What is RCM in GST?

Reverse Charge Mechanism (RCM) is a GST provision where the buyer, not the supplier, pays the tax for specific goods and services.

In a typical GST transaction, the supplier collects GST and deposits it with the government. Under RCM, the recipient calculates and pays GST directly.

Key Points:

- Supplier does not charge GST on the invoice

- Recipient calculates and pays GST to the government

- Payment is made in cash first, then Input Tax Credit (ITC) can be claimed

- Mainly applies to notified services, unregistered suppliers, and imported services

Why RCM was introduced:

- Prevent tax evasion

- Bring unorganized sectors under GST

- Ensure tax collection when suppliers don’t charge GST

RCM shifts responsibility to the buyer, making compliance more reliable.

How Does Reverse Charge Mechanism Under GST Work?

The RCM process is straightforward but must be followed carefully:

Step-by-step RCM process

- Supplier issues an invoice without GST: The supplier does not charge tax.

- Recipient calculates applicable GST: The buyer applies the correct rate.

- Payment in cash: Tax must be paid through the GST portal using cash (not ITC).

- Report in GST returns: Record the liability in GSTR-3B under the RCM section. All RCM payments must be correctly reported in your GST returns to claim ITC and avoid notices

- Claim ITC: After paying GST in cash, the recipient can claim ITC if eligible.

Important Points to Remember

- GST under RCM is always paid by the recipient

- Proper invoices and records are essential

- Incorrect reporting can result in penalties

- RCM primarily affects cash flow, not the final tax cost if ITC is claimed correctly

RCM Applicability: When Does Reverse Charge Apply?

RCM does not apply to all transactions. It applies only in specific cases defined by GST law, mainly:

- Notified goods and services

- Certain unregistered suppliers

- Imported services

1. Notified Goods & Services

The government has specified certain services and goods where GST must be paid by the recipient instead of the supplier.

These usually include services where:

- The supplier is a professional or unorganized entity

- Tax collection is difficult to monitor

- Compliance needs to be ensured at the recipient’s end

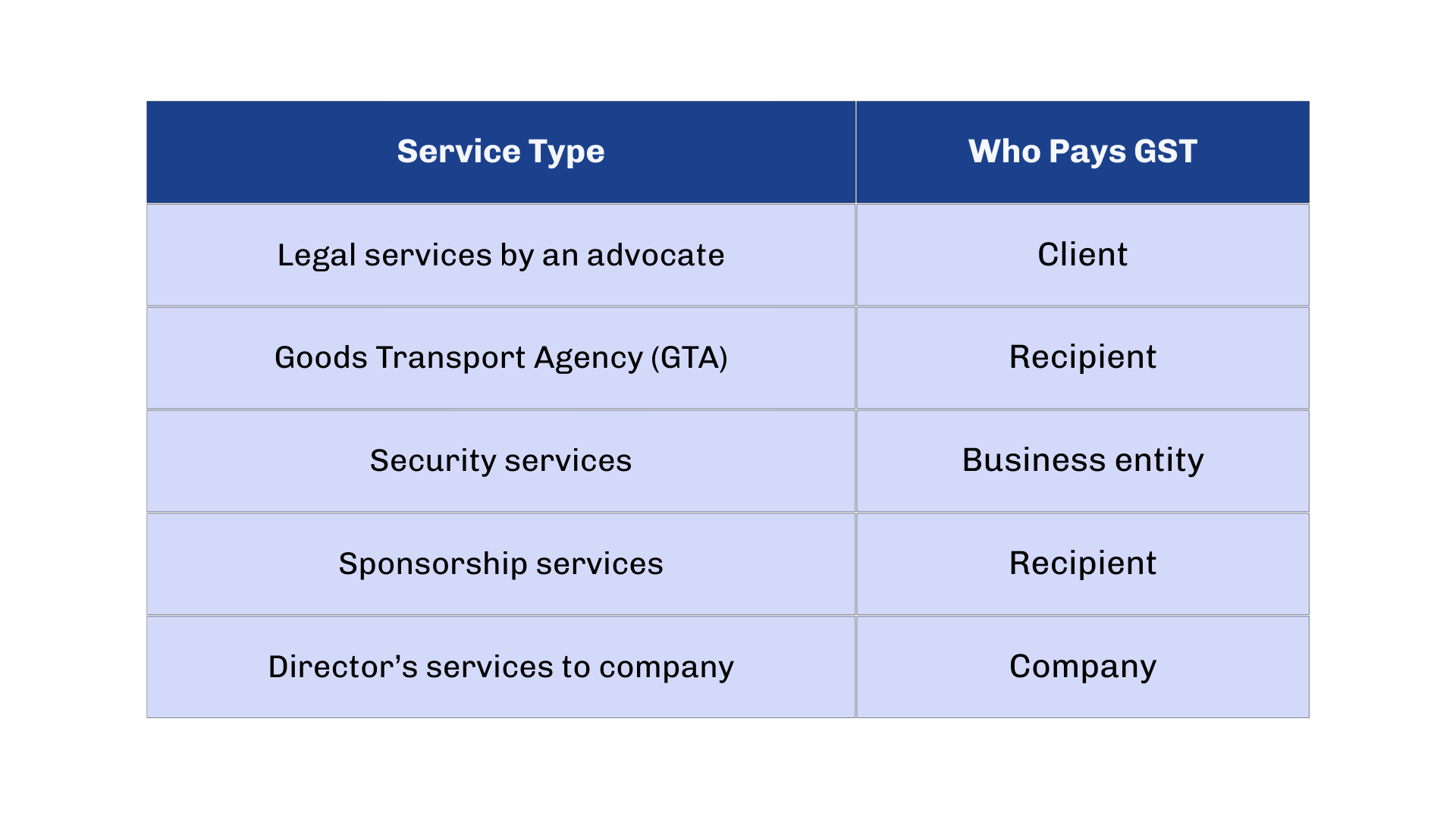

Some common examples include:

In all these cases, the supplier issues an invoice without GST, and the recipient pays tax under RCM.

2. RCM on Unregistered Supplier

RCM applies when a registered business purchases from an unregistered supplier but only for notified services or goods.

- Not all purchases from unregistered suppliers attract RCM

- Ensures tax collection even when suppliers are outside the GST system

3. Import of Services

If a business imports services from outside India, GST is payable under GST reverse charge.

This includes:

- SaaS subscriptions

- Foreign consulting services

- Digital marketing services

- Technical or IT support

Since the foreign supplier cannot collect Indian GST, the Indian recipient pays it under RCM.

Who Pays GST Under RCM?

Under RCM, the buyer is liable to pay GST, not the supplier.

In RCM Transactions:

- Supplier does not collect GST

- Recipient calculates the GST and pays via GST portal

- Applies even if the supplier is unregistered, exempt, or foreign

Recipient Definition:

The registered person or business receiving the goods/services and liable to pay GST.

Why liability shifts to the recipient:

- Supplier is outside GST system

- Imported services

- Hard-to-monitor sectors

This ensures compliance and prevents tax evasion.

Input Tax Credit Under RCM: Can You Claim It?

Yes, Input Tax Credit (ITC) under RCM can be claimed, but only after the GST has been paid by the recipient.

Unlike normal GST transactions, the tax under RCM is first paid in cash, and then ITC can be availed.

How ITC works under RCM

Under the Reverse Charge Mechanism:

- The recipient pays GST to the government

- Payment must be made in cash (not using ITC balance)

- After payment, ITC can be claimed in the same or next return

This means RCM does not increase your final tax cost, but it can affect short-term cash flow.

Conditions to claim ITC under RCM

To claim Input Tax Credit, all of the following must be met:

- GST under RCM has been fully paid

- Goods or services are used for business purposes

- A valid invoice is available

- The transaction is reported correctly in GSTR-3B

If any of these conditions are missed, ITC may be denied.

Important: ITC cannot be claimed for personal-use expenses. Incorrect claims may lead to penalties.

Common Mistakes & Compliance Tips

Many businesses make errors under the Reverse Charge Mechanism (RCM) simply because the rules feel technical. Avoiding these mistakes can save you from penalties and compliance issues.

Common mistakes under RCM

- Ignoring RCM on imported services: SaaS tools, consulting, and foreign services often attract RCM.

- Assuming all unregistered supplier purchases attract RCM: RCM applies only to notified categories, not every transaction.

- Claiming ITC without paying GST: ITC can be claimed only after RCM tax is paid in cash.

- Wrong service classification: Misclassifying services can lead to incorrect tax payment.

- Not reporting RCM in returns: RCM liabilities must be shown separately in GSTR-3B.

Practical compliance tips

- Track all RCM-related invoices separately

- Verify vendor registration status regularly

- Maintain proper service classification records

- Pay RCM tax on time to avoid interest

- Seek professional GST support when in doubt

Tracking RCM invoices and paying GST on time is critical for overall GST compliance.

RCM Examples

Understanding RCM becomes much easier when you see how it works in real situations.

Below are two common RCM examples that most businesses encounter.

Example 1: Legal Service

A company hires a lawyer for professional legal advice.

- Service value: ₹50,000

- GST rate: 18%

- GST charged by lawyer: ₹0

Since legal services fall under RCM applicability, the lawyer does not charge GST.

What the company does:

- Calculates GST = ₹9,000

- Pays ₹9,000 directly to the government

- Claims ₹9,000 as Input Tax Credit (if eligible)

The recipient pays the GST, not the lawyer.

Example 2: Import of SaaS Tool

A business subscribes to a foreign software tool.

- Subscription fee: ₹1,00,000

- GST charged by foreign vendor: ₹0

Since this is an import of services, GST is payable under GST reverse charge.

What the business does:

- Calculates applicable GST

- Pays the tax through the GST portal

- Claims ITC after payment

Foreign vendors don’t collect Indian GST, the Indian buyer pays it.

Why Understanding RCM Matters for Your Business

The Reverse Charge Mechanism (RCM) directly affects how your business pays GST, reports transactions, and claims Input Tax Credit.

If RCM is missed or handled incorrectly, it can lead to:

- Interest and penalties

- ITC denial

- Compliance notices

- Cash flow issues

For startups, freelancers, and MSMEs, even small mistakes can create unnecessary stress.

How RCM impacts your business

RCM influences:

- Your GST liability: You may have to pay tax even when the supplier doesn’t charge it

- Your cash flow: Tax must be paid in cash before claiming ITC

- Your compliance risk: Errors are easy to track in GST returns

- Your audits: RCM records are closely reviewed

Understanding RCM helps you stay prepared, not reactive.

Conclusion

The Reverse Charge Mechanism (RCM) is a key part of GST compliance that shifts the tax responsibility from the seller to the buyer in specific situations.

The 3 key takeaways:

- RCM applies only to notified cases such as certain services, unregistered suppliers, and imported services.

- The recipient is responsible for paying GST, not the supplier.

- Input Tax Credit can be claimed after the tax is paid in cash and reported correctly.

Understanding these basics helps businesses avoid penalties, manage cash flow better, and stay compliant with GST regulations.

Stay compliant with Filing Buddy and let experts handle your GST and tax obligations while you focus on growing your business.

FAQs: Reverse Charge Mechanism (RCM)

- What is Reverse Charge Mechanism in GST?

RCM is when the recipient of goods or services pays GST instead of the supplier, typically for notified services, unregistered suppliers, or imported services.

- Who is liable to pay GST under RCM?

The registered recipient of goods or services is responsible for paying GST directly to the government.

- When does RCM apply?

RCM applies to notified services, purchases from certain unregistered suppliers, and import of services from outside India.

- Can ITC be claimed under RCM?

Yes, Input Tax Credit can be claimed after the GST is paid in cash and reported correctly in GSTR-3B.

- Does RCM apply to all suppliers?

No. It applies only to notified goods/services, specific unregistered suppliers, or imported services, not all transactions.

- What services are covered under RCM?

Examples include: legal services, GTA services, security services, sponsorship, and director’s services.

- Is GST paid by the supplier under RCM?

No. Under RCM, the supplier does not charge GST; the recipient pays it.

- How is GST calculated under RCM?

The recipient applies the relevant GST rate to the invoice value and pays it directly to the government.

- Is RCM applicable on imported digital services?

Yes. Foreign services like SaaS tools, consulting, or technical support are subject to RCM.

- What happens if RCM tax is not paid?

Non-payment may lead to interest, penalties, denial of ITC, and compliance notices.

- How is RCM reported in GST returns?

RCM liabilities are reported in GSTR-3B under the reverse charge section, separately from normal GST.

- Can personal expenses claim ITC under RCM?

No. Only business-use goods or services qualify for ITC under RCM.

- What are common mistakes in RCM compliance?

Ignoring imported services, misclassifying services, claiming ITC without payment, and not reporting RCM in returns.

- Does RCM affect cash flow?

Yes. Tax must be paid in cash first, which may temporarily impact cash flow before claiming ITC.

- Why is RCM important for businesses?

RCM ensures tax compliance, prevents evasion, and allows proper ITC, helping businesses avoid penalties and maintain accurate GST records.

Why choose Us?

Filing Buddy is an entity which is focused at providing legal, financial, and corporate and compliances consultancy services to business entities. Our organisation is a structure made of enthusiastics.

EXPERTISE & RELIABILITY

Trusted industry professionals ensuring compliance, accurate tax filing, and comprehensive services for your business needs.

TAILORED SOLUTIONS

Customized services to meet your specific requirements, including business incorporation, trademarks, patents, and seamless GST return filing.

TIMELY SUPPORT

Dedicated support team committed to providing prompt assistance, resolving queries, and ensuring smooth operations for your business.

COMPETITIVE ADVANTAGE

Gain a competitive edge with our comprehensive suite of services, enabling you to focus on growth while we handle your compliance and taxation needs.

.webp)

.webp)

.webp)