Inventory Valuation: Avoid Overvaluing Stock

By Filing Buddy . 18 Feb 26

When raising capital, it’s tempting to present your business in the best possible light. Strong revenue, impressive margins, growing demand and a healthy inventory balance.

But there’s one mistake that can quietly damage investor trust and future funding opportunities: overvaluing your inventory.

Inventory valuation isn’t just an accounting exercise. It directly affects profitability, working capital, tax liability, and ultimately, how investors perceive your business health.

When preparing financial statements for investors, every number tells a story. Among those numbers, inventory valuation plays a critical role in shaping how your business is perceived.

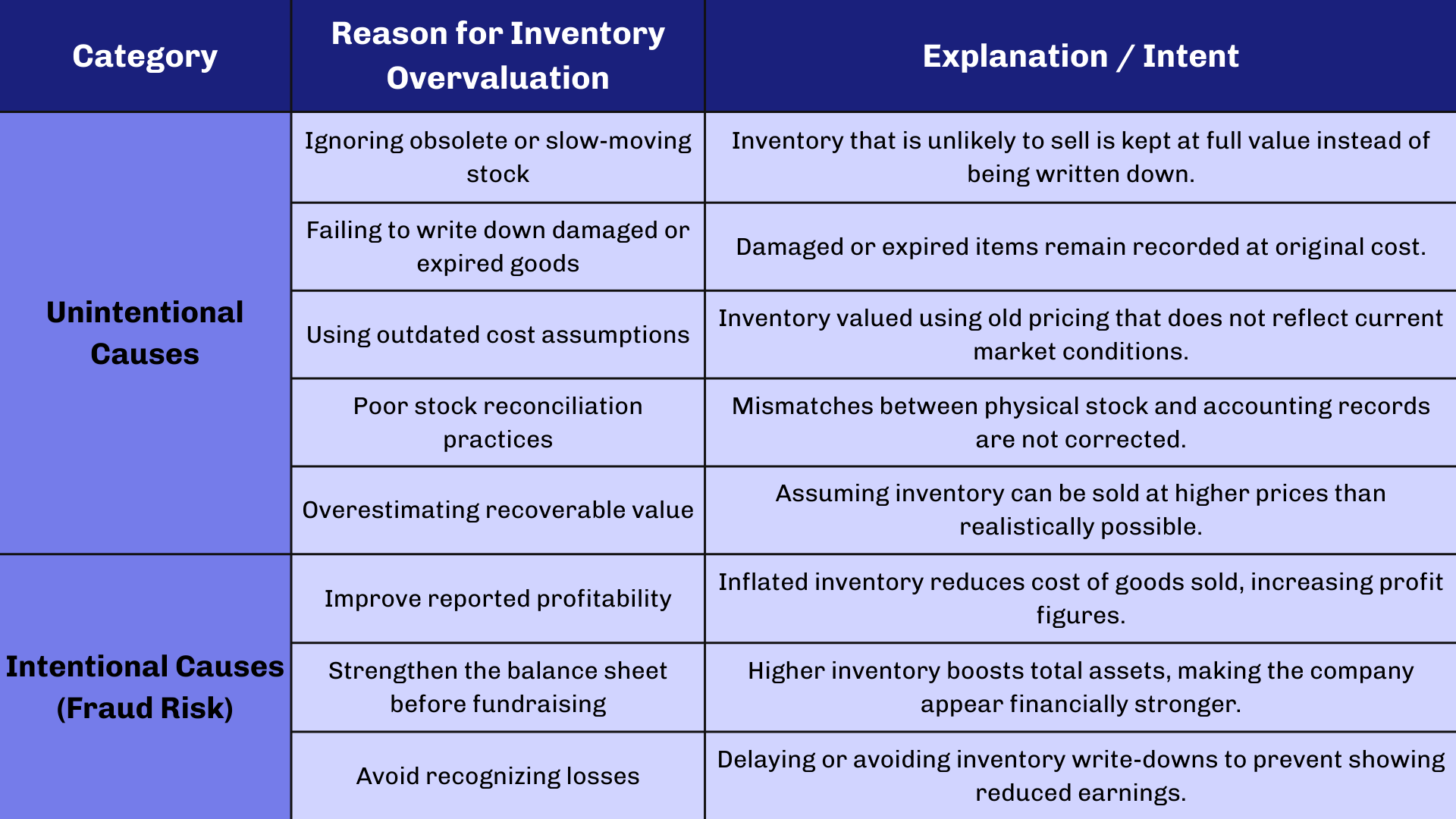

At Filing Buddy, we often see businesses unintentionally (and sometimes intentionally) overvalue inventory to present stronger margins and higher profits. While this may seem beneficial in the short term, it can seriously damage investor confidence and create compliance risks.

Let’s understand why accuracy matters more than appearance.

What Went Wrong?

Why Inventory Valuation Matters

Inventory is often one of the largest assets on a company’s balance sheet especially in manufacturing, retail, e-commerce, and distribution businesses.

Your inventory valuation impacts:

- Cost of Goods Sold (COGS)

- Gross profit margins

- Net income

- Working capital

- Tax liability

- Company valuation

If inventory is overstated, profits appear higher than they actually are. While this may look attractive in the short term, it creates long-term financial and credibility risks.

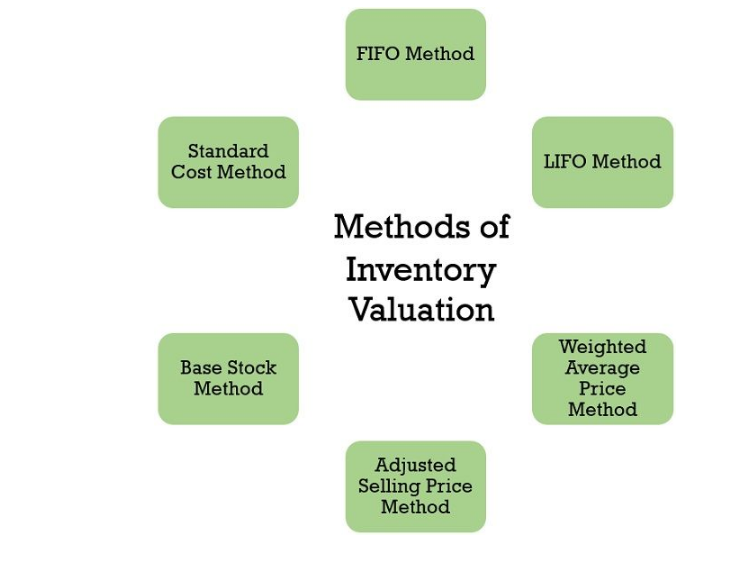

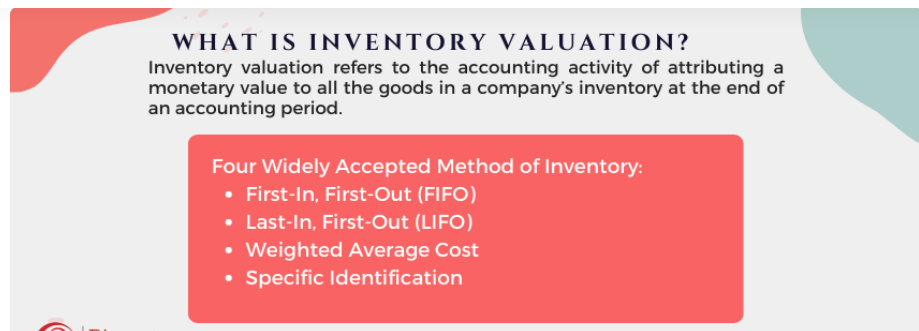

Common Inventory Valuation Methods

Understanding the accepted inventory valuation methods helps ensure compliance and clarity:

- FIFO (First In, First Out): Assumes the earliest goods purchased are sold first. This method usually results in lower COGS and higher profits when prices are rising.

- LIFO (Last In, First Out): Assumes the latest goods purchased are sold first. Can result in higher COGS and lower profits in inflationary environments. (Note: LIFO is prohibited under IFRS but allowed under some US GAAP provisions.)

- Weighted Average Cost: Calculates an average cost for inventory, smoothing out price fluctuations.

- Specific Identification: Assigns actual cost to individual items, often used for unique or high-value inventory.

The key is consistency, you must apply your chosen method consistently and disclose it in your financial statements.

Why Companies Overvalue Inventory

The Hidden Risks of Overvaluing Inventory

1. Inflated Profits That Don’t Reflect Reality

When inventory is overstated, COGS is understated. This artificially increases gross profit and net income.

Investors rely heavily on margin analysis. If future corrections reduce margins, it raises red flags immediately.

2. Damaged Investor Trust

Due diligence processes often uncover discrepancies.

If investors discover inventory write-downs after investing, trust erodes quickly and future funding rounds become much harder.

In early-stage businesses, credibility is often more valuable than short-term financial presentation.

3. Cash Flow Problems

Inventory is not cash.

A company can appear profitable while struggling with liquidity because cash is tied up in unsellable or slow-moving stock.

Smart investors focus heavily on:

- Inventory turnover ratio

- Days inventory outstanding (DIO)

- Working capital efficiency

Overvalued stock weakens all of these metrics.

4. Compliance & Audit Risks

Auditors frequently test inventory valuation.

Overstatement can lead to:

- Audit qualifications

- Financial restatements

- Regulatory scrutiny

- Legal exposure in extreme cases

This can significantly reduce company valuation during acquisition or IPO.

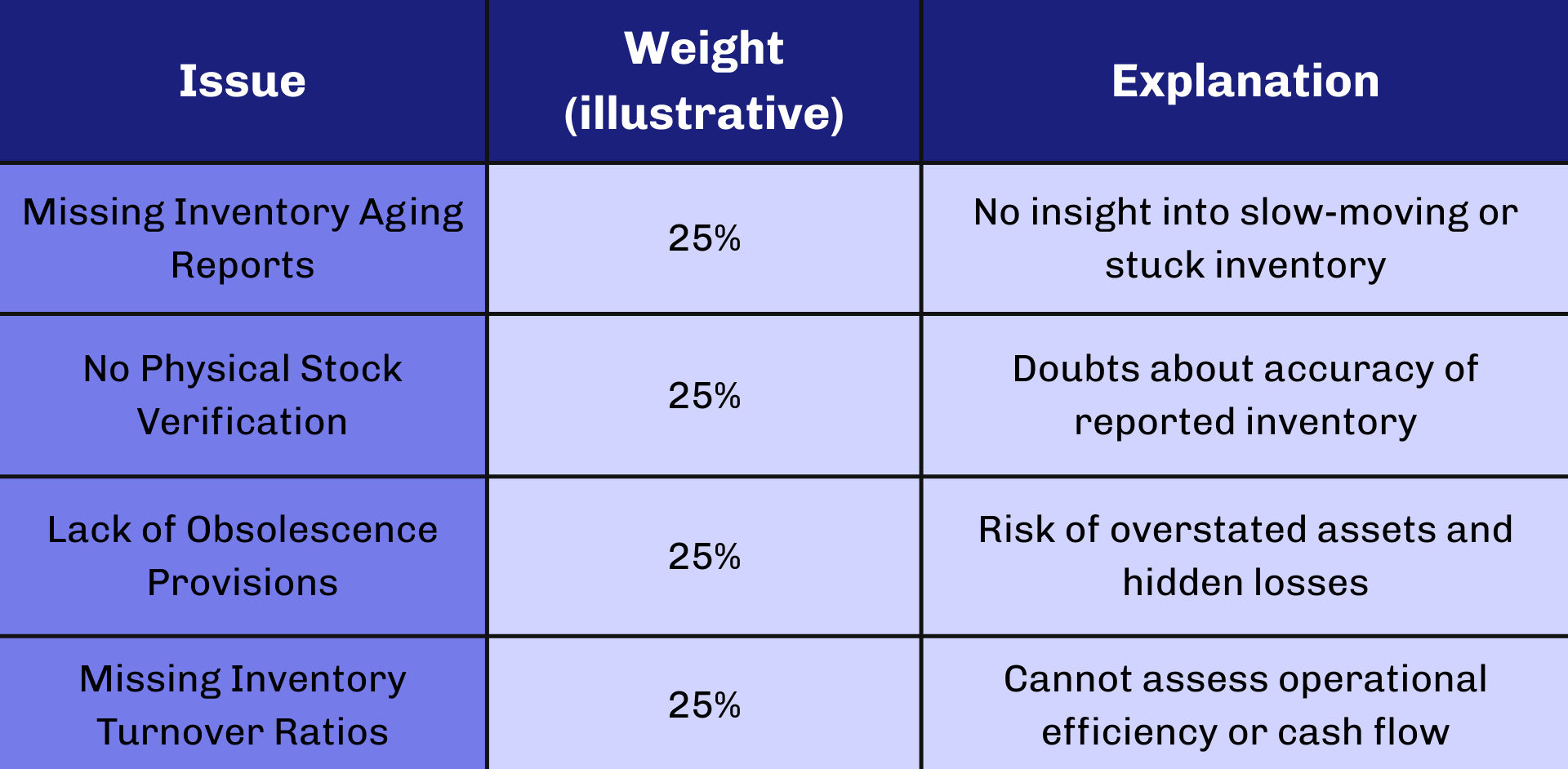

What Investors Actually Want to See

Contrary to popular belief, sophisticated investors don’t expect perfect numbers. They expect accurate and transparent numbers.

They look for:

- Clear inventory policies (FIFO, LIFO, Weighted Average, etc.)

- Regular stock reconciliations

- Obsolescence provisions

- Realistic write-down practices

- Healthy inventory turnover

A company that proactively manages inventory risk signals strong operational discipline.

The Long-Term View: Transparency Wins

Overvaluing inventory may temporarily boost your balance sheet. But experienced investors can detect inconsistencies quickly.

A business built on realistic numbers:

- Builds Investor Trust: Accurate numbers foster strong, long-lasting investor relationships.

- Reduces Financial Risks: Proper valuation prevents costly restatements and tax penalties.

- Improves Operational Efficiency: Knowing your true inventory position helps optimize stock levels.

- Enhances Business Valuation: Realistic financials lead to fair and sustainable company valuations.

- Supports Strategic Decisions: Reliable data empowers better growth and funding decisions.

In fundraising, credibility compounds faster than inflated numbers ever will.

Best Practices for Accurate Inventory Valuation

1. Conduct Regular Physical Inventory Counts: Schedule periodic physical stock verification to reconcile system records with actual goods.

2. Implement Inventory Aging Reports: Track inventory age to identify slow-moving or obsolete stock and make appropriate write-downs.

3. Apply Consistent Valuation Methods: Stick to one recognized valuation method and avoid changing it arbitrarily.

4. Maintain Proper Documentation: Document your inventory policies, procedures, and assumptions clearly.

5. Strengthen Internal Controls: Segregate duties, perform reconciliations, and review valuation calculations regularly.

6. Engage Professional Help: Seek expertise from accountants and compliance advisors to ensure accuracy and regulatory compliance.

These practices protect both your compliance standing and your investor relationships.

How Filing Buddy Can Help

Whether you are preparing for funding, audit, or regulatory filings, our team ensures your financials are accurate, compliant, and investor-ready.

We assist with:

- Inventory reconciliation reviews

- Audit preparation

- Financial statement compliance

- Tax advisory

- Internal control assessments

Our goal is simple: help you build credibility through strong compliance.

Final Thought

Inventory valuation is often overlooked but critical to your company’s financial integrity and investor perception. Overvaluing your stock may offer a short-term boost but exposes you to long-term risks damaged credibility, compliance issues, and financial setbacks.

At Filing Buddy, we emphasize accuracy, transparency, and compliance as the pillars of strong financial reporting. By valuing your inventory correctly, you not only protect your business but also build a foundation of trust that attracts investors and fuels sustainable growth.

FAQs

1. What is inventory valuation?

Inventory valuation is the method used to determine the monetary value of unsold stock. It affects COGS, profits, taxes, and overall financial reporting accuracy.

2. Why is inventory valuation important for investors?

It directly impacts profit margins, working capital, and company valuation. Investors rely on accurate inventory numbers to assess operational efficiency and financial health.

3. What happens if inventory is overvalued?

Overvaluation understates COGS and inflates profits. This can mislead investors, distort margins, create audit risks, and damage credibility during due diligence.

4. How does inventory valuation affect COGS?

If inventory is overstated, COGS appears lower. If understated, COGS increases. This directly influences gross profit and net income.

5. What are the main inventory valuation methods?

The primary methods are FIFO, LIFO, Weighted Average Cost, and Specific Identification. Each impacts profit differently depending on price trends.

6. Is LIFO allowed under IFRS?

No. LIFO is prohibited under IFRS but permitted under certain US GAAP standards.

7. Which inventory valuation method is best?

There’s no universal “best” method. The right choice depends on your business model, industry, pricing trends, and compliance requirements. Consistency is key.

8. How does inventory overvaluation impact cash flow?

Inventory is not cash. Overvalued stock can hide liquidity issues and make a business look profitable while cash remains tied up in unsold goods.

9. What do investors check during inventory due diligence?

They review valuation methods, stock reconciliations, aging reports, write-downs, turnover ratios, and consistency in accounting policies.

10. Can incorrect inventory valuation affect taxes?

Yes. Overstated inventory can inflate profits, increasing tax liability. Errors may also trigger penalties or regulatory scrutiny.

11. What is inventory write-down?

A write-down reduces the recorded value of inventory when it becomes obsolete, damaged, or unsellable, ensuring financial statements remain accurate.

12. How often should businesses verify inventory?

Physical inventory counts should be conducted periodically, quarterly or annually, along with regular reconciliations and aging analysis.

13. What is inventory turnover ratio?

It measures how quickly inventory is sold and replaced. Low turnover may indicate overstocking or slow-moving inventory.

14. What is Days Inventory Outstanding (DIO)?

DIO calculates the average number of days inventory remains unsold. Higher DIO may signal inefficiency or excess stock.

15. How can businesses avoid overvaluing inventory?

Use consistent valuation methods, conduct physical counts, implement aging reports, maintain documentation, strengthen internal controls, and seek professional review before fundraising.

Contact Us

An expert will call you within 24 hours. No payment required to get started.

Related Post

LLP vs. LLC: Choosing the Right Structure for Your Business

Making the appropriate legal structure choice is one of the most important decisions you'll need to make when launching a business in India. Limited Liability Companies (LLCs) and Limited Liability Partnerships (LLPs) are two well-liked alternatives.

. 3 min read2.png)

LLP Agreements: Creating a Solid Foundation for Your Business

A Limited Liability Partnership (LLP) is a business structure that combines the benefits of a partnership with limited liability protection, typically associated with corporations. It is designed to provide a more flexible and tax-efficient framework for professionals and businesses with multiple partners.

. 3 min read.png)

Revised LLP (Amendment) Rules for 2023 – Enhanced LLP Form No. 3

The Ministry of Corporate Affairs (MCA) has recently issued the Limited Liability Partnership (LLP) (Amendment) Rules, 2023, which were officially gazetted on June 2, 2023. These rules bring about amendments to the pre-existing Limited Liability Partnership Rules of 2009. These amendments came into effect upon their publication in the Official Gazette. A noteworthy change introduced through these amendments is the revision of the LLP Form No.3, which pertains to "Information concerning Limited Liability Partnership Agreement."

. 3 min read