GST Can Deny ITC Even After Return Filing

By Filing Buddy . 08 Jan 26

Introduction

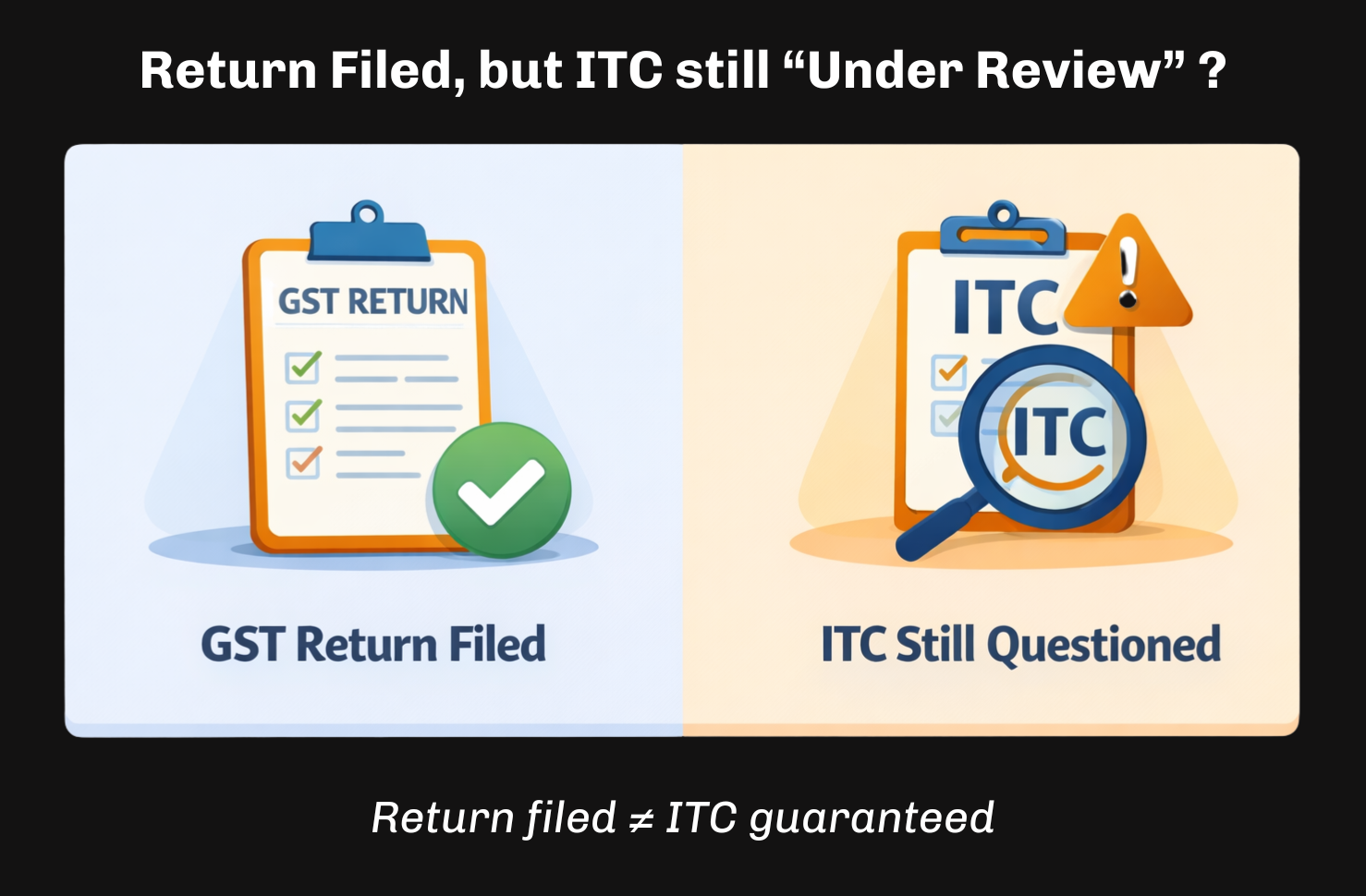

You file your GST return on time. It gets accepted. Everything looks fine.

Then, weeks or months later, your ITC is questioned.

The immediate reaction is obvious: “If my return wasn’t rejected, how can my ITC be denied?”

This confusion is far more common than most businesses realise. Under GST, return filing and ITC eligibility are treated as two separate checks. So even when a return is successfully filed, the credit claimed in it can still be examined, restricted, or reversed later.

In this guide, we’ll break down how and why GST can deny ITC without rejecting your return, the most common situations where businesses get caught off guard, and simple steps you can take to safeguard your credit. No legal jargon, just clear, practical explanations based on how GST works in practice.

At Filing Buddy, we see this issue surface after the damage is already done. This blog is meant to help you spot the risk early and stay compliant with confidence.

If My GST Return Is Filed Successfully, Why Was My ITC Denied?

This is where GST often catches businesses off guard. From a taxpayer’s perspective, a successfully filed return feels like approval. Even when your return is accepted, any ineligible ITC (a credit that doesn’t meet GST eligibility conditions) can still be questioned or reversed later. But under GST, return acceptance and ITC eligibility are two separate checks.

Let’s simplify this.

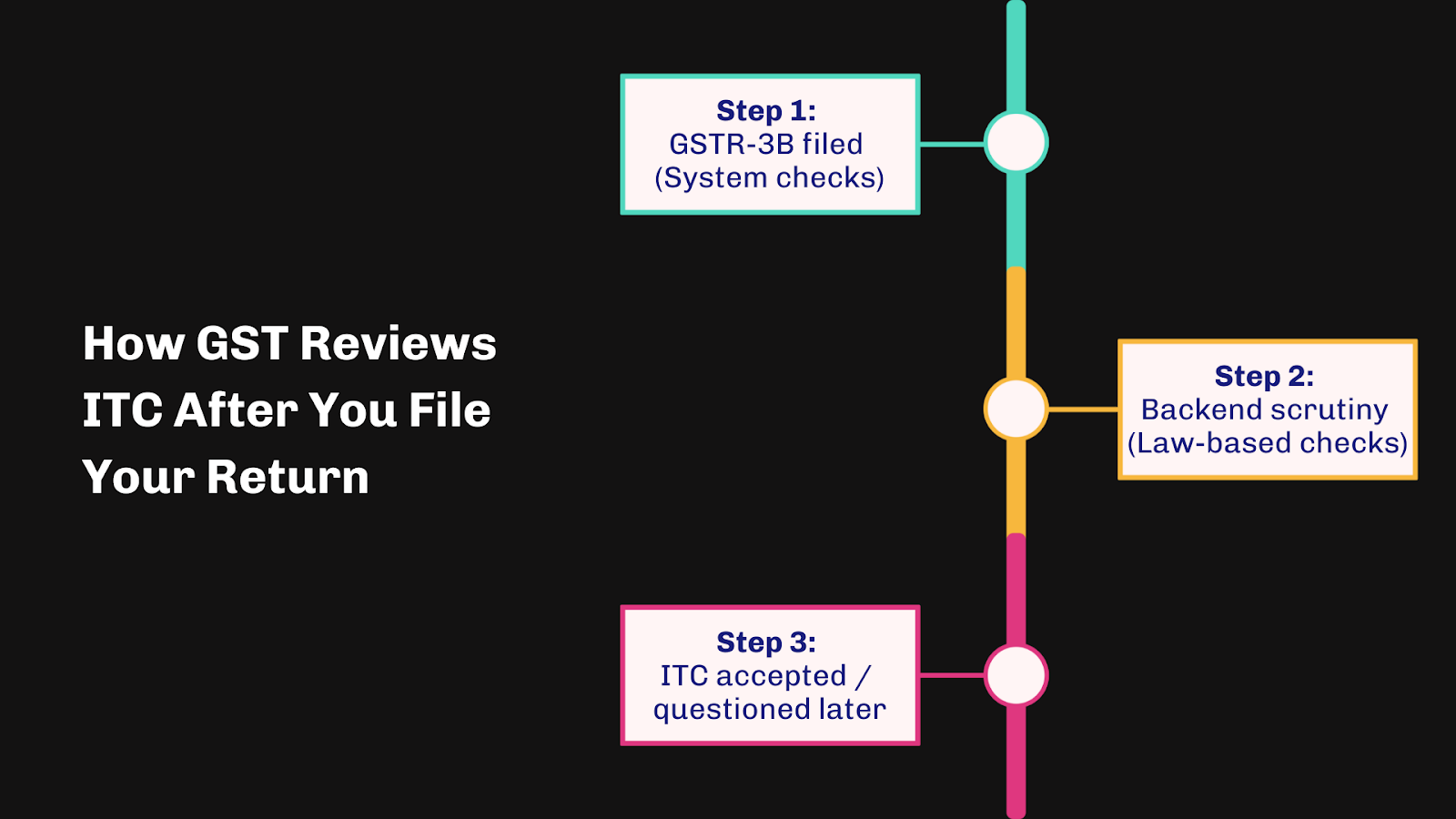

Return filing is system-based; ITC verification is law-based

When you file GSTR-3B, the GST portal performs only basic validations, such as, timely filing and arithmetical accuracy. It does not verify whether the ITC claim is legally eligible at that stage.

That verification happens later through backend checks, scrutiny, audits, or notices.

GSTR-3B follows a self-assessment model

GST works on trust at the time of filing. The system allows taxpayers to declare ITC on their own assessment.

In practical terms:

- Returns can be filed even if some ITC is ineligible

- The portal does not block ITC claims upfront

- Errors are usually identified after filing, not during it

This is why a return may remain accepted while specific ineligible ITC claims are later questioned or reversed.

ITC is conditional, not automatic

Input Tax Credit is allowed only when all legal conditions are met, not merely because an invoice exists or payment is made.

Some key conditions depend on factors beyond your immediate control:

- Whether the supplier filed their returns

- Whether the supplier paid the tax to the government

- Whether invoice details reflect correctly in GSTR-2B

If these conditions fail, ITC can be denied even when your return was filed correctly and on time.

Why issues surface later

Most ITC problems emerge during:

- GSTR-2B reconciliation

- Departmental scrutiny or audit

- Backend risk analysis by GST authorities

At the time of filing, nothing appears wrong. The issue arises only when data from multiple sources is matched later.

Who is most affected

This typically impacts:

- Businesses dealing with multiple vendors

- Taxpayers dependent on supplier compliance

- Those not reconciling GSTR-2B regularly

It’s not about negligence, it’s about how GST is structured.

At Filing Buddy, we explain this as a timing issue, not a filing mistake. The key takeaway is simple: a filed return confirms submission, not final ITC eligibility. Understanding this early helps avoid confusion, reversals, and unnecessary stress later.

On What Legal Basis Can GST Deny ITC After Accepting the Return?

Even if your GST return is accepted, ITC is not automatically guaranteed. GST law has clear provisions that allow authorities to deny or reverse credit if certain conditions are not met. Understanding these rules early helps you stay compliant and avoid surprises.

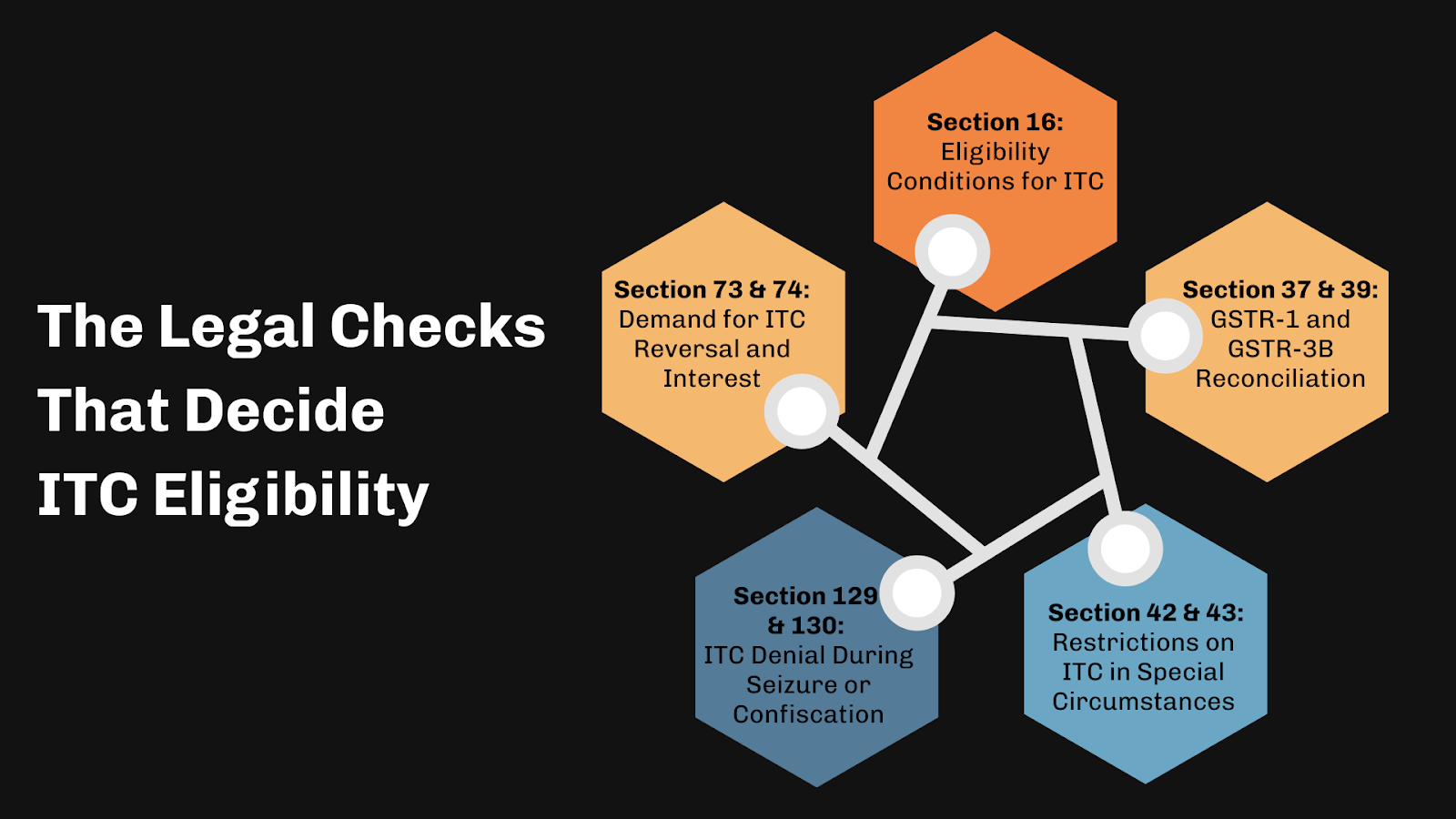

1. Section 16: Eligibility Conditions for ITC

Section 16 of the CGST Act lays down the fundamental conditions for claiming Input Tax Credit:

- You must possess a tax invoice or debit note issued by a registered supplier.

- You must have received the goods or services.

- The supplier must have paid the tax to the government.

- ITC must be claimed within the prescribed time limits.

If any of these conditions fail, ITC can be denied, even though your return was filed and accepted.

2. Section 37 & Section 39: GSTR-1 and GSTR-3B Reconciliation

The law also requires proper reporting and reconciliation:

- Section 37: Suppliers must report outward supplies in GSTR-1.

- Section 39: Recipients report inward supplies in GSTR-3B.

Mismatch between supplier and recipient data can trigger scrutiny. For example:

- ITC claimed in GSTR-3B but not reported by supplier in GSTR-1

- Supplier’s tax not deposited while credit is claimed

These situations give the authorities legal ground to deny or reverse ITC.

3. Section 42 & 43: Restrictions on ITC in Special Circumstances

GST also specifically restricts ITC under certain conditions:

- Blocked credits: e.g., personal expenses, motor vehicles (unless exempt), goods/services for non-business purposes.

- Fraudulent claims: ITC claimed on invoices issued for non-existent supplies.

Authorities can issue Show Cause Notices (SCNs) to deny ITC when such restrictions are triggered.

4. Section 73 & 74: Demand for ITC Reversal and Interest

Even if your return was accepted, if authorities find ineligible ITC during audit or investigation:

- They can issue a demand notice

- Recover the ITC along with interest and penalties

5. Section 129 & Section 130: ITC Denial During Seizure or Confiscation

In rare cases involving goods seized or confiscated, ITC can also be denied under:

- Section 129: Detention or seizure of goods

- Section 130: Confiscation of goods or conveyance

While uncommon, these provide additional legal backing for ITC reversal.

Understanding the legal grounds for ITC denial helps you see why a filed return doesn’t automatically guarantee credit. Next, we’ll look at the most common reasons GST actually denies ITC, including situations many businesses encounter in practice.

Common Reasons GST Denies ITC

Even if your GST return is filed correctly, ITC can still be denied. Understanding why this happens helps you stay ahead and avoid surprises.

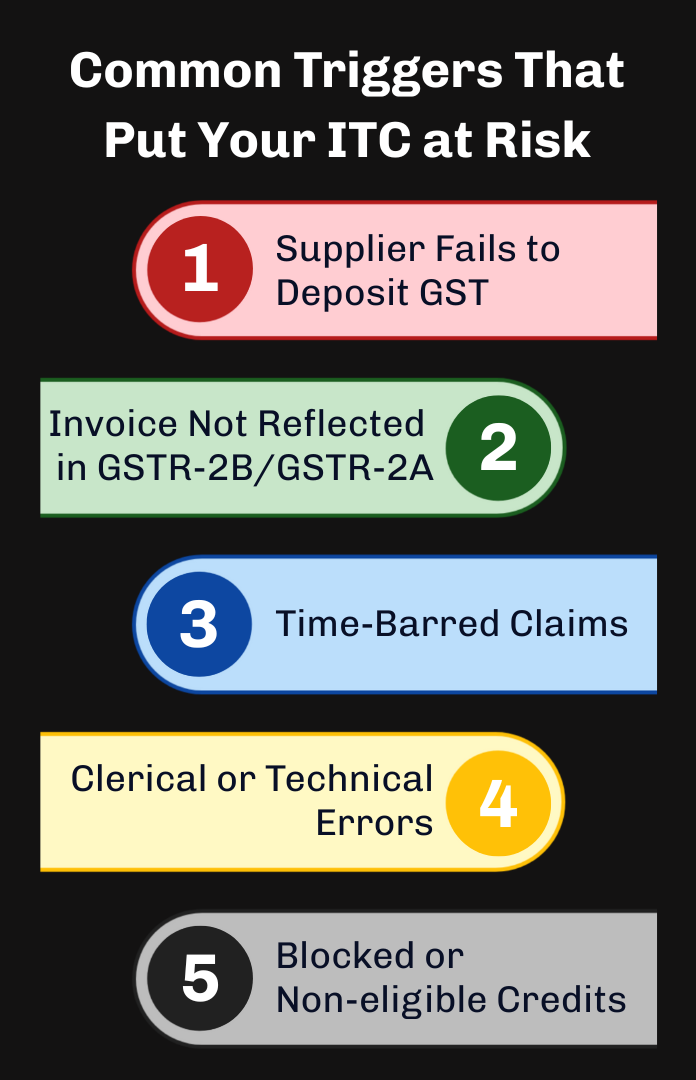

1. Supplier Fails to Deposit GST

One of the biggest shocks for businesses is when the supplier doesn’t remit GST collected to the government, even though all invoices are valid and payments are made correctly.

- ITC is claimed on genuine invoices.

- Payments are made through proper banking channels.

- Returns are filed on time and accepted on the portal.

Yet, the credit may still be denied. A notable example is Pinstar Automotive India Pvt. Ltd. v. Additional Commissioner (Madras High Court, 2023). In this case, the company had claimed ITC on multiple invoices from a registered supplier, all payments were made through banking channels, and the GSTR-3B returns were filed correctly. Later, the authorities questioned the ITC because the supplier had failed to deposit the GST. The return itself remained accepted, but the ITC was reversed.

This shows that even fully compliant buyers can be affected when suppliers default.

Key points to check:

- Supplier has filed their GSTR-1

- Tax has been deposited to the government

- Invoice details match in GSTR-2B

2. Invoice Not Reflected in GSTR-2B / GSTR-2A

If an invoice is not uploaded or delayed, it may not appear in GSTR-2B, and ITC claims can be questioned.

- Common in businesses with multiple vendors

- Even correct invoices can be flagged if the supplier hasn’t filed returns

In Suncraft Energy Pvt. Ltd. v. Assistant Commissioner (Calcutta High Court), a business claimed ITC on invoices that were genuine, and payments were made properly. Later, authorities questioned the ITC because the invoices hadn’t appeared in GSTR-2B. The return itself remained accepted, but the ITC was temporarily disallowed until the company provided reconciliation and supporting documents.

This highlights the importance of regularly reconciling your claimed ITC with GSTR-2B, instead of assuming portal acceptance guarantees credit.

3. Time-Barred Claims

ITC must be claimed within the earlier of 1 year from invoice date or due date of September GSTR-3B of the next financial year. Claims beyond this are automatically ineligible.

4. Clerical or Technical Errors

Errors like wrong GSTIN, branch code, or invoice details can trigger ITC denial. Authorities emphasize accuracy, though courts sometimes prioritize substance over minor clerical mistakes.

5. Blocked or Non-eligible Credits

Certain ITC is legally ineligible:

- Personal expenses

- Motor vehicles (except specific business uses)

- Goods/services for non-business purposes

Even valid invoices in these categories cannot be claimed.

Spotting these common triggers shows why ITC can be denied even when everything seems in order. In the next section, we’ll explore how GST can block or reverse ITC without rejecting your return, and what that process looks like in practice.

Can GST Block or Reverse ITC Without Issuing a Notice First?

A lot of businesses assume that as long as their GST return shows “Filed Successfully,” the Input Tax Credit is untouchable. The reality? ITC can be questioned or even reversed without the return being rejected, and sometimes without a notice being immediately visible on the portal.

How It Happens

GST works on a self-assessment model, meaning the system trusts taxpayers when they file returns. But the authorities conduct backend checks, reconciliations, and audits to ensure all claimed ITC meets legal conditions. Any ineligible ITC can be flagged and reversed even without immediate notice on the portal.

- Sometimes, ITC is flagged because invoices don’t match GSTR-2B.

- Other times, the supplier has defaulted on tax payment.

- In certain cases, ITC is reversed after a Show Cause Notice (SCN) is issued, even when the portal never “rejects” the original return; it just adjusts or disallows specific credits.

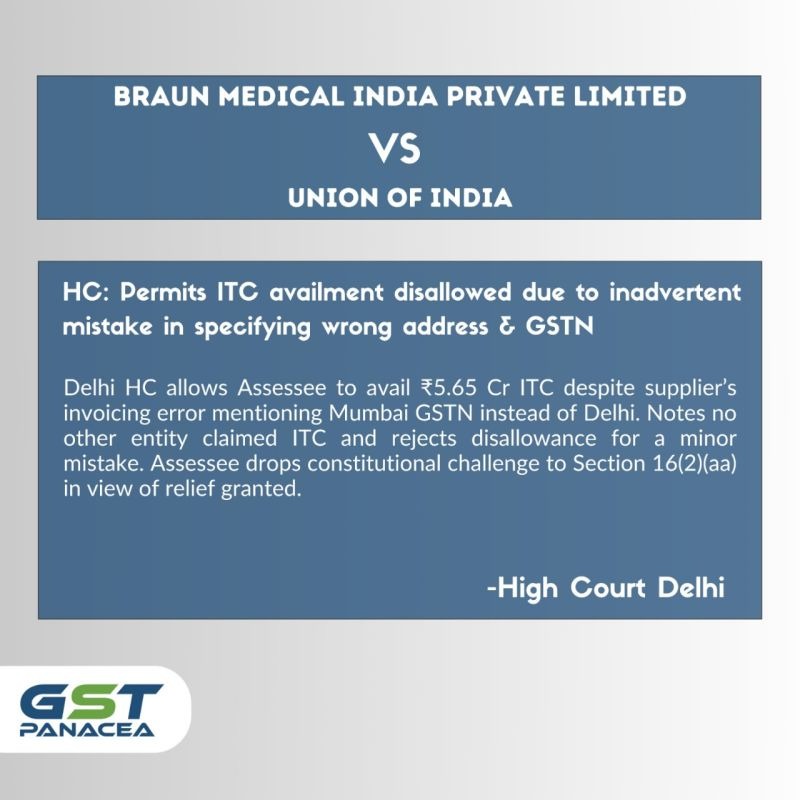

SCN Reversal Case Example

A clear example is B Braun Medical India Pvt. Ltd. v. Union of India (Delhi High Court, 2022). The company had claimed ITC on invoices with a minor clerical error, the wrong branch GSTIN was mentioned. The GSTR-3B return itself was filed on time and correctly.

Later, the tax authorities issued an SCN seeking reversal of ITC due to this discrepancy. The portal still showed the return as accepted, but the ITC was effectively denied until the issue was resolved through the court.

This shows that return acceptance does not automatically protect your ITC, and specific credits can be reversed if authorities identify inconsistencies, even small ones.

Why Businesses Get Surprised

- No portal alert: The original GSTR-3B continues to show “Filed Successfully.”

- SCNs are issued later: The system flags ITC for review and may demand reversal.

- Backend reconciliation: GST authorities compare your claimed ITC with supplier deposits, GSTR-2B, and other data.

Even fully compliant businesses can face reversals if ineligible ITC is identified due to minor errors or supplier defaults.

Even when your return shows as accepted, claiming ITC incorrectly or having small discrepancies can trigger reversals or SCNs. This naturally brings up the next question: what actually happens if ITC is wrongly claimed?

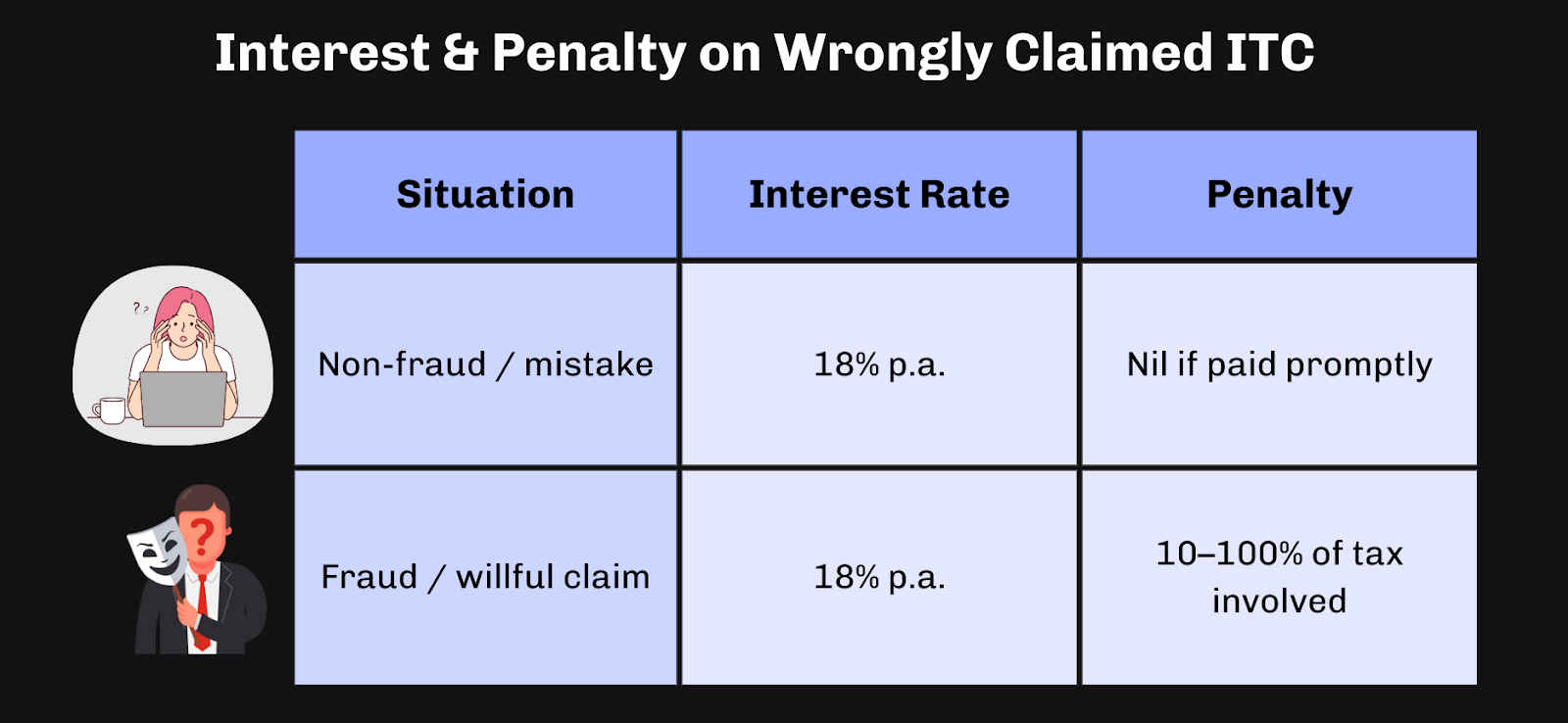

What Happens If ITC Is Wrongly Claimed?

Claiming Input Tax Credit incorrectly can happen even to careful businesses. The portal may not reject your GSTR-3B return, but errors in ITC can still trigger actions from GST authorities. Understanding what happens helps you manage risks and avoid surprises.

1. Show Cause Notice (SCN) May Be Issued

When discrepancies or ineligible ITC are detected, the tax authorities often issue a Show Cause Notice (SCN) asking the taxpayer to explain why the ITC should not be reversed.

- The SCN specifies the invoices or credits in question.

- It may also include interest on the amount claimed.

- The taxpayer is given an opportunity to provide evidence or clarification.

This is a standard procedural step, the return itself remains accepted, but the specific ITC claim can be contested.

2. Reversal of ITC

If the authorities are not satisfied with the explanation or if the ITC is genuinely ineligible:

- The claimed credit is reversed in the system.

- Interest may be charged from the date the ITC was claimed.

- Penalties can apply in cases of negligence or fraud.

Now that we understand what happens when ITC is wrongly claimed, it’s important to look at how businesses can proactively protect their ITC going forward, so you can claim what you’re entitled to without stress.

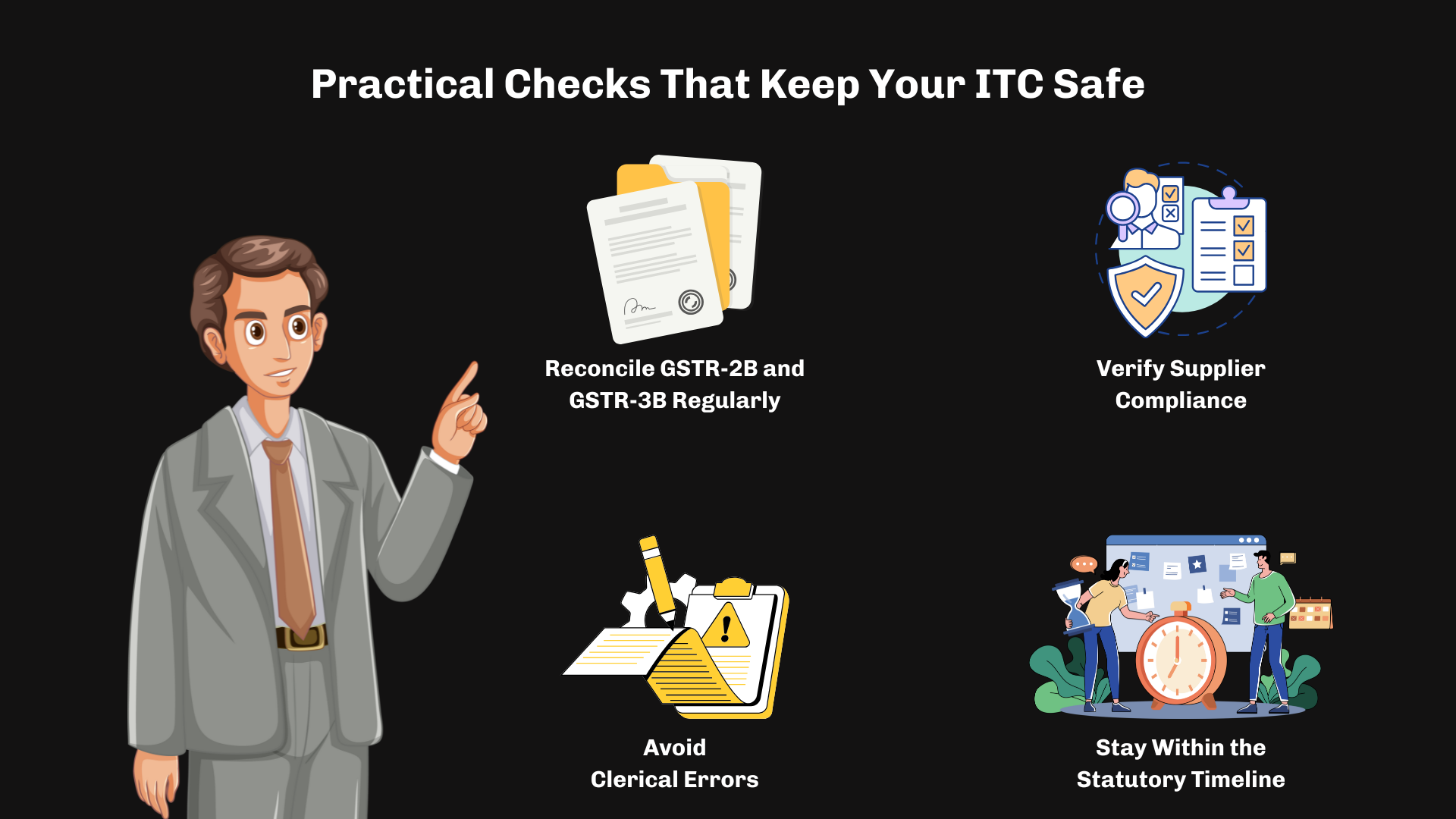

How Can You Protect Your ITC Going Forward?

After looking at why ITC can be denied and the common mistakes that cost businesses their credit, the next logical question is: how do you protect your ITC proactively? The good news is that most risks can be minimized with consistent checks and preventive practices.

1. Reconcile GSTR-2B and GSTR-3B Regularly

One of the simplest yet most effective ways to avoid ITC reversals is to reconcile your returns with auto-populated supplier data.

- Check that all invoices claimed in GSTR-3B appear in GSTR-2B

- Resolve mismatches immediately rather than waiting for an SCN

- Maintain a log of reconciled invoices for audits

For example, in Pacific Industries Ltd. v. Union of India (Rajasthan High Court), the company had some ITC that was initially not reflected on the portal due to missing auto-populated forms. By providing proper documentation and reconciliation records, the company successfully claimed the unutilized ITC.

This shows how proactive verification can prevent unnecessary reversals even when the portal data is incomplete.

2. Verify Supplier Compliance

ITC is only as safe as your supplier’s compliance. Steps to take:

- Ensure your suppliers file GSTR-1 on time

- Confirm that taxes collected have been remitted

- Keep payment records through banking channels for proof

Regular follow-ups with suppliers reduce the risk of losing ITC due to their defaults.

3. Avoid Clerical Errors

Simple errors like incorrect GSTIN, branch codes, or invoice numbers can cost ITC.

- Double-check invoice details before claiming credit

- Implement internal reviews if dealing with multiple vendors

- Maintain a standard process for entering invoices into your accounting system

Even minor mistakes can trigger notices, so prevention is better than cure.

4. Stay Within the Statutory Timeline

- Claim ITC within 1 year from the invoice date or by the due date of September GSTR-3B of the next FY, whichever is earlier

- Monitor deadlines to avoid automatic ineligibility

By reconciling your returns, verifying supplier compliance, avoiding clerical errors, and staying within timelines, businesses can safeguard their ITC and reduce the risk of reversals. Tools like Filing Buddy make these checks easier, helping you track invoices, reconcile GSTR-2B with GSTR-3B, and stay compliant without the stress.

Conclusion: Filing GST Returns Is Only Step One

Filing your GST return on time is just the beginning. Protecting your Input Tax Credit requires awareness, diligence, and a proactive approach. Here are the 3 key takeaways from this guide:

- Return Acceptance ≠ ITC Guarantee

Even if your GSTR-3B is filed successfully, ITC can still be denied due to supplier defaults, clerical errors, or mismatches in GSTR-2B. Always treat filing as the first step, not the final step.

- Small Mistakes Can Have Big Consequences

Minor errors: wrong GSTIN, invoice mismatches, or delayed claims can trigger SCNs, reversals, or interest. Regular reconciliation and attention to detail can save you from unnecessary stress and financial loss.

- Proactive Measures Protect Your Credit

Reconcile returns, verify supplier compliance, claim ITC within timelines, and maintain proper records. These practices help ensure you claim every rupee you’re entitled to, while minimizing risks.

Staying on top of your GST compliance doesn’t have to be overwhelming. With consistent checks, careful bookkeeping, and the right tools, you can safeguard your ITC and avoid surprises.

Stay compliant with Filing Buddy, your partner in simplifying GST, tracking ITC, and keeping your business stress-free.

FAQs

1. What is ITC in GST?

ITC is the credit you can claim for GST paid on business purchases to reduce your GST liability on sales.

2. Does filing GSTR-3B guarantee ITC?

No. Return acceptance only confirms submission; ITC is verified later against supplier compliance, GSTR-2B, and legal conditions.

3. Can GST deny ITC after the return is accepted?

Yes. ITC can be denied due to supplier default, invoice mismatches, clerical errors, or time-barred claims.

4. What is GSTR-2B?

GSTR-2B is a system-generated purchase statement showing eligible ITC based on supplier-uploaded invoices, used for reconciliation with GSTR-3B.

5. How does supplier non-compliance affect ITC?

If your supplier doesn’t file GSTR-1 or deposit GST, your claimed ITC can be denied even if your invoices are valid.

6. What happens if ITC is wrongly claimed?

Authorities may issue a Show Cause Notice (SCN), reverse the ITC, and charge interest or penalties depending on negligence or fraud.

7. What are common clerical errors affecting ITC?

Wrong GSTIN, incorrect branch code, invoice number mistakes, or mismatched invoice dates can trigger ITC denial.

8. Can ITC be claimed after one year?

No. ITC must be claimed within 1 year from invoice date or by the due date of September GSTR-3B of the next financial year.

9. What is a Show Cause Notice (SCN)?

An SCN is a formal notice asking the taxpayer to justify why claimed ITC should not be reversed or denied.

10. Are all business expenses eligible for ITC?

No. Blocked credits include personal expenses, motor vehicles (except exempt uses), and goods/services for non-business purposes.

11. How often should GSTR-3B and GSTR-2B be reconciled?

Monthly reconciliation is recommended to catch mismatches early and avoid ITC reversals.

12. Can ITC be denied even if invoices are paid through banking channels?

Yes. ITC may still be denied if the supplier hasn’t remitted GST or filed returns, despite proper payment.

13. Does the GST portal reject a return if ITC is ineligible?

No. The portal accepts the return; ITC eligibility is verified later through audits, reconciliations, or notices.

14. What sections of the CGST Act affect ITC denial?

Key sections include 16 (eligibility), 37 & 39 (reporting/reconciliation), 42 & 43 (restricted ITC), and 73 & 74 (demand & reversal).

15. How can businesses protect their ITC?

Reconcile GSTR-3B with GSTR-2B, verify supplier compliance, avoid clerical errors, and claim within statutory timelines.

Contact Us

An expert will call you within 24 hours. No payment required to get started.

Related Post

How should a start-up complete ITR filing

Business entities must file their ITR annually to comply with the tax laws of their respective countries. It helps the government assess and collect the appropriate amount of income tax from taxpayers and ensures proper accountability of financial activities.

. 3 Mins.png)

5 step checklist for GST compliance in Indian Startups

Learn about how GST works. The basics of GST along with its compliances. Uncover what your business needs to keep in mind concerning GST rules and GST compliance.

. 3 min read.png)

₹20 Lakhs and Beyond: Understanding GST for Freelancers in India

Are you a freelancer or aspiring to be one? In this blog, uncover the basics of freelancing and requirements involving GST. Learn about all the exemptions, obligations, and compliances of GST for freelancers in india.

. 5 min read