GST Raid at Registered Office: What Officers Check

By Filing Buddy . 10 Feb 26

Structural Analysis of GST Enforcement and Inspection Protocols

In simple terms, think of the GST registered office as the "home base" for a business. While it is a private legal space, the government has the power to enter and investigate it if they suspect something is wrong with the taxes being paid.

Here is a breakdown of how these "raids" or investigations works:

- The Power to Investigate: Under Section 67 of the GST law, tax officers can inspect or search a business. This isn't a routine check; it is a serious action taken when the government believes a business is hiding sales, claiming fake tax credits, or breaking the law to avoid paying taxes.

- Not Just a Guess: An officer can’t just walk in because they feel like it. A high-ranking official (Joint Commissioner or above) must have a "reason to believe", meaning they need actual proof or solid information that tax evasion is happening.

- Physical vs. Digital: For the officers, the office is a treasure chest of evidence. They go there to see if the physical reality (the actual stock in the warehouse or cash in the safe) matches the digital records (the numbers the business reported online).

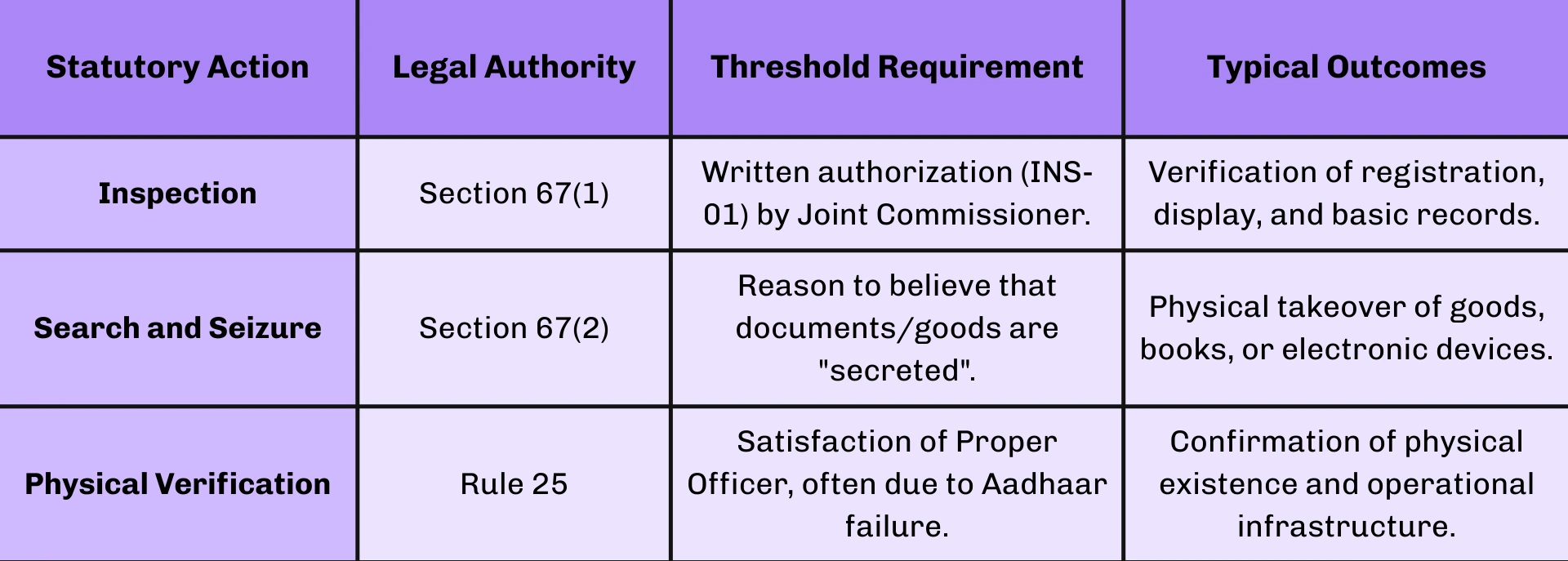

The Two Levels of Intervention

The law looks at these visits in two ways:

- Inspection (The "Soft" Check): A preventive visit to look at records and stock to make sure everything is in order.

- Search (The "Hard" Check): A much deeper dive. This happens when officers believe a business has hidden documents or goods that shouldn't be there, and they have the power to seize them as evidence.

Statutory powers Related to raid:

The execution of a search warrant, issued in Form GST INS-01, grants the authorized officer the power to seal or break open the door of any premises, almirah, or electronic device if access is denied. This power is not absolute and must be exercised in accordance with the Code of Criminal Procedure, 1973, which mandates the presence of at least two independent witnesses and the preparation of a "Panchnama" or seizure memo.

The Digital Panopticon: Predictive Analytics and Pre-Raid Intelligence

In the past, tax raids might have felt random, but today they are driven by powerful technology. Think of the GST system as a "digital eye" that watches every transaction in real-time. Before an officer even steps into an office, they already have a "Risk Profile" generated by AI.

Here is how the government uses data to decide who to investigate:

1. The "Digital Eye" (DGARM)

The government uses a special analytics wing (DGARM) that uses Artificial Intelligence to scan every tax return. They don't just guess; they use Predictive Analytics to spot patterns of fraud before they even visit a business.

2. Common "Red Flags" (Why raids happen)

The system automatically flags a business if the numbers don't add up. The most common triggers are:

- Sales Mismatch: If your sales report (GSTR-1) shows you owe a lot of tax, but your payment report (GSTR-3B) shows you paid very little.

- Fake Tax Credits: Claiming more Input Tax Credit (ITC) than what your suppliers have actually reported.

- Sudden Growth: A massive, unexplained jump in sales (which often hints at fake billing).

- Ghosting the System: Failing to file tax returns for two or more months, which makes the government think the business has disappeared.

3. GSTR-2B: The "Gold Standard"

Since 2021, a report called GSTR-2B has become the most important document.

- What it is: A "frozen" list of every tax credit a business is allowed to claim.

- How it's used in a raid: When officers arrive, they compare the physical paper bills in the office against this digital GSTR-2B list. If a business claims a credit that isn't on that list, it’s considered an immediate violation.

Anatomy of the "Registered Office" Visit: Initial Checkpoints

When GST officers enter an office, the first thing they do is check if the business is real or just a "paper company." They want to see if the office actually looks like a place where work happens.

Here is what they look for:

1. The "Identity" Check (Rules 18 & 25)

A business must "wear its identity" on its sleeve. Officers look for two specific things immediately:

- The Name Board: There must be a sign at the entrance showing the Legal Business Name and the GST Number (GSTIN).

- The Certificate: The original GST Registration Certificate must be framed and hung in a spot where everyone can see it.

Note: If these are missing, officers immediately suspect the business is fake, which can lead to heavy fines.

2. Is it a "Real" Office or a "Shell"?

Officers check if the physical space matches what the business claims to do.

- For Manufacturers: There should be machines and raw materials.

- For Service Providers: There should be desks, computers, and employees.

- The Red Flag: If a company claims to do millions in business but the "office" is just a tiny empty room with one chair and a laptop, it is flagged as a "shell company" (a fake business used for fraud).

3. High-Tech Verification (Geocoding)

Officers now use Geocoding to prevent fraud. They use GPS to check if the exact location (latitude and longitude) of the office matches the address registered on the GST portal. If you are operating from a different building than the one you registered, your GST number could be suspended on the spot.

4. Checking the People

The officers will ask to see the "Identity" of the people running the show:

- ID Proof: They will demand original PAN and Aadhaar cards of the owners, partners, or directors.

- The Boss's Presence: They check if the "Authorized Signatory" (the person legally responsible for the GST) is there.

- Missing People: If the owners are not present and haven't left a representative with a written authorization letter, it is recorded in the official report (REG-30), which looks very bad for the business.

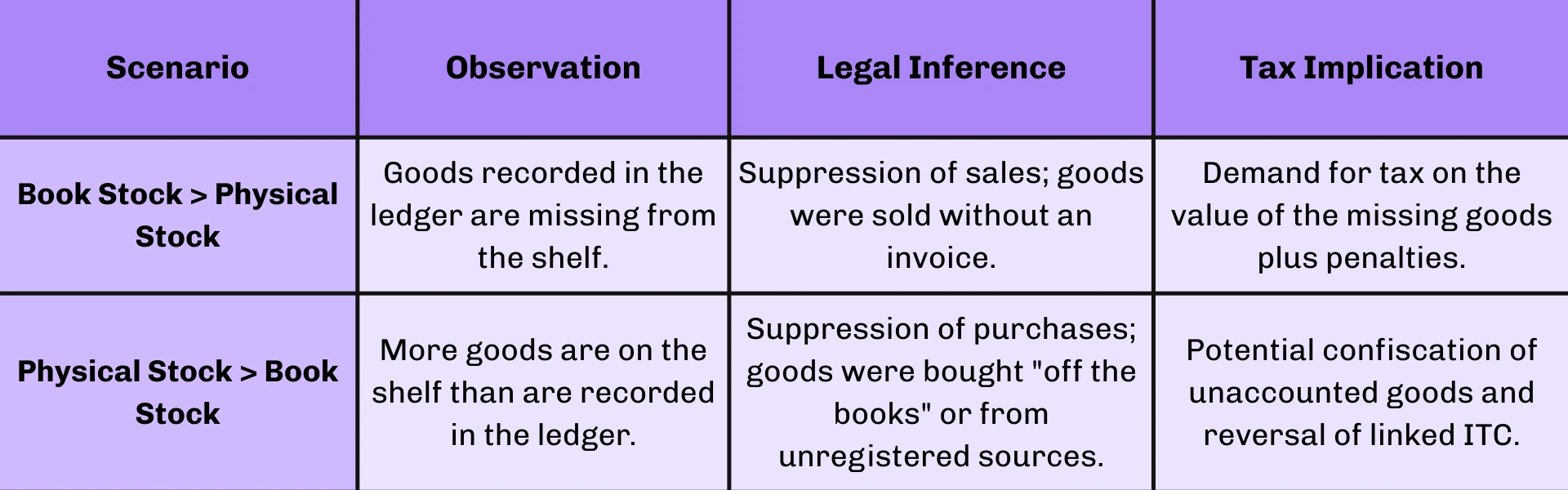

The Inventory Audit and Physical Stock Reconciliation

For manufacturing and trading entities, physical stock verification is the most critical component of the on-site inspection. Any mismatch between the "Book Stock" and the "Physical Stock" is legally interpreted as either suppressed sales or unaccounted purchases.

The fundamental formula utilized is:

Opening Stock (Value)+Purchases (Value)−Closing Stock (Value)=Cost of Goods Sold

During a raid, officers will:

- Freeze Transactions: All movement of goods into or out of the warehouse is halted to obtain a static count.

- Conduct a Physical Count: Every item is counted manually or through barcode scanning, including raw materials and work-in-progress.

- Compare with the Register: The physical count is compared with the stock register maintained under Section 35.

The Digital Battlefield: Forensics and Access to Systems

In today’s world, most "books" are actually digital databases (like Tally or SAP). Because of this, GST raids have turned into a "digital battlefield" where officers act like tech investigators.

1. Digging Into Your Computers

Under the law, businesses must give officers full access to their computers, servers, and even cloud accounts. Here is what the tech team does:

- Cloning Hard Drives: Instead of just looking at files, they make an exact "mirror image" (copy) of your hard drive. This way, they can take the data back to their lab to study it without changing or damaging the original files.

- Checking "Metadata" (The Digital Fingerprint): This is how they catch backdated invoices. Even if a paper says "January," the metadata shows the exact second the file was actually created on the computer. If you made a January invoice in June, they will know.

- Cloud Access: If you use online software (like QuickBooks), you must give them the passwords. If you refuse, they have the legal right to "break open" the devices or even start criminal proceedings for not cooperating.

2. Privacy and Personal Space

Sometimes, a search happens at a home or involves CCTV cameras. Since this is a private space, the law (and the High Courts) set strict rules to protect your rights:

- Family Must Be Present: Officers can’t just go through your home or private CCTV footage alone; at least one family member must be there to watch what they are doing.

- Relevant Files Only: They are only allowed to take data related to taxes. They cannot legally keep your personal photos, private messages, or family videos.

- Entering Locked Rooms: If a room is locked and they don't have the owner's permission or a key, they must follow a formal "lock-breaking" procedure. They can't just use a tenant's key to sneak in.

The Evolution of Cash Seizure Jurisprudence

Officers traditionally argued that cash found during a raid was a "thing" relevant to the proceedings under Section 67(2). However, the definition of "goods" under Section 2(52) specifically excludes "money".

The current legal position, finalized by the Supreme Court in 2024, establishes that:

Cash is not "Goods": Because money is excluded from the definition of goods, it cannot be seized as "goods liable for confiscation".

Procedural Rigor: The Panchnama and Taxpayer Safeguards

A GST raid follows a strict "playbook" to ensure evidence is legal. If officers skip a step, the case can fail in court.

1. The Witnesses (Panchas)

Officers cannot search alone. They must bring two independent witnesses (Panchas) from the local area.

- The "Safety" Search: Before the raid starts, the officers must let the witnesses search them to prove they aren't carrying "planted" evidence. They must do this again when leaving.

- ID Check: Officers must show their government ID cards to you and the witnesses immediately.

2. The Panchnama (The Official Diary)

This is the "Order of Seizure" (Form GST INS-02). It is a minute-by-minute record of the raid. It must include:

- Time: Exactly when they started and when they finished.

- Detailed List: A serial-numbered list of every laptop, file, or phone taken (e.g., "One Black Dell Laptop, Serial #1234").

- Signatures: Every single page must be signed by you, the two witnesses, and the officer. Never sign a blank page.

3. Key Rights & Realities

- "Supurdagi" (Detention): If items are too big to carry (like heavy machinery), officers "seize" them on paper but leave them in your care. You become the legal guardian and cannot move or sell them.

- Copies: You have a legal right to receive a signed copy of the Panchnama before the officers leave.

- Reason to Believe: The officer must explain (on paper) why they think the items being taken are linked to tax fraud.

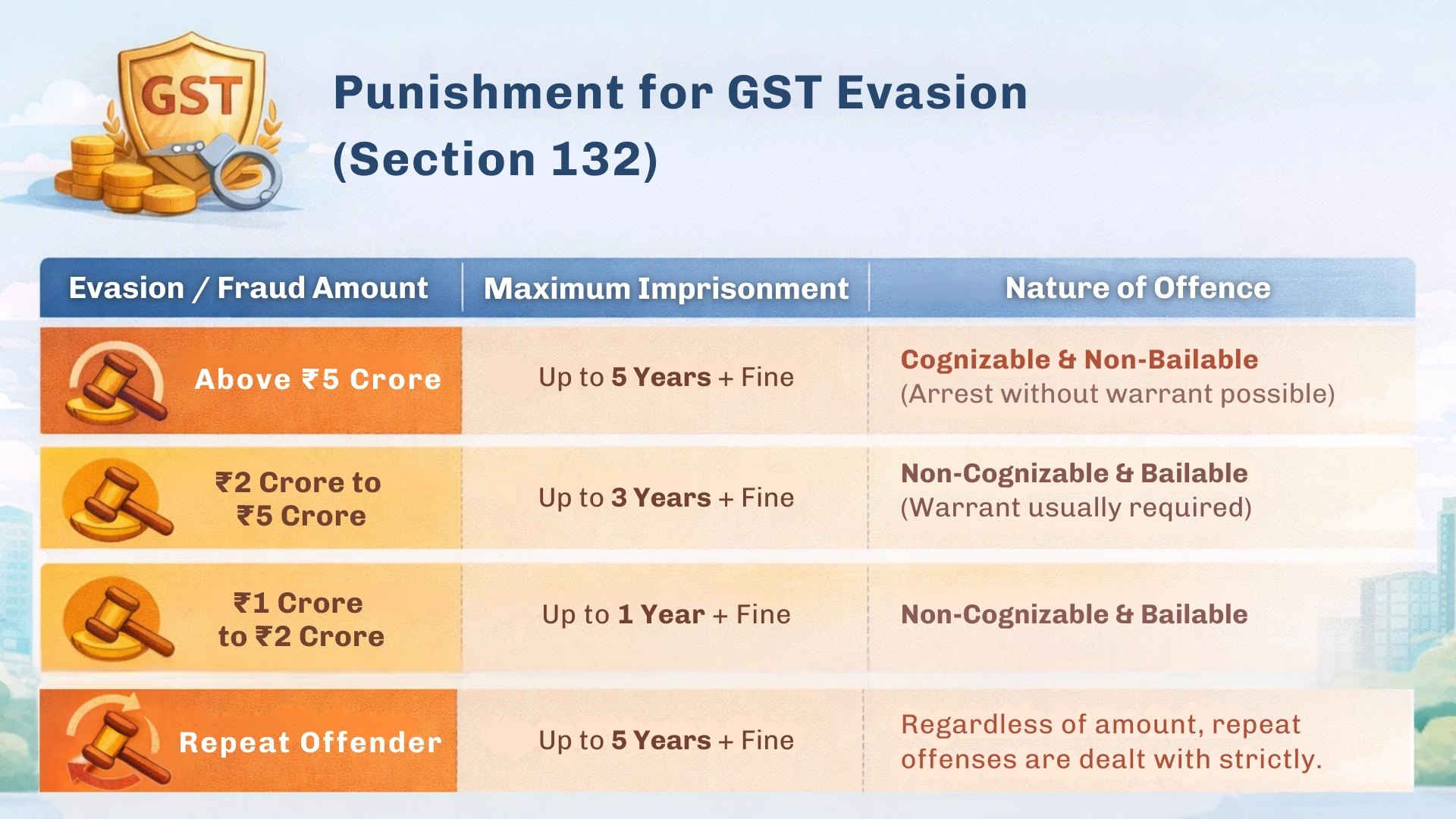

Consequences of Tax Evasion Found During GST raids

The penalties depend on whether the error was an "honest mistake" or "intentional fraud."

Financial Penalties (Section 122 & 74)

- Fraudulent Evasion: If there was "intent to evade" (fake invoices, suppressed sales), the penalty is 100% of the tax amount or ₹10,000, whichever is higher.

- Non-Fraudulent Evasion: If the error was unintentional, the penalty is 10% of the tax amount or ₹10,000, whichever is higher.

- Interest: A mandatory interest of 18% per annum is charged on the unpaid tax amount from the date it was due (Section 50)

Punishment for GST Evasion (Section 132)

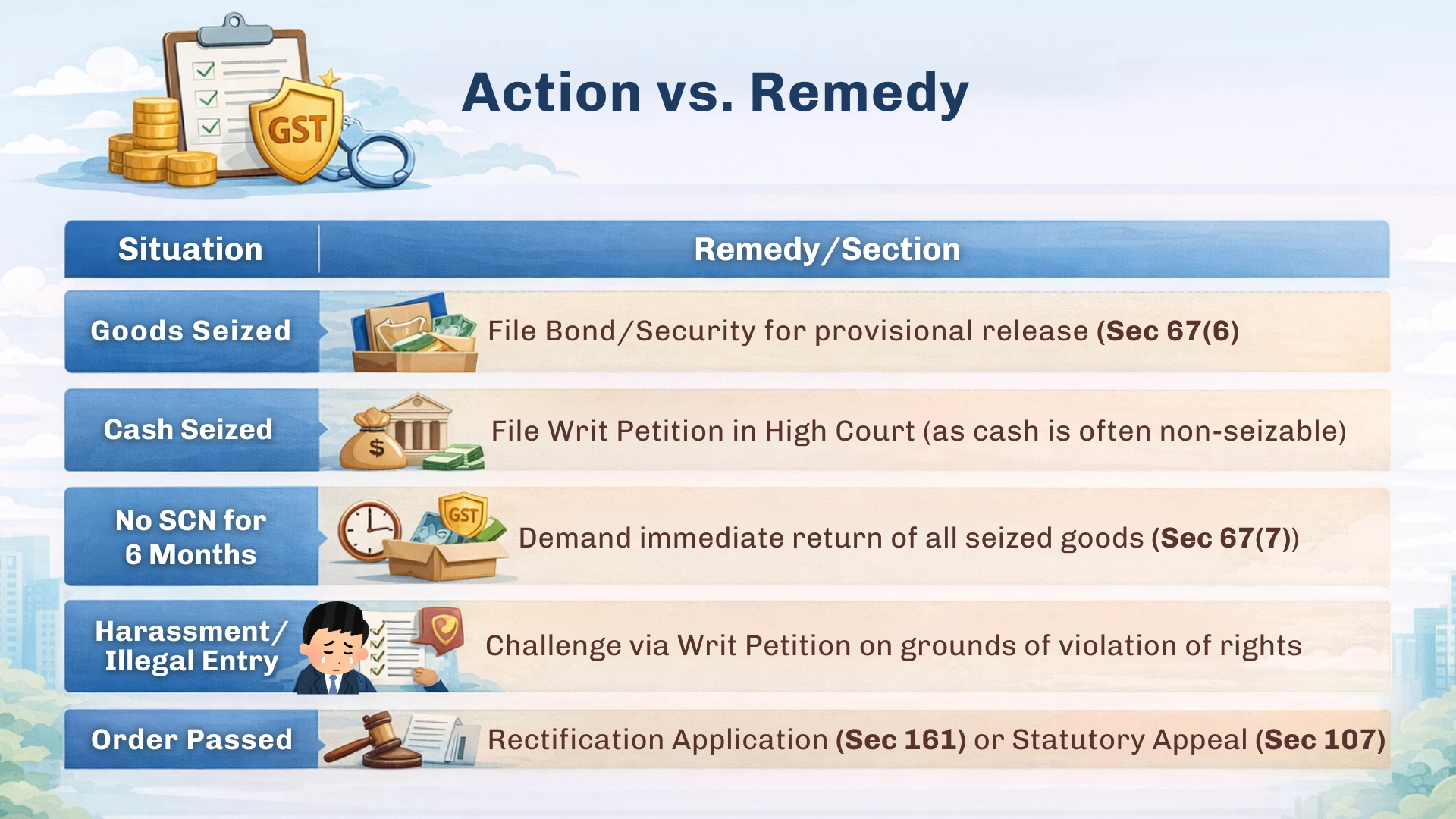

Remedies available to assessee after GST raid

In the event of a GST raid (technically termed "Search and Seizure" under Section 67 of the CGST Act), you have several legal remedies to protect your business interests and assets.

The law provides specific safeguards to ensure that the "extraordinary" powers of search are not misused. Below are the key remedies available to you.

1. Statutory Remedies for Seized Items

If the department seizes your goods, books, or documents, you have the following rights:

- Provisional Release of Goods: You can apply for the provisional release of seized goods by executing a bond (Form GST INS-04) and providing a security (usually a bank guarantee) or by paying the applicable tax, interest, and penalty.

- Release if No Notice is Issued: If the department does not issue a Show Cause Notice (SCN) within 6 months of the seizure, the goods must be returned to you. This period can only be extended by another 6 months for sufficient cause.

- Right to Copy Documents: You have the legal right to take photocopies or extracts of any seized documents in the presence of an officer.

- Return of Non-Relied Documents: Any documents or "things" seized that are not relied upon for the final SCN must be returned within 30 days of the notice issuance.

2. Challenging the Validity of the Raid (Writ Petitions)

You can approach the High Court under Article 226 (Writ Jurisdiction) if the raid was conducted illegally. Common grounds for a Writ include:

- Lack of "Reason to Believe": The Joint Commissioner must have documented reasons to believe that you have suppressed transactions or evaded tax. If the raid was a "fishing expedition" without prior evidence, it can be challenged.

- Illegal Seizure of Cash: Multiple High Courts (e.g., Delhi High Court) have ruled that cash is not "goods" under GST and cannot be seized unless it is the "proceeds of sale" of offending goods.

- Procedural Lapses: If the search was conducted without two independent witnesses or without a proper Search Warrant (Form GST INS-01).

3. Remedies Against Arrest

If an arrest is made during or after the raid:

- Bail: For offences involving tax amounts below ₹5 Crores, the offence is usually bailable. The Assistant/Deputy Commissioner has the power to grant bail.

- Magisterial Production: If the offence is non-bailable (above ₹5 Crores and involving specific frauds), the person must be produced before a Magistrate within 24 hours.

4. Post-Raid Adjudication

Once the raid concludes, the department will typically issue a Show Cause Notice (SCN).

- Adjudication: You have the right to file a detailed reply and request a personal hearing to contest the findings.

- Appeals: If the order is against you, you can file an appeal with the Appellate Authority (within 3 months) and subsequently to the GST Appellate Tribunal (GSTAT).

Summary Table: Action vs. Remedy

Conclusion

In simple terms, a GST raid is a major test for any business. While the government uses these raids to stop tax evasion, the best way to stay safe is to keep honest, digital records and do regular self-checks.

If a raid does happen, you need to stay calm and move from just following orders to protecting your rights. This means checking the officer’s warrant and making sure every detail is recorded correctly in the Panchnama.

You aren't helpless, you have legal remedies, like asking for your goods back or going to court if the officers overstep their bounds. A raid isn't the end of your business; it’s a legal process. By cooperating while also standing up for your rights, you can handle the situation without letting it ruin your company.

FAQ RELATED TO GST RAID:

1. Can officers enter my premises without a warrant?

No. Officers must carry a written authorization called Form GST INS-01 (Search Warrant) signed by a senior officer (Joint Commissioner or above). You have the right to see this warrant before they start.

2. Can the officers arrest me on the spot?

Only in serious cases. Arrests usually happen if the suspected tax evasion is more than ₹5 Crores. For smaller amounts, they generally cannot arrest you immediately without a court process.

3. Can I call my lawyer during the raid?

Yes. You have the right to consult your legal advisor. While the lawyer may not be allowed to interfere with the search, they can observe and ensure that your rights are not being violated.

4. Can officers seize my personal cash?

Technically, no. They can only seize "goods" or "documents" relevant to the investigation. Many High Courts have ruled that seizing personal cash is illegal unless it is proven to be the direct "sale proceeds" of illegal business.

5. What if I am forced to sign a statement?

Don't panic. Any statement given under pressure or "third-degree" tactics is not valid in court. However, you should try to mention in the Panchnama (the final report) that you are signing under protest or disagreement.

6. How do I get my seized goods back?

You can apply for Provisional Release. This usually involves giving a bank guarantee or a bond to the department so you can continue your business while the case goes on.

7. Do there have to be witnesses?

Yes. The law requires at least two independent witnesses (usually people from the locality) to be present during the entire search. They must sign the search report along with you.

Contact Us

An expert will call you within 24 hours. No payment required to get started.

Related Post

How should a start-up complete ITR filing

Business entities must file their ITR annually to comply with the tax laws of their respective countries. It helps the government assess and collect the appropriate amount of income tax from taxpayers and ensures proper accountability of financial activities.

. 3 Mins.png)

5 step checklist for GST compliance in Indian Startups

Learn about how GST works. The basics of GST along with its compliances. Uncover what your business needs to keep in mind concerning GST rules and GST compliance.

. 3 min read.png)

₹20 Lakhs and Beyond: Understanding GST for Freelancers in India

Are you a freelancer or aspiring to be one? In this blog, uncover the basics of freelancing and requirements involving GST. Learn about all the exemptions, obligations, and compliances of GST for freelancers in india.

. 5 min read