Depreciation: Definition, Methods, and Impact on Business Accounting

Definition

Depreciation is the progressive loss in the value of an item over time caused by factors such as wear and tear, obsolescence, or age.

Description

It is a strategy used in accounting to distribute the cost of an asset across its useful life, appropriately reflecting its declining value in financial statements.

Depreciation is the gradual decline in the recorded cost of a fixed asset. The main reasons for depreciation include wear and tear, obsolescence, and natural decay. The Straight-Line Method is a typical formula for calculating depreciation, in which the cost of the asset minus its salvage value is divided by its usable life:

Depreciation Expense = [Cost of Asset - Salvage Value]/Useful Life

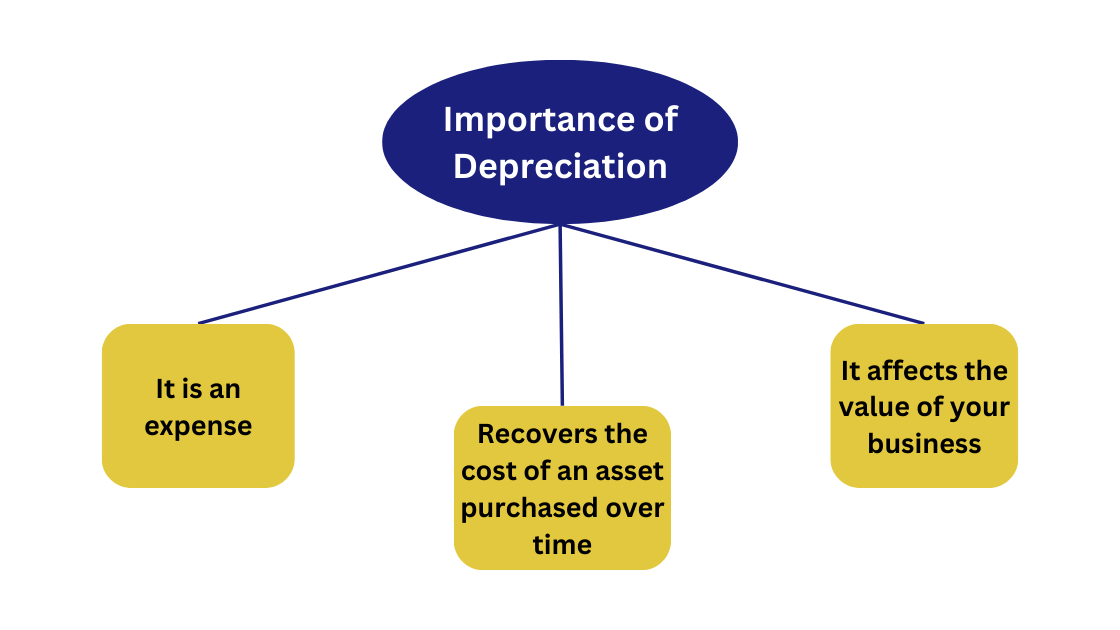

Importance of Depreciation for a business

Let us understand the importance of knowing the depreciation for a business:

1. It is an expense

Depreciation accounting describes how much value your business assets lose each year. This amount must be recorded in your P&L report as a loss and deducted from your revenue. This lets you see how much money you're producing and ensures you're considering your costs.

2. Recovers the cost of an asset purchased over time

Depreciation is a business expenditure, so corporations can cover the complete cost of an asset during its lifetime rather than collecting the purchase cost right away, which would result in a high price and reduced earnings. This could influence your credit rating, investment options, and dividends.

Businesses can deduct the cost of assets from their company tax using the capital allowance, available when an investment is purchased (and annually if necessary). If you list the depreciation of your business assets, you can avoid paying too much tax. And we do not want that.

3. It affects the value of your business.

Your assets, and therefore your firm, might lose value over time. Inaccurate asset tracking may lead to overestimating your company's value, making it more difficult to obtain financing.

How to calculate the depreciation?

One of the most basic and widely used methods for calculating depreciation is the Straight-Line Method, which has a few simple stages. Here's how you can accomplish it:

Step 1: Determine the Cost of the Asset

Determine the entire starting cost of the asset. This covers the purchase price and any additional expenses required to prepare the asset for usage, such as installation, transportation, and setup fees.

Step 2: Estimate the Salvage Value

Estimate the asset's salvage value or expected worth at the end of its useful life. This can sometimes be zero, but it can also be favorable if you sell the item for a residual value.

Step 3: Determine the Useful Life of the Asset

Determine the asset's useful life and the period estimated to be usable for its intended purpose. This is often expressed in years and can be based on industry standards, manufacturer guidelines, or prior experience.

Step 4: Calculate the Depreciable Cost

To calculate the depreciable cost, subtract the salvage value from the total starting cost. This sum will depreciate over the asset's useful life.

Step 5: Apply the Straight-Line Depreciation Formula

Divide the depreciable cost by the asset's useful life to calculate the annual depreciation expenditure. This expense will be consistent yearly over the asset's useful life.

Annual Depreciation Expense=(Cost of Asset−Salvage Value)/Useful Life

Emerging trends for calculating depreciation

There are some emerging trends that are changing how businesses approach depreciation calculations:

1. Big Data and Analytics

Businesses are increasingly using big data and analytics to predict equipment degradation and optimise depreciation schedules. This data-driven strategy can account for real-time consumption trends, resulting in more accurate depreciation computations.

2. Activity-Based Depreciation

This realistic technique of depreciation allocation is based on an asset's level of activity rather than simply the passage of time. It is especially valuable for assets that deteriorate quicker with increased use, providing a more realistic and accurate representation of an asset's value over time.

3. Fair Value Accounting

This strategy focuses on an asset's current market worth rather than its previous cost. This might be especially important for assets whose values fluctuate over time.

Example

Here's a simple example of depreciation for a computer over a period of three years:

| Year | Beginning Value | Depreciation Expense | Ending Value |

| 1 | $1,000 | $333.33 | $666.67 |

| 2 | $666.67 | $333.33 | $333.34 |

| 3 | $333.34 | $333.33 | $0.01

|

FAQ

What is the depreciation rate?

The depreciation rate is the percentage by which an asset's value falls over time. It is calculated using parameters such as the asset's usable life and projected salvage value at the end of its life. A higher depreciation rate suggests greater value loss, whereas a lower rate indicates slower depreciation.

What are the leading causes of depreciation?

Depreciation can occur owing to a variety of reasons. Common causes include wear and tear, technological obsolescence, physical damage, and the passage of time. Changes in market conditions, such as demand shifts or technical advancements, can all lead to depreciation.

What is the provision for depreciation?

The provision for depreciation is the amount set aside by a corporation each period to account for the progressive decline in the value of its fixed assets. This provision is recognized as an expense on the income statement and lowers the asset's carrying value on the balance sheet. By investing funds for depreciation, a corporation assures that its assets' genuine worth decreases over time.

What is zero depreciation?

Zero depreciation is an accounting approach in which an asset is not depreciated during its useful life. This strategy can be applied to some types of corporate assets that are either not projected to lose value due to usage or time, or have such a low value that depreciation is inconsequential.

Why choose Us?

Filing Buddy is an entity which is focused at providing legal, financial, and corporate and compliances consultancy services to business entities. Our organisation is a structure made of enthusiastics.

EXPERTISE & RELIABILITY

Trusted industry professionals ensuring compliance, accurate tax filing, and comprehensive services for your business needs.

TAILORED SOLUTIONS

Customized services to meet your specific requirements, including business incorporation, trademarks, patents, and seamless GST return filing.

TIMELY SUPPORT

Dedicated support team committed to providing prompt assistance, resolving queries, and ensuring smooth operations for your business.

COMPETITIVE ADVANTAGE

Gain a competitive edge with our comprehensive suite of services, enabling you to focus on growth while we handle your compliance and taxation needs.

.webp)

.webp)

.webp)