’t Useless Without a Login

The GST website login might get you access to your dashboard but even before that, the portal serves as a public hub of vital information and tools for taxpayers, consultants, and businesses alike.

How to Login to GST Portal: Step-by-Step Guide

Whether you’re a seasoned taxpayer or nervously logging in for the first time, the GST portal login process is surprisingly straightforward once you know what to expect.

Here’s your cheat sheet, no second guessing required.

A. For Existing Users

You’ve got your GSTIN, your login credentials, and hopefully your password isn’t scribbled on a sticky note somewhere. Let’s get you in.

Step-by-Step: Existing User Login

- Go to the official GST portal:

???? https://www.gst.gov.in

(Bookmark it — there are lookalikes!) - Click on ‘Login’

Top-right corner of the homepage. - Enter your credentials

- I. Username (the one you created after registration)

- II. Password

- III. Captcha code

- IV. Hit LOGIN

- You’re in! ????

You’ll land on your Dashboard, which includes:- Return filing status

- Notices & orders

- Payment options

- Profile & GSTIN summary

Tip: If you’ve forgotten your password, use the ‘Forgot Password’ link below the login box. It’ll guide you through OTP verification via your registered mobile or email.

B. For First-Time Users

Logging in for the first time? Take a deep breath this is where provisional IDs become real, usable credentials.

Step-by-Step: First-Time GST Login Setup

- Visit: www.gst.gov.in

- Click ‘Login’ (top right)

- Click: ‘First Time Login: Click Here’

You’ll find this link just below the login form. - Enter:

- I. Provisional ID/GSTIN (from registration email)

- II. Temporary password (sent to your registered email)

- III. Captcha

- Create your permanent credentials:

- I. Choose a new username

- II. Set a strong new password

- III. Reconfirm and submit

- Success!

You’ll see a confirmation message. Your new credentials are now active. - (Important!) Submit Your First Amendment:

On first login, the portal may prompt you to:- File a non-core amendment (especially to add bank account details)

- Go to the ‘Bank Accounts’ tab → Click ‘Add New’ → Submit

Skipping this step may restrict your access to some filing features. Finish it right away.

Pro Tips:

- Use Google Chrome or Firefox for best experience

- Double-check your email spam folder for the provisional credentials

- If login fails, wait 5–10 minutes and try again (portal can be glitchy during peak hours)

What You Can Do After Logging In

You’ve officially crossed the gateway welcome to your GST login dashboard.

Now what?

Think of this as your personal tax command center, where every button, tab, and tile has a purpose. Here’s what you can (and should) do after logging into your GST account.

1. Dashboard Overview: Your Compliance Cockpit

The GST login dashboard is your home screen after you sign in.

Here you’ll find:

- Return filing status (due, filed, pending)

- Notices and orders (if any)

- Quick links to create challans, file returns, or view ledgers

- Profile summary: GSTIN, trade name, constitution of business, ARN, etc.

Think of it as your “tax health tracker.” Red = take action. Green = you’re good.

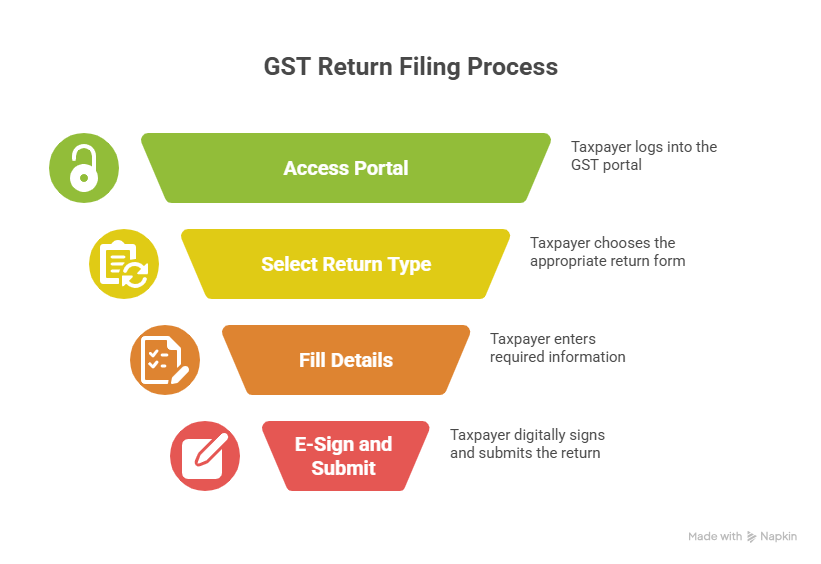

2. GST Return Filing (GSTR-1, GSTR-3B, etc.)

Return filing is the heart of the portal. Every registered taxpayer must file either monthly or quarterly returns.

GSTR-1 → Details of outward supplies (sales)

GSTR-3B → Summary return including tax liability & ITC claim

Others: GSTR-4, GSTR-9, depending on your category

Steps:

- Go to Services → Returns → File Returns

- Select the period

- Fill details online or use JSON/Excel upload

- E-sign and submit

Timely filing = no late fees + smooth ITC flow

3. Ledger Management: Your GST Wallets

3. Ledger Management: Your GST Wallets

The portal keeps track of every rupee you pay, use, or carry forward via 3 ledgers:

- Electronic Cash Ledger: Money you deposit (like a wallet balance)

- Electronic Credit Ledger: ITC available to you

- Electronic Liability Ledger: Total GST due

Access from: Services → Ledgers

Tip: Download statements for your accountant. They’ll thank you later.

4. Create and Manage Challans (GST PMT-06)

Need to pay tax, interest, or penalty? You’ll need a challan.

Steps to create:

- Go to Services → Payments → Create Challan

- Choose tax heads (CGST/SGST/IGST, Interest, Fee, etc.)

- Select payment method (Net banking, NEFT/RTGS, OTC)

- Generate and download challan for records

Validity: Challans expire in 15 days if not paid.

5. Apply for Refunds

Eligible for a GST refund? You can initiate a claim directly from your account.

Refund types include:

- Excess cash balance

- Export without payment of tax (with LUT)

- Inverted duty structure

How:

- Go to Services → Refunds → Application for Refund

- Choose reason and period

- Upload necessary documents

- Submit with EVC or DSC

Keep ARN safe; you'll need it to track status later.

Other Handy Features After Login

- Respond to notices and assessments

- Amend registration details (core and non-core)

- Download filed returns and challans

- Generate reconciliation reports for GSTR-2A vs 2B

- File ITC mismatches or rectify errors

GST Login Errors & Troubleshooting

Let’s face it no matter how smooth the GST portal login process looks on paper, reality loves to throw curveballs. From vanishing OTPs to “invalid credentials” that you swear are correct, here's how to survive and fix the most common GST login issues.

1. Forgot GST Password or Locked Account?

Happens to the best of us.

Solution:

- Go to gst.gov.in

- Click ‘Forgot Password’

- Enter your username & registered email/mobile

- Verify OTP → Set a new password → Done!

Pro Tip: Too many wrong attempts? Your account may be locked temporarily. Wait 15–30 minutes and try again.

2. Not Getting OTPs or Facing Authentication Failures?

If your OTP is MIA, blame the gods of network lag (or spam folders).

Solution:

- Check SMS AND email (both receive OTPs)

- Wait for 60–90 seconds before requesting a new one

- Avoid using browser autofill or multiple tabs

- Use incognito/private mode if it keeps failing

If the issue persists, update your contact details via non-core amendment post-login.

3. TRN or ARN Login Issues (During Registration)?

Trying to login with a Temporary Reference Number (TRN) or ARN during registration?

Common Errors:

- “Invalid TRN”

- “TRN expired”

- "SCN reference no not found"

Fixes:

- Make sure you’ve entered the correct TRN, not the GSTIN

- TRN is valid only for 15 days

- SCN (Show Cause Notice) can be checked via:

Services → User Services → View Notices and Orders

Pro Tip: Track application status via ‘Track Application Status’ on homepage

4. Browser Not Cooperating?

GST portal isn’t a fan of outdated browsers or heavy extensions.

Browser Checklist:

- Use Google Chrome, Mozilla Firefox, or Edge

- Clear cache and cookies regularly

- Disable auto-fill and ad-block extensions temporarily

- Avoid mobile browsers for sensitive tasks like filing

For DSC functions: Use the EM Signer utility (especially for companies/LLPs)

5. Still Stuck? Contact GST Helpdesk

Sometimes, you just need a human on the other end.

Options:

- Call: 1800-103-4786 (toll-free)

- Email: helpdesk@gst.gov.in

- Raise a ticket:

- I. Go to Help → Grievance Redressal Portal

- II. Select issue category → Attach screenshots → Submit

Pro Tip: Note your ticket/ARN number for follow-up.

Your GST Login Journey Made Simple

Let’s be real, government portals aren’t always known for their user-friendliness, but the GST portal is your all-access pass to tax compliance, minus the late-night panic.

From registering your business and filing GSTR-3B, to tracking refunds and managing ledgers it all starts with a simple (and slightly finicky) GST login.

Bookmark this guide, revisit it every time you feel lost in the www.gst.gov.in maze, and remember if things go sideways, there’s no shame in getting help.

Forgot your password? Fixed.

TRN not working? Handled.

Portal acting weird? Blame the browser (or Mercury retrograde).

And hey if you’re a busy founder, freelancer, or just don’t want to risk a compliance nightmare…

Need help with GST compliance? Filing Buddy got your back.

From registration to return filing and everything in between our experts make GST almost fun.

Contact Us | Explore Services

FAQs

- How do I log in to the GST portal?

To log in, visit www.gst.gov.in, click the “Login” button on the top right, and enter your GSTIN/User ID and password.

- What is the GST login ID and password?

The GST login ID is the username or GSTIN allotted during registration. The password is set during registration or reset via the “Forgot Password” option.

- How do I get my GST login credentials for the first time?

After successful registration, you’ll receive a username and temporary password via email and SMS. You must change the password on your first login.

- What should I do if I forgot my GST password?

Click on “Forgot Password” on the GST login page, enter your username, verify OTP sent to your registered email or mobile, and reset your password.

- Can I log in to the GST portal using TRN?

Yes, you can log in using a Temporary Reference Number (TRN) during the registration process to complete the application.

- What to do if my GST login account is locked?

Wait for 15–30 minutes after multiple failed attempts. Then reset your password using the “Forgot Password” option or contact the GST helpdesk.

- How to reset GST login credentials?

Go to the login page, select “Forgot Username” or “Forgot Password,” verify via OTP, and set a new username or password.

- How many times can I attempt to log in to the GST portal?

The GST portal typically allows up to 5 failed login attempts before temporarily locking your account for security.

- Why is my GST portal login not working?

Incorrect credentials, expired TRN, cache issues, or server downtime may prevent login. Clear browser cache or reset your password if needed.

- Can I log in with ARN on the GST portal?

No, the Application Reference Number (ARN) is used to track registration status, not for logging in.

- How do I track my GST application status without logging in?

Click “Track Application Status” on the GST homepage, enter ARN/TRN and captcha to view the status.

- Is GST login required to file returns?

Yes, login is mandatory to access your dashboard and file returns like GSTR-1, GSTR-3B, and annual returns.

- What services are available on the GST portal without login?

You can access registration, application tracking, refund guides, help content, notifications, and law updates without logging in.

- What browsers are best for logging into the GST portal?

Use the latest versions of Google Chrome, Mozilla Firefox, or Microsoft Edge. Avoid outdated browsers or mobile logins for filing.

- Can I use the same GST login for multiple businesses?

No, each business with a separate GSTIN has its own unique login credentials and dashboard.

- How do I log in to the GST portal as a tax consultant or CA?

You must register as a GST Practitioner (GSTP), obtain a GSTP ID, and use it to log in on gst.gov.in.

- What is the difference between GSTIN and GST login ID?

GSTIN is the 15-digit unique taxpayer ID. The login ID may be the GSTIN or a username set during registration.

- Can I update my mobile number or email on the GST portal?

Yes, after logging in, go to “Services → Registration → Amendment of Core/Non-Core Fields” to update contact details.

- What if I didn’t receive OTP for GST login?

Check both SMS and email inbox. Wait 60–90 seconds before retrying. If issue persists, contact GST helpdesk or update contact details.

- How can I contact the GST helpdesk for login issues?

Call 1800-103-4786 (toll-free) or email helpdesk@gst.gov.in. You can also raise a grievance via the portal’s Help section.

Contact Us

An expert will call you within 24 hours. No payment required to get started.

Related Post

How should a start-up complete ITR filing

Business entities must file their ITR annually to comply with the tax laws of their respective countries. It helps the government assess and collect the appropriate amount of income tax from taxpayers and ensures proper accountability of financial activities.

. 3 Mins.png)

5 step checklist for GST compliance in Indian Startups

Learn about how GST works. The basics of GST along with its compliances. Uncover what your business needs to keep in mind concerning GST rules and GST compliance.

. 3 min read.png)

₹20 Lakhs and Beyond: Understanding GST for Freelancers in India

Are you a freelancer or aspiring to be one? In this blog, uncover the basics of freelancing and requirements involving GST. Learn about all the exemptions, obligations, and compliances of GST for freelancers in india.

. 5 min read