How to Handle GST Notices and Scrutiny | Filing Buddy

By Filing Buddy . 16 Dec 25

How to Handle GST Notices and Scrutiny

Opening your inbox to a GST notice can instantly raise a hundred questions. Is this serious? Did I miss something? Will this lead to penalties or scrutiny?

For freelancers, small business owners, and growing startups, GST notices often arrive without warning and the uncertainty can feel more stressful than the notice itself.

Here’s the reassuring truth: receiving a GST notice is not unusual, and it doesn’t automatically mean non-compliance. In most cases, it’s simply the tax system asking for clarification or flagging a data mismatch that can be resolved with the right approach.

In this guide, we break down how to handle GST notices and scrutiny in a clear, step-by-step manner. You’ll understand why GST notices are issued, how to respond correctly, what mistakes to avoid, and how to stay scrutiny-ready in the future so GST compliance feels manageable, not intimidating.

What Is a GST Notice?

A GST notice is an official communication sent by the GST Department to a registered taxpayer seeking clarification, correction, or action related to GST compliance. It is usually issued when the system or tax officer detects an inconsistency in your returns, payments, or records.

It’s important to understand that a GST notice is not a penalty by default. In most cases, it is a query raised to verify information or resolve discrepancies before matters escalate further.

Why Are GST Notices Issued?

GST operates on a self-assessment and data-matching system. Notices are generated when reported data does not align across filings or databases. Common reasons include:

- Mismatch between GSTR-1 and GSTR-3B

- Difference between Input Tax Credit (ITC) claimed and GSTR-2B

- Late or non-filing of GST returns

- Short payment or non-payment of GST

- Inconsistencies between turnover and e-way bills

- Routine scrutiny under the CGST Act

These triggers are often system-generated and can affect even compliant businesses.

Who Can Receive a GST Notice?

A GST notice can be issued to any person registered under GST, regardless of the size or nature of the business. There is no minimum turnover or industry-specific threshold that protects a taxpayer from scrutiny. If you are part of the GST system, notices are a routine compliance mechanism.

This applies equally to businesses that are actively operating and those with limited or irregular transactions.

- Small business owners and MSMEs

- Freelancers and consultants registered under GST

- Start-up's and growing companies

- Traders, manufacturers, and service providers

- Regular and composition scheme taxpayers

If you are registered under GST, scrutiny is a normal part of the compliance lifecycle.

Legal Basis for GST Notices

The GST Department derives its authority from the CGST Act, 2017, which empowers tax officers to examine GST returns and seek explanations whenever discrepancies or irregularities are identified.

Some of the key legal provisions under which GST notices are commonly issued include:

- Section 61 (Scrutiny of Returns): This provision allows GST officers to review filed returns as part of routine scrutiny and ask for clarification when inconsistencies, mismatches, or unusual patterns are detected in reported data.

- Section 73 (Non-Fraud Cases): This section applies when tax has not been paid, has been short paid, or excess Input Tax Credit (ITC) has been claimed without any intent to commit fraud or wilful misstatement. These cases generally allow taxpayers an opportunity to correct errors with relatively lower penalties.

- Section 74 (Fraud or Wilful Misstatement): Invoked in serious situations involving deliberate suppression of facts, fraud, or intentional misreporting. Notices issued under this section carry stricter consequences and significantly higher penalties.

- Show Cause Provisions under GST Law: These provisions enable the department to formally ask taxpayers to explain why tax, interest, or penalties should not be imposed before passing a final order, ensuring an opportunity to be heard.

Understanding the specific section mentioned in your GST notice is crucial, as it indicates the severity of the issue, the level of scrutiny involved, and the nature of the response required.

What a GST Notice Usually Requires You to Do

A GST notice typically asks you to take specific corrective or clarificatory action within a defined timeline. Depending on the issue identified, the department may require you to:

- Provide an explanation for a mismatch or discrepancy

- Submit supporting documents or records

- Pay differential tax along with applicable interest

- Reverse excess or ineligible Input Tax Credit

- File pending GST returns

Every GST notice clearly mentions a response deadline, and missing it can lead to penalties or escalation. Understanding exactly what the notice expects from you is the foundation of an effective response.

In simple terms, a GST notice is a compliance checkpoint, not a compliance failure. Once you clearly understand what the notice is asking for and why it has been issued, handling it becomes far more structured and manageable, setting the stage for the next steps in the process.

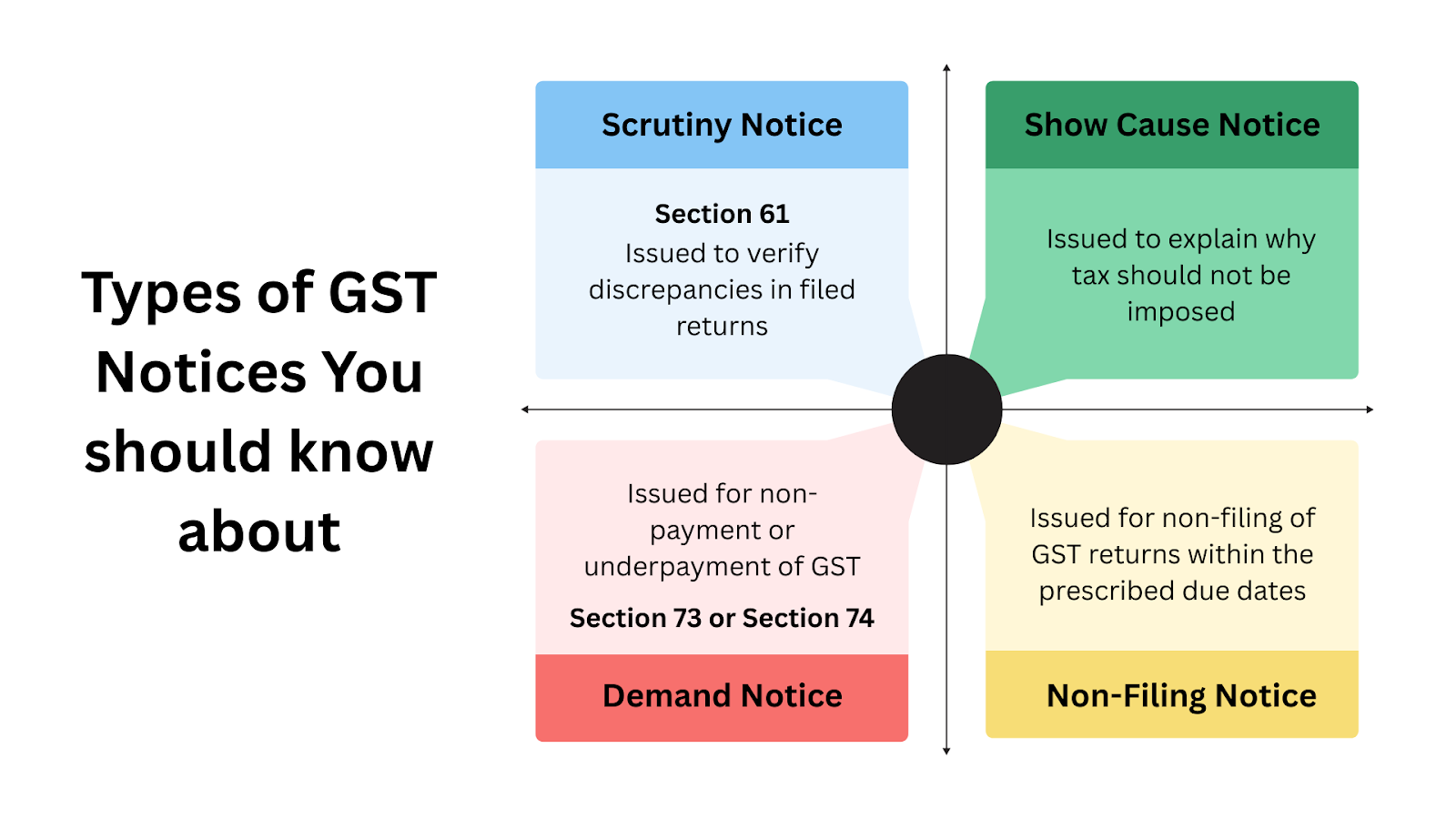

Types of GST Notices You Should Know About

GST notices are issued for different purposes, and each type carries a different level of seriousness and response requirement. Understanding the type of notice you’ve received helps you decide how detailed your reply should be and how quickly you need to act.

Below are the most common GST notices businesses encounter.

Scrutiny Notice (Section 61)

This notice is issued when the GST officer examines your filed returns and finds discrepancies that need clarification.

It usually relates to:

- Mismatch in turnover or tax liability

- ITC differences between returns and auto-populated statements

A scrutiny notice gives you an opportunity to explain or correct the issue before it escalates.

Show Cause Notice (SCN)

A Show Cause Notice asks you to explain why tax, interest, or penalty should not be imposed.

It is issued when:

- Discrepancies remain unresolved

- The department believes there may be a tax shortfall

An SCN requires a detailed, well-documented reply, as it can lead to demand proceedings.

Demand Notice (Section 73 or Section 74)

A demand notice is issued when the department determines that tax has not been paid or ITC has been wrongly claimed.

- Section 73 applies to cases without fraud or wilful misstatement

- Section 74 applies to cases involving fraud or intentional suppression

The consequences under Section 74 are significantly more severe.

Notice for Non-Filing of Returns

This notice is sent when GST returns are not filed within the prescribed due dates.

If ignored, it can lead to:

- Late fees and interest

- Best judgment assessment

- Cancellation of GST registration

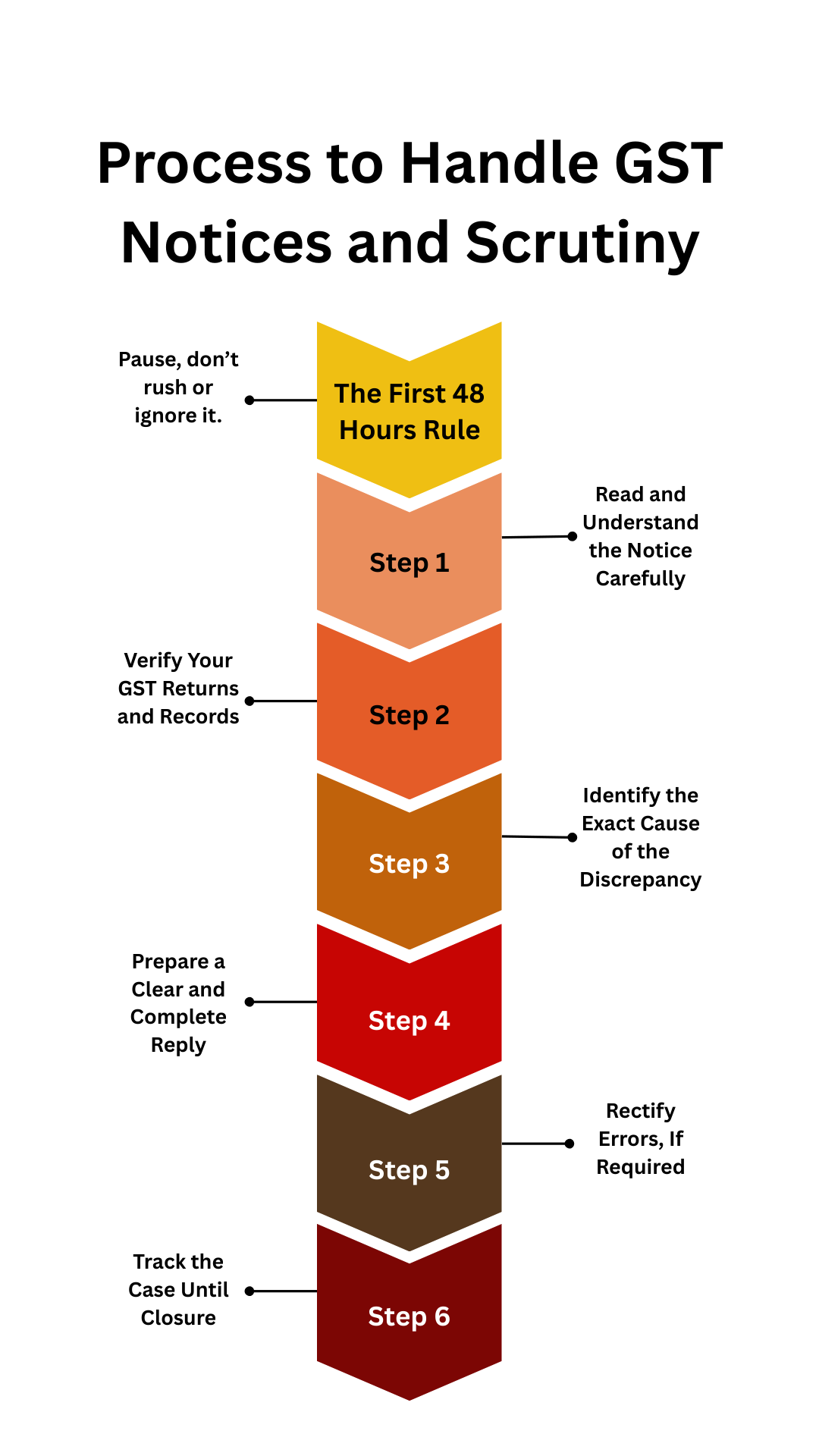

Step-by-Step Process to Handle GST Notices and Scrutiny

Handling a GST notice becomes far simpler when you follow a structured and methodical process. Reacting in haste or ignoring the notice can create avoidable complications, while a step-by-step approach helps resolve issues efficiently and keeps scrutiny under control.

The First 48 Hours Rule: What to Do Immediately After Receiving a GST Notice

The moment you receive a GST notice, it’s natural to feel anxious. However, the first 48 hours are about control—not correction. What you do (and don’t do) during this period often determines whether the matter closes smoothly or escalates into prolonged scrutiny.

1. Pause Before You Respond: Avoid replying immediately or making payments in haste. A rushed response can lead to incorrect admissions or incomplete explanations, which may complicate the case later.

2. Check the Deadline and Notice Details: Note the response due date, the section mentioned in the notice, and the specific issue raised. Missing timelines is one of the fastest ways a notice escalates.

3. Secure and Organise Your GST Records: Collect relevant returns, invoices, ITC statements (GSTR-2B), and payment records. Having documents ready ensures accuracy when you prepare your reply.

4. Do Not Ignore the Notice: Even if you believe the notice is system-generated or incorrect, silence is treated as non-compliance. Every notice requires acknowledgment through action.

5. Plan Your Response Strategy: Decide whether the issue is a simple mismatch or a complex scrutiny matter. This is the stage where seeking professional guidance can prevent costly mistakes.

Think of the first 48 hours as a stabilisation window. Once you stay calm, understand the notice, and organise your data, the actual response becomes structured, confident, and far less stressful.

Step 1: Read and Understand the Notice Carefully

Start by reviewing the notice in detail. Identify:

- The section under which the notice is issued

- The issue or discrepancy highlighted

- The deadline for response

Every GST notice has a specific intent clarification, correction, or enforcement. Understanding this intent at the outset determines the depth and nature of your reply.

Step 2: Verify Your GST Returns and Records

Next, cross-check the data mentioned in the notice with your GST filings and accounting records. This typically includes:

- Comparing GSTR-1 and GSTR-3B

- Matching ITC claimed with GSTR-2B

- Reviewing tax payment challans and ledgers

This step helps confirm whether the discrepancy is genuine, supplier-related, or a timing difference.

Step 3: Identify the Exact Cause of the Discrepancy

Once records are verified, pinpoint the root cause:

- Reporting error

- Excess or ineligible ITC

- Delayed filing or payment

- Supplier non-compliance

Clarity at this stage prevents incorrect explanations and repeated queries from the department.

Step 4: Prepare a Clear and Complete Reply

Draft a point-by-point response addressing each issue raised in the notice. Your reply should:

- Be factual and concise

- Refer to relevant documents

- Avoid unnecessary or unrelated explanations

All replies must be submitted through the GST portal within the prescribed timeline.

Step 5: Rectify Errors, If Required

If the notice reveals an actual mistake, take corrective action promptly:

- Pay differential tax along with interest

- Reverse excess Input Tax Credit

- File pending returns

Voluntary correction often reduces the risk of penalties and further scrutiny.

Step 6: Track the Case Until Closure

After submission, monitor the status of your reply on the GST portal. In some cases, follow-up queries or additional documentation may be required.

Ensuring proper closure of the notice helps prevent the same issue from resurfacing in future assessments.

By following this step-by-step process, GST notices and scrutiny become a controlled compliance exercise rather than a business disruption. A disciplined response at each stage significantly reduces the chances of escalation and long-term compliance issues.

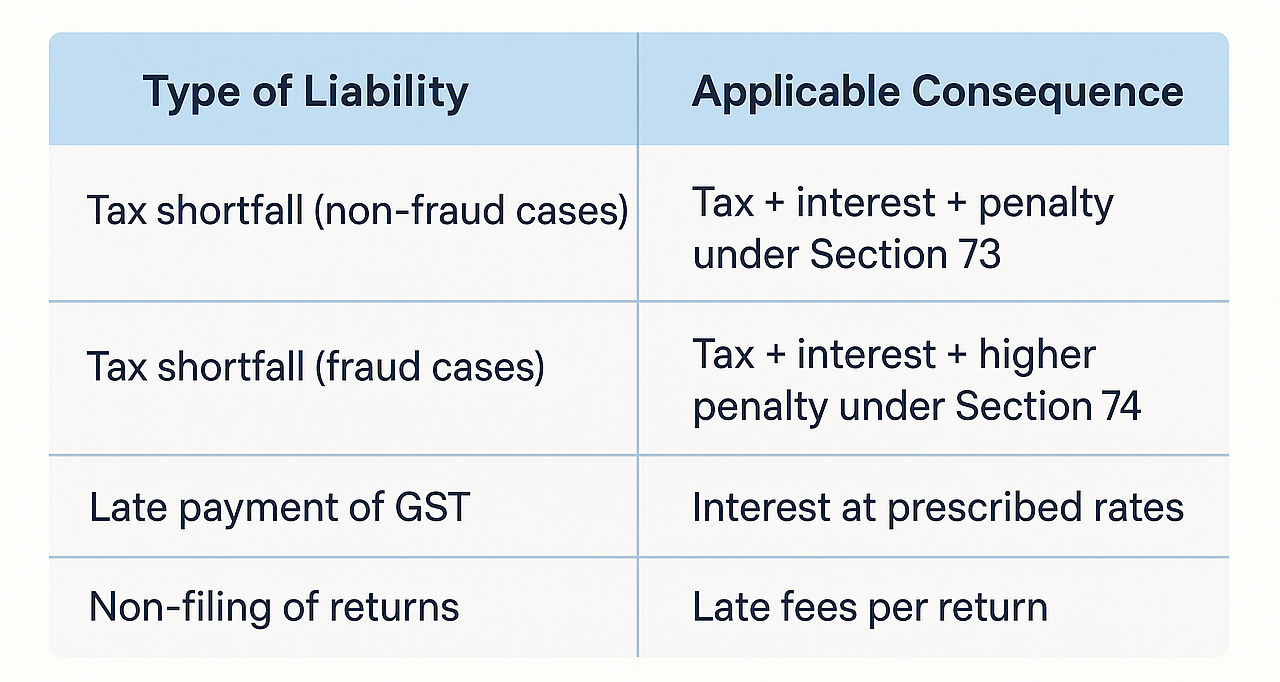

Penalties for Ignoring or Mishandling GST Notices

Ignoring a GST notice or responding to it incorrectly can have serious financial and compliance consequences. GST law is structured in a way that gives taxpayers an opportunity to explain or correct issues early. When that opportunity is missed, penalties and enforcement actions follow.

Understanding these consequences highlights why timely and accurate handling of GST notices is critical.

Financial Penalties and Interest

If a GST notice relates to unpaid tax, short payment, or excess ITC, the department may levy:

Even small discrepancies can grow into substantial liabilities when interest and penalties accumulate over time.

Escalation into Demand Proceedings

Failure to respond to a GST notice within the specified deadline may lead to:

- Show Cause Notices

- Best judgment assessments

- Formal demand orders without further hearing

Once a case escalates, reversing the outcome becomes more complex and time-consuming.

Input Tax Credit (ITC) Restrictions

Mishandling GST notices can result in:

- Blocking or reversal of ITC

- Increased scrutiny on future ITC claims

- Supplier-related credit disputes

For many businesses, this directly affects working capital and cash flow.

Cancellation of GST Registration

In cases involving repeated non-compliance, such as continuous non-filing or ignoring departmental communications, the GST department may initiate cancellation of GST registration.

This can disrupt:

- Ongoing business operations

- Client invoicing and collections

- Contractual obligations

Why Early Action Matters

Most GST penalties are avoidable when notices are handled correctly at the initial stage. Prompt replies, accurate reconciliation, and proper documentation often resolve matters before they escalate into formal demand proceedings.

In GST compliance, delays are costlier than corrections, both financially and operationally.

Why GST Notices Escalate: Common Mistakes Businesses Make

Most GST notices do not escalate because of serious violations, they escalate because of avoidable mistakes made during the response process. Understanding these common errors can help businesses prevent a simple clarification request from turning into prolonged scrutiny or demand proceedings.

Ignoring the Notice or Missing Deadlines

One of the most frequent mistakes is assuming that a GST notice is system-generated and can be dealt with later. Every notice carries a specific response timeline, and missing it can lead to ex-parte orders or automatic escalation.

Delayed responses are often interpreted as non-cooperation.

Replying Without Understanding the Notice

Many businesses rush to submit a reply without identifying:

- The section under which the notice is issued

- The exact discrepancy being questioned

This results in incomplete or irrelevant responses, prompting follow-up notices instead of closure.

Submitting Incomplete or Unstructured Replies

Uploading invoices or documents without a clear explanation is another common error. GST officers review replies as formal records, not casual clarifications.

A response must be point-by-point, supported by documents, and aligned with the issue raised.

Failing to Reconcile Data Before Responding

Responding without reconciling GSTR-1, GSTR-3B, and GSTR-2B often exposes new mismatches. What starts as one issue can quickly expand into multiple queries.

This is a key reason why notices escalate into deeper scrutiny.

Handling Complex Notices Without Expert Support

GST scrutiny and show cause notices involve technical interpretation of law and data. Attempting to handle them without professional guidance increases the risk of:

- Incorrect admissions

- Excess payments

- Long-term compliance issues

GST notices usually escalate not because of intent, but because of process gaps. A calm, structured, and well-informed response at the first stage is often all it takes to resolve the issue efficiently.

How to Become “Scrutiny-Ready” Under GST

Becoming scrutiny-ready doesn’t mean avoiding GST notices altogether, it means building a system where notices don’t disrupt your business. When your GST compliance is organised, consistent, and well-documented, scrutiny becomes easier to handle and quicker to close.

Here’s how businesses can stay prepared.

Maintain Regular GST Reconciliation

One of the most effective ways to stay scrutiny-ready is monthly reconciliation of GST data. This includes:

- Matching GSTR-1 with GSTR-3B

- Reconciling ITC claimed with GSTR-2B

- Identifying differences early, before returns are filed

Regular reconciliation ensures discrepancies are corrected proactively, not questioned later.

Track Vendor Compliance Closely

Your GST compliance is closely linked to your suppliers’ compliance. Delays or errors on their end can directly impact your ITC eligibility.

Businesses should:

- Monitor whether vendors are filing returns on time

- Follow up on missing or incorrect invoices

- Avoid claiming ITC on non-compliant suppliers

This reduces ITC-related scrutiny significantly.

File Returns and Pay Taxes on Time

Timely filing and payment create a strong compliance track record. Consistent delays, even if small, increase the likelihood of system-generated scrutiny.

Making GST deadlines non-negotiable helps build long-term credibility with the tax department.

Maintain Clear Documentation

Every figure reported in GST returns should be traceable to documents, such as:

- Tax invoices

- Credit and debit notes

- Payment challans

- Accounting ledgers

Well-maintained records make it easier to respond confidently if scrutiny arises.

Adopt a Preventive Compliance Approach

Instead of reacting to notices, scrutiny-ready businesses:

- Review returns before filing

- Fix errors voluntarily

- Seek expert review for complex transactions

This preventive approach reduces both financial risk and compliance stress.

Being scrutiny-ready under GST is less about fear and more about discipline and consistency. With the right systems in place, GST scrutiny becomes a manageable compliance checkpoint, not a business disruption.

How Filing Buddy Helps You Handle GST Notices Smoothly

Handling a GST notice requires more than just uploading documents, it calls for expert interpretation, accurate data reconciliation, and timely execution. This is where Filing Buddy steps in as your compliance partner, not just a service provider.

Expert Analysis of GST Notices

Every GST notice is first reviewed by experienced tax professionals to understand:

- The legal section under which it is issued

- The level of risk involved

- The exact data or compliance gap triggering the notice

This ensures your response strategy is aligned with the notice intent, not based on assumptions.

Accurate GST Data Reconciliation

Filing Buddy focuses on data-first resolution. Our team reconciles:

- GSTR-1 with GSTR-3B

- ITC claimed with GSTR-2B

- Tax liability with payment records

This prevents over-disclosure and helps address only the issues actually flagged by the department.

Professional Reply Drafting and Submission

We prepare clear, point-by-point replies supported by relevant documents and submit them within prescribed timelines on the GST portal. Each response is treated as a formal record, designed to close the issue, not invite further scrutiny.

End-to-End Follow-Up Until Closure

GST notices don’t always end with a single reply. Filing Buddy tracks the case, handles follow-up queries, and ensures proper closure, so you’re not left navigating the system alone.

Ongoing Compliance Support

Beyond notice handling, Filing Buddy helps businesses stay compliant through:

- GST return filing

- Bookkeeping and reconciliation

- Preventive compliance reviews

With a Pro-Digital, paperless process, Filing Buddy makes GST compliance faster, simpler, and far less stressful, letting you focus on growing your business while we handle the complexities.

Conclusion: Handle GST Notices with Confidence, Not Panic

GST notices are not a sign of failure, they are a part of a data-driven tax system. The key lies in how you respond.

Here are the three key takeaways to remember:

- GST notices are manageable when understood early and handled systematically.

- Most escalations happen due to delays, poor reconciliation, or unstructured replies, not serious violations.

- Being scrutiny-ready through regular compliance and documentation significantly reduces future risk.

When approached calmly and systematically, even GST scrutiny becomes a routine compliance checkpoint rather than a business disruption.

If you’ve received a GST notice or want to ensure you’re always prepared, Filing Buddy is here to help. From reconciliation and professional replies to ongoing compliance support, we make GST simpler, clearer, and stress-free.

Stay compliant. Stay confident. Stay supported with Filing Buddy.

Frequently Asked Questions (FAQs)

1. Is receiving a GST notice serious?

Not always. Most GST notices are issued for clarification or data mismatches and can be resolved with a proper and timely response.

2. What happens if I ignore a GST notice?

Ignoring a GST notice can lead to penalties, interest, demand orders, ITC blockage, or even cancellation of GST registration.

3. How much time do I get to reply to a GST notice?

The response timeline varies by notice type and is mentioned in the notice itself. Missing the deadline can cause escalation.

4. Can GST notices be issued even if returns are filed correctly?

Yes. Notices can be triggered due to system mismatches, supplier non-compliance, or routine scrutiny, even if filings appear correct.

5. Should I reply to a GST notice myself or take professional help?

Simple mismatches may be handled internally, but scrutiny or show cause notices are best handled with professional support to avoid errors and escalation.

6. Can a GST notice be issued for a very small amount?

Yes. GST notices are often system-generated and do not depend on the amount involved. Even minor mismatches or delays can trigger a notice, especially if they occur repeatedly.

7. Is it mandatory to reply to every GST notice?

Yes. Every GST notice requires a response or corrective action within the specified timeline. Ignoring a notice can lead to escalation, penalties, or demand orders.

8. Can I revise my GST return after receiving a notice?

Revisions to GST returns are not directly allowed, but errors can often be corrected in subsequent returns or through payment, reversal, or explanation, depending on the nature of the issue.

9. What happens if I miss the GST notice reply deadline?

Missing the deadline may result in ex-parte orders, best judgment assessments, or demand notices without further opportunity to explain your position.

10. Do GST notices affect future scrutiny or audits?

Yes. Repeated notices, delayed responses, or unresolved discrepancies can increase the likelihood of future scrutiny or audit selection by the GST department.

11. Can GST notices be issued due to supplier mistakes?

Yes. Supplier non-compliance—such as delayed return filing or incorrect reporting—can cause ITC mismatches and lead to notices, even if the buyer has complied correctly.

12. Should I pay the tax immediately after receiving a GST notice?

Not always. Payments should be made only after verifying the discrepancy. In some cases, the issue may be explainable or resolvable without additional tax payment.

Contact Us

An expert will call you within 24 hours. No payment required to get started.

Related Post

How should a start-up complete ITR filing

Business entities must file their ITR annually to comply with the tax laws of their respective countries. It helps the government assess and collect the appropriate amount of income tax from taxpayers and ensures proper accountability of financial activities.

. 3 Mins.png)

5 step checklist for GST compliance in Indian Startups

Learn about how GST works. The basics of GST along with its compliances. Uncover what your business needs to keep in mind concerning GST rules and GST compliance.

. 3 min read.png)

₹20 Lakhs and Beyond: Understanding GST for Freelancers in India

Are you a freelancer or aspiring to be one? In this blog, uncover the basics of freelancing and requirements involving GST. Learn about all the exemptions, obligations, and compliances of GST for freelancers in india.

. 5 min read