New vs Old Tax Regime 2026: Founder Tax Guide

By Filing Buddy . 04 Feb 26

A Strategic Analysis of the Union Budget 2026

The Union Budget 2026-27, presented by the Finance Minister on February 1, 2026, serves as a definitive blueprint for India’s transition into a simplified, compliance-centric, and technology-driven economic landscape. For founders and the broader entrepreneurial ecosystem, this budget represents a shift from a "deduction-maximizing" culture to one focused on "actual tax outgo" and structural efficiency. By maintaining the status quo on personal income tax rates while reinforcing the new tax regime as the default mainstream, the government has signaled the beginning of the end for the complex, documentation-heavy tax planning of previous decades. This analysis explores the multi-dimensional impact of the budget on founder compensation, equity distribution, corporate structuring, and regional development, particularly within emerging hubs like Madhya Pradesh and Indore.

The Personal Taxation Paradigm: Strategic Divergence of Regimes

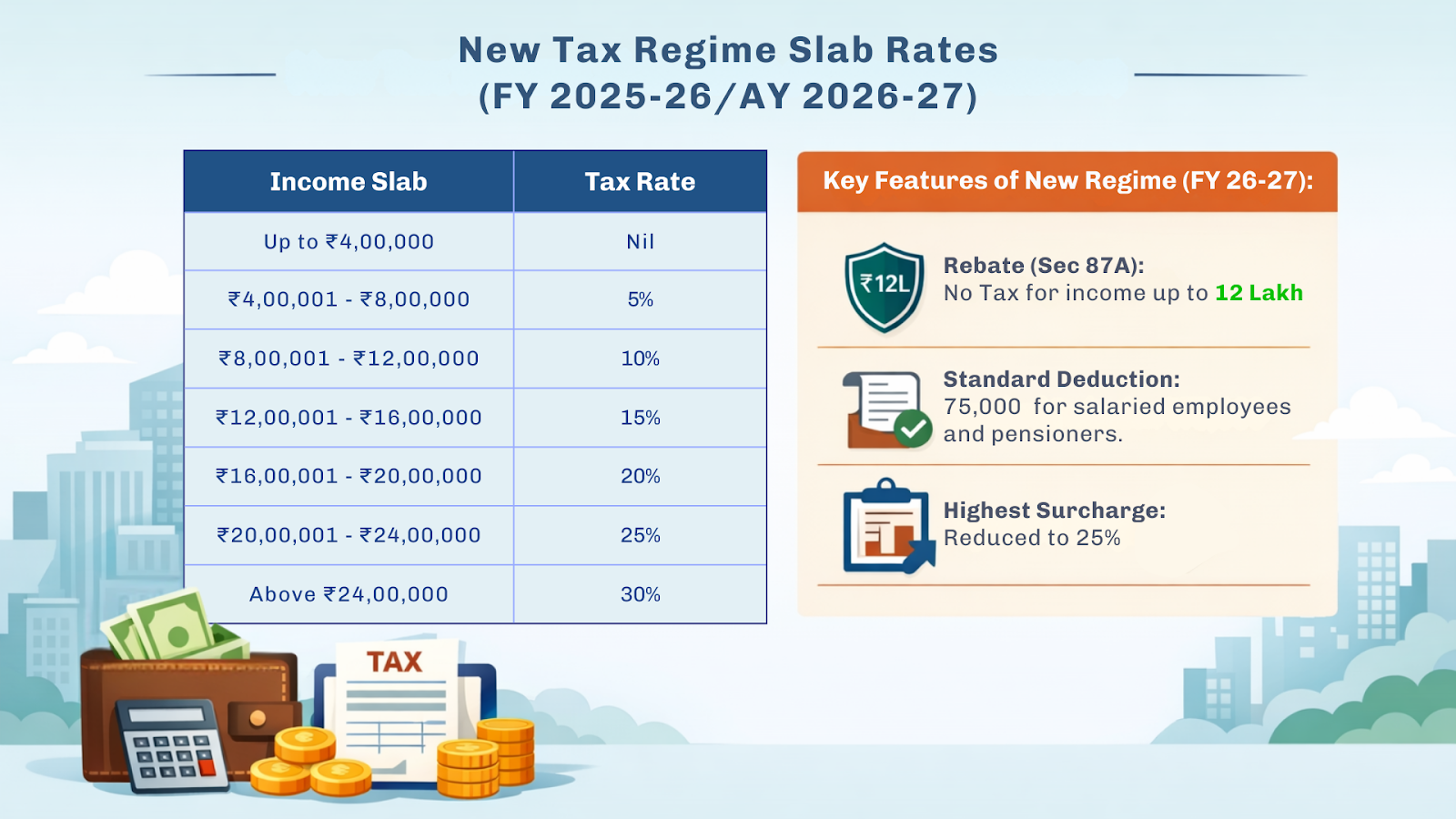

The personal income tax structure for the Financial Year 2026-27 (Assessment Year 2027-28) remains a continuation of the reformist trajectory established in the preceding year. For founders who often find themselves balancing modest initial salaries with the promise of long-term equity upside, the choice of tax regime has become a foundational decision in cash flow management. The new tax regime, now fully optimized with enhanced rebates and wider slabs, offers a unique opportunity for early-stage founders to minimize their personal tax liability during the lean years of business building.

New Tax Regime Slab Rates (FY 2025-26/AY 2026-27)

Old Tax Regime Slab Rates (FY 2025-26/AY 2026-27)

Structural Comparison of Income Tax Slabs

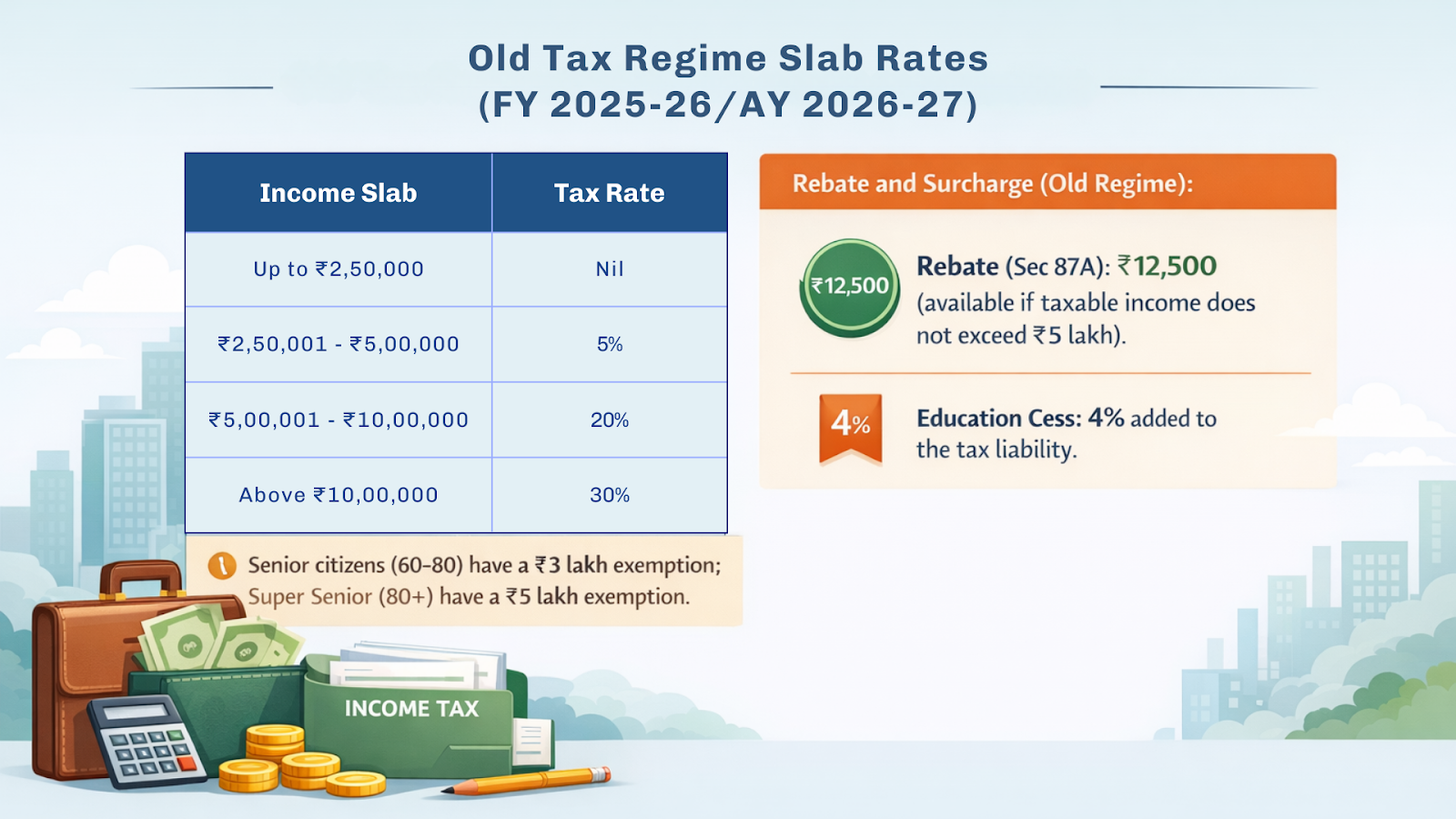

The structural differences between the old and new regimes highlight a deliberate policy of nudging high-income earners and professionals away from the legacy system. Under the old regime, the maximum marginal rate of 30% begins at an income of ₹10 lakh, whereas the new regime extends this threshold to ₹24 lakh, providing a much wider runway for middle-to-high income earners.

The introduction of the Section 87A rebate, which effectively makes income up to ₹12 lakh tax-free under the new regime, is a cornerstone of this structural shift. For a resident individual, this rebate of up to ₹60,000 ensures that no tax is payable on regular income up to the ₹12 lakh threshold. Furthermore, the concept of marginal relief has been integrated to ensure that individuals earning slightly above ₹12 lakh are not unfairly penalized by a sudden spike in tax liability, limiting the tax to the amount earned in excess of the threshold.

Standard Deduction and the Break-even Point

For founders drawing a salary from their startups, the standard deduction provides an additional layer of relief. Under the new regime, this deduction stands at ₹75,000, effectively raising the tax-free income limit for salaried individuals to ₹12.75 lakh. In contrast, the old regime maintains a lower standard deduction of ₹50,000.

The "break-even point", the level of deductions required under the old regime to match the tax liability of the new regime has shifted significantly. For a founder with a gross salary of ₹25 lakh, the tax under the new regime is approximately ₹3,19,800. To achieve the same liability under the old regime, the founder would need to claim nearly ₹8.5 lakh in deductions, including Section 80C (EPF, PPF), 80D (Health Insurance), and significant interest on home loans or House Rent Allowance (HRA). As salary levels increase, the effort required to document and plan for these deductions often outweighs the diminishing tax benefits, reinforcing the mainstream status of the new regime.

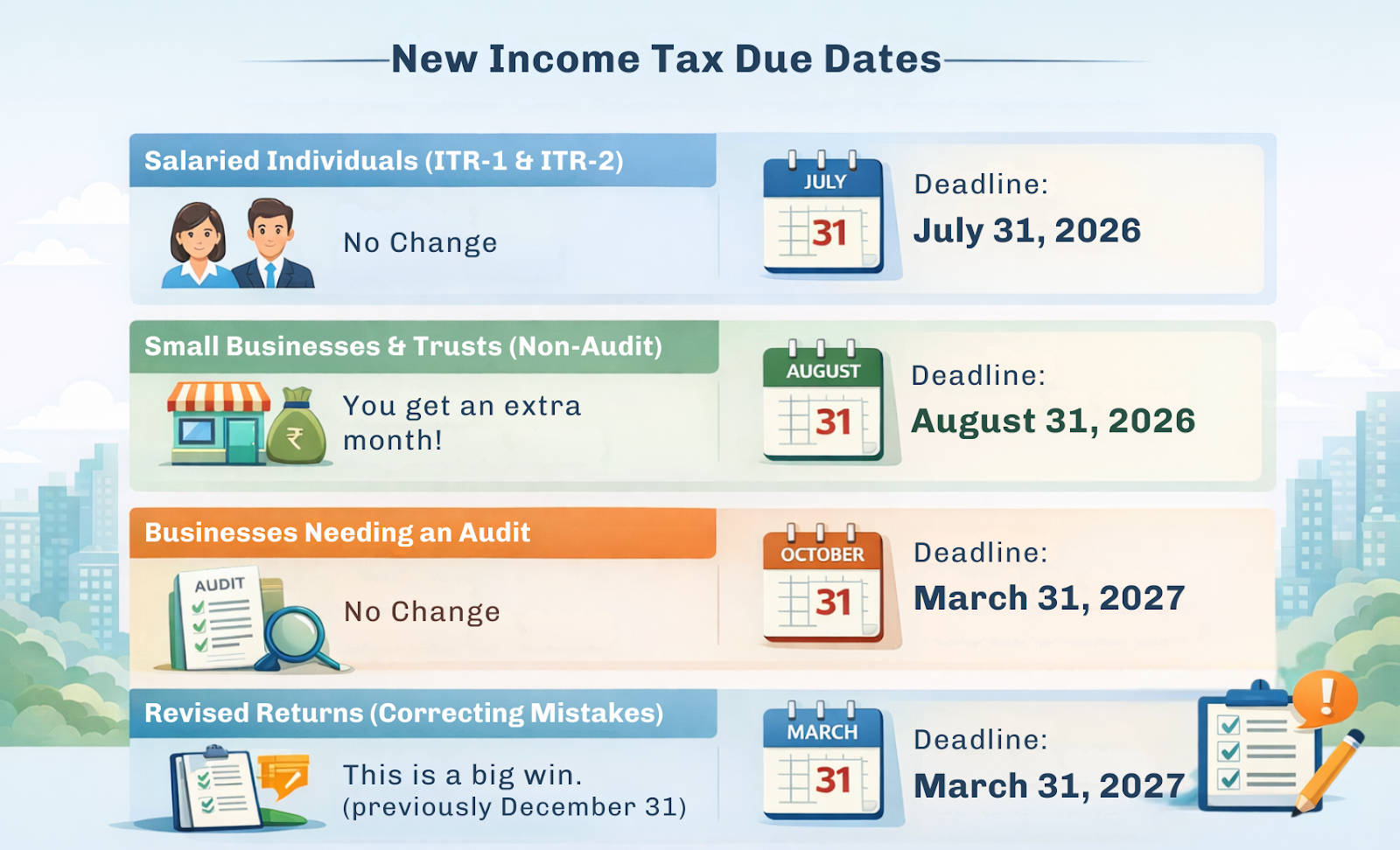

New Income Tax Due Dates

For the current financial year (FY 2025-26), the deadlines depend on who you are:

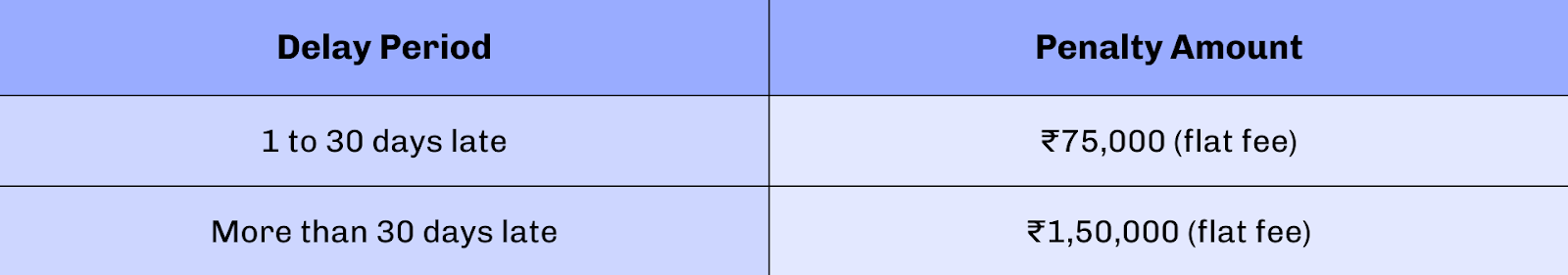

Audit Penalty Update (The "Fixed Fee" Rule)

Previously, penalties for missing a tax audit deadline were discretionary (based on a percentage of turnover). The 2026 Budget has replaced this with a fixed, graded fee structure so you know exactly what the "fine" is for being late:

Note: Even a one-day delay now triggers the ₹75,000 penalty.

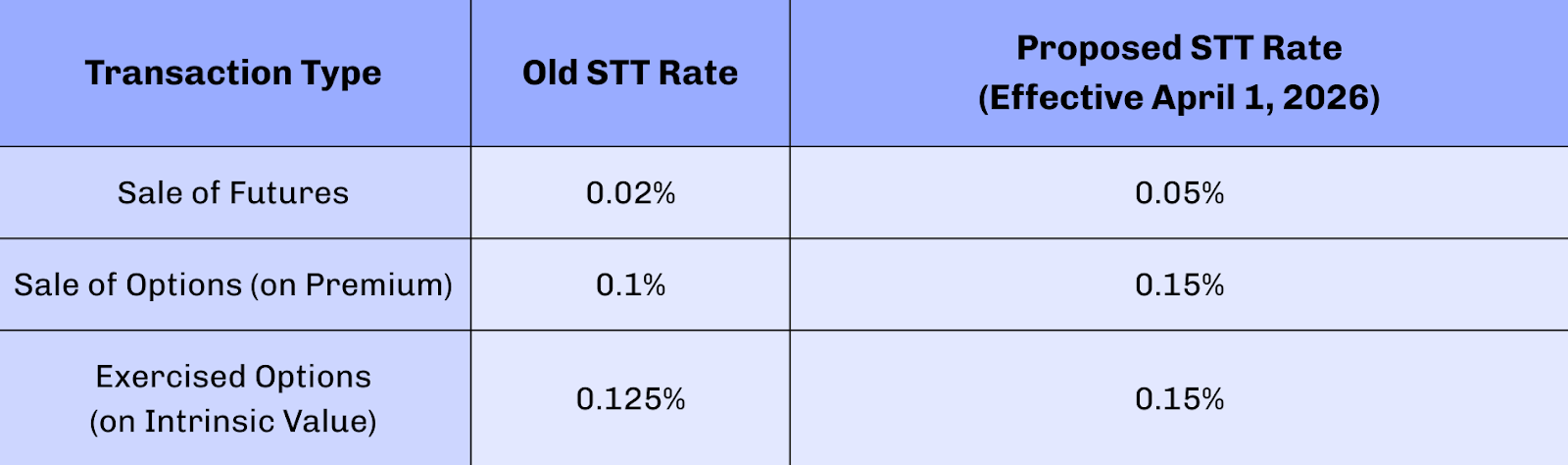

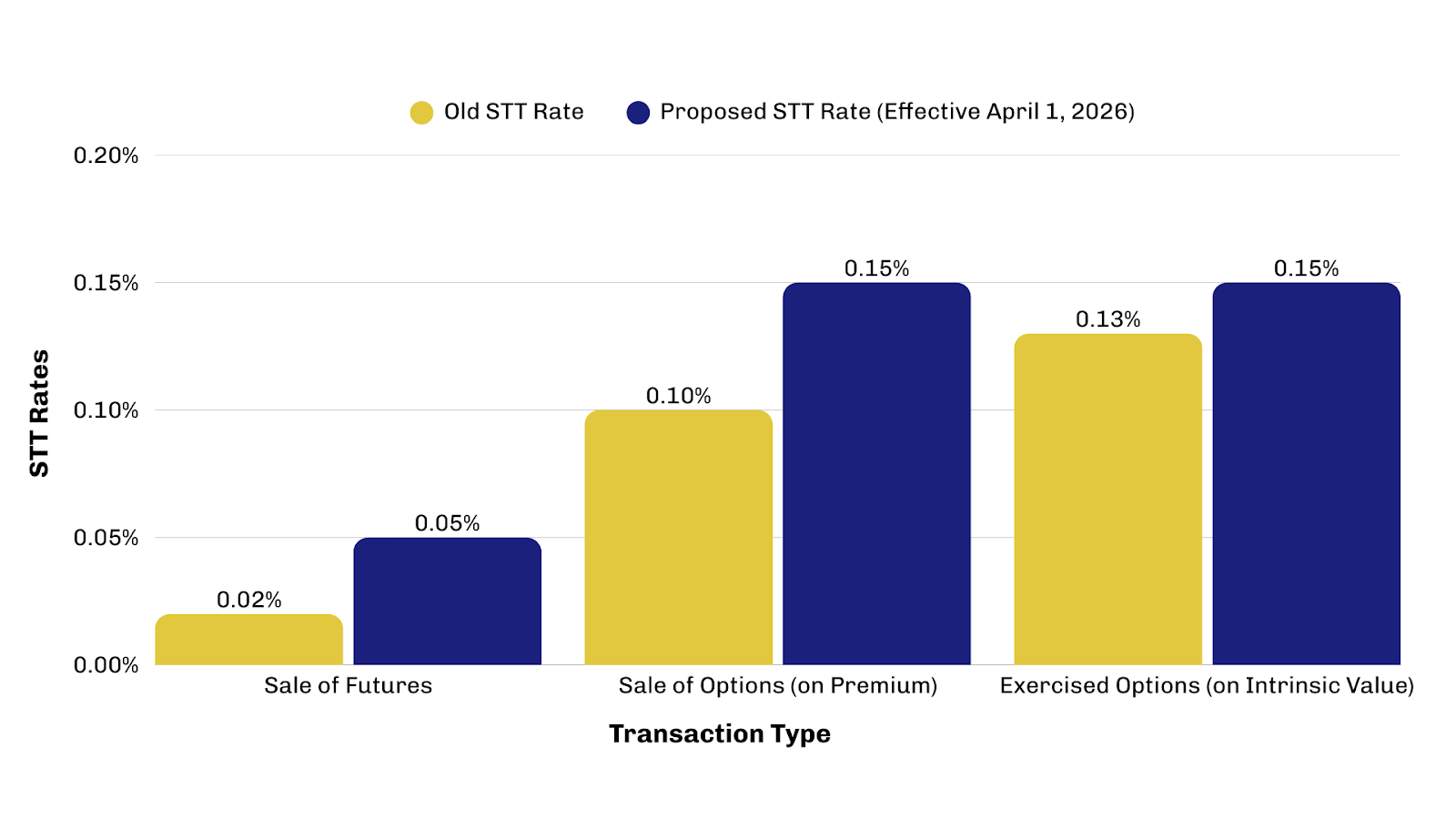

Capital Gains and Market Integrity: The STT Hike on Derivatives

While providing relief in administrative areas, the budget introduced measures to discourage speculative trading in the capital markets by increasing the Securities Transaction Tax (STT) on derivatives.

This move is seen as an attempt to reduce volatility and encourage long-term capital formation over short-term speculative gains. For founders who use derivatives for hedging business risks or personal wealth management, these frictional costs will necessitate a re-evaluation of trading strategies.

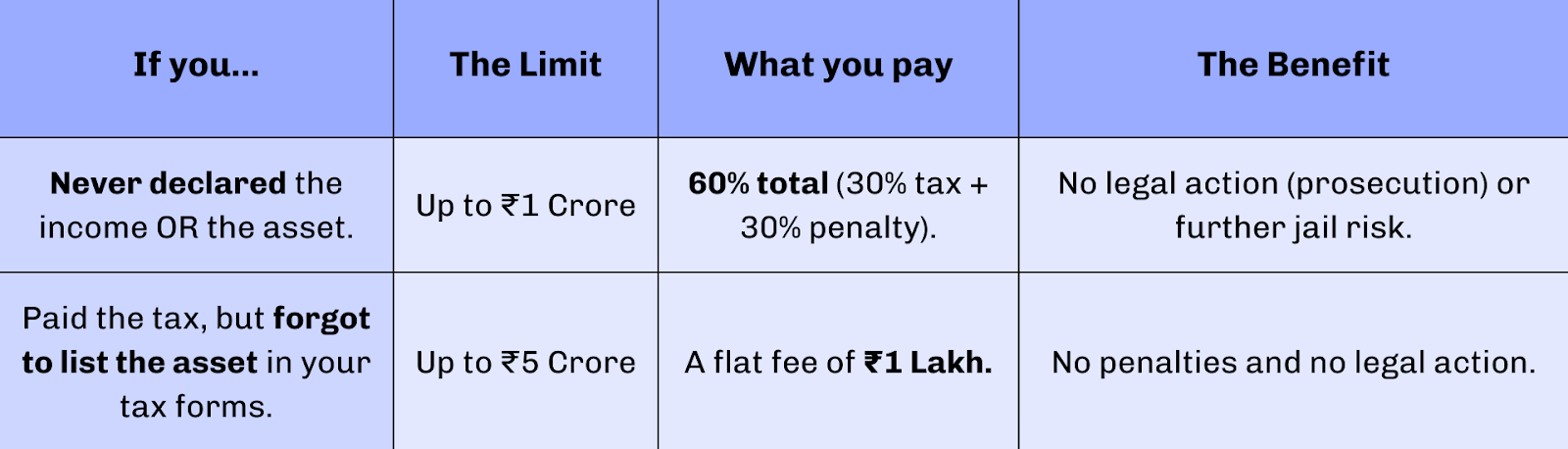

One-time amnesty scheme

In the 2026 Union Budget, the government introduced a "one-time amnesty scheme" officially called the Foreign Assets of Small Taxpayers – Disclosure Scheme (FAST-DS 2026).

In simple language, this is a "Clean Slate" opportunity. It is designed for people (like students, techies, or NRIs) who lived abroad, earned some money or bought assets there, and "forgot" or didn't know they had to tell the Indian tax department about them.

How it Works (The 2 Categories)

The scheme is open for 6 months and divides people into two groups:

Why is this important?

1. Avoid Jail/Heavy Fines: Under the "Black Money Act," even a small mistake like not declaring a dormant bank account from your college days in the US can lead to a ₹10 lakh fine or even jail. This scheme lets you fix that mistake legally.

2. Special Relief for Very Small Amounts: If your foreign assets (excluding property) are worth less than ₹20 Lakh, the government has decriminalized the error entirely. You won't face criminal charges.

3. Target Audience: It’s specifically for "small" cases—students who had stipends, professionals who got ESOPs (company shares) while working abroad, or NRIs who moved back to India with some savings.

The Catch

1. One-Time Only: This is a limited 6-month window. Once it closes, the old, strict rules (and heavy punishments) return.

2. Not for "Big Fish": If the assets are worth more than the limits (₹1 crore or ₹5 crore), you cannot use this simple route.

Administrative Reforms and the Future: The New Income Tax Act 2025

Perhaps the most transformative structural announcement is the introduction of the New Income Tax Act 2025, which aims to replace the 1961 legislation starting April 1, 2026. The new Act is designed to be "revenue-neutral" but significantly simpler, reducing text volume and sections by approximately 50%.

Trust-Based Governance and Voluntary Compliance

The 2026 budget reinforces a "trust first, scrutinize later" philosophy. Key procedural reforms include:

- The reduction of pre-deposit for tax appeals from 20% to 10%, easing working capital strain for startups in litigation.

- Allowing taxpayers to file updated returns even after reassessment proceedings have commenced, upon payment of an additional 10% tax.

- A one-time, six-month foreign asset disclosure scheme for small taxpayers (students, tech professionals, NRIs) to regularize undisclosed overseas assets below a certain threshold without prosecution.

These measures indicate a move toward a more cooperative relationship between the state and the taxpayer, prioritizing ease of compliance and decriminalization of minor offenses over punitive enforcement.

Strategic Outlook: A Checklist for Founders Post-Budget 2026

The Union Budget 2026 demands a strategic re-evaluation of both personal and corporate financial planning for founders. As the tax landscape shifts toward the New Tax Act 2025 and the new regime becomes the default for most salaried Indians, several immediate actions are recommended.

1. Compensation and Equity Planning

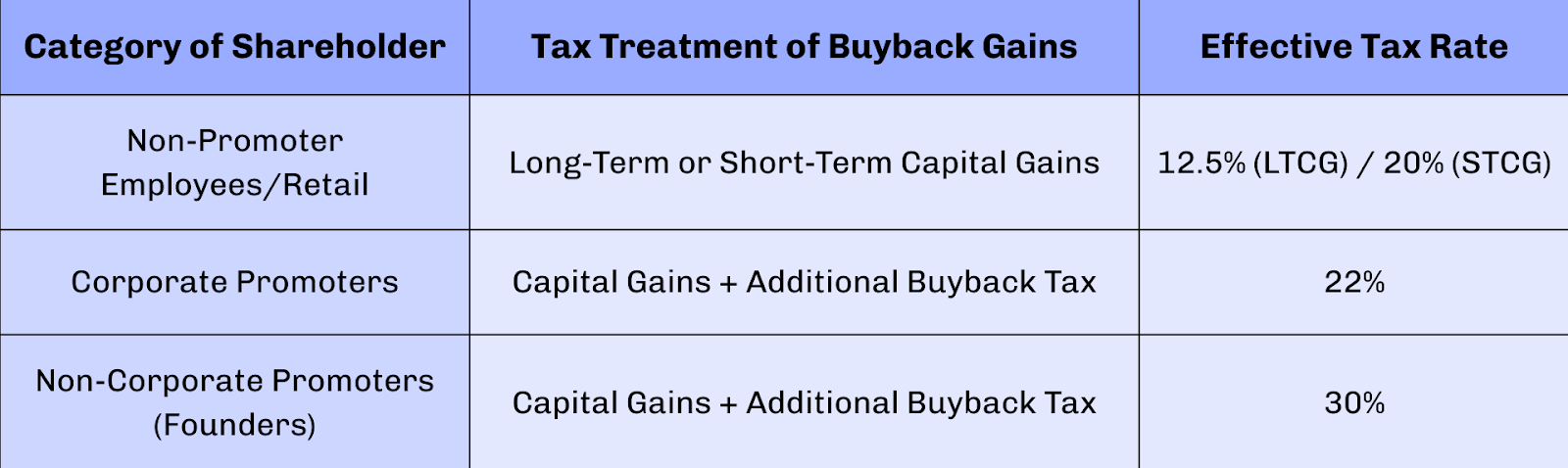

Founders should reassess their salary-bonus mix to leverage the ₹12.75 lakh zero-tax threshold provided by the new regime. For high-income earners, the 25% surcharge cap in the new regime offers a substantial effective tax saving compared to the old regime’s 37% cap. Furthermore, the restoration of capital gains treatment for buybacks provides a more efficient liquidity route for employees and early-stage investors, though founders must account for the 30% promoter levy.

2. Compliance and Regulatory Timing

The strict timelines for 80-IAC and the new limits on "evergreening" losses under Section 72A mean that founders must integrate tax planning into their core business lifecycle. Applications for 80-IAC should be prioritized immediately post-DPIIT recognition to maximize the three-year tax-holiday window. Similarly, any M&A activities must be structured with the understanding that the "loss reset" mechanism is no longer available for new schemes.

3. Regional and Sectoral Opportunities

Founders in the manufacturing, biopharma, and green energy sectors should explore the massive capital expenditure outlays and duty exemptions on capital goods. The Indore and Madhya Pradesh region, with its dedicated SME Growth Funds and developing IT corridors, presents a compelling alternative for founders looking to balance cost-efficiencies with high-quality infrastructure.

Conclusion

The Union Budget 2026 provides a framework of stability, predictability, and simplification. While it removes certain legacy tax planning avenues, it replaces them with a more transparent system that rewards genuine business growth over complex financial engineering. For founders, the path forward is to embrace this compliance-first era, utilizing the streamlined safe harbors and digital-first administrative reforms to build globally competitive ventures from India

FAQs

1. What are the new income tax slabs for FY 2026-27?

Under the new regime, income up to ₹12 lakh is effectively tax-free due to the Section 87A rebate. The 30% tax rate now applies only after ₹24 lakh, giving salaried individuals and founders lower tax liability.

2. Which is better: new tax regime or old tax regime in 2026?

The new regime suits most founders because of lower slab rates and fewer documentation requirements. The old regime is beneficial only if you claim large deductions like HRA, home loan interest, and 80C investments.

3. Is income up to ₹12 lakh tax-free under the new regime?

Yes. With the Section 87A rebate, resident individuals pay zero tax on income up to ₹12 lakh. Salaried founders also get a ₹75,000 standard deduction, raising the effective tax-free limit to ₹12.75 lakh.

4. What is the standard deduction under the new tax regime?

Salaried individuals can claim a ₹75,000 standard deduction under the new regime. This reduces taxable income without any paperwork and benefits founders drawing salaries from their startups.

5. How should founders choose between salary and equity for tax efficiency?

Founders often keep salaries near the tax-free threshold and take wealth through equity or ESOPs. This reduces immediate tax outgo and aligns compensation with long-term capital gains.

6. What is the tax holiday for startups under Section 80-IAC?

Eligible DPIIT-recognised startups can claim a 100% tax exemption on profits for any three consecutive years within the first ten years of incorporation, significantly improving cash flow during early growth stages.

7. Who is eligible for the startup tax exemption under 80-IAC?

Startups must be DPIIT-recognised, incorporated before March 31, 2030, and obtain approval from the Inter-Ministerial Board. The benefit applies only after approval, not retrospectively.

8. Can startups carry forward losses after funding rounds?

Yes. Section 79 allows recognised startups to carry forward losses even if shareholding changes, provided original shareholders continue holding shares. This helps preserve tax benefits during fundraising.

9. How are share buybacks taxed after Budget 2026?

Buybacks are now taxed as capital gains instead of dividends. Shareholders pay tax only on profits, not the entire amount received, making buybacks more efficient for investors and employees.

10. What is the promoter levy on buybacks?

Promoters and shareholders holding over 10% equity face a higher effective tax rate of 30% on buyback gains. This prevents misuse while still allowing legitimate capital returns.

11. Has the MAT rate changed in Budget 2026?

Yes. The Minimum Alternate Tax rate has been reduced from 15% to 14%. MAT is now treated as a final tax, simplifying compliance and limiting future credit carry-forwards.

12. What are the new income tax return due dates for FY 2025-26?

Salaried individuals typically file by July 31, while audited businesses have later deadlines. Missing audit deadlines now attracts fixed penalties, making timely compliance critical.

13. What is the break-even point between old and new tax regimes?

If your deductions exceed ₹7–9 lakh annually, the old regime may help. Otherwise, the new regime usually results in lower tax and less paperwork, especially for founders with fewer deductions.

14. Does the new tax regime allow deductions like 80C or 80D?

Most deductions, including 80C and 80D, are not allowed under the new regime. However, lower slab rates and rebates often compensate for the loss of these benefits.

15. How does Budget 2026 benefit startup founders overall?

Budget 2026 simplifies taxes, offers startup tax holidays, restores fair buyback taxation, lowers MAT, and promotes compliance. Founders benefit from lower tax outgo, easier filing, and better capital management.

Contact Us

An expert will call you within 24 hours. No payment required to get started.

Related Post

How should a start-up complete ITR filing

Business entities must file their ITR annually to comply with the tax laws of their respective countries. It helps the government assess and collect the appropriate amount of income tax from taxpayers and ensures proper accountability of financial activities.

. 3 Mins.png)

5 step checklist for GST compliance in Indian Startups

Learn about how GST works. The basics of GST along with its compliances. Uncover what your business needs to keep in mind concerning GST rules and GST compliance.

. 3 min read.png)

₹20 Lakhs and Beyond: Understanding GST for Freelancers in India

Are you a freelancer or aspiring to be one? In this blog, uncover the basics of freelancing and requirements involving GST. Learn about all the exemptions, obligations, and compliances of GST for freelancers in india.

. 5 min read