Startup Valuation Guide: Methods, Metrics & 2026 Trends

By Filing Buddy . 29 Jan 26

The Valuation Paradigm Shift of 2026

The Indian startup ecosystem has matured significantly over the last five years. Gone are the liquidity-fueled days of 2021, when valuations were driven by hype and easy capital. In 2026, value is grounded in unit economics, governance, and defensible IP.

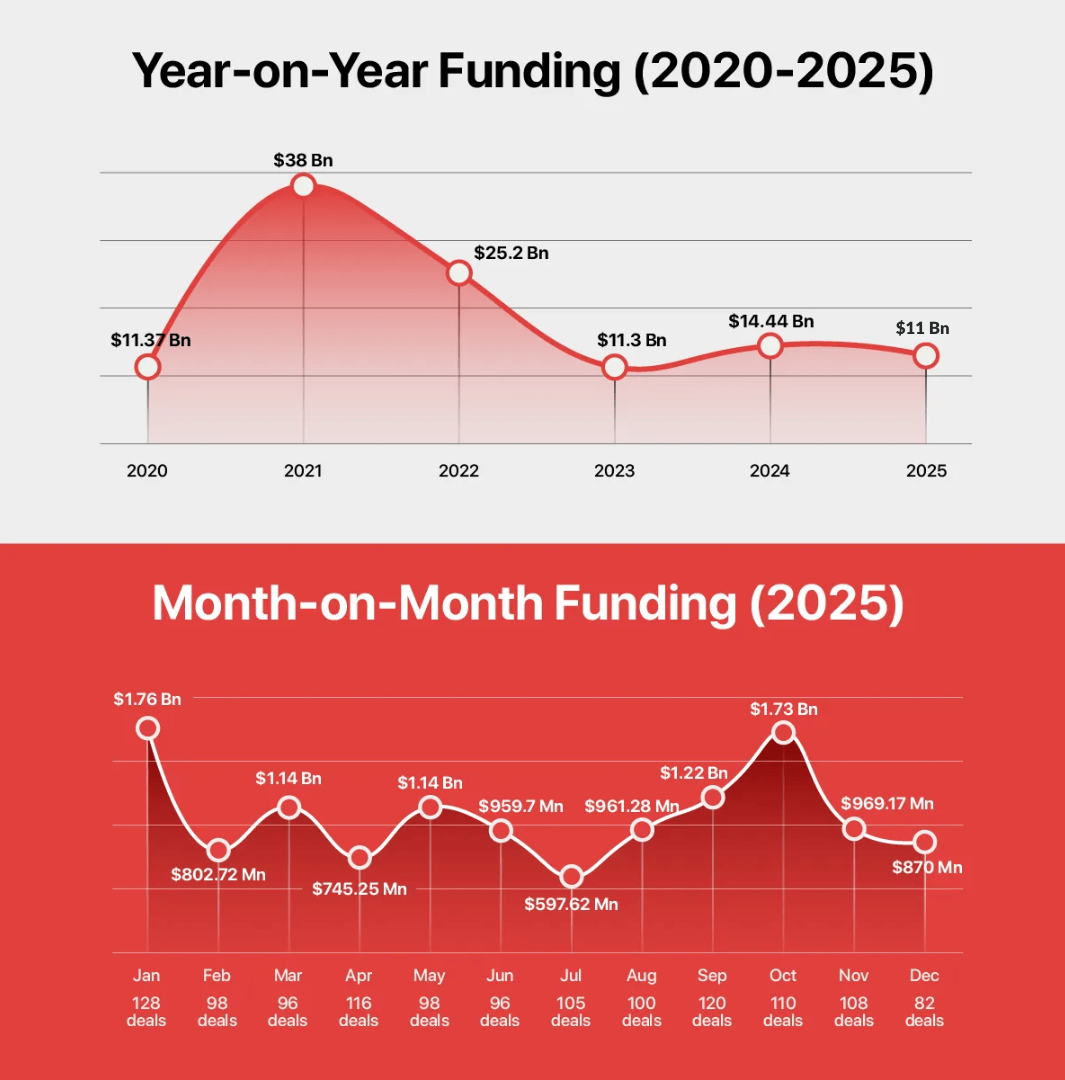

In 2025, Indian startups raised $10.5–$13B, keeping India as the world’s third-largest startup ecosystem. But the surface numbers hide a divergence:

- Early-stage funding: +7% YoY

- Late-stage funding: –26% YoY

Capital hasn’t disappeared, it’s now selective. The “unicorn at any cost” mindset has been replaced by the “proficorn”: profitable, sustainable, scalable companies.

This guide equips founders with practical insight into valuation today, covering funding dynamics, regulatory shifts (Angel Tax abolition, FEMA norms), investor methods, and real-world lessons from Zepto, Dunzo, and PharmEasy. It also highlights contrarian philosophies from leaders like Sridhar Vembu and Nithin Kamath.

Because in 2026, valuation is no longer about storytelling, it’s about execution.

Chapter 1: The Macro-Funding Landscape and Valuation Climate

Startup valuations reflect market conditions. Capital availability, sector trends, and investor sentiment define pricing. 2025 was a year of selective deployment rather than scarcity.

1.1 The Consolidation of Capital: 2025 in Review

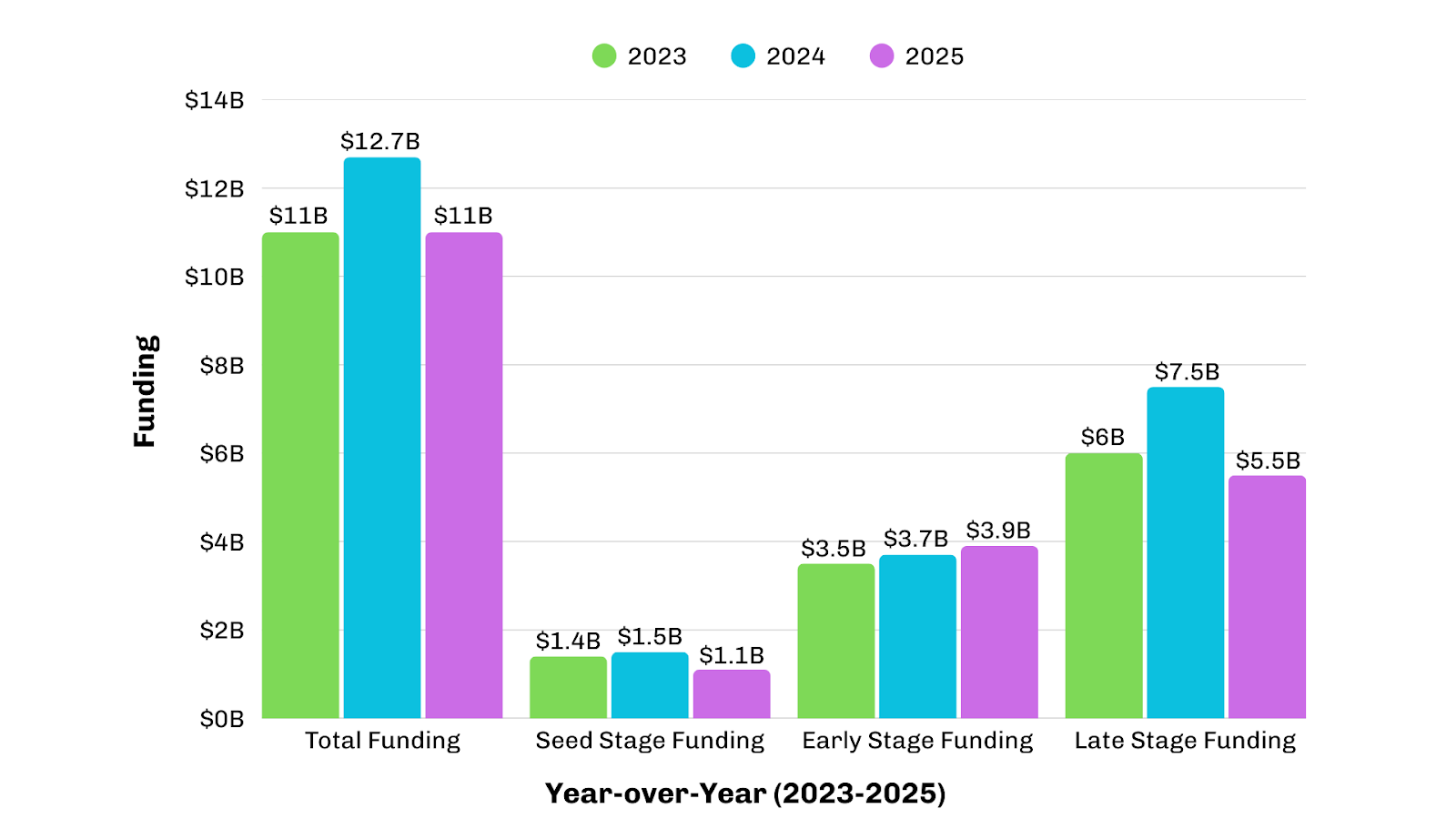

Funding stabilized at $10.5–$13B, down slightly from $12.7B in 2024. This was a correction, not a collapse.

- Investors concentrated capital on category leaders; fewer startups raised funds, but those that did commanded premiums.

- Big rounds like Zepto’s $450M and Lenskart’s secondary sales illustrate the “flight to quality.”

- The ecosystem saw 14 rounds exceeding $100M, reinforcing a clear winner-takes-most dynamic.

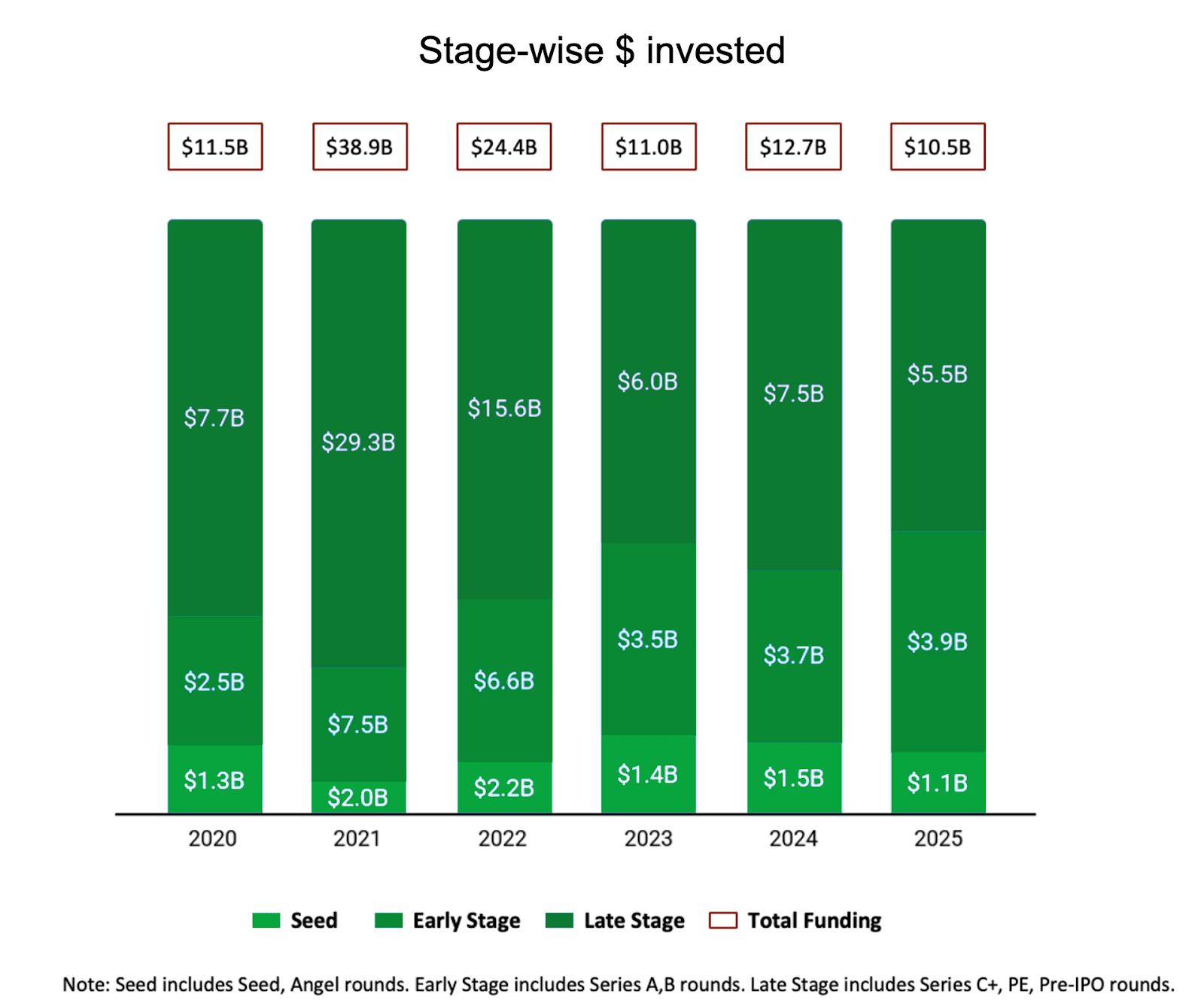

1.2 Stage-Wise Valuation Dynamics

The funding environment affected each stage differently, creating distinct valuation realities for startup funding in India.

1. The Seed Stage Squeeze

Seed funding dropped 30% to $1.1B.

In 2025, the "idea premium" has largely disappeared. Investors now expect:

- Working prototypes

- Early customer traction

- A credible path to product-market fit (PMF)

What once raised at $5–10M on a deck now requires proof. Founders often dilute more equity unless they bring exceptional teams or deep-tech IP.

2. The Early-Stage Resilience (Series A/B)

Funding rose 7% to $3.9B. Investors now back startups that survived the valley of death and prioritize unit economics over raw growth. Metrics like contribution margins, CAC/LTV, and sustainable customer acquisition drive valuations.

3. The Late-Stage Correction

Late-stage funding fell 26% to $5.5B.

This segment is closely tied to public markets.

As public tech stocks underwent a repricing, late-stage private valuations were forced to compress to align with exit realities.

Crossover investors retreated, and consequently, founders increasingly faced flat rounds, structured down rounds, or a push toward profitability.

Late-stage valuations now reflect realistic exit pricing, not speculative premiums.

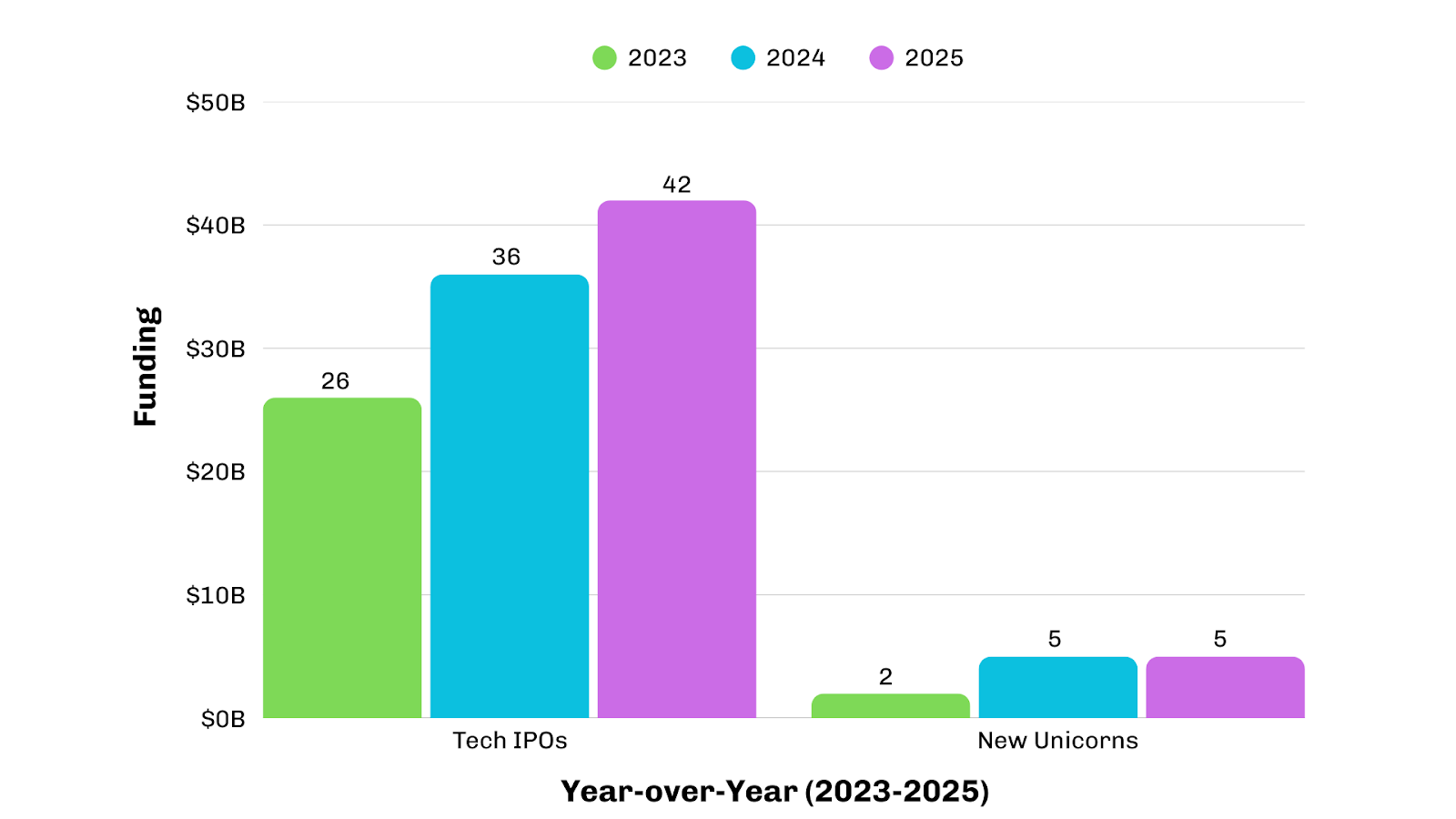

1.3 The IPO Anchor Effect

Tech IPOs rebounded in 2025 (18–42 listings), providing transparent valuation benchmarks. Private investors anchor to public comps; if listed peers trade at certain revenue multiples, private startups struggle to justify higher numbers..

1.4 Sectoral Valuation Divergence

The rising tide did not lift all boats in 2025. Valuation multiples diverged sharply across sectors, shaped by distinct regulatory, structural, and demand-side headwinds and tailwinds.

1. The DeepTech and AI Premium

Artificial Intelligence (AI) and DeepTech emerged as the clear darlings of the ecosystem. Backed by the government’s ₹10,000 crore India AI Mission and committed capital for deep-tech R&D, startups in these segments commanded a distinct “scarcity premium.”

Unlike consumer apps, deep-tech ventures possess hard-to-replicate IP, allowing them to dictate valuations even in a tight market. AI-led dealmaking surged, with companies involved in semiconductor design, space-tech, and generative AI applications seeing strong investor interest.

2. The Fintech & Retail Reality Check

Fintech and Retail remained heavily funded but saw valuation compression amid tighter regulation.

The Reserve Bank of India (RBI) strengthened norms around unsecured lending and digital payments, increasing compliance costs. Valuation benchmarks shifted from “tech multiples” (10x–20x revenue) to “lending multiples” (2x–4x book value), materially reducing valuations.

Retail and consumer internet startups faced similar scrutiny, with investors favoring omnichannel brands with stronger gross margins over high-burn, pure-play marketplaces.

3. The SaaS Efficiency Mandate

For SaaS companies, the focus moved from “growth at all costs” to “efficient growth,” measured by the Rule of 40 (Growth Rate + EBITDA Margin > 40%).

Companies with strong Net Revenue Retention (NRR) and efficient sales cycles sustained valuations, while those with high churn and long payback periods saw multiples contract to 5x–7x Annual Recurring Revenue (ARR).

Comparative Funding and Valuation Trends (2023-2025)

Chapter 2: The Regulatory Framework of Valuation

Valuation today is not just a negotiation, it is also a compliance exercise shaped by the Tax Act and the strictures of the Foreign Exchange Management Act (FEMA).

2.1 The Abolition of Angel Tax: Unleashing Domestic Capital

Angel Tax previously penalized capital raised above FMV. Its 2025–26 removal:

- Frees pricing for domestic rounds

- Encourages family offices, HNIs, and angel networks

- Reduces compliance burden

2.2 FEMA Valuation Norms: The Floor for Foreign Investment

While domestic fundraising now enjoys greater pricing flexibility, foreign investment remains regulated under FEMA.

1. The Pricing Floor: Under the Foreign Exchange Management (Non-debt Instruments) Rules, 2019, equity issued to non-residents cannot be priced below Fair Market Value (FMV). This FMV must be certified by a SEBI-registered Merchant Banker or Chartered Accountant.

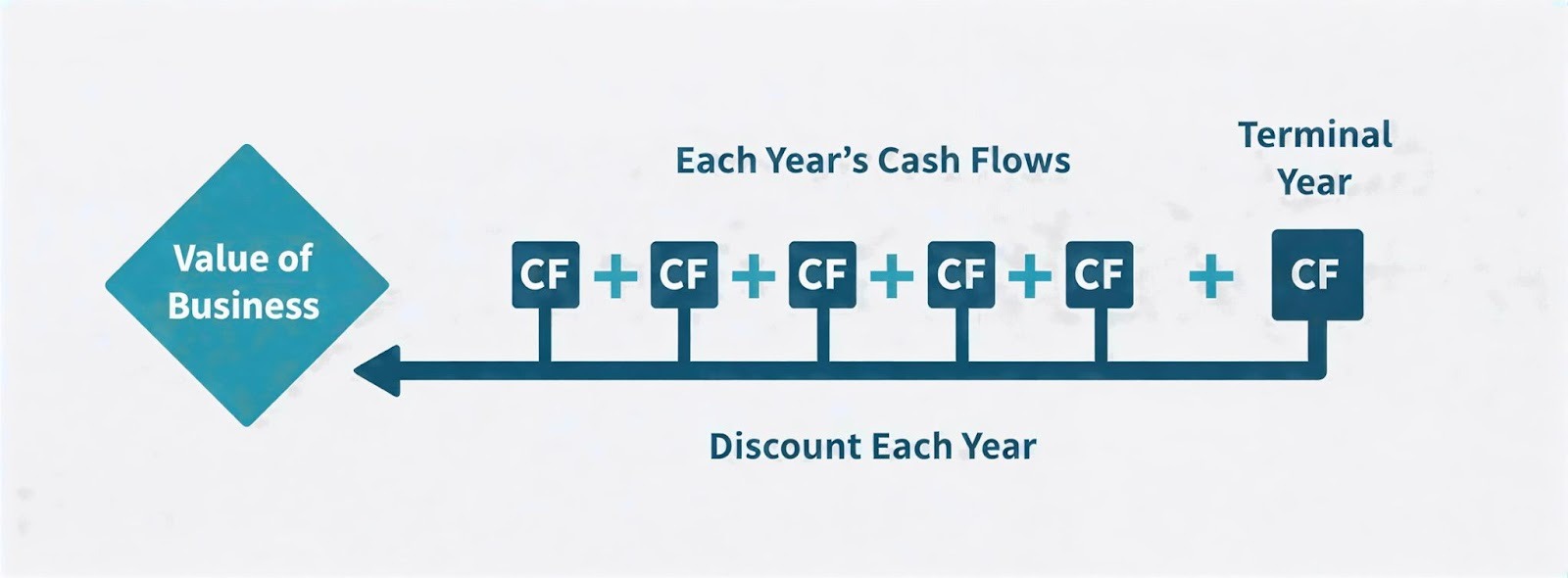

2. Methodology: The valuation must follow an internationally accepted, arm’s-length method. In practice, startups typically use the Discounted Cash Flow (DCF) approach, as it captures future growth potential.

3. The “Floor” Implication: These rules effectively create a hard valuation floor. Shares cannot be issued below the certified FMV.

This becomes challenging during down rounds or distress raises. A startup must obtain a fresh valuation to justify any drop. If the revised DCF value still exceeds the commercial price an investor is willing to pay, the deal cannot proceed under the automatic route, potentially creating a liquidity trap.

Compliance Mechanics

1. Form FC-GPR: Shares issued to foreign investors must be reported to the RBI within 30 days using Form FC-GPR, along with the Valuation Certificate.

2. Validity: The valuation report is typically valid for 90 days, so deal closure and fund receipt must be timed carefully to avoid re-valuation.

3. Scrutiny: In 2025, the RBI and authorized dealer (AD) banks increased scrutiny. Values must clearly justify assumptions, and aggressive projections that inflate or deflate valuations can trigger regulatory red flags.

2.3 The Governance Premium

In 2026, governance directly impacts valuation multiples.

Investors now price trust the same way they price growth.

Startups with:

- Big 4 audits

- clean cap tables

- independent boards

- transparent reporting

often receive faster term sheets and higher multiples.

Weak controls, related-party transactions, or messy accounting trigger governance discounts, tougher terms, or stalled deals.

Beyond governance, founders must stay on top of startup compliance to maintain investor confidence and avoid regulatory penalties.

Simply put: good governance and compliance reduce perceived risk, and lower risk drives higher valuation.

Chapter 3: Early-Stage Valuation Methods (Pre-Revenue to Series A)

At early stages, financial data is limited. Valuation focuses on reducing uncertainty rather than forecasting profits.

3.1 The Berkus Method

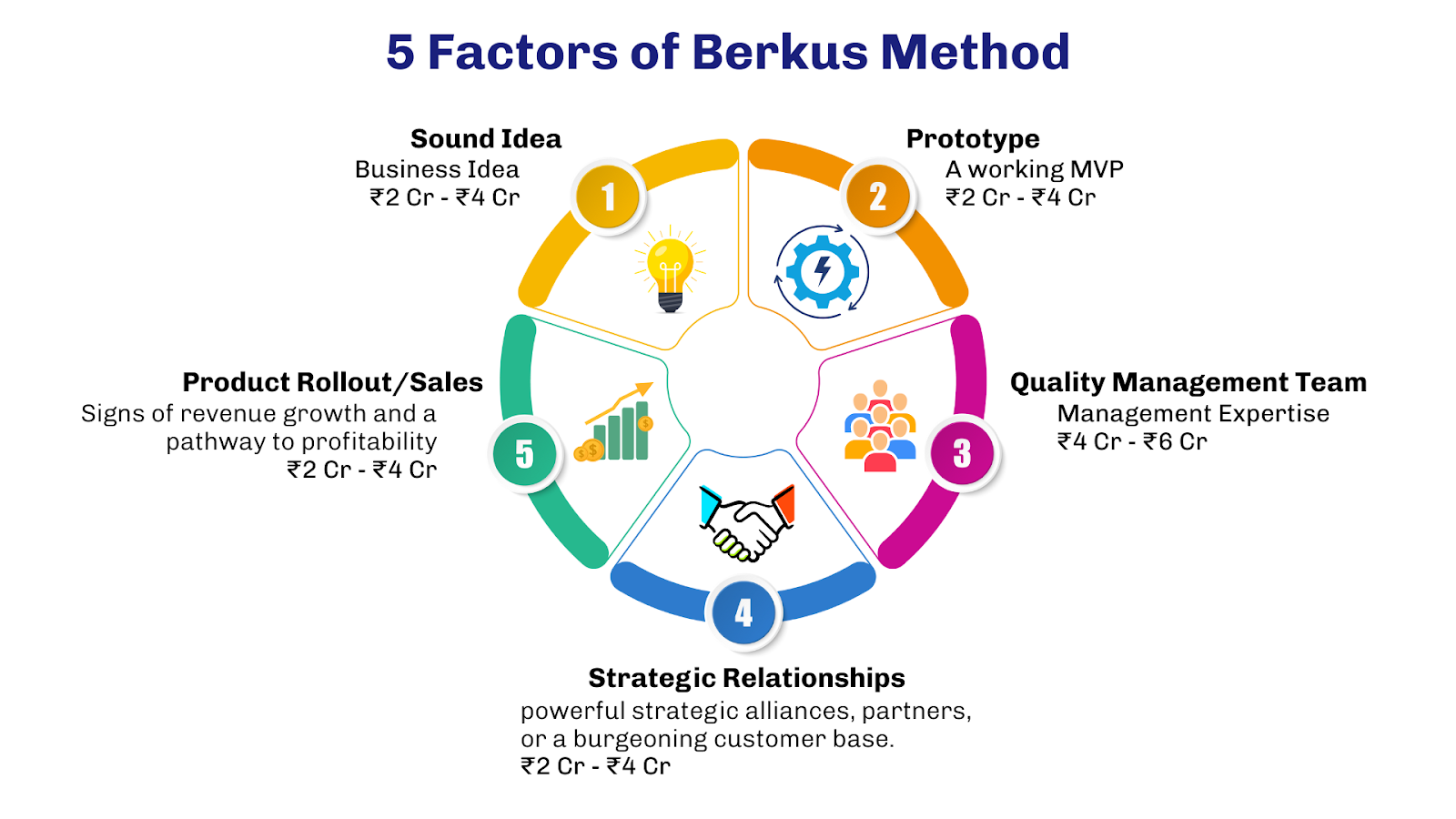

Developed by angel investor Dave Berkus, this method is designed for pre-revenue startups. Instead of relying on financial projections (often unreliable at this stage), it values tangible, risk-reducing milestones by assigning financial weight to five key drivers.

The 2026 Application: In the current Indian context, the “maximum value” per driver has adjusted for inflation and market maturity.

1. Sound Idea (Basic Value): ₹2 Cr – ₹4 Cr. A credible, viable business concept.

2. Prototype (Technology Risk): ₹2 Cr – ₹4 Cr. A working MVP that meaningfully reduces execution risk.

3. Quality Management Team (Execution Risk): ₹4 Cr – ₹6 Cr. In 2026, founder pedigree commands a premium; prior exits or deep domain expertise push valuations toward the higher end.

4. Strategic Relationships (Market Risk): ₹2 Cr – ₹4 Cr. Early partnerships or distribution channels that ease go-to-market friction.

5. Product Rollout/Sales (Production Risk): ₹2 Cr – ₹4 Cr. Initial traction demonstrating the product can be sold.

Total Valuation Potential: A startup meeting all five criteria could theoretically command a pre-money valuation of ~₹20–25 Cr ($2.5M – $3M), broadly aligning with average seed deal sizes in 2025.

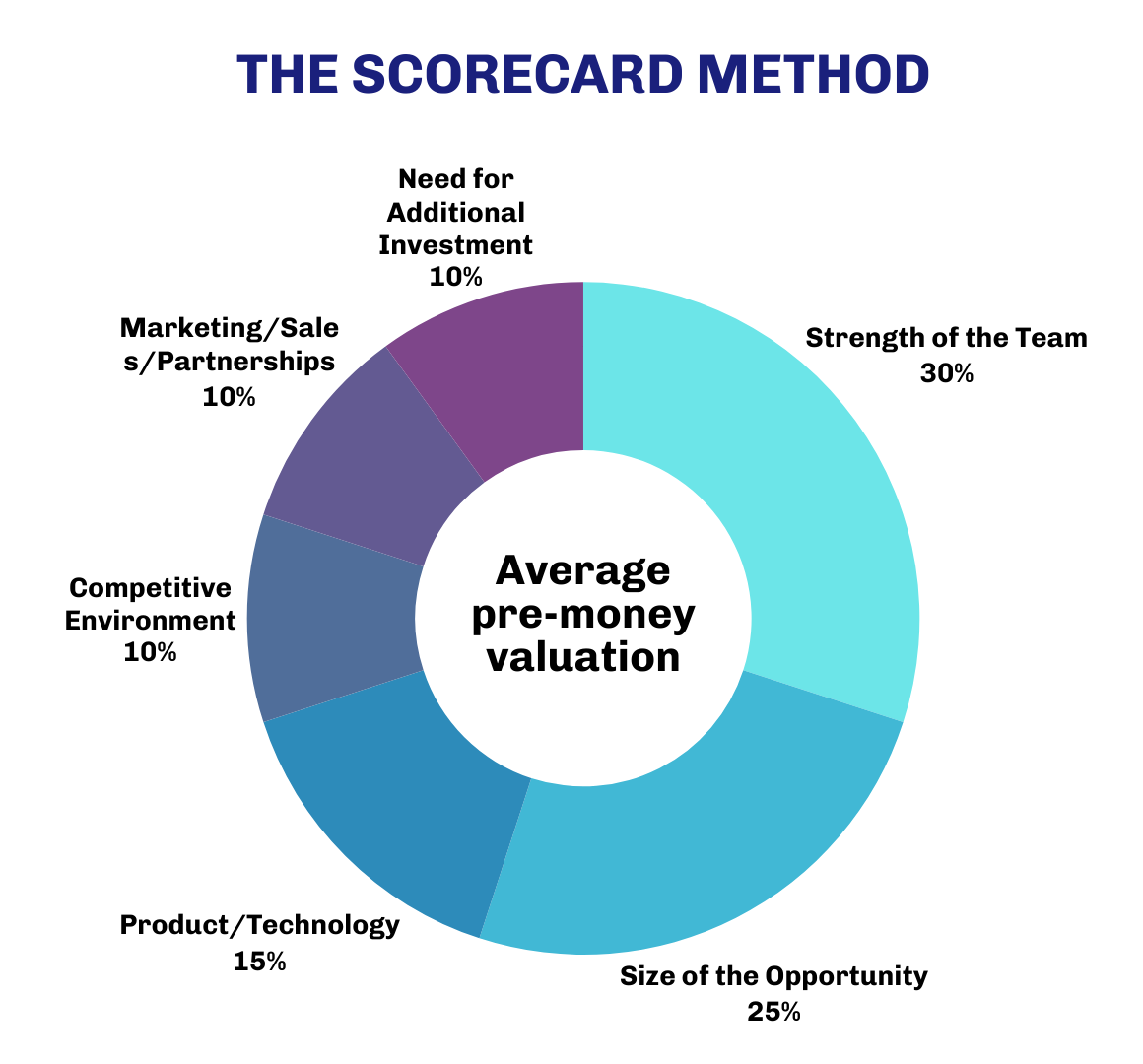

3.2 The Scorecard Method

The Scorecard Method is a comparative approach that adjusts valuation based on a startup’s strengths relative to its peers. It is widely used by angel groups and accelerators.

Step 1: Determine the Average Valuation.

Identify the average pre-money valuation of similar pre-revenue startups in the same sector and geography (e.g., early-stage AI startups in Bengaluru may average ₹15 Cr).

Step 2: Apply Weighted Comparisons.

Benchmark the startup against this “average” across weighted factors:

- Strength of the Team (30%): Is the team stronger than average (e.g., 120%)?

- Size of the Opportunity (25%): Is the TAM materially larger?

- Product/Technology (15%): Is the IP more defensible?

- Competitive Environment (10%)

- Marketing/Sales/Partnerships (10%)

- Need for Additional Investment (10%)

Nuance: In 2025, “Team” and “Technology” carry disproportionate weight. Teams with AI capabilities or proprietary hardware can justify multipliers of 150% or more versus the average, significantly lifting valuation.

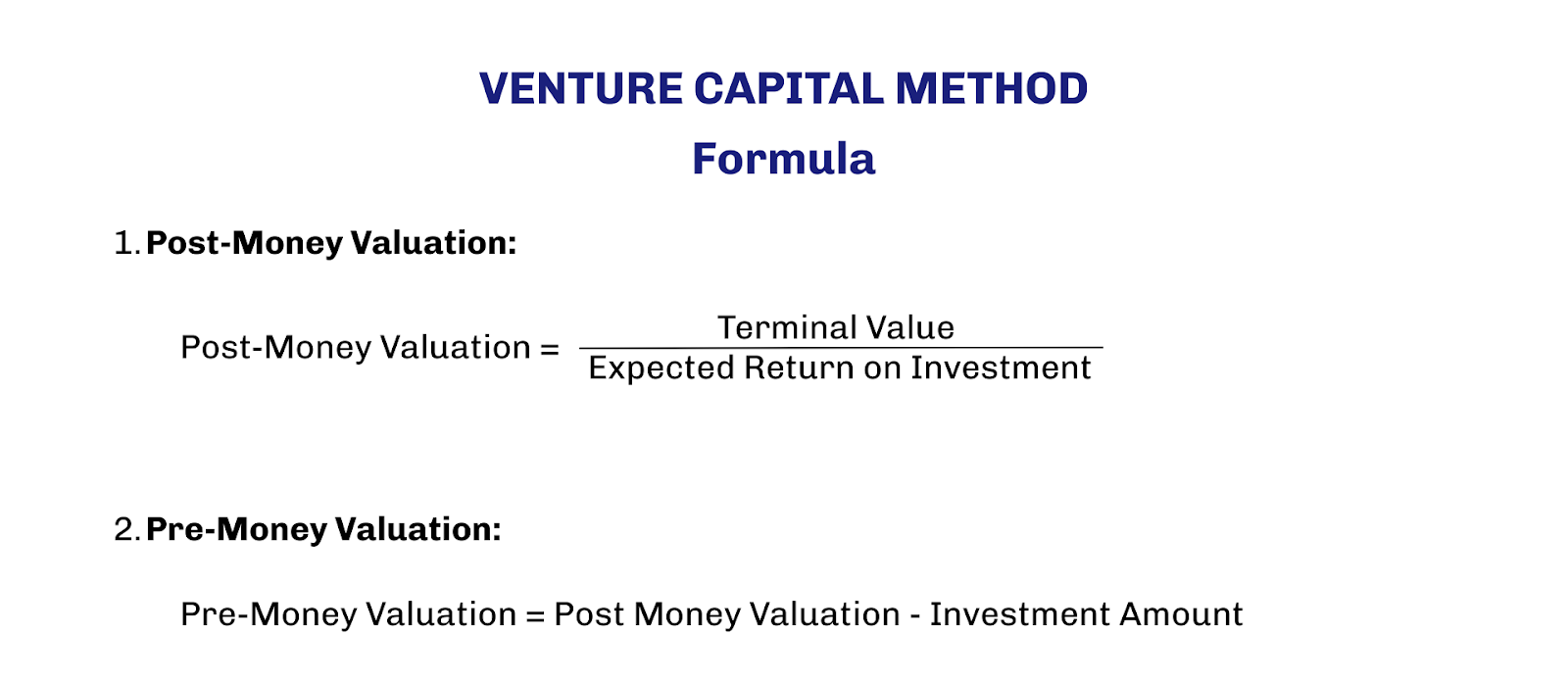

3.3 The Venture Capital (VC) Method: Working Backward

This method is standard among institutional investors (Seed funds and Series A VCs) who underwrite investments to a target return on investment (ROI). Valuation is derived from the expected exit.

Step 1: Estimate Terminal Value.

Project what the company could sell for in 5–7 years, typically using forecasted revenue multiplied by a sector exit multiple (e.g., ₹100 Cr revenue × 5x = ₹500 Cr Terminal Value).

Step 2: Determine Expected ROI.

VCs apply defined hurdle rates: 20x–30x for higher-risk seed investments, and 10x–15x for relatively safer Series A rounds.

Example Calculation

- Terminal Value: ₹500 Cr

- Expected ROI: 20x

- Post-Money Valuation: ₹500 Cr ÷ 20 = ₹25 Cr

- Investment: ₹5 Cr

- Pre-Money Valuation: ₹20 Cr

2026 Context: The key shift in 2026 is the compression of Terminal Value assumptions (5x–8x revenue for SaaS).

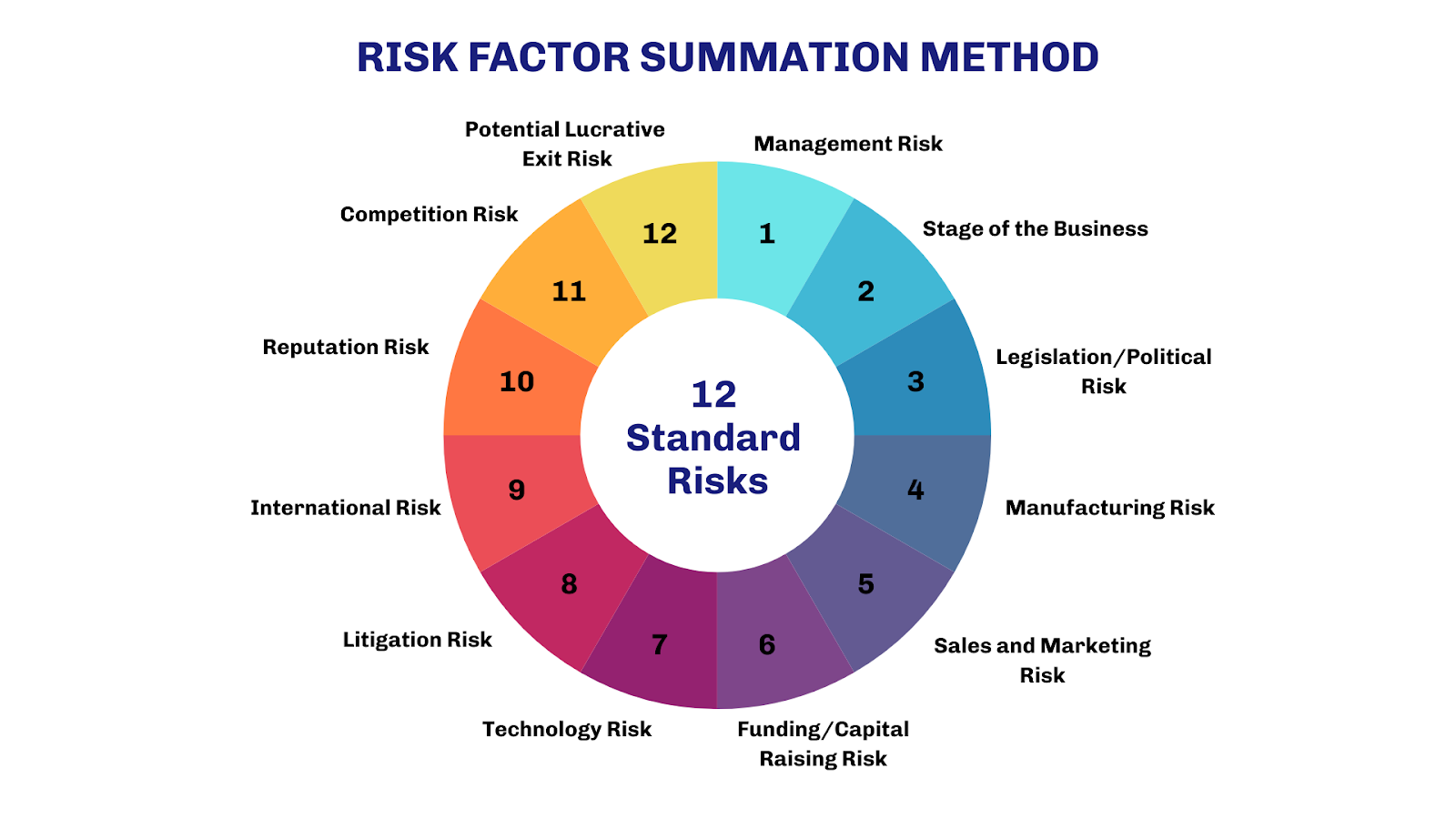

3.4 Risk Factor Summation Method

Adjusts base valuation ±₹25–50L across 12 risk factors, including management, stage, regulatory, technology, and competition risks. Serves as a sanity check.

Adjustment Scale:

- +2 (Very positive / low risk): +₹50 Lakhs

- +1 (Positive): +₹25 Lakhs

- 0 (Neutral): No change

- –1 (Negative): –₹25 Lakhs

- –2 (Very negative / high risk): –₹50 Lakhs

Utility: Used primarily as a sanity check alongside other methods to explicitly price in identified risks (e.g., regulatory exposure in fintech).

Chapter 4: Growth-Stage Valuation Methods (Series B to Pre-IPO)

As startups mature and generate predictable revenue, valuation moves from qualitative judgment to financial rigor. Narrative helps, but numbers drive decisions.

4.1 Discounted Cash Flow (DCF): The Intrinsic Value

DCF is the gold standard for intrinsic valuation and mandatory for FEMA compliance. It estimates future free cash flows (FCF) and discounts them to present value using a risk-adjusted rate.

The Mechanics

1. Forecast Period: 5–10 years.

2. Terminal Value: Calculated using the Gordon Growth Model or an exit multiple.

3. Discount Rate Weighted Average Cost of Capital (WACC): In 2025, typical WACC for Indian startups ranges 15%–25%, depending on stage.

The 2026 Nuance

1. Sensitivity to Assumptions: Small changes in growth or WACC can materially impact valuation. Investors scrutinize inputs closely and discount “hockey stick” forecasts in favour of historically grounded assumptions.

2. Path to Profitability: Positive cash flows are expected earlier (Years 3–4). Prolonged burn (e.g., 8 years) results in higher discount rates and sharply lower valuations.

4.2 Comparable Company Analysis (Multiples): The Market Reality

This is the most practical and widely used method in term sheet negotiations. It values a startup using trading metrics of comparable public companies or recent private deals.

The Formula:

Valuation = Key Metric × Multiple

Key Metrics by Sector:

1. SaaS (B2B): Valued on Annual Recurring Revenue (ARR).

- 2025 Multiple: 5x–7x ARR.

- Premium: 10x–15x ARR for >40% YoY growth with strong unit economics (Rule of 40).

- Churn: High churn (>10% annually) materially reduces multiples.

2. D2C Brands: Valued on Revenue or EBITDA.

- Revenue Multiple: 2x–6x Revenue, with premiums for >65% gross margins and strong repeat rates.

- EBITDA Multiple: 15x–25x EBITDA for mature, profitable brands.

3. Fintech: Valued on Book Value or Revenue.

- Multiple: 2x–4x Book Value (lending); 5x–12x Revenue (tech-first payments/SaaS-fintech).

- Regulatory compliance significantly impacts valuation; non-compliance attracts steep discounts.

4. E-Commerce/Marketplaces: Valued on GMV or Revenue.

- Multiple: 0.3x–1.2x GMV, reflecting compressed expectations and focus on take rate and contribution margin per order

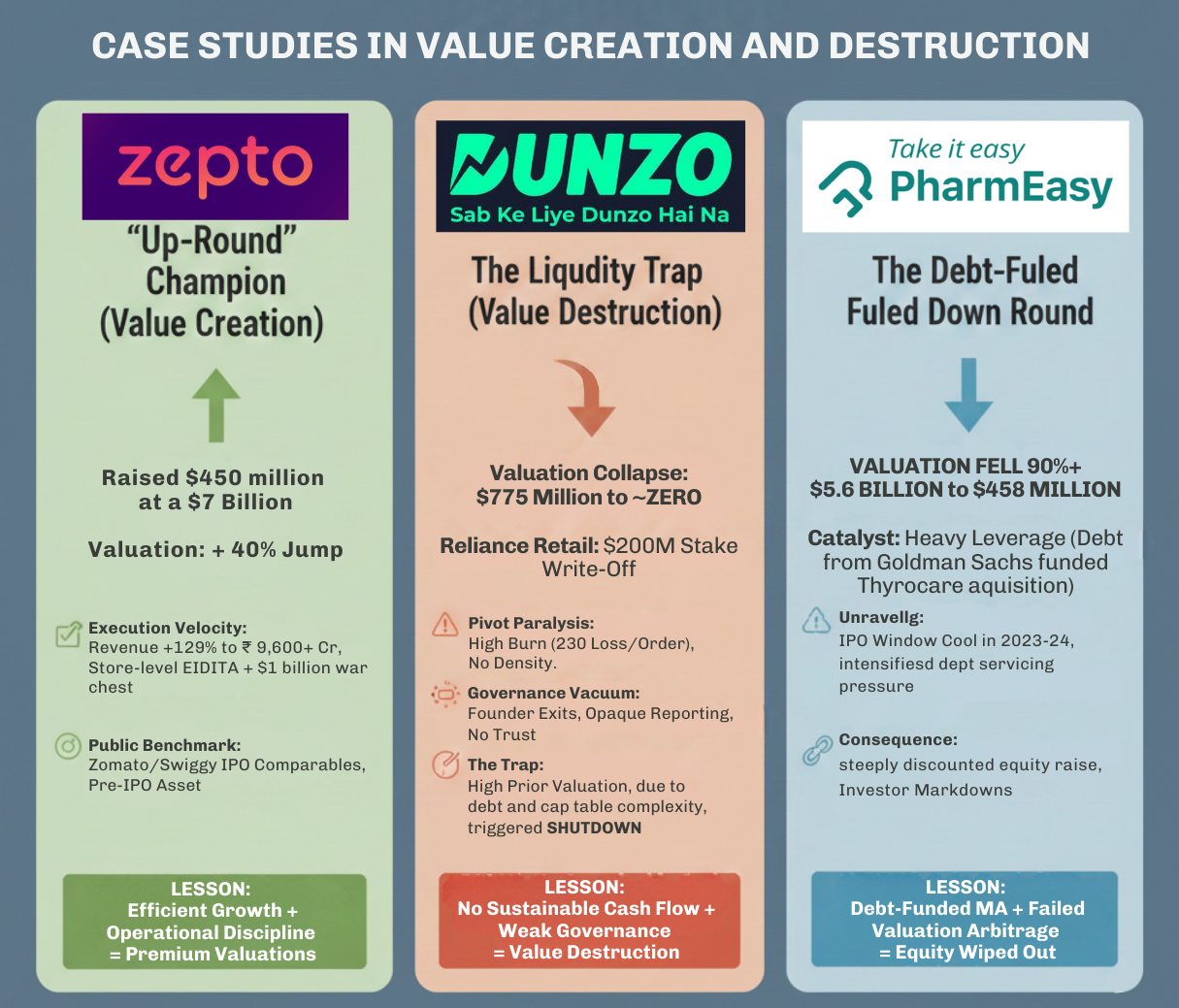

Chapter 5: Case Studies in Value Creation and Destruction

Valuation theory makes more sense in practice. The contrasting fortunes of Indian startups in 2025 show one thing clearly: valuation isn’t static, it’s a live scorecard of operational discipline and strategic decisions.

5.1 Zepto: The "Up-Round" Champion (Value Creation)

In a year dominated by down-rounds, quick commerce player Zepto raised $450 million at a $7 billion valuation, a 40% jump from its previous round.3

The Valuation Drivers

- Execution Velocity: Growth was efficient, not reckless. Revenue surged 129% to ₹9,600+ crore, alongside a visible path to store-level EBITDA profitability.

- Strategic Cash Management: Burn was controlled, with a nearly $1 billion war chest, reducing the “desperation risk” investors typically discount.

- Public Benchmark: With Zomato (Blinkit) and Swiggy trading at healthy public multiples, investors saw clear IPO comparables. Zepto was priced like a pre-IPO asset, not a risky private bet.

- Lesson: Efficient growth + operational discipline commands premium valuations. Cash burn is tolerated only when unit economics improve.

5.2 Dunzo: The Liquidity Trap (Value Destruction)

Dunzo’s valuation collapsed from $775 million to effectively zero, with Reliance Retail writing off its entire $200 million stake.

The Collapse

- Pivot Paralysis: The shift from courier to dark-store quick commerce burned capital without achieving density, peaking at ₹230 loss per order.

- Governance Vacuum: Founder exits and opaque reporting eroded trust. Without governance credibility, funding dried up.

- The Trap: A high prior valuation made a realistic down-round difficult due to cap table complexity and debt, triggering a liquidity crunch and shutdown.

- Lesson: Paper valuations mean little without sustainable cash flows. Weak governance can destroy value faster than markets.

5.3 PharmEasy: The Debt-Fueled Down Round

PharmEasy’s valuation fell over 90%, from $5.6 billion to ~$458 million.31

- The Catalyst: Heavy leverage. Debt from Goldman Sachs funded the Thyrocare acquisition, assuming a high-valuation IPO to repay the loan.

- The Unraveling: When the IPO window cooled in 2023–24, debt servicing pressure intensified.

- The Consequence: Survival required a steeply discounted equity raise. Investors like Janus Henderson marked down holdings accordingly.

- Lesson: Debt-funded M&A is high risk. If the valuation arbitrage fails, equity can be wiped out.

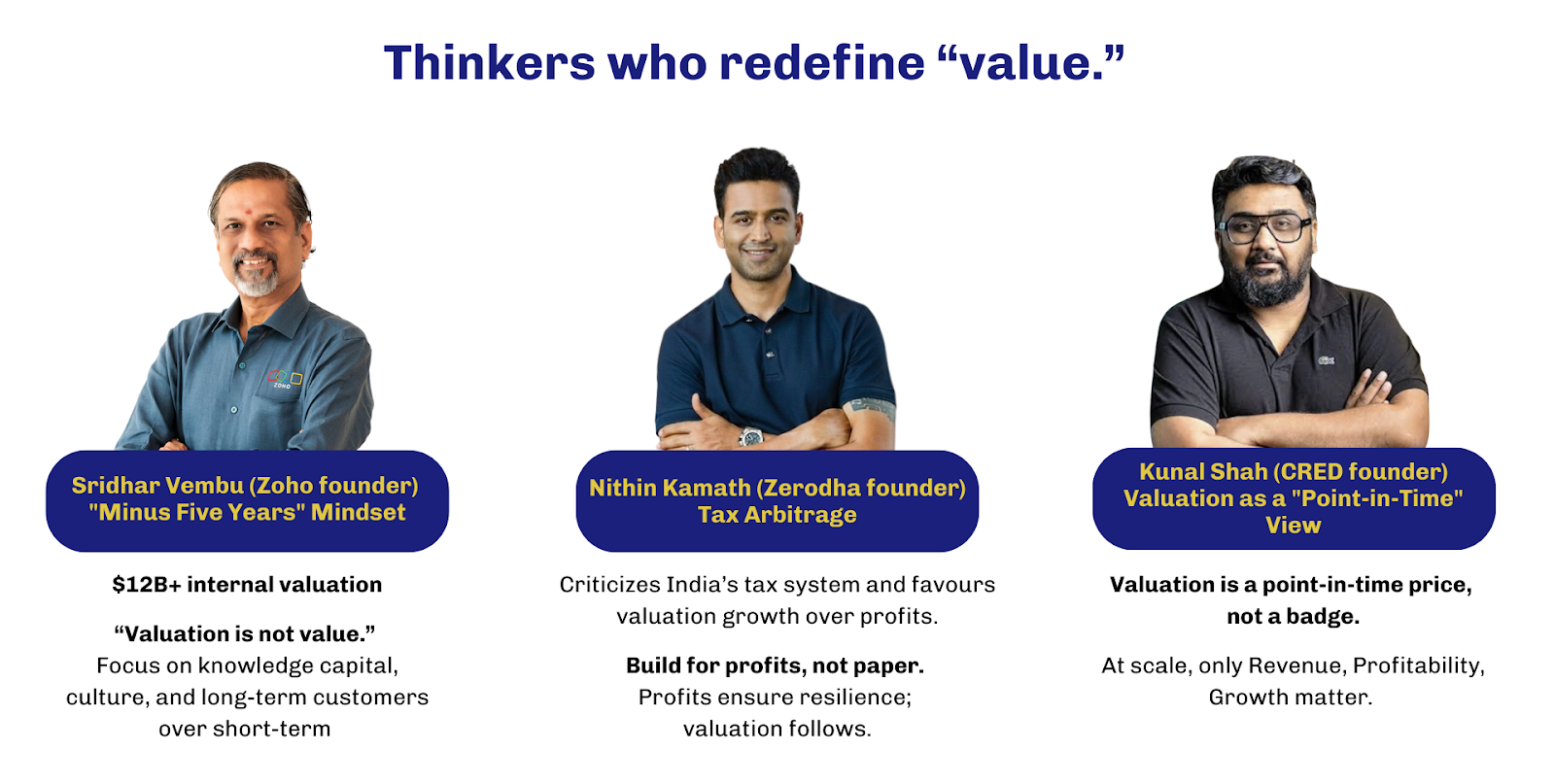

Chapter 6: Alternative Valuation Philosophies

Beyond VC models, 2025 highlighted thinkers who redefine “value” These perspectives are crucial for founders weighing bootstrapping vs. funding.

6.1 Sridhar Vembu (Zoho): "Minus Five Years" Mindset

Sridhar Vembu, Zoho founder ($12B+ internal valuation), rejects financialization.

- Philosophy: “Valuation is not value.” Focus on knowledge capital, culture, and long-term customers over short-term metrics.

- Approach: Built with patience and frugality, he advocates for a "Minus Five Years" mindset. Avoid chasing valuations; durability and self-sufficiency matter most.

6.2 Nithin Kamath (Zerodha): Tax Arbitrage

Kamath critiques how India’s tax system favors valuation growth over profits.

- Dividends: taxed up to ~50%

- Long-term capital gains: ~12.5–15%

Effect: Founders reinvest profits to inflate valuation instead of distributing earnings, creating fragile businesses.

Takeaway: Build for profits, not paper. Profits ensure resilience; valuation follows.

6.3 Kunal Shah (CRED): Valuation as a "Point-in-Time" View

Valuation is a point-in-time price, not a badge.

Action: At scale, only Revenue, Profitability, Growth matter. CRED’s 2025 shift-cutting burn 50% and focusing on monetization, shows fundamentals drive valuation.

Chapter 7: The Unlisted Market and Pre-IPO Discovery

A defining 2025–2026 trend is the rapid growth of the unlisted share market, a shadow exchange for late-stage startups.

It has become an informal price discovery engine, often signaling a company’s real valuation before any IPO or VC round.

7.1 The Price Discovery Mechanism

Investors now actively trade shares of “Soonicorns” (soon-to-be unicorns) in the grey market to capture upside early. As a result, pricing moves in real time and can diverge sharply from the last official private round.

Real-Time Sentiment:

Lenskart shares trading at ₹300 (implied market cap ~₹50,000 Cr) reflected strong confidence in its profitability turnaround, well before any IPO announcement.

NSE vs. Groww Comparison:

7.2 Risks for Founders

The unlisted market isn’t always beneficial.

Volatility: Falling prices can spook employees (ESOP holders) and investors, complicating fresh fundraising.

IPO Anchoring: Bankers often treat grey-market prices as IPO benchmarks. If hype inflates prices too high, listings may happen below those levels, effectively a “down-round IPO” for recent buyers.

Chapter 8: Dilution and Founder Equity

Valuation and dilution go hand in hand, how much of the company founders give away directly affects control. Knowing 2026 benchmarks is critical.

8.1 2026 Dilution Benchmarks

From 2025 data:

- Pre-Seed: 10-15% dilution. Expensive equity, but needed for proof-of-concept.

- Seed: 15-25% dilution. Standard for early traction.

- Series A: Typically 20-25%. Creates a bell curve.

Cumulative Impact: After Series A and ESOPs, founders usually retain ~50% of the company.

Danger Zone: >30% dilution in a single round is risky, leaves too little equity for future rounds and may discourage VCs, who prefer founders with “skin in the game.”

8.2 The Rise of High-Cap SAFE Notes

SAFE agreements remain the preferred early-stage instrument.

Trend: Despite smaller round sizes, valuation caps for strong startups rose or stayed flat, meaning less dilution for the same capital.

Strategy: Founders are modeling scenarios to keep seed-round dilution under 18-20%.

Conclusion: The New Rules of the Game

The 2021 “valuation game” vanity metrics, endless burn, FOMO investing is over. 2026 rewards rigor, efficiency, and governance.

Key Takeaways:

1. Profitability Drives Valuation: Show you don’t need capital. Operational efficiency (EBITDA, Rule of 40) now outweighs raw growth.

2. Governance is Essential: Clean cap tables, transparent reporting, and robust controls directly affect your multiple.

3. Regulatory Savvy Matters: Use Angel Tax abolition for domestic capital; follow FEMA rules for foreign investment.

4. Embrace the Boring: Steady profits, sustainable margins, and long-term focus create true value.

Bottom line: The founders who will define 2026 aren’t the best storytellers, they build the strongest businesses.

Formula for success:

Valuation = (Execution + Governance) ^ Consistency

FAQs: Startup Valuation

1. What is startup valuation in simple terms?

Startup valuation is the price investors are willing to pay for a stake in your company. It reflects risk, growth potential, unit economics, governance quality, and market conditions, not just revenue or hype.

2. How do investors value pre-revenue startups?

They use qualitative methods like Berkus, Scorecard, and Risk Factor models, focusing on team strength, prototype, market size, and traction. At this stage, reducing risk matters more than financial projections.

3. What is a good seed-stage valuation in India in 2026?

Most seed rounds fall between ₹15–25 Cr pre-money, depending on traction, team pedigree, and defensible IP. Pure “idea decks” rarely command premiums anymore.

4. Why are valuations lower than 2021–22 levels?

Capital is selective. Investors now prioritize profitability, unit economics, and governance. The “growth at any cost” era is over; sustainable businesses earn higher multiples.

5. Which metrics matter most for Series A and beyond?

CAC/LTV, contribution margin, EBITDA, burn multiple, and Rule of 40. Growth alone isn’t enough, efficiency drives valuation.

6. How does dilution affect founders?

Dilution reduces ownership and control. Excessive early dilution (<30% in one round) can hurt future fundraising and investor confidence. Post-Series A, founders typically retain ~50%.

7. What is the Venture Capital (VC) valuation method?

VCs work backward from expected exit value. They estimate the future sale price, apply a target return (10x–20x), then calculate today’s valuation.

8. Why is DCF important for Indian startups?

DCF is mandatory for FEMA compliance and foreign investments. It estimates intrinsic value based on projected cash flows and discount rates, creating a valuation floor for pricing shares.

9. What is the Rule of 40 in SaaS valuation?

Growth rate + EBITDA margin should exceed 40%. Companies meeting this benchmark command premium ARR multiples because they balance growth with profitability.

10. How do public markets impact private startup valuations?

Private rounds anchor to listed peers. If public SaaS or fintech multiples fall, late-stage private valuations compress too. IPO comps set the ceiling.

11. What is the unlisted (grey) share market?

It’s an informal market where late-stage startup shares trade pre-IPO. It provides real-time price discovery and signals investor sentiment before official funding or listing.

12. Can grey-market prices affect IPO outcomes?

Yes. Bankers often anchor IPO pricing to unlisted trades. If hype inflates prices too much, listing lower can create a “down-round IPO” for recent buyers.

13. Does governance really impact valuation?

Absolutely. Clean cap tables, audits, compliance, and transparent reporting reduce risk. Strong governance attracts premium multiples; weak controls trigger discounts or deal rejections.

14. Are SAFE notes better than priced rounds for seed funding?

SAFEs are faster and simpler, delaying valuation negotiations. With higher caps in 2025–26, founders dilute less upfront while keeping flexibility for the next round.

15. What’s the fastest way to increase valuation today?

Improve fundamentals: stronger margins, lower burn, predictable revenue, and clear profitability. In 2026, execution beats storytelling, investors pay for performance, not pitch decks.

Contact Us

An expert will call you within 24 hours. No payment required to get started.

Related Post

.png)

Why Do 9 In 10 Startups Fail in India?

Learn how from science exhibitions in schools to the hostel rooms of IITs and IIMs, each day a startup is born. Also, explore the reasons for failed startups in India.

. 5 min read.png)

Startup India Fund Scheme- How to Apply, Features, Benefits

Discover this scheme's contribution to the growth of early-stage startups through seed funding, mentoring, networking, and others.

. 3 min read.png)

4 Common Reasons Why Businesses Need to Amend Their Registered Trademark

Learn why businesses often need to make amendments to their registered trademarks. Discover the importance of trademark name search for business identity and the procedure for making changes in India.

. 5 min read