Fiscal Deficit, Cess & Surcharge Explained

Why Fiscal Deficit, Cess & Surcharge Matter to You

Every Budget season, terms like fiscal deficit, cess, and surcharge show up everywhere. They may sound like technical budget terminology, but their impact is very real.

These charges directly affect how much tax you pay, how expensive goods and services become, and how much it costs to run a business. A higher fiscal deficit in India can lead to future tax pressure, while surcharge and cess quietly increase your final income tax bill.

In short, these aren’t abstract economic concepts, they influence your cash flow and profits.

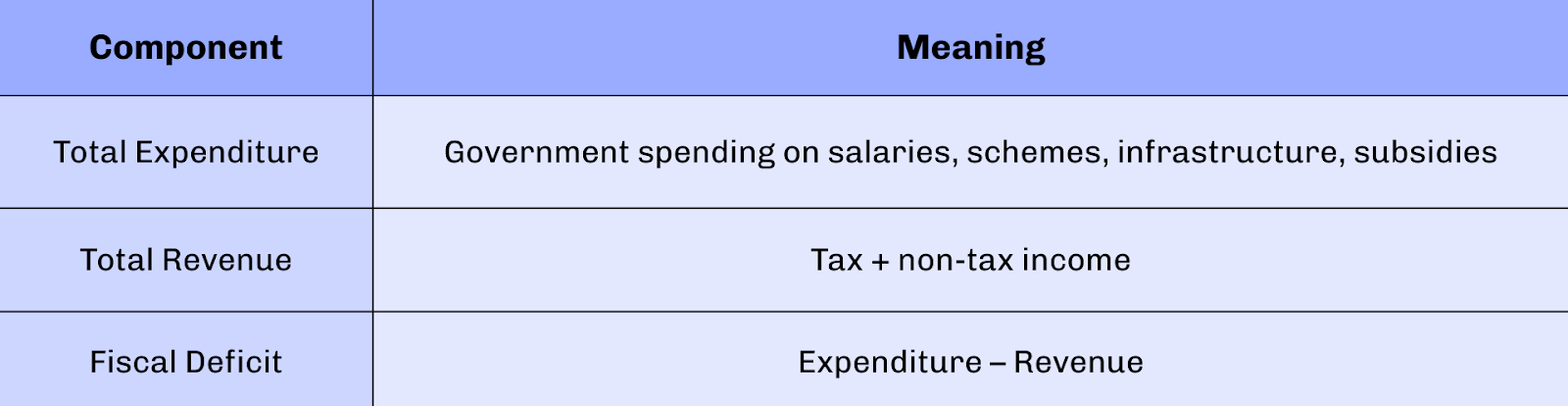

Here’s the fiscal deficit meaning explained.

What is Fiscal Deficit in India?

The fiscal deficit in India is the difference between the government’s total spending and its total revenue in a financial year.

When expenditure exceeds income, the government borrows the remaining amount. This borrowed gap is called the fiscal deficit.

Formula & Calculation

Formula:

Fiscal Deficit = Total Expenditure – Total Revenue

Example: If government spending is ₹100 and revenue is ₹80 → fiscal deficit = ₹20.

Why It Happens

A fiscal deficit may increase due to:

- Higher public spending

- Lower tax collections

- Economic slowdown

- Emergency or welfare expenditures

How It Affects Businesses and Individuals

A higher fiscal deficit can lead to:

- Increased taxes in future budgets

- Inflation and rising prices

- Higher borrowing costs

- Reduced disposable income.

Impact: It indirectly raises the overall cost of living and doing business. If you’re running a startup, following a GST compliance checklist for startups can help avoid surprises.

Note: Freelancers should also check GST compliance for freelancers to plan their taxes accurately.

What is Cess in Tax?

A cess in tax is an additional charge levied over and above the base tax, collected for a specific purpose or welfare objective.

Unlike regular taxes that go into the general government fund, cess is imposed to finance targeted initiatives such as education, healthcare, or infrastructure.

In simple terms, cess is extra tax for a defined cause, not a separate tax category.

Key Features of Cess

- Charged in addition to income tax or GST

- Collected for a specific objective (e.g., health or education)

- Not shared with states

- Calculated as a percentage of the total tax payable

- Applies to all eligible taxpayers, irrespective of income slab

Common example:

This cess in income tax is currently charged as 4% Health & Education Cess on your total tax liability.

How Cess is Calculated

Cess is calculated after your total tax liability is determined.

Example calculation:

- Income tax payable = ₹50,000

- Health & Education Cess @ 4% = ₹2,000

- Final tax payable = ₹52,000

Formula:

Final Tax = Tax + (Tax × Cess %)

This is why even a small cess percentage slightly increases your overall tax outflow.

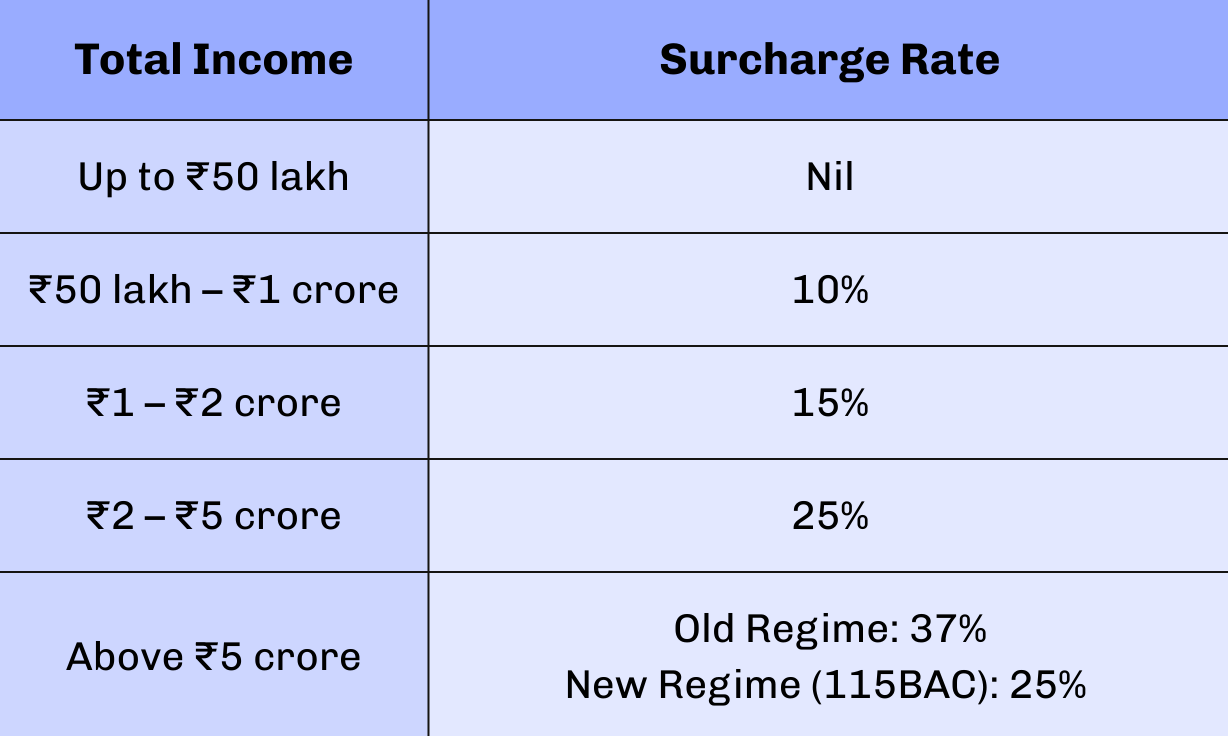

What is the Surcharge on Income Tax?

The surcharge on income tax is an additional tax charged on taxpayers with higher income levels.

It is applied over and above the calculated income tax, increasing the total tax liability for high earners.

Unlike cess, which applies to all taxpayers, surcharge is income-based and only applies once your income crosses specified thresholds.

Income Slabs for Surcharge (Individuals)

Who Needs to Pay

Surcharge typically applies to:

- High Net-Worth Individuals (HNIs)

- High-income professionals and consultants

- Profitable businesses and firms

- Startup founders after exits or large payouts

- Corporates crossing prescribed income limits

Impact: Even a small surcharge percentage can significantly increase the overall tax payable at higher income levels.

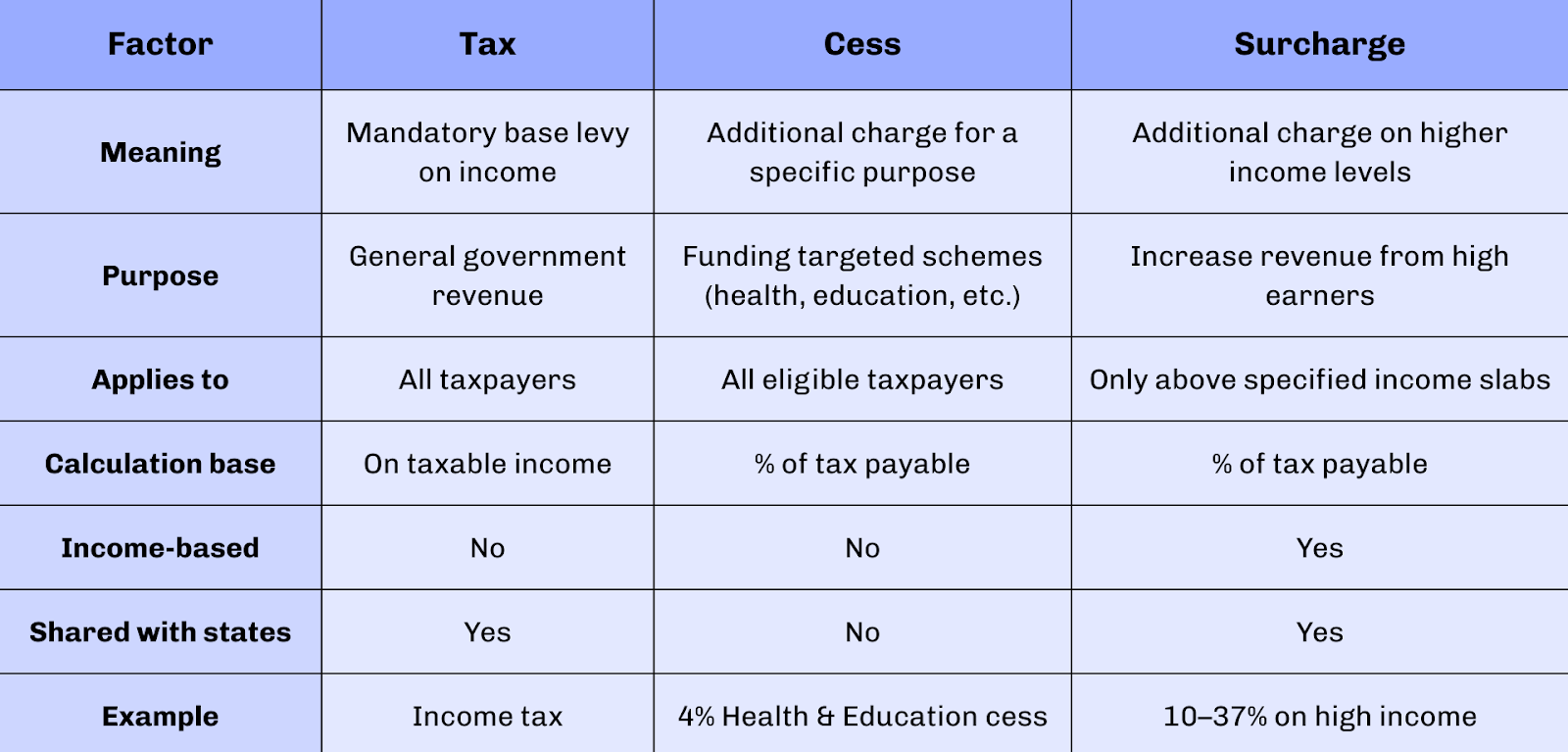

Difference Between Cess and Surcharge

Both surcharge and cess increase your final tax, but they serve different purposes and are applied differently.

Understanding the difference between cess and surcharge helps you estimate liability accurately.

In simple terms:

- Cess: extra charge for a specific purpose, applies to all taxpayers

- Surcharge: extra charge for higher income, applies only above certain thresholds

Comparison Table: Tax vs Cess vs Surcharge

Summary:

Tax forms the base, surcharge is added for higher income, and cess is added at the end for specific funding needs.

How These Charges Are Added to Your Tax Bill

Your final tax payable is not just the base income tax. Surcharge and cess are added in a specific sequence, which increases the total amount step by step.

Understanding this order helps you estimate liability correctly and avoid underpayment.

Step-by-Step Flow

Step 1: Calculate taxable income

Determine your total income after deductions and exemptions.

Step 2: Apply income tax slab rates

Compute the base income tax as per the applicable slab.

Step 3: Add surcharge (if applicable)

If your income crosses the prescribed limit, add surcharge as a percentage of the tax.

Step 4: Add cess

Apply cess (currently 4% Health & Education cess) on the total of tax + surcharge.

Quick Formula

Final Tax Payable = Income Tax + Surcharge + Cess

Example

- Income tax = ₹2,00,000

- Surcharge @ 10% = ₹20,000

- Subtotal = ₹2,20,000

- Cess @ 4% = ₹8,800

- Final tax payable = ₹2,28,800

This sequence explains why your final amount is always slightly higher than the base tax calculated initially.

Common Mistakes & Risks Taxpayers Should Avoid

Small calculation gaps can result in interest, penalties, or notices. Awareness prevents last-minute surprises.

Estimation Mistakes

Errors while calculating total tax liability:

- Ignoring cess in tax while estimating final payable

- Forgetting to check surcharge slabs after income increases

- Calculating tax only on slab rates, not adding extra charges

- Confusing surcharge and cess with penalties

Impact: Underestimation of tax outflow and cash flow issues.

Underpayment Interest & Notices

If the correct tax is not paid on time:

- Interest may be charged on shortfall

- Late payment penalties may apply

- Notices for mismatch in tax liability

- Additional compliance and follow-ups

Even small gaps due to missed surcharge and cess can trigger these costs.

Planning Errors with Advance Tax

Common advance tax issues include:

- Paying advance tax based only on base income tax

- Not revising estimates after bonuses, profits, or capital gains

- Ignoring higher liability due to surcharge

Result: Large year-end payments with interest.

Tip: Always calculate advance tax on the final tax amount (tax + surcharge + cess), not just the base tax.

H2: Smart Tips to Reduce Extra Tax Burden

Proper tax planning ensures you avoid overpayment, underpayment, and stress.

Practical Planning Tips for Salaried & Businesses

- Estimate your final tax liability, not just slab-based tax

- Always include surcharge and cess while calculating payable tax

- Review income slabs before bonuses, incentives, or large withdrawals

- Pay advance tax quarterly to avoid interest

- Track profits regularly if you run a business or freelance

- Use reliable tax calculators to understand how surcharge is calculated

Small planning adjustments can prevent sudden cash flow pressure at year-end.

When to Seek Professional Help

Consider expert support if:

- Your income crosses surcharge thresholds

- You have multiple income sources (salary, business, capital gains)

- Tax calculations feel complex or time-consuming

- You want accurate compliance without penalties

Filing Buddy helps you plan, calculate, and file correctly, so you can focus on growing your business while we handle the compliance.

Budget Terminology Made Simple

Understanding fiscal deficit, cess, and surcharge doesn’t have to be complicated. These terms affect your tax liability, business costs, and cash flow, but with clear planning, you can manage them effectively.

3 Quick Takeaways

- Fiscal Deficit: Indicates government borrowing; impacts future taxes and prices

- Cess: Extra tax for a specific purpose, applied on total tax payable

- Surcharge: Additional tax for high-income earners, calculated over income tax

Focus on your business. Compliance? Filing Buddy handles it for you, from calculation to filing, making sure you stay on top of taxes without stress.

FAQs: Fiscal Deficit, Cess & Surcharge

- What is the fiscal deficit in India?

Fiscal deficit is the gap between the government’s total expenditure and total revenue in a year. It indicates how much the government needs to borrow.

- How does fiscal deficit affect taxpayers?

Higher fiscal deficit can lead to increased taxes, inflation, and borrowing costs, indirectly affecting individuals and businesses.

- What is cess in tax?

Cess is an extra tax levied for a specific purpose, such as education or health, charged on top of the base tax.

- What is the surcharge on income tax?

Surcharge is an additional tax applied to high-income taxpayers, calculated as a percentage of income tax, increasing total liability.

- Who needs to pay a surcharge?

High earners, profitable businesses, HNIs, and startup founders with large payouts typically pay surcharge.

- How is cess calculated?

Cess is calculated as a percentage of the total tax payable, not on income. For example, Health & Education Cess is 4% of tax.

- How is the surcharge calculated?

Surcharge = Income Tax × Surcharge Rate (based on income slab). It is applied before adding cess.

- What is the difference between cess and surcharge?

Cess is for a specific purpose and applies to all taxpayers. Surcharge applies only to high-income taxpayers and increases total tax.

- Does cess go to the state government?

No. Cess is collected for central government schemes and is not shared with states.

- Are cess and surcharge mandatory?

Yes. Both are legally imposed and must be included in your final tax liability.

- How do these charges affect small businesses?

They increase tax outflow and affect cash flow, pricing, and financial planning for businesses.

- Do you pay a surcharge on cess?

No. Surcharge is applied on income tax first; cess is calculated on tax + surcharge.

- Can fiscal deficit impact prices?

Yes. Higher fiscal deficit can lead to inflation, affecting the cost of goods, services, and loans.

- How often do cess and surcharge rates change?

Rates are set in the annual Budget and can change each financial year.

- How can I avoid errors with cess and surcharge?

Plan your taxes including these charges, use calculators, pay advance tax quarterly, and consult professionals if needed.

Why choose Us?

Filing Buddy is an entity which is focused at providing legal, financial, and corporate and compliances consultancy services to business entities. Our organisation is a structure made of enthusiastics.

EXPERTISE & RELIABILITY

Trusted industry professionals ensuring compliance, accurate tax filing, and comprehensive services for your business needs.

TAILORED SOLUTIONS

Customized services to meet your specific requirements, including business incorporation, trademarks, patents, and seamless GST return filing.

TIMELY SUPPORT

Dedicated support team committed to providing prompt assistance, resolving queries, and ensuring smooth operations for your business.

COMPETITIVE ADVANTAGE

Gain a competitive edge with our comprehensive suite of services, enabling you to focus on growth while we handle your compliance and taxation needs.

.webp)

.webp)

.webp)