New vs Old Tax Regime: Which Is Better for FY 2025–26

By Filing Buddy . 23 Dec 25

New Tax Regime vs Old Regime: Which is Better for FY 2025–26?

For many salaried professionals and freelancers, the New Tax Regime vs Old Regime decision is being made in seconds, often by clicking “continue” on a portal that never explains what you’re giving up. The real surprise comes later, when deductions don’t apply and the final tax payable doesn’t match expectations.

And this year, the uncertainty feels even sharper. For FY 2025–26, the New Tax Regime is the default option, deduction rules under the Old Regime work differently, and income tax slabs have changed. Advice that made sense last year doesn’t always apply now. Colleagues suggest one approach, social media pushes another, and somewhere in between, you’re left wondering which tax regime is actually better for you.

That’s exactly where this guide comes in.

In this blog, we break down New Tax Regime vs Old Regime for FY 2025–26 in a clear, practical way, without legal jargon or complicated formulas. You’ll understand how both tax regimes work, who each one is best suited for, the common mistakes taxpayers make while choosing, and most importantly, how to decide which option saves you more tax.

Think of this as a friendly, no-pressure conversation, the kind that helps you make a confident tax decision, not a rushed one.

Why This Choice Matters More in FY 2025–26

For FY 2025–26, choosing between the New and Old Tax Regime is no longer a background decision made during filing. Structural changes in how tax options are presented and applied have increased the risk of unintentional choices and unintended tax outcomes.

This year, how you choose matters just as much as what you choose.

The New Tax Regime Is the Default

One of the most significant changes is procedural.

- The New Tax Regime is auto-selected for most taxpayers

- Many individuals proceed without actively reviewing the alternative

- The choice is often made early, during salary declarations or portal logins

This matters because the default option may not align with your income structure or existing deductions.

Past Tax Advice Doesn’t Always Apply Anymore

Tax planning habits formed over the last few years can be misleading in FY 2025–26.

- Deduction eligibility has evolved

- Slab structures have been reworked

- What worked last year may no longer be optimal

Relying on outdated advice, whether from peers or online posts, increases the chance of choosing the wrong regime.

The Impact Is Financial and Often Invisible

There is no penalty for selecting the “wrong” tax regime. But the consequences usually show up later, when the tax calculation doesn’t match expectations.

A mismatched choice can lead to:

- Paying more tax than necessary

- Losing benefits you assumed would apply

- Realising the impact only after filing is complete

What makes this tricky is that the effect isn’t always obvious at the time of selection. For many taxpayers, the real cost becomes clear only when it’s too late to revise.

That’s why understanding the rules before choosing a regime matters far more than correcting it afterward.

Understanding the Two Tax Regimes

At its core, the difference between the Old Tax Regime and the New Tax Regime lies in how income is treated before tax is calculated. Both regimes tax income progressively, but they follow two very different philosophies, one rewards tax planning, the other prioritises simplicity.

Understanding this distinction makes it easier to evaluate which option fits your financial situation.

Old Tax Regime: Tax Planning–Driven Structure

The Old Tax Regime allows taxpayers to reduce their taxable income by claiming deductions and exemptions available under the Income Tax Act.

Who this regime suits best:

- Salaried individuals claiming HRA or LTA

- Taxpayers investing in 80C instruments

- Individuals with insurance premiums or loan interest

- Anyone actively planning tax-saving investments

How it works:

- Start with gross income

- Reduce eligible deductions and exemptions

- Apply tax rates on the net taxable income

The effectiveness of this regime depends entirely on how much you can legitimately claim.

New Tax Regime: Simplified, Deduction-Light Structure

The New Tax Regime takes the opposite approach. Instead of relying on deductions, it offers lower tax rates across more income slabs while removing most exemptions.

Who this regime suits best:

- Individuals with limited or no deductions

- First-time taxpayers

- Freelancers or professionals preferring predictable tax outflow

- Anyone seeking simpler compliance

How it works:

- Tax is calculated directly on income

- Most deductions and exemptions are not available

- Lower rates aim to balance the loss of deductions

This structure reduces paperwork and planning effort, shifting the focus from optimisation to rate-based taxation.

Flexibility vs Simplicity: The Core Trade-Off

Instead of remembering sections and limits, it helps to think in terms of access.

- Under the Old Regime, deductions and exemptions reduce taxable income

- Under the New Regime, income is largely taxed as earned

At its core, the decision comes down to:

- Flexibility, if you plan and claim

- Simplicity, if you prefer clean structures and minimal intervention

Once this distinction is clear, the numbers in the tax slab comparison becomes far more meaningful and far easier to evaluate.

Tax Slabs Comparison for FY 2025–26

Now that the structure of both tax regimes is clear, the next step is understanding how income is actually taxed under each option. The slab rates determine where your income gets taxed and how quickly it moves into higher tax brackets.

This comparison is especially important if your income falls between ₹6–15 lakh, where the difference between the two regimes is most noticeable.

Old vs New Tax Regime: Slab-wise Comparison

The table below shows how the same income range is taxed differently under the Old and New Tax Regimes for FY 2025–26.

OLD Tax Regime

| Income Tax Slab | Income Tax Rate |

| Up to 2,50,000 | Nil |

| 2,50,001 - 5 lakh | 5% |

| 5 lakh - 10 lakh | 20% |

| Above 10 lakh | 30% |

New Tax Regime

| Income Tax Slabs for FY 2025-26 | Income Tax Rates for FY 2025-26 |

| Up to Rs. 4 lakh | Nil |

| Rs. 4 lakh to Rs. 8 lakh | 5% |

| Rs. 8 lakh to Rs. 12 lakh | 10% |

| Rs. 12 lakh to Rs. 16 lakh | 15% |

| Rs. 16 lakh to Rs. 20 lakh | 20% |

| Rs. 20 lakh to Rs. 24 lakh | 25% |

| Above Rs. 24 lakh | 30% |

What These Slabs Mean in Real Terms

Instead of looking at rates in isolation, focus on how income moves through slabs:

- Under the Old Regime, income crosses into the 30% slab once it exceeds ₹10 lakh

- Under the New Regime, income between ₹6–15 lakh is spread across multiple lower-rate slabs

- This makes the New Regime appear cheaper before deductions are considered

Income Ranges Where the Decision Changes

- Up to ₹7 lakh: The New Regime can result in zero tax liability due to rebate benefits.

- ₹6–15 lakh: This is the most sensitive range.

- Fewer deductions → New Regime often works better

- Significant deductions → Old Regime may reduce taxable income more effectively

- Above ₹15 lakh: Both regimes apply 30% tax, so deductions under the Old Regime become the key differentiator.

How to Use This Comparison

- Don’t choose based on rates alone

- Map your actual income across slabs

- Then apply deductions (if any) to see the real impact

This slab comparison sets the stage for the next step, deciding which regime is better for you, based on your income and deductions.

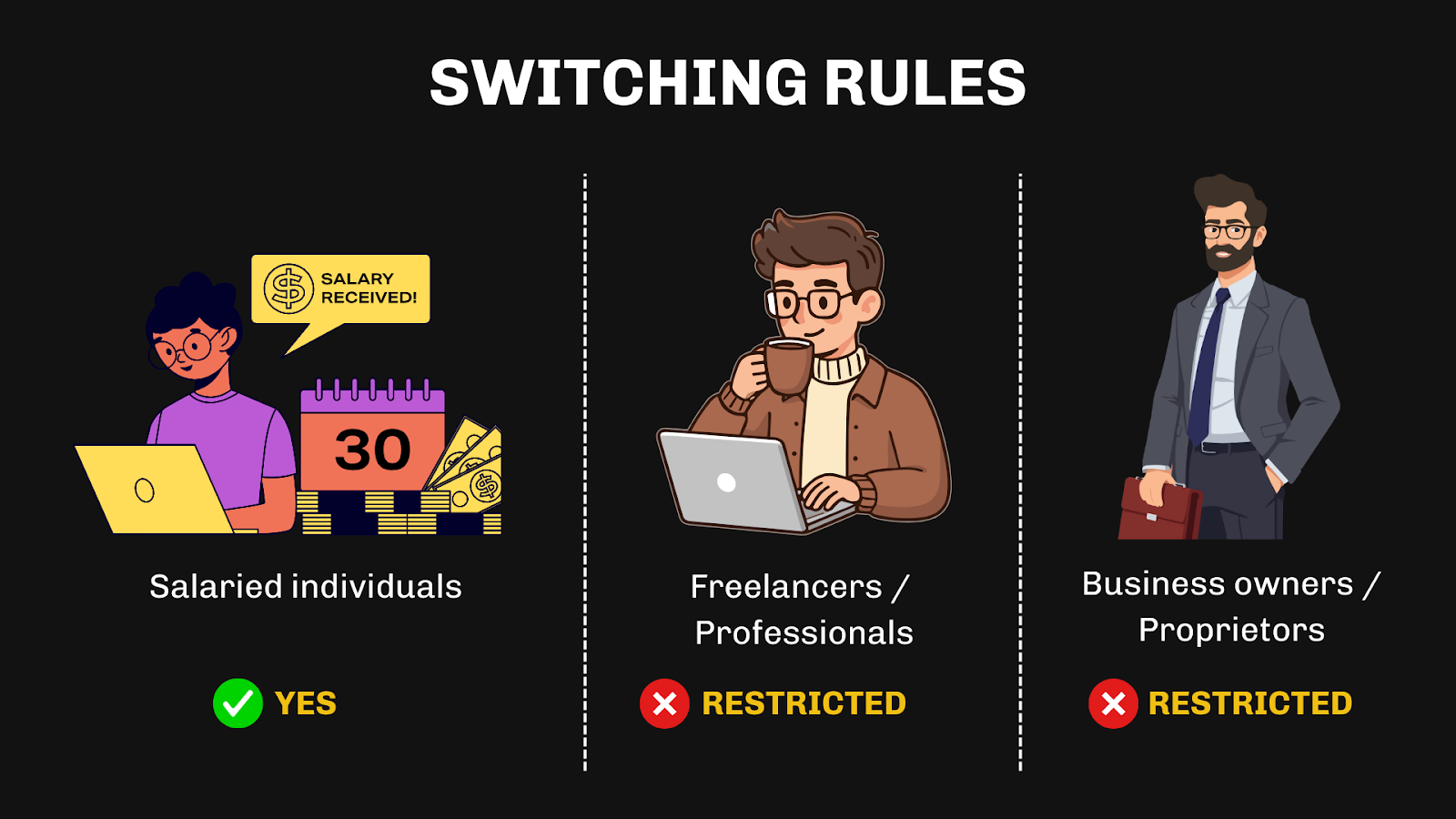

Who Can Choose Which Regime?

Not every taxpayer has the same flexibility when it comes to choosing between the New and Old Tax Regimes. The option available to you depends largely on your source of income. Understanding this is crucial before making a selection, because in some cases, the choice you make can affect future years as well.

Salaried Individuals

Salaried taxpayers have the maximum flexibility when it comes to choosing a tax regime.

Who this applies to:

- Employees earning salary income only

- Individuals without business or professional income

How the choice works:

- You can choose either regime every financial year

- You are not locked into one option

- The choice can be changed year after year based on your situation

What to keep in mind:

- The New Tax Regime may appear as the default on employer portals

- You must actively opt for the Old Regime if that suits you better

This flexibility allows salaried individuals to reassess their choice after salary hikes, job changes, or changes in deductions.

It’s also important to note that TDS (Tax Deducted at Source) on your salary is calculated by your employer based on the tax regime you declare. If the declared regime doesn’t align with your actual deductions, excess TDS may be deducted during the year, which you can only adjust later while filing your return.

Freelancers and Professionals

Freelancers and professionals face more restrictive rules.

Who this applies to:

- Freelancers

- Consultants

- Self-employed professionals

- Individuals with professional income

How the choice works:

- You can choose between regimes initially

- Once you opt out of the New Regime, switching back is restricted

- The choice impacts future assessment years

Why this matters:

- A wrong choice can limit long-term tax planning

- Careful evaluation is essential before committing

For freelancers, the decision is often less about convenience and more about future flexibility.

Business Owners and Proprietors

Business income taxpayers have the least flexibility.

Who this applies to:

- Sole proprietors

- Individuals running small businesses

- Taxpayers with income under the head “Profits and Gains of Business or Profession”

How the choice works:

- Once you opt out of the New Regime, you generally cannot switch back

- The decision can have multi-year implications

This makes regime selection a strategic decision, not just an annual one.

First-Time Taxpayers

First-time filers often assume the regime choice is automatic.

What to know:

- The New Tax Regime is the default

- A choice still exists

- Understanding both options early helps avoid future confusion

Before you start comparing tax savings or running calculations, it helps to know how much flexibility you actually have. For some taxpayers, the choice between regimes can be revisited every year. For others, it’s a decision that carries forward and affects future filings.

Understanding where you stand sets the right expectations. It ensures that when you move on to choosing a regime, you’re doing it with clarity, not assumptions and with a view that goes beyond just this year’s tax bill.

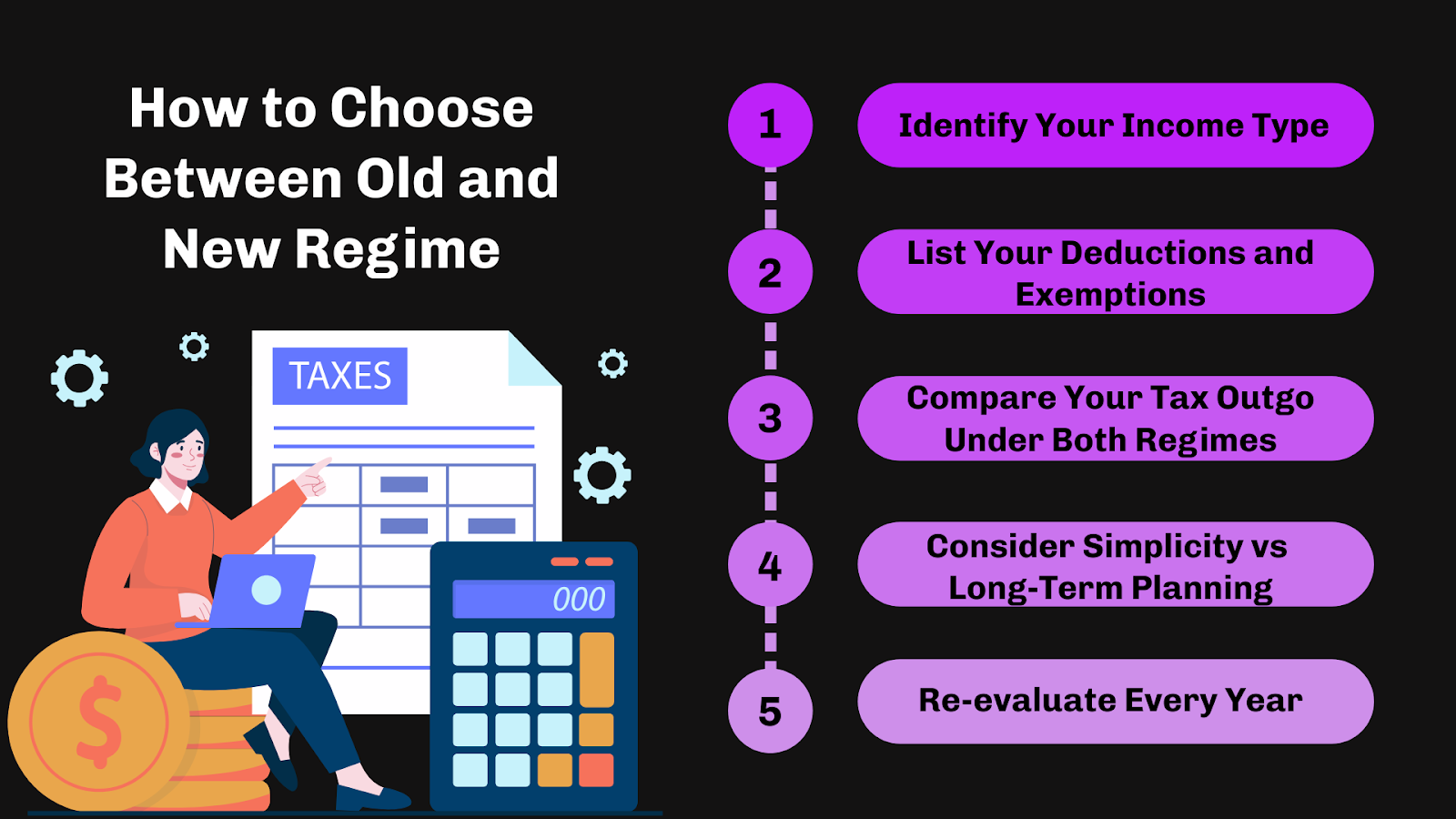

How to Choose Between Old and New Regime

Choosing the right tax regime is less about following popular advice and more about understanding your own income and habits. The better option isn’t universal, it changes based on what you earn, what you invest in, and how structured your finances are.

Instead of guessing, follow a simple, step-by-step approach.

Step 1: Identify Your Income Type

Start by clarifying where your income comes from. This determines both flexibility and planning scope.

- Salary income

- Freelance or professional income

- Business income

- Multiple income sources

If you earn only a salary, you can review this decision every year. If you earn business or professional income, your choice may affect future years.

Step 2: List Your Deductions and Exemptions

Next, look at the deductions you can actually claim, not the ones you plan to claim.

Common examples under the Old Regime include:

- Section 80C investments

- House Rent Allowance (HRA)

- Health insurance premiums

- Home loan interest

If these form a significant portion of your income, the Old Regime often becomes more effective.

Step 3: Compare Your Tax Outgo Under Both Regimes

Once income and deductions are clear, calculate tax liability under both regimes.

- Use official calculators or tax software

- Compare final tax payable, not just slab rates

- Include surcharge and cess where applicable

The regime with the lower total tax is usually the better choice, but only for that year.

Step 4: Consider Simplicity vs Long-Term Planning

Tax decisions aren’t only about numbers.

- The Old Regime rewards disciplined tax planning

- The New Regime offers ease and predictability

If you prefer minimal paperwork and straightforward compliance, the New Regime may suit you better. If you actively invest for tax efficiency, the Old Regime often aligns better.

Step 5: Re-evaluate Every Year (Where Allowed)

Your financial situation changes over time.

- Salary hikes

- New investments

- Lifestyle changes

- Loans or insurance additions

If your income type allows, reassess your choice every financial year instead of sticking to last year’s decision.

A Simple Way to Think About It

- High deductions + structured investments → Old Regime

- Low deductions + preference for simplicity → New Regime

The right choice is the one that fits your current reality, not what worked for someone else.

Making this decision with clarity helps you avoid overpaying tax and ensures your filing aligns with how you actually manage your money, not how you think you should.

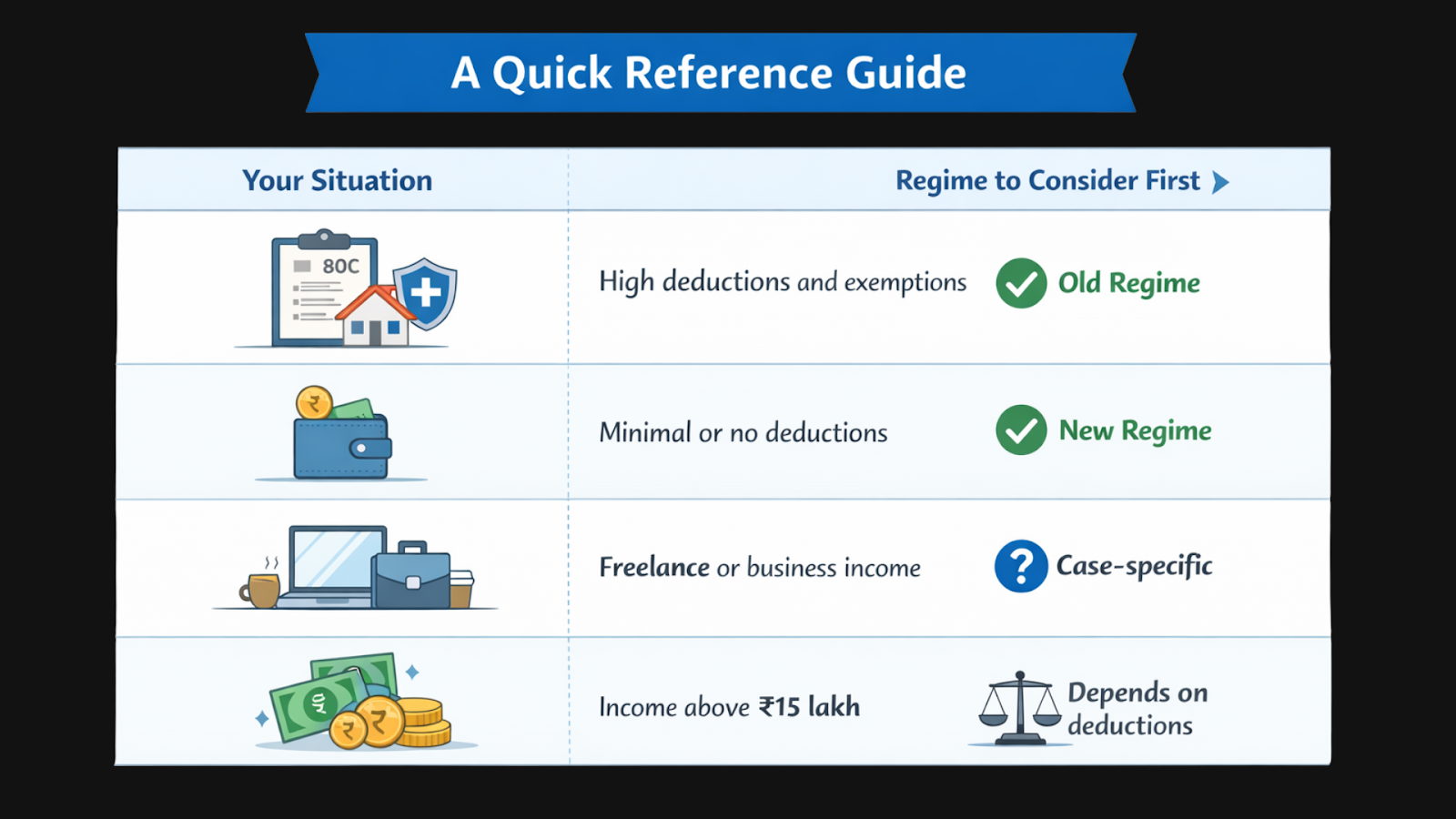

Which Regime is Better for You?

If you’re looking for a quick sense-check before making your choice, this section helps you narrow it down. These aren’t hard rules, but patterns that hold true for most taxpayers when everything above is considered.

The Old Tax Regime may suit you better if:

- You regularly claim deductions like HRA, Section 80C, or health insurance

- Your tax-saving investments form a meaningful part of your financial planning

- You don’t mind maintaining proofs and documentation

- Your deductions significantly reduce your taxable income

The New Tax Regime may suit you better if:

- You have limited or no deductions to claim

- You prefer a simpler filing process with fewer conditions

- You want predictable tax outgo without active tax planning

- Your income is stable and deductions don’t change much year to year

One Thing to Keep in Mind

The “better” regime isn’t the one with lower rates or more benefits, it’s the one that fits how you actually earn and manage your money. A quick review each year can help you avoid paying more tax than necessary.

Common Mistakes Taxpayers Make

Most tax regime mistakes don’t happen because the rules are complex, they happen because people rush decisions or rely on incomplete advice. Being aware of these common missteps can help you avoid unnecessary tax outgo and last-minute stress.

1. Assuming the Default Option Is the Best One:

For many taxpayers, the New Tax Regime appears as the default choice on filing portals and employer systems.

- This does not mean it is automatically better for you

- Defaults are designed for simplicity, not optimisation

- Failing to review the option can lead to higher tax liability

Always pause and evaluate before proceeding.

2. Not Recalculating Every Financial Year

Tax regime decisions are often repeated year after year without reassessment.

- Income may increase or decrease

- Deductions may change

- New investments or loans may come into play

What worked last year may not work for the current year.

3. Overestimating or Assuming Deductions

Many taxpayers assume they will “manage deductions later” while choosing the Old Regime.

- Planned investments don’t always happen

- Documentation may be incomplete

- Actual deductions may fall short of expectations

This can result in higher tax than anticipated.

4. Ignoring Switching Restrictions

This mistake particularly affects freelancers and business owners.

- Switching flexibility is limited for non-salaried income

- An uninformed choice can lock you into a less suitable regime

- Future planning may be restricted

Understanding switching rules before opting in or out is critical.

5. Following Generic Advice Without Context

Advice from colleagues, social media, or online calculators often lacks context.

- Someone else’s tax situation is rarely identical to yours

- Income structure and deductions vary widely

- Copying advice can lead to poor outcomes

Tax decisions should always be personalised.

6. Choosing Based Only on Tax Slab Rates

Lower slab rates can be misleading when viewed in isolation.

- Slab rates don’t reflect final tax payable

- Deductions and exemptions change the outcome

- Total tax outgo is what matters

Always compare the final numbers under both regimes.

Most tax regime mistakes aren’t irreversible, but they are avoidable. They usually stem from assumptions, haste, or relying on incomplete information. Taking a few extra minutes to understand how each regime applies to your income can prevent unpleasant surprises when it’s time to file.

Tips to Maximise Tax Savings (Regardless of Regime)

No matter which tax regime you choose, there are a few smart practices that help reduce tax stress and improve outcomes. These tips focus on planning, timing, and awareness and apply to salaried individuals, freelancers, and business owners alike.

1. Plan Your Taxes Early in the Financial Year

Waiting until the last quarter often limits your options.

- Early planning gives you time to align investments and expenses

- You avoid rushed decisions and missed opportunities

- It helps you spread investments instead of making lump-sum choices

Tax planning works best when it’s proactive, not reactive.

2. Track Income and Expenses Consistently

Accurate records make a significant difference, especially for non-salaried taxpayers.

- Maintain income records month-wise

- Track eligible expenses and investments

- Keep documentation organised throughout the year

This is particularly important for freelancers and professionals.

3. Don’t Choose a Regime Without Doing the Math

Even if a regime looks simpler, a quick comparison can save money.

- Use reliable tax calculators

- Compare final tax payable under both regimes

- Focus on net tax, not just slab rates

A short calculation can prevent long-term regret.

4. Be Mindful of Long-Term Implications

Some taxpayers face restrictions on switching regimes.

- Freelancers and business owners should evaluate multi-year impact

- A short-term saving may reduce future flexibility

- Think beyond a single assessment year

Tax choices should align with your broader financial plan.

5. Stay Updated on Tax Rule Changes

Tax laws evolve, and small changes can impact your decision.

- Slab rates may change

- Deductions may be added or removed

- Default options can shift

Relying on outdated advice can be costly.

6. Seek Professional Clarity When Needed

If your income structure is complex, expert guidance helps.

- Multiple income sources

- Business or professional income

- Large deductions or investments

And if all of this still feels overwhelming, that’s completely normal. Tax decisions aren’t meant to be figured out alone. At Filing Buddy, we believe having a reliable tax “buddy” makes the process easier, someone who understands your income structure, explains your options clearly, and helps you choose with confidence, not confusion.

A Simple Rule to Remember

Tax savings don’t come from choosing a popular regime, they come from choosing the right regime and managing your finances consistently. A little awareness goes a long way in keeping your tax liability in check.

What Happens If You Choose the Wrong Regime?

Even after understanding the rules and comparing both tax regimes, one question tends to linger, what if the wrong tax regime is chosen? It’s a fair concern.

The good news is that for most taxpayers, especially salaried individuals, the impact is financial rather than legal. Choosing a less optimal regime usually means paying more tax than necessary, not facing penalties or notices. However, the consequences can still be meaningful if the decision isn’t reviewed in time.

The Most Common Impact: Higher Tax Outflow

The immediate effect of choosing the wrong regime is usually simple:

- Paying more tax despite having the same income

- Losing deductions or exemptions you could have claimed

- Realising the impact only after filing, when changes may be limited

There’s typically no penalty involved, but the extra outflow can still feel like an expensive oversight.

If You’re a Salaried Individual

Salaried taxpayers usually have the most flexibility.

- Even if a regime is selected through your employer, it is not always final

- You can often choose the appropriate regime while filing your Income Tax Return

- The final validation of your choice happens at the ITR filing stage

This means an early mistake isn’t irreversible, but reviewing your choice before filing is still important to avoid last-minute stress.

If You’re a Freelancer or Business Owner

For freelancers and business owners, the stakes are higher.

- Regime selection can affect multiple financial years

- Switching between regimes may be restricted once a choice is made

- A wrong selection can limit long-term tax planning flexibility

Because the ability to switch is not always available later, this decision deserves intention rather than haste.

Can You Fix the Mistake Later?

In many cases, yes, but with conditions.

Corrections may be possible while filing or revising your return, but these options are time-bound. Any correction or revision must be completed before the applicable ITR filing or revision deadlines, which is why reviewing your tax regime choice well ahead of the ITR due date (usually 31 July for most individuals) becomes important.

The ease of making a correction also depends on your income type. The sooner a mismatch is identified, the easier it is to address and the fewer constraints you face during filing.

What This Means Practically

Choosing the wrong regime isn’t disastrous, but it is avoidable.

- It can lead to unnecessary tax outflow

- It may restrict future choices for some taxpayers

- It often creates avoidable pressure during filing season

The safer approach is to treat regime selection as a decision point, not a formality. Reviewing your income structure and understanding the implications upfront helps ensure your tax filing reflects what actually works best for you, not what was chosen in a hurry.

Conclusion

If there’s one clear takeaway from this guide, it’s this: the “better” tax regime depends entirely on your income structure, deductions, and financial habits. And that’s not a flaw in the system, it’s by design.

The Old Tax Regime continues to reward structured tax planning and active use of deductions. The New Tax Regime works well for those who prefer simplicity, fewer claims, and predictable taxation. Neither is inherently better; each becomes effective only when it aligns with how you earn and save.

The real risk isn’t choosing the wrong regime.

It’s choosing one without understanding what you’re trading off.

Tax decisions don’t need to feel rushed or overwhelming. With the right clarity, they become part of a smarter financial routine and not a yearly headache. And when you want a second pair of eyes before filing, staying compliant feels easier when you’re not doing it alone.

That’s where Filing Buddy fits in quietly, helping you make informed choices and file with confidence, not confusion.

FAQs

1. Which tax regime is better for salaried employees?

It depends on deductions. Salaried employees with HRA, 80C investments, or insurance benefits often benefit from the Old Regime, while those with minimal deductions may find the New Regime better.

2. Is the New Tax Regime mandatory for FY 2025–26?

No. The New Tax Regime is the default option, but taxpayers can still choose the Old Regime if it suits them better.

3. Can I switch between tax regimes every year?

Salaried individuals can switch every year. Freelancers and business owners face restrictions on switching once a choice is made.

4. What happens if I choose the wrong tax regime?

There’s usually no penalty, but you may end up paying more tax. In some cases, the choice can be corrected while filing the return.

5. Are deductions allowed under the New Tax Regime?

Most deductions are not allowed, but a few, like the standard deduction, are still available.

6. Which tax regime is better for income above ₹15 lakh?

It depends on how many deductions you can claim. High deductions often favour the Old Regime; fewer deductions may make the New Regime more efficient.

7. Can freelancers opt for the Old Tax Regime?

Yes, freelancers can opt for the Old Regime, but switching back later may be restricted, so the decision should be made carefully.

8. Is HRA allowed in the New Tax Regime?

No, House Rent Allowance (HRA) exemption is not available under the New Tax Regime.

9. Do I need to inform my employer about my tax regime choice?

Yes. Employers deduct TDS based on the regime you declare, though the final choice can usually be adjusted while filing your return.

10. Does the New Tax Regime increase take-home salary?

In some cases, yes. Lower slab rates can increase take-home pay, especially for those with few deductions.

11. Can first-time taxpayers choose the Old Regime?

Yes. First-time taxpayers can choose either regime, even though the New Regime is set as default.

12. Is standard deduction available in both regimes?

Yes, the standard deduction is available under both the Old and New Tax Regimes.

13. Should I blindly choose the default tax regime?

No. The default option prioritises simplicity, not tax optimisation. It’s always better to evaluate both regimes.

14. Can tax regime choice affect future years?

Yes. For freelancers and business owners, choosing a regime can impact flexibility in future assessment years.

15. How do I decide which tax regime is right for me?

Compare tax liability under both regimes based on your actual income and deductions, and reassess the decision each year where allowed.

Contact Us

An expert will call you within 24 hours. No payment required to get started.

Related Post

How should a start-up complete ITR filing

Business entities must file their ITR annually to comply with the tax laws of their respective countries. It helps the government assess and collect the appropriate amount of income tax from taxpayers and ensures proper accountability of financial activities.

. 3 Mins.png)

5 step checklist for GST compliance in Indian Startups

Learn about how GST works. The basics of GST along with its compliances. Uncover what your business needs to keep in mind concerning GST rules and GST compliance.

. 3 min read.png)

₹20 Lakhs and Beyond: Understanding GST for Freelancers in India

Are you a freelancer or aspiring to be one? In this blog, uncover the basics of freelancing and requirements involving GST. Learn about all the exemptions, obligations, and compliances of GST for freelancers in india.

. 5 min read

1.png)