Collateral: Definition, Types, and Importance in Secured Loans

Definition

In finance, collateral is a valued asset pledged by a borrower as security for a loan.

Description

Collateral for startups refers to assets or property that a company promises as security to secure financing or loans from lenders or investors. These assets ensure that the lender will regain their investment if the startup defaults on the loan or fails to meet its financial obligations.

Common types of collateral for startups provide a variety of possibilities, allowing entrepreneurs to choose what is best for their business:

- Intellectual Property (IP): Startups have distinct intellectual property, such as patents, trademarks, copyrights, or trade secrets, that can be collateralized. These valuable intellectual property assets can serve as solid collateral, increasing the startup's confidence in obtaining finance.

- Equipment and Machinery: Startups with equipment or machinery related to their business activities can utilise it as collateral. This could include office furniture, manufacturing equipment, or specialised tools needed for production.

- Inventory: Startups with inventory or stock might use it as collateral to obtain finance. Goods-based financing enables entrepreneurs to raise funds based on the value of their goods, which serves as collateral for the loan.

- Accounts Receivable: Startups can utilise accounts receivable, or money owed to customers, as collateral for financing. This is referred to as invoice financing or accounts receivable finance, in which the lender advances funds based on the amount of outstanding bills.

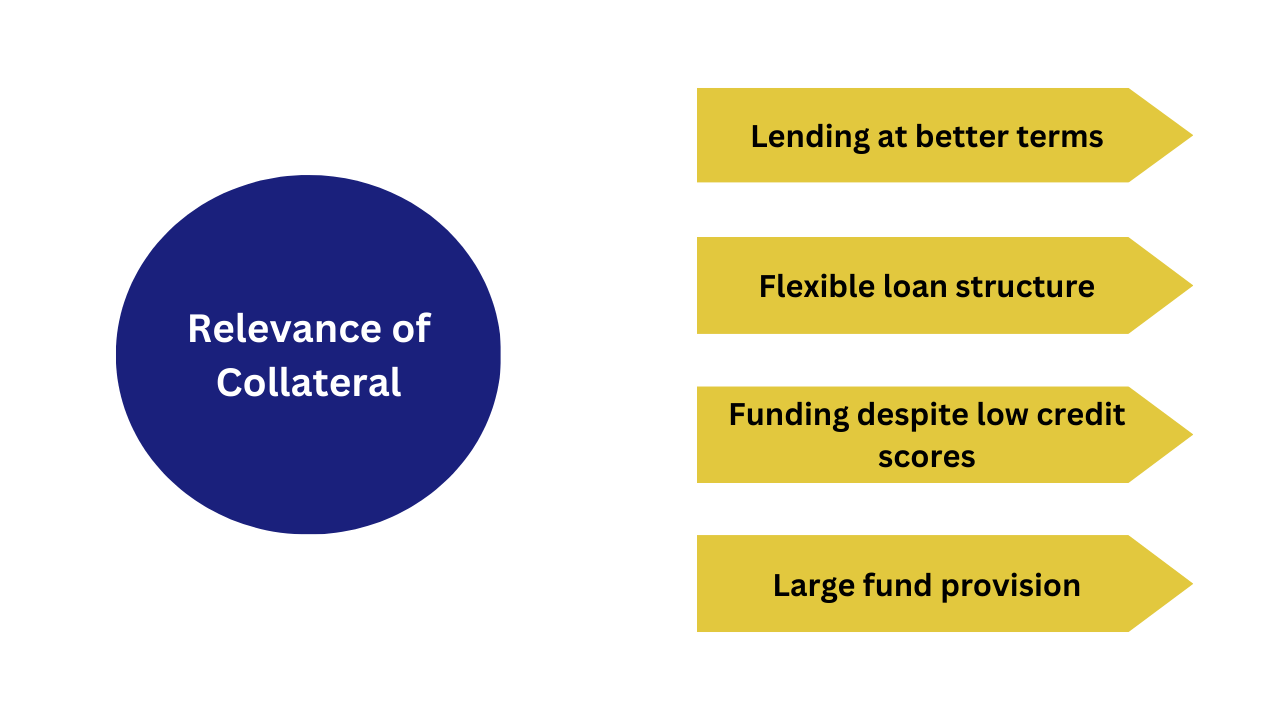

Relevance of Collateral for startup and small businesses

- Lending at better terms:

When a borrower provides collateral, the financial institution is more likely to consider them a low-risk borrower. If the borrower fails to repay the loan, the lender can recover the sum by selling the collateral.

As a result, lenders are more inclined to provide better loan terms, such as reduced interest rates, to borrowers with collateral. For example, secured starting business loans often have lower interest rates, which can dramatically reduce a borrower's overall interest payments, allowing them to retain financial discipline in the long run.

- Flexible loan structure

For first-time entrepreneurs, repaying a start-up loan in a short amount of time can be difficult. However, possessing collateral may provide them an advantage in this area. Traditional lenders are more willing to extend repayment terms to applicants who promise valuable assets as security.

In some situations, the repayment period might last up to 30 years, allowing firms to pay off their obligations without experiencing financial hardship. A longer repayment time also implies that the Equated Monthly Instalment (EMI) amount is lower, which might be advantageous for new businesses.

- Funding despite low credit scores

Lenders can provide credit funding to borrowers with weaker credit scores since the promised collateral acts as a solid backup if the borrower fails to repay.

- Large fund provision

Lenders are more likely to grant larger lending amounts if the borrower provides a highly liquid asset with a significant market value as security. This protects the lender from financial losses if the borrower defaults on the loan. As a result, a lending institution can provide a big amount of funding without assuming any substantial financial risks.

How does collateral work?

Here are seven steps that demonstrate how collateral works:

- Asset Identification: The borrower (person or corporation) identifies valuable assets that they own, such as real estate, equipment, vehicles, or investments, and can utilize them as collateral.

- Agreement with Lender: In order to get a loan or credit facility, the borrower enters into a contract with a lender, usually a bank or financial institution. As part of the agreement, the borrower agrees to pledge particular assets as collateral for the loan.

- The lender assesses the requested collateral to determine its worth and acceptability as loan security. This may include appraisals, inspections, or checks of ownership documents.

- Loan Collateralization: Once the lender has approved the collateral, the borrower commits the assets as security for the loan. This is usually accomplished by signing a security agreement or other legal instrument that details the terms and conditions of the collateral arrangement.

- Disbursement of cash: After securing the collateral, the lender transfers the loan cash to the borrower. The loan amount can be determined by the value of the collateral, with the lender offering a percentage of the assessed value.

- Risk Mitigation: The lender holds the collateral as security for the loan, lowering the risk of financial loss in the case of the borrower's default. If the borrower fails to repay the loan on the agreed-upon terms, the lender may seize and sell the collateral to recoup the outstanding amount.

- Release or Seizure of Collateral: If the borrower repays the loan as promised, the collateral is returned to them. If the borrower defaults on the loan, the lender may take and sell the collateral to repay the obligation. Any residual selling revenues, after deducting the outstanding loan principal and associated fees, are repaid to the borrower.

Emerging trends for collateral

- Digital Collateral: As digital assets such as cryptocurrencies, non-fungible tokens (NFTs), and digital securities become more prevalent, there is a growing trend of using them as loan collateral. Platforms are emerging to permit lending against digital assets, giving borrowers access to liquidity without selling their holdings.

- Tokenization of assets: Tokenization of traditional assets like real estate, art, and intellectual property creates new opportunities. This approach allows for fractional ownership and quicker transferability, making these tokenized assets suitable as loan collateral. This increases liquidity for asset owners and broadens the pool of potential collateral for lenders, resulting in a more dynamic and liquid market.

- Data-Driven Collateral: Alternative data sources, such as transactional data, social media activity, and digital footprint, are gaining popularity as a means of assessing creditworthiness and calculating collateral value. Machine learning algorithms use this data to produce more accurate risk assessments, guaranteeing a fair and inclusive credit assessment process that increases loan availability for underprivileged borrowers.

- Smart Contracts and Blockchain: Blockchain technologies and smart contracts are transforming collateral management by automating collateral agreement verification, transfer, and enforcement. Blockchain-based technologies allow for transparent and immutable records of collateral ownership and transactions, lowering the risk of fraud and expediting the collateralization process.

Example

Imagine a well-known Indian jewellery firm allows customers to purchase gold items through their gold lending scheme. Customers can pledge their gold jewellery as collateral for a loan up to the appraised value. Customers can use this collateralized loan to get money quickly and easily while keeping their prized jewellery.

The pledged jewellery is returned to the customer if the loan is repaid within the timeframe agreed upon. Customers who want financial flexibility without having to sell their valued assets might benefit from XYZ Jewellers' gold loan arrangement.

FAQ

What is collateral in the context of lending?

Collateral in lending is defined as assets or property a borrower commits to a lender as security for a loan. If the borrower fails to repay the loan as agreed, the lender may seize and sell the collateral to recoup the outstanding amount.

What is collateral for a loan?

A borrower commits an item or property to a lender as collateral to secure the loan. Real estate, automobiles, equipment, inventories, and investment assets are all common types of collateral. Collateral lowers the lender's risk of financial loss by providing a means of repayment if the borrower defaults.

What is tangible collateral?

Tangible collateral are physical assets or properties that can be handled, seen, and measured. Tangible collateral includes real estate, automobiles, machinery, inventory, and equipment. Tangible collateral is easily identified and valued, making it a popular type of security for loans and financial arrangements.

Why choose Us?

Filing Buddy is an entity which is focused at providing legal, financial, and corporate and compliances consultancy services to business entities. Our organisation is a structure made of enthusiastics.

EXPERTISE & RELIABILITY

Trusted industry professionals ensuring compliance, accurate tax filing, and comprehensive services for your business needs.

TAILORED SOLUTIONS

Customized services to meet your specific requirements, including business incorporation, trademarks, patents, and seamless GST return filing.

TIMELY SUPPORT

Dedicated support team committed to providing prompt assistance, resolving queries, and ensuring smooth operations for your business.

COMPETITIVE ADVANTAGE

Gain a competitive edge with our comprehensive suite of services, enabling you to focus on growth while we handle your compliance and taxation needs.

.webp)

.webp)

.webp)