Clearing House

Definition

A clearing house is a financial intermediary that reduces risk by settling trades between buyers and sellers.

Description

A clearinghouse's functions include "clearing" or concluding trades, settling trading accounts, collecting margin payments, overseeing asset delivery to new owners, and reporting trading data.

Clearinghouses serve an essential function as mediators in futures and options contracts. They operate as buyers for every clearing member seller and sellers for every clearing member buyer, ensuring that transactions run smoothly.

The clearinghouse enters the scene once a buyer and seller complete a transaction. It must complete the processes required to conclude and validate the transaction. The clearinghouse acts as a middleman, providing the security and efficiency necessary for financial market stability.

A clearinghouse takes the opposing position of each trade to act efficiently, considerably lowering the cost and risk of settling many transactions between different parties. While their goal is to reduce risk, the fact that they must serve as both buyer and seller at the start of a transaction exposes them to default risk from both parties. To address this, clearinghouses implement margin requirements.

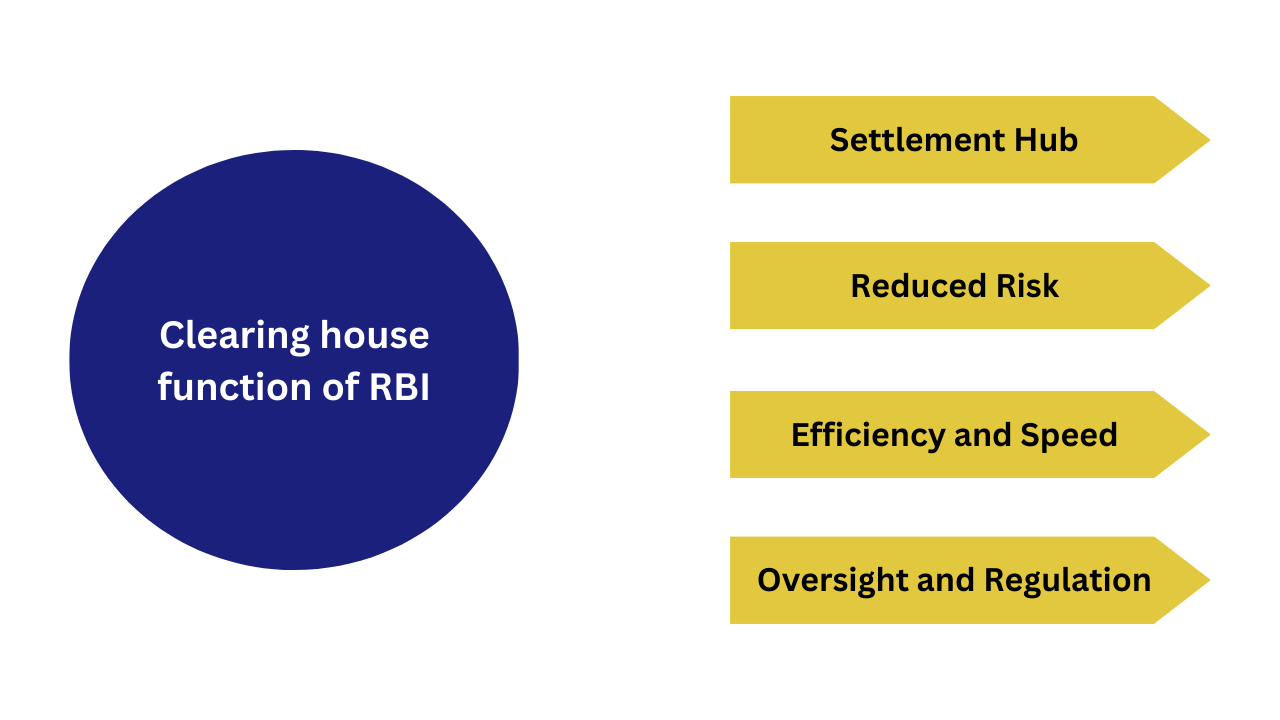

Clearing house function of RBI

Here are four pointers on the Clearing House function of the RBI:

- Settlement Hub: The RBI serves as a central hub for settling interbank transactions. Banks exchange cheques, bills, and other instruments, and the RBI allows net transfers of money between accounts.

- Reduced Risk: By settling through the RBI, banks eliminate the risks associated with exchanging actual cash or relying on individual bank balances. This reduces the chances of settlement failures.

- Efficiency and Speed: The clearing house structure encourages faster and more efficient transaction settlement, allowing money to move smoothly throughout the economy.

- Oversight and Regulation: The RBI establishes rules and regulations for the clearing process to ensure a consistent and secure system for all participating banks.

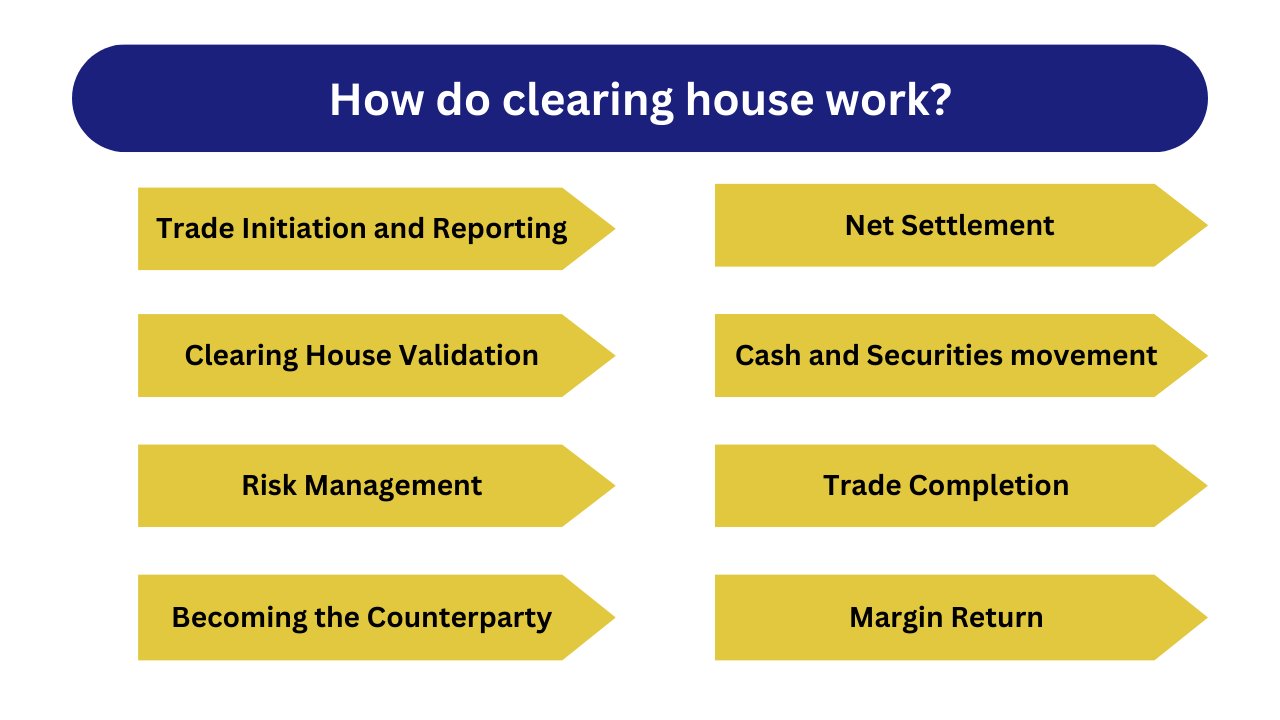

How do clearing house work?

Clearing house works for smooth functioning of financial institutions

1. Trade Initiation:

Imagine a trade between companies (Company A and Company B) on an exchange platform (similar to a stock market). This could involve purchasing or selling stocks, derivatives, or other financial products.

2. Trade Reporting:

The exchange platform does not directly handle settlement (exchanging money and securities). Instead, it sends trade information (who bought what from whom and at what price) to the clearing house.

3. Clearing House Validation:

The clearinghouse validates trade details and ensures both parties (Company A and Company B) have adequate funds or securities to complete the transaction.

4. Risk Management (Margin Requirement):

To prevent defaults, the clearing house may require both parties to deposit a specified amount of money (known as margin) with it. This is a security deposit if one party fails to fulfil its duty.

5. Becoming the Counterparty:

This is the essential phase. The clearing house becomes the counterparty to Company A and Company B. The clearing house acts as the seller, ensuring that Company A (the buyer) receives the securities acquired.

For Company B (seller), the clearing house acts as the buyer, ensuring they will be paid for the securities they sell.

6. Net Settlement: The clearinghouse only physically swaps securities and cash for specific trades. Instead, it completes a net settlement. It computes the net liability of each clearing member (businesses' brokers/banks) involved in the trades on that day.

7. Cash and Securities movement: The clearinghouse facilitates the movement of cash and securities among clearing members based on net settlement commitments. This promotes efficient asset movement by eliminating the requirement for individual transactions for each trade.

8. Trade Completion: After net settlement, the clearing house handles final delivery of securities from seller to buyer and payment from buyer to seller.d. It performs a net settlement. It computes the net liability of each clearing member (businesses' brokers/banks) involved in the trades on that day.

9. Margin Return:

After the trade is settled and the risk of default is gone, the clearing house typically returns the margin deposit to the respective companies.

Trends that can impact the clearing house

Here are 4 emerging trends that can potentially affect clearing houses:

- Rise of Blockchain Technology: Blockchain technology provides a safe and transparent method for recording and tracking transactions. This could result in alternative settlement platforms that circumvent traditional clearing houses. While blockchain is still in its early phases, it could disrupt the clearinghouse model, particularly for certain asset classes. Blockchain technology has the potential to transform clearing houses by providing a faster, more transparent, and disruptive alternative to trade settlement.

- Growth of Fintech and Alternative Investments: The fast expansion of FinTech companies and alternative investments poses both a difficulty and an opportunity for clearing houses. By adjusting their operations, companies can efficiently accept these developments while continuing to play an essential part in the financial system.

- Cybersecurity Threats: The fast expansion of FinTech companies and alternative investments poses both a difficulty and an opportunity for clearing houses. By adjusting their operations, companies can efficiently accept these developments while continuing to play an essential part in the financial system.

- Regulatory Changes: In reaction to these changing trends, regulatory authorities may implement new rules and regulations. These laws could impact how clearinghouses operate, requiring them to adjust risk management techniques or reporting criteria.

Example

In India, a clearing house is the National Securities Clearing Corporation Limited (NSCCL), which is a subsidiary of the National Stock Exchange of India. NSCCL offers clearing, settlement, risk management, and other post-trade services for transactions on the NSE. It ensures the effective transfer of securities and funds between trading participants, minimising counterparty risk while encouraging the smooth operation of the Indian stock market.

FAQ

What is a clearing house in banking?

A clearing house in banking is a financial institution or business that helps banks and other financial institutions transparently settle financial transactions. It serves as a central centre for transaction processing, verification, and settlement, ensuring the efficient transfer of payments between various banks and their consumers. This simplifies the payment process, lowers transaction costs, and reduces the risks connected with financial transfers.

How does a clearing house mitigate counterparty risk?

A clearing house mitigates counterparty risk by acting as a central counterparty to all trades. It interposes itself between buyers and sellers, becoming the buyer to every seller and the seller to every buyer. This arrangement ensures that even if one party defaults on its obligations, the clearing house can fulfil them, reducing the risk of financial losses for other participants.

Why choose Us?

Filing Buddy is an entity which is focused at providing legal, financial, and corporate and compliances consultancy services to business entities. Our organisation is a structure made of enthusiastics.

EXPERTISE & RELIABILITY

Trusted industry professionals ensuring compliance, accurate tax filing, and comprehensive services for your business needs.

TAILORED SOLUTIONS

Customized services to meet your specific requirements, including business incorporation, trademarks, patents, and seamless GST return filing.

TIMELY SUPPORT

Dedicated support team committed to providing prompt assistance, resolving queries, and ensuring smooth operations for your business.

COMPETITIVE ADVANTAGE

Gain a competitive edge with our comprehensive suite of services, enabling you to focus on growth while we handle your compliance and taxation needs.

.webp)

.webp)

.webp)