DIR-3 KYC Explained: Rules, Applicability & DIN Risks

By Filing Buddy . 06 Jan 26

Introduction

DIR-3 KYC just got simpler.

Under the latest MCA update, directors no longer need to file it every year. It’s now required once every three years, based on the MCA-prescribed cycle.

But here’s what hasn’t changed:

DIR-3 KYC still decides whether your DIN stays active.

For many directors, especially those not involved in day-to-day operations, DIR-3 KYC feels like background paperwork that someone else will “take care of.” That assumption is exactly where problems begin. When the filing becomes due and is missed, DIN deactivation can happen quietly, without reminders or warnings.

This guide breaks down what DIR-3 KYC really is, how it’s different from DIR-3, and why it still matters, simply, clearly, and without legal jargon.

Why DIR-3 KYC Matters for Directors

DIR-3 KYC is often treated as routine compliance, but its role is far more fundamental. It is the mechanism through which the Ministry of Corporate Affairs (MCA) verifies and maintains the identity of every individual holding a Director Identification Number (DIN). In simple terms, DIR-3 KYC keeps your DIN valid and usable.

At its core, DIR-3 KYC is not about the company, it is about the director as an individual. Regardless of how active or inactive your role may be, the MCA expects directors to periodically confirm that their personal and contact details remain accurate, as prescribed under the compliance framework.

DIR-3 KYC as a Director’s Identity Verification

A DIN functions much like a corporate identity number. Just as PAN or Aadhaar confirms personal identity, the DIN establishes your legal presence in the corporate ecosystem. DIR-3 KYC is the periodic verification process that keeps this identity authenticated.

Through this filing, the MCA verifies:

- Your full name and date of birth

- Your residential address

- Your registered email ID and mobile number

- Your linkage to a valid DIN

Without this verification, the DIN is treated as inactive for regulatory purposes.

Why the MCA Requires Periodic KYC Confirmation

The MCA maintains a central registry of directors across companies and LLPs. Over time, personal details can change, addresses, contact information, or even directorship status. Periodic DIR-3 KYC ensures that the regulator’s records remain current and reliable.

This verification helps the MCA:

- Prevent misuse or duplication of DINs

- Improve transparency in corporate governance

- Maintain accurate communication with directors

- Strengthen accountability at the individual level

From a regulatory perspective, DIR-3 KYC is about maintaining trust in the corporate framework, not just ticking a compliance box.

How an Inactive DIN Disrupts Director Responsibilities

A deactivated DIN does not generate immediate alerts, but its impact is significant. Once inactive, the DIN cannot be used for any MCA-related filing until compliance is restored.

This can affect a director’s ability to:

- Sign and submit ROC forms

- Be appointed or resigned as a director

- Approve statutory filings requiring DIN authentication

- Participate in corporate compliance actions

Why this matters beyond theory

DIR-3 KYC may now be required once every three years, but the risk of overlooking it remains very real.

In 2019 alone, over 1.9 million DINs were deactivated due to non-filing of DIR-3 KYC. This wasn’t a niche compliance lapse, it was widespread, cutting across industries and director roles.

The reduced frequency makes compliance easier, not optional. The scale of past deactivations shows what happens when personal DIN obligations are deprioritised.

In the next section, we’ll look at who exactly is required to file DIR-3 KYC, including cases where directors often assume it doesn’t apply to them.

Who Needs to File DIR-3 KYC?

One of the most common misconceptions around DIR-3 KYC is that it applies only to “active” or working directors. In reality, DIR-3 KYC is linked to the DIN, not to your current role or level of involvement. If you hold a DIN, the responsibility to file DIR-3 KYC follows automatically.

Understanding applicability clearly helps directors avoid unintentional non-compliance, especially now that filing frequency has been simplified.

Directors Required to File DIR-3 KYC

DIR-3 KYC must be filed by every individual who holds a DIN, regardless of their current status or activity level. This includes:

- Active directors involved in daily company operations

- Non-executive and independent directors

- Inactive directors who are not currently participating in board activities

- Disqualified directors who still hold a DIN

- Individuals holding a DIN but not presently associated with any company

- Directors serving on the boards of multiple companies

If a DIN has been allotted to you, DIR-3 KYC is mandatory unless the DIN has been formally surrendered.

Applicability Across Companies and LLPs

DIR-3 KYC is not limited to company directorships alone. Individuals holding DINs in connection with LLPs or combined company–LLP structures are also covered under this requirement.

It is important to note that:

- DIR-3 KYC is filed per DIN, not per entity

- It is not filed separately for each company or LLP

- One valid filing keeps the DIN active across all associations

Revised Applicability Rule (Post MCA Update)

Under the updated framework, DIR-3 KYC is no longer a yearly obligation. Instead, directors are required to complete DIR-3 KYC once every three years, or as otherwise prescribed by the MCA.

Applicability is determined by:

- Whether you hold an active DIN, and

- Whether your DIR-3 KYC is due under the current compliance cycle

The revised framework has reduced filing frequency, not responsibility.

DIR-3 KYC is now easier to manage, but missing your applicable cycle still leads to DIN deactivation. Directors who assume past compliance guarantees future validity often discover the issue only when an urgent filing is blocked.

In the next section, we’ll clarify the often-confusing distinction between Form DIR-3 and DIR-3 KYC, and why understanding the difference prevents compliance errors.

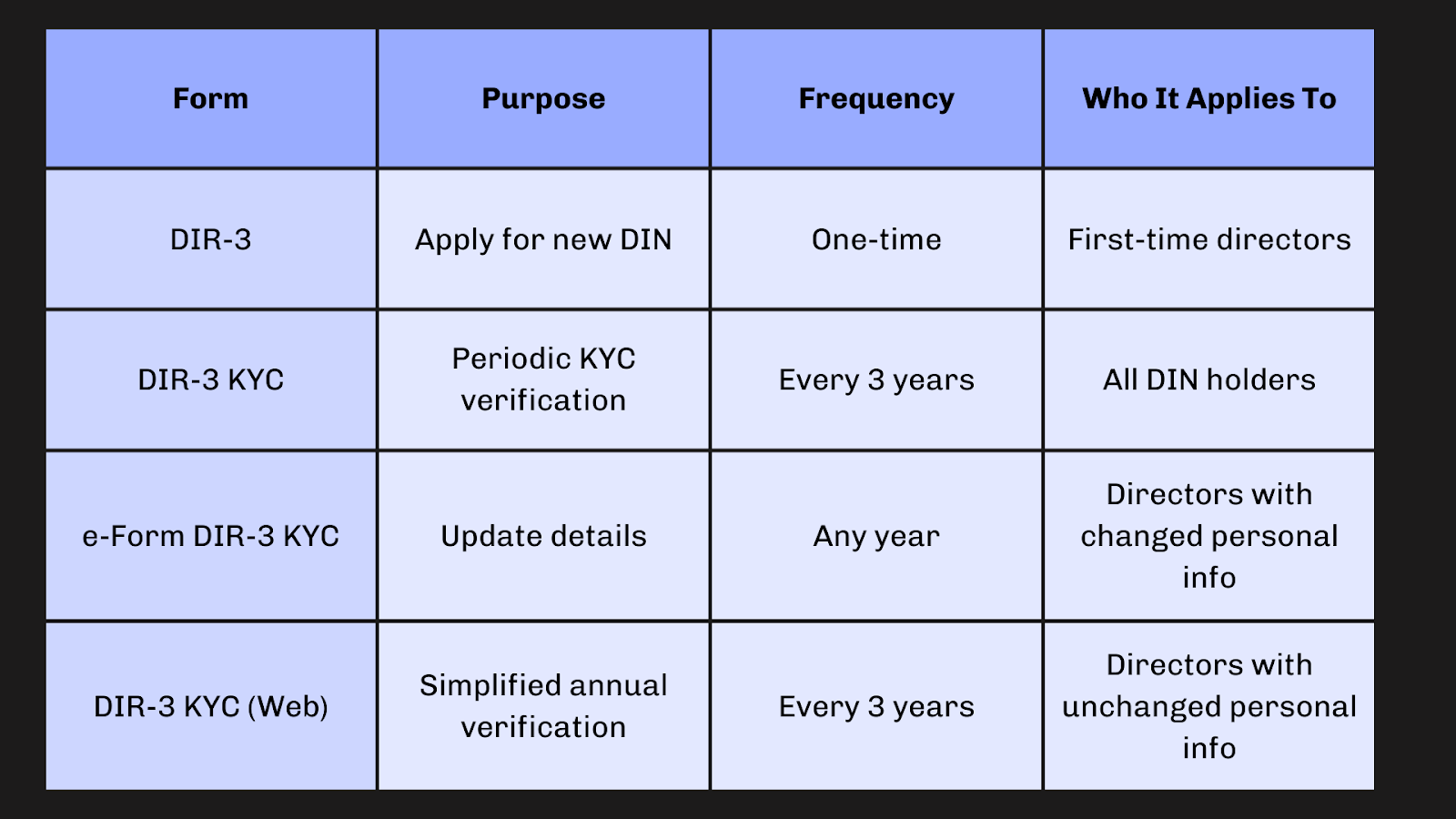

DIR-3 vs DIR-3 KYC: Understanding the Difference Between Forms

The similarity in names is one of the biggest reasons directors get confused about DIR-3 compliance. While Form DIR-3 and DIR-3 KYC sound related, they serve very different purposes and apply at different stages of a director’s journey.

Understanding this distinction is essential, because many compliance lapses occur simply due to filing the wrong form or assuming one filing covers the other.

Form DIR-3: Application for a New DIN

Form DIR-3 is used only once, at the very beginning. It is the application through which an individual obtains a Director Identification Number for the first time.

This form applies to:

- Individuals who are about to be appointed as directors

- First-time directors who do not already hold a DIN

Key characteristics of Form DIR-3:

- Filed only at the time of DIN allotment

- Requires submission of identity and address proofs

- Authenticated using a Digital Signature Certificate (DSC)

- Once approved, a DIN is permanently allotted

After a DIN is issued, Form DIR-3 is not used again unless the DIN is surrendered or cancelled.

DIR-3 KYC: Verification for Existing DIN Holders

DIR-3 KYC comes into play after a DIN has already been allotted. Its purpose is to verify and update the personal details of existing DIN holders in the MCA database.

This requirement applies to:

- All individuals holding an active DIN

- Directors, whether active or inactive

- DIN holders associated with companies, LLPs, or currently unassociated

Key features of DIR-3 KYC:

- Mandatory once every 3 years (previously annual)

- Ensures the DIN remains active and compliant

- Verifies personal and contact details such as email ID and mobile number

- Failure to file results in DIN deactivation

In short, Form DIR-3 creates the DIN; DIR-3 KYC keeps it alive, now with a 3-year filing cycle, reducing the compliance burden while remaining mandatory.

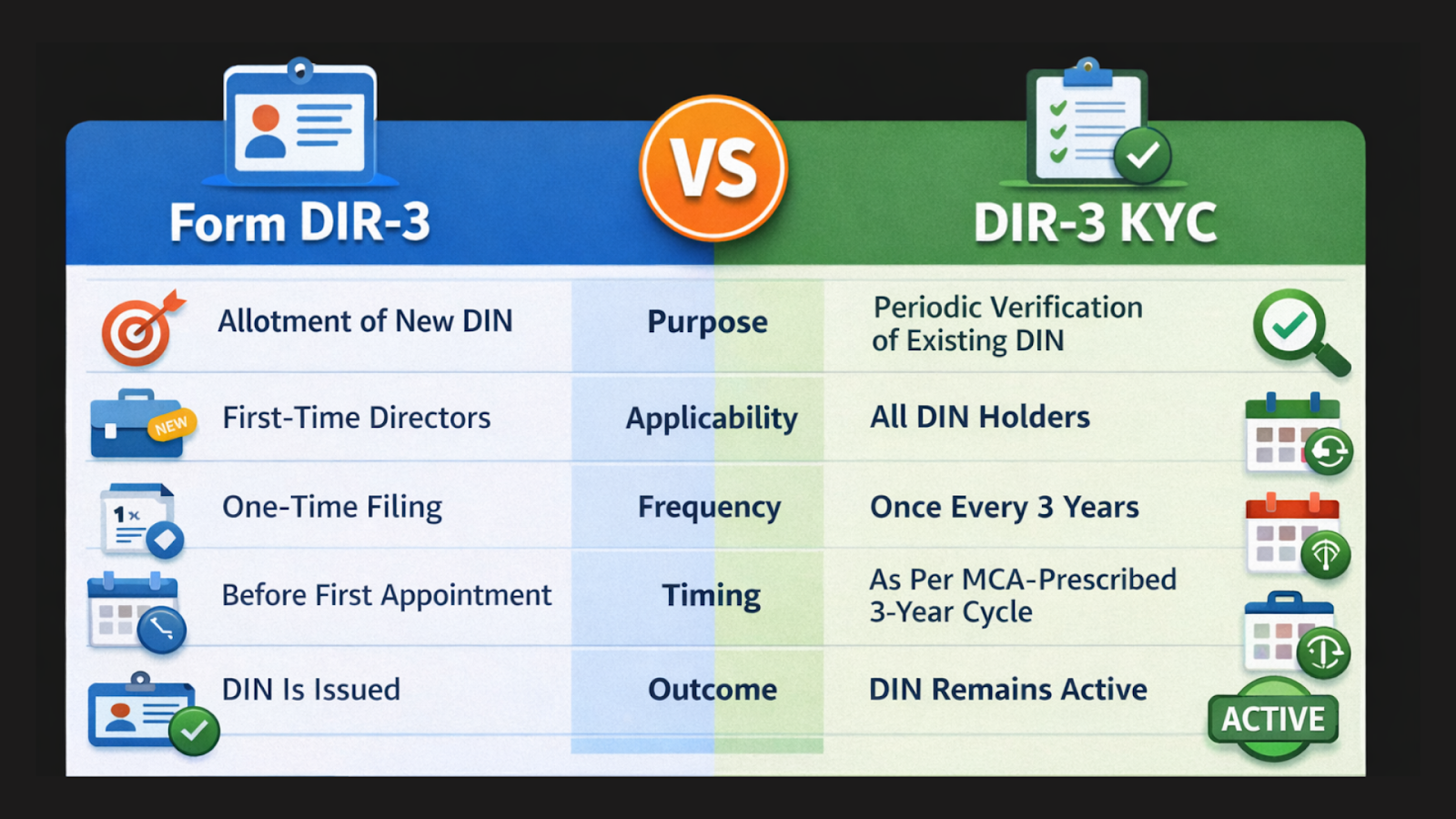

Key Differences at a Glance:

The distinction becomes clearer when the two are viewed side by side:

Recognising this difference helps directors avoid a common and costly assumption, that once a DIN is allotted, no further personal compliance is required. In the next section, we’ll examine what happens if DIR-3 KYC is missed, and why the consequences often surface at inconvenient moments.

What Happens If You Miss DIR-3 KYC?

Mr. Abdul Samad Ansari experienced this first-hand when the ROC, Kanpur, found his DIN deactivated due to non-filing of DIR-3 KYC during an inquiry into Al-Ameen Mutual Benefit Nidhi Limited. A penalty was subsequently imposed.

Missing the DIR-3 KYC deadline is one of those compliance slips that feels small, but creates outsized problems later. The MCA doesn’t send reminders, doesn’t issue prior notices, and doesn’t ask for explanations upfront. The system simply acts.

Let’s break down what actually happens, who it impacts, and how directors usually discover the problem.

Immediate Consequence: DIN Gets Deactivated

The first and most direct impact of not filing DIR-3 KYC is DIN deactivation.

Your DIN status changes to “Deactivated due to non-filing of DIR-3 KYC.”

This applies to:

- Active directors

- Inactive or resigned directors

- Individuals holding DINs but not currently on any board

This process isn’t discretionary, the system acts automatically.

DIN deactivation can surface unexpectedly, often during unrelated regulatory actions.

Once deactivated, the DIN cannot be used for any MCA filing.

What You Can’t Do With a Deactivated DIN

A deactivated DIN quietly blocks multiple corporate actions. Directors usually realise the issue only when something urgent comes up.

With a deactivated DIN, you cannot:

- Sign or file company forms on the MCA portal

- Be appointed as a director in a new company

- File annual returns or event-based compliances

- Approve changes like share transfers or resignations

This often delays company filings and puts entire compliance calendars on hold.

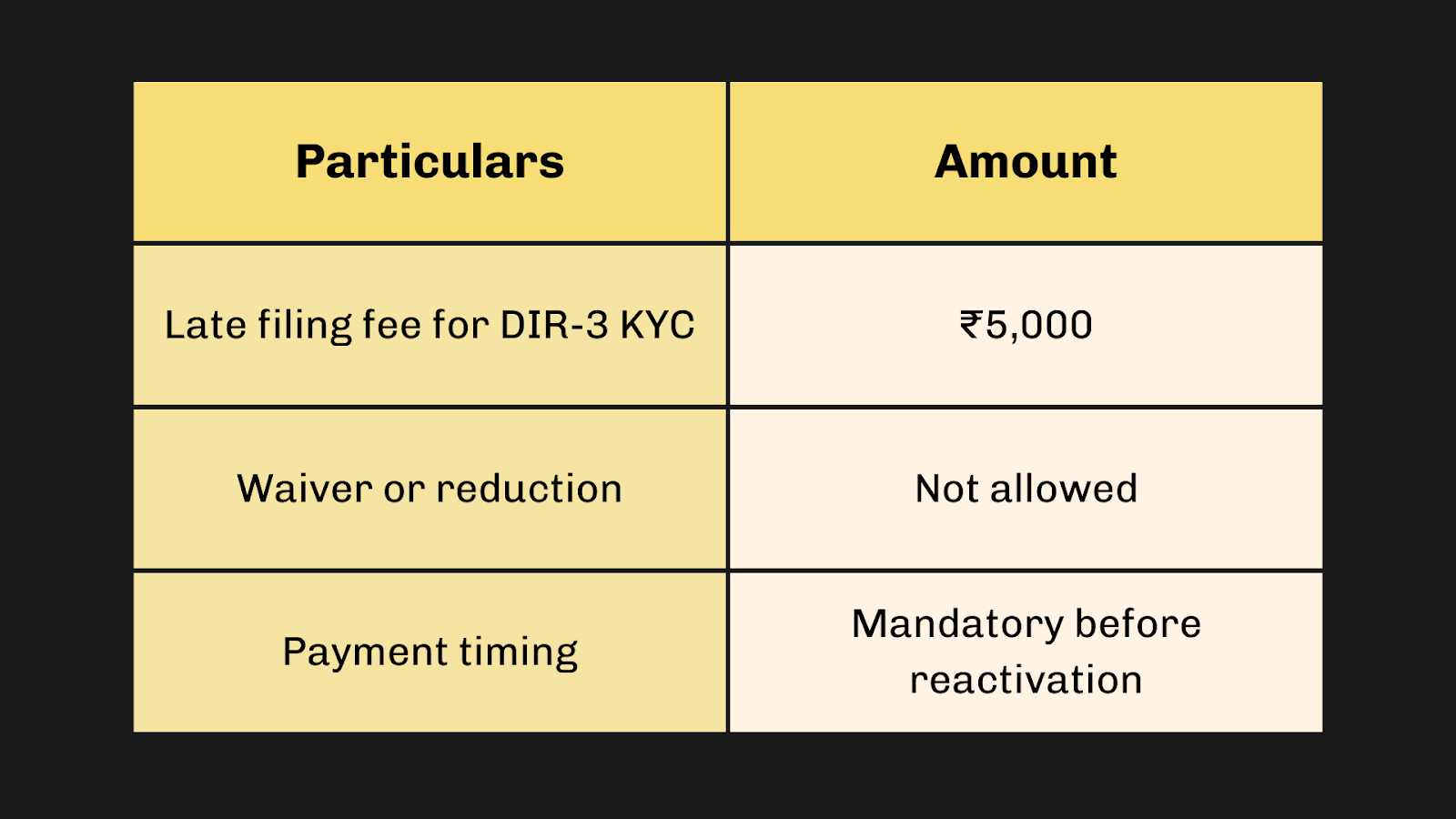

Monetary Penalty for Late Filing

There is no slab system or per-day calculation for DIR-3 KYC delay. The penalty is fixed and non-negotiable.

The financial consequence of missing DIR-3 KYC is fixed and non-negotiable.

In one such case, Mr. Durlabh Darshan Sharma was penalised ₹5,000 by the ROC, Uttar Pradesh for non-compliance with KYC provisions, which also resulted in DIN deactivation. The adjudicating authority noted that this constitutes non-compliance with Rule 12A of the Companies (Appointment and Qualification of Directors) Rules, 2014, and is punishable under Section 450 of the Companies Act.

Whether the delay is accidental or prolonged, the penalty framework does not differentiate.

Does Intent or Inactivity Matter?

This is where many directors get caught off-guard.

DIR-3 KYC is required regardless of:

- Whether you attended board meetings

- Whether the company is active or dormant

- Whether you’re an executive or independent director

- Whether you received any MCA reminder

The MCA treats DIN compliance as individual responsibility, not company-driven compliance.

The Bigger Takeaway

DIR-3 KYC penalties aren’t designed to be harsh, but they are designed to be strict and automatic. Most directors don’t lose money because of ignorance; they lose time and momentum because of last-minute discovery.

In the next section, we’ll look at the most common mistakes directors make while filing DIR-3 KYC and how to avoid repeating them.

Common Mistakes Directors Make

DIR-3 KYC is technically simple, but in practice, most penalties don’t happen because directors can’t file it. They happen because of small, avoidable mistakes that compound over time. Let’s look at the most common ones and why they keep recurring.

1. Assuming the Company Will Handle It

One of the biggest misconceptions is that DIR-3 KYC is a company-level compliance.

DIR-3 KYC is an individual obligation, not the company’s. Even if your company secretary or finance team handles all filings, this one still requires your personal verification.

2. Believing “Inactive” or “Resigned” Directors Are Exempt

Many directors think DIR-3 KYC applies only to active board members.

This is incorrect. If you hold a DIN, you must file DIR-3 KYC, regardless of whether:

- You’ve resigned

- The company is dormant

- You haven’t signed anything all year

The MCA tracks DINs, not involvement.

3. Missing the Deadline Due to Date Confusion

Deadlines are another frequent pain point.

Directors often confuse:

- Financial year end (31 March)

- DIR-3 KYC cut-off dates

Since DIR-3 KYC is DIN-based, its deadline doesn’t align neatly with company filings, leading to oversight.

This confusion is why we separately explain deadline extensions and updates later in the guide.

4. Using an Email or Mobile Number Not Linked to You

DIR-3 KYC requires OTP verification on:

- Your personal mobile number

- Your personal email ID

Using office emails, assistants’ numbers, or outdated contact details leads to OTP failures and rejected filings.

5. Not Updating Changes in Personal Details

Some directors continue using DIR-3 KYC (Web) even after their details have changed.

If your:

- Address

- Mobile number

- Email ID

has changed since last year, you must use e-Form DIR-3 KYC, not the web version.

Using the wrong mode can lead to form rejection or incorrect MCA records.

6. DSC Issues at the Last Minute

For e-Form DIR-3 KYC, a valid Digital Signature Certificate (DSC) is mandatory.

Common DSC-related mistakes include:

- Expired DSC

- DSC not registered on the MCA portal

- Using someone else’s DSC

These issues usually surface only at the submission stage, when time is already running out.

7. Ignoring Errors Until Something Breaks

Most directors don’t check their DIN status proactively.

They find out there’s an issue only when:

- A company form gets rejected

- A new directorship appointment fails

- An urgent filing is blocked

At that point, the ₹5,000 penalty becomes unavoidable.

Why These Mistakes Keep Happening

DIR-3 KYC sits in an awkward space:

- It’s now periodical, but not tied to company filings

- It’s simple, so it’s deprioritised

- It’s personal, yet affects corporate actions

That’s why directors who otherwise stay compliant still slip here.

In the next section, we’ll shift focus from mistakes to practical habits and tips that help directors stay DIR-3 KYC-compliant year after year, without stress or last-minute surprises.

Key Takeaways & Smart Compliance Habits

As we wrap up Part 1, it’s important to step back and reflect on the big lessons from everything we’ve covered so far. DIR-3 KYC may feel like just another form, but for directors, it’s your personal compliance passport, missing it can quietly disrupt your corporate responsibilities.

Here’s what every director should keep top-of-mind.

1. DIR-3 KYC Is Mandatory (Now Every 3 Years)

Even inactive directors or those with multiple DINs must file to keep DINs active and avoid penalties.

2. Understand the Difference Between Forms

Confusing Form DIR-3 with DIR-3 KYC leads to rejected filings and unnecessary delays.

3. Treat Deadlines Seriously

Plan assuming no extensions. Use 30 September as your baseline filing date.

4. Build Smart Compliance Habits

Maintain a personal compliance calendar, verify details before filing, and submit early.

5. Small Efforts Prevent Big Problems

Confirm your contact details, choose the correct filing mode, and monitor confirmation on the MCA portal.

Conclusion

DIR-3 KYC is not just a formality. It reflects a director’s professional discipline and corporate credibility. While the MCA has reduced the frequency of filing to once every three years, the responsibility to stay compliant remains unchanged.

Directors who understand the distinction between forms, track their applicable DIR-3 KYC cycle, and build proactive compliance habits turn what many perceive as a risky obligation into a predictable, stress-free process.

In Part 2, we’ll take these lessons forward and walk through the DIR-3 KYC filing process step-by-step, highlight common errors, and show you how to stay compliant under the new 3-year framework, without last-minute panic or disruption.

FAQs

1. What is DIR-3 KYC?

DIR-3 KYC is a mandatory compliance requirement through which DIN holders verify and update their personal details with the MCA to keep their DIN active.

2. Who needs to file DIR-3 KYC?

All individuals holding a DIN, whether active, inactive, executive, non-executive, or unassociated, must file DIR-3 KYC as per the applicable MCA cycle.

3. How often is DIR-3 KYC required to be filed?

DIR-3 KYC is required to be filed once every three years, as per the revised MCA guidelines.

4. Is there a fixed annual deadline like 30 September?

No. Under the new framework, DIR-3 KYC must be filed as per the MCA-prescribed 3-year cycle applicable to the DIN, not on a universal annual date.

5. What happens if I miss my DIR-3 KYC due cycle?

Your DIN is deactivated, you cannot sign statutory filings, and a ₹5,000 penalty must be paid to reactivate it.

6. What is the difference between DIR-3 and DIR-3 KYC?

DIR-3 is used once for DIN allotment, while DIR-3 KYC is used periodically to verify and maintain the DIN.

7. Do inactive or resigned directors need to file DIR-3 KYC?

Yes. DIR-3 KYC is linked to the DIN, not to current board positions or activity status.

8. Can I use DIR-3 KYC (Web) if my details have changed?

No. The web version can be used only when details remain unchanged. Any updates require filing the e-Form DIR-3 KYC.

9. Is there a penalty for late or missed DIR-3 KYC filing?

Yes. The MCA imposes a fixed penalty of ₹5,000 for non-filing, along with DIN deactivation.

10. How is DIR-3 KYC verified?

Verification is done via OTP to registered email and mobile (Web version) or through DSC authentication (e-Form).

11. What documents are required for DIR-3 KYC?

No additional documents are required if details are unchanged. Updated details require valid ID proofs and DSC.

12. Do directors with multiple DINs need to file multiple DIR-3 KYC forms?

Yes. Each DIN must be individually verified as per its applicable filing cycle.

13. Are extensions applicable under the new rule?

The concept of annual extensions no longer applies. Filing must be done within the MCA-specified 3-year cycle.

14. Can foreign directors file DIR-3 KYC?

Yes. Foreign DIN holders must file using valid passport details, registered email, and mobile number, or the e-Form if details change.

15. How do I know my DIR-3 KYC is successfully filed?

Once filed successfully, the DIN status is shown as “Active” on the MCA portal, and confirmation is sent to the registered email.

Contact Us

An expert will call you within 24 hours. No payment required to get started.

Related Post

How to Obtain a Company Registration Number in India

Understanding Corporate Identification Numbers (CINs) and How to Obtain Them in India

. 2 mins.png)

Difference between Udyog Adhaar and Udyam Certificate

Want to get registered for Udyog Aadhar and Udyam Certificate? Here is their registration processes. Also, know about their differences. Explore their features, benefits, and processes to register online for each, helping you to choose the right option as per your need.

. 3 min read.png)

Changing Your Bank Signatory? Here are the Y Documents Required by Most Banks in India

Learn how bank signatory is important for financial workflow. Know why bank signatories are important and discover the documents required to change signature of your signatory.

. 5 min read