GST for E-Commerce Sellers (2026): Complete Guide & Rules

By Filing Buddy . 23 Dec 25

The Ultimate GST Guide for E-Commerce Sellers in India (2026 Edition)

Thinking of selling on Amazon, flipping gadgets on Flipkart, or launching your own Shopify empire? Congratulations! You’ve probably realized that the hardest part isn't finding a supplier who actually delivers on time, it's the three-letter monster hiding under the bed: GST.

Let’s be real. India’s e-commerce market is exploding faster than a viral reel. Everyone wants a piece of the pie, but the moment you Google "GST for e-commerce sellers," you’re hit with a wall of "legalese" that makes you want to crawl back into bed.

But here’s the good news: It’s not actually rocket science.

In this guide, we'll debunk the big myths (spoiler: you might not need a GST number immediately), break down the game-changing exemption rules from the Oct 2023 update, and explain why TCS and TDS aren't actually stealing your money.

Ready to turn that compliance panic into profit? Let’s dive in.

Do You Actually Need a GST Number to Sell Online?

This is where most people get cold feet. You ask your uncle (who "knows business") or check a forum from 2019, and they all scream: "YES! Mandatory Registration! Immediately!"

Well, hold your horses. That advice is officially outdated.

Let's break down the actual rules without the headache.

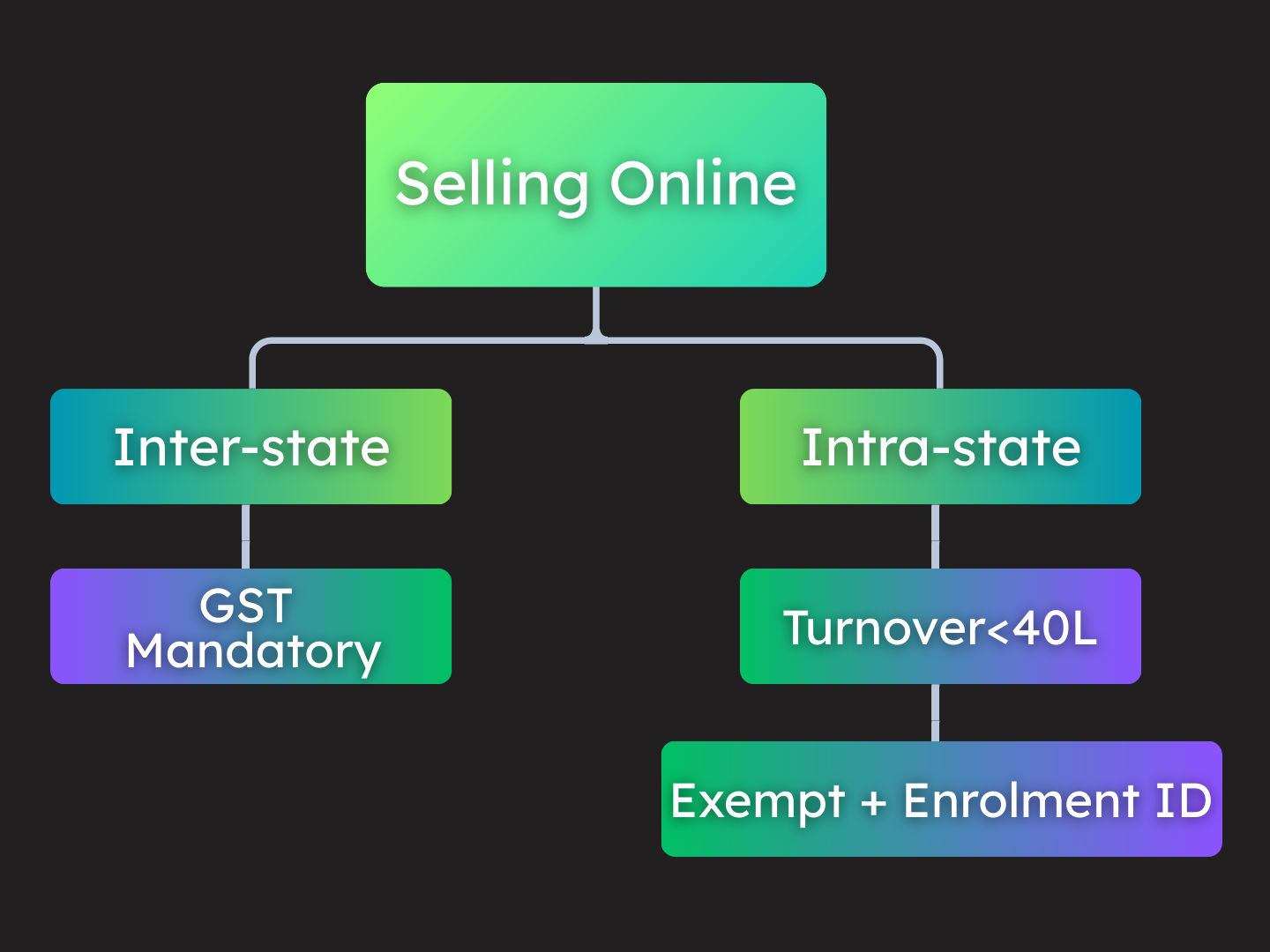

The General Rule: Crossing Borders? Get Registered.

If you plan to be the next Amazon kingpin, shipping your products from Mumbai to customers in Delhi, Bangalore, and Kolkata, then yes, you need a GST number from Day 1.

It doesn't matter if you sell ₹100 worth of pens or ₹10 Lakhs worth of laptops. In the eyes of the taxman, Inter-state supplies (selling outside your home state) = Mandatory GST Registration. No excuses.

The "Game Changer" Exemption (Oct 2023 Update)

Here is the plot twist that saved thousands of small businesses.

If you are a small seller dealing only in goods (not services) and you sell only within your state (Intra-state), you might be EXEMPT from GST registration.

Meet "Candle-Maker Kavita":

Kavita makes scented candles in Pune and sells them online only to customers in Maharashtra. Her annual turnover is ₹15 Lakhs.

- Old Rule: She needed a GST number immediately.

- New Rule: She is safe. Since her turnover is under the threshold (₹40 Lakhs for most states, ₹20 Lakhs for some), she doesn't need a full GST registration.

The Catch? You Need an "Enrollment ID"

You can't just operate invisibly. You must apply for an Enrollment ID on the GST portal. Think of it as "GST Lite" ; it lets you sell on platforms like Amazon or Flipkart strictly within your state without filing monthly returns.

What About Service Providers? (Section 9(5))

If you are a freelancer or service provider, the rules are slightly different and honestly, easier.

If you provide services through an "aggregator" app (think Urban Company for plumbers, Swiggy for restaurants, or Uber for drivers), relax. Under Section 9(5) of the CGST Act, the platform is responsible for paying the GST, not you.

So, if you’re driving a cab or delivering pizza via an app, you generally don't need to worry about the GST paperwork. The app handles the headache for you.

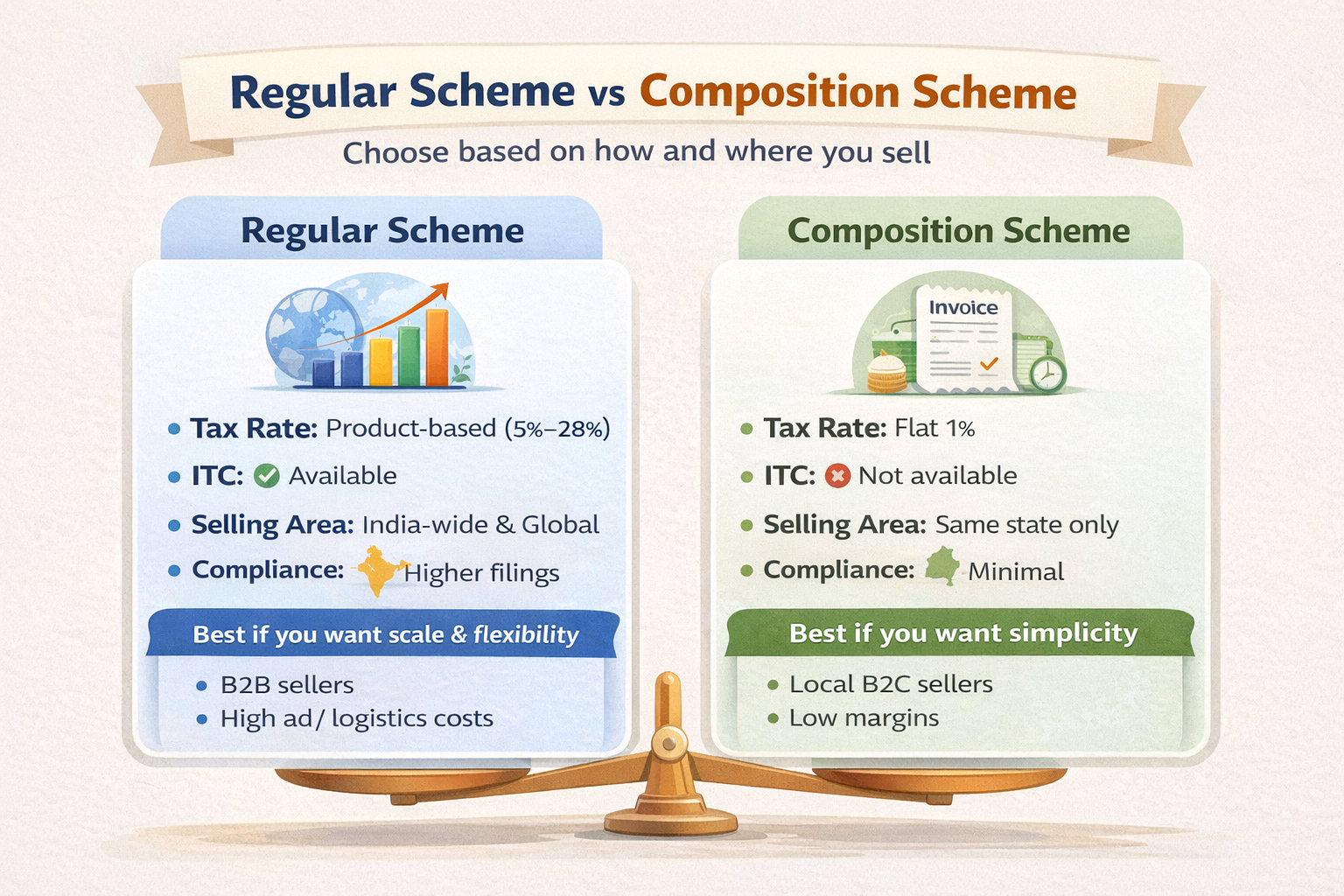

Regular vs. Composition Scheme: The Fork in the Road

Once you decide to register, you have to make a choice. Do you go for the full-blown experience or the "lite" version? It’s a bit like choosing between an à la carte meal and a set buffet, one gives you more choices, the other is simpler but rigid.

Can E-Commerce Sellers Opt for the Composition Scheme?

If you had asked this a couple of years ago, the answer would have been a hard "No." E-commerce sellers were treated like the bad boys of the tax world strictly barred from this benefit.

But things have changed!

- Old Rule: E-commerce sellers had to be under the Regular Scheme.

- New Rule: Yes! If you are a supplier of goods (sorry, service providers), you can now opt for the Composition Scheme.

The Condition: You must sell only within your state. If you ship even one package from Pune to Delhi, you are disqualified and kicked back to the Regular Scheme.

Which One Should You Choose?

If you hate math and sell locally, Composition is great. If you want to claim refunds on your business expenses, Regular is your friend.

Here is the breakdown:

Pro Tip: Most e-commerce sellers stick to the Regular Scheme. Why? Because even though the filing is annoying, being able to sell Inter-state (to the whole of India) is usually the whole point of being online!

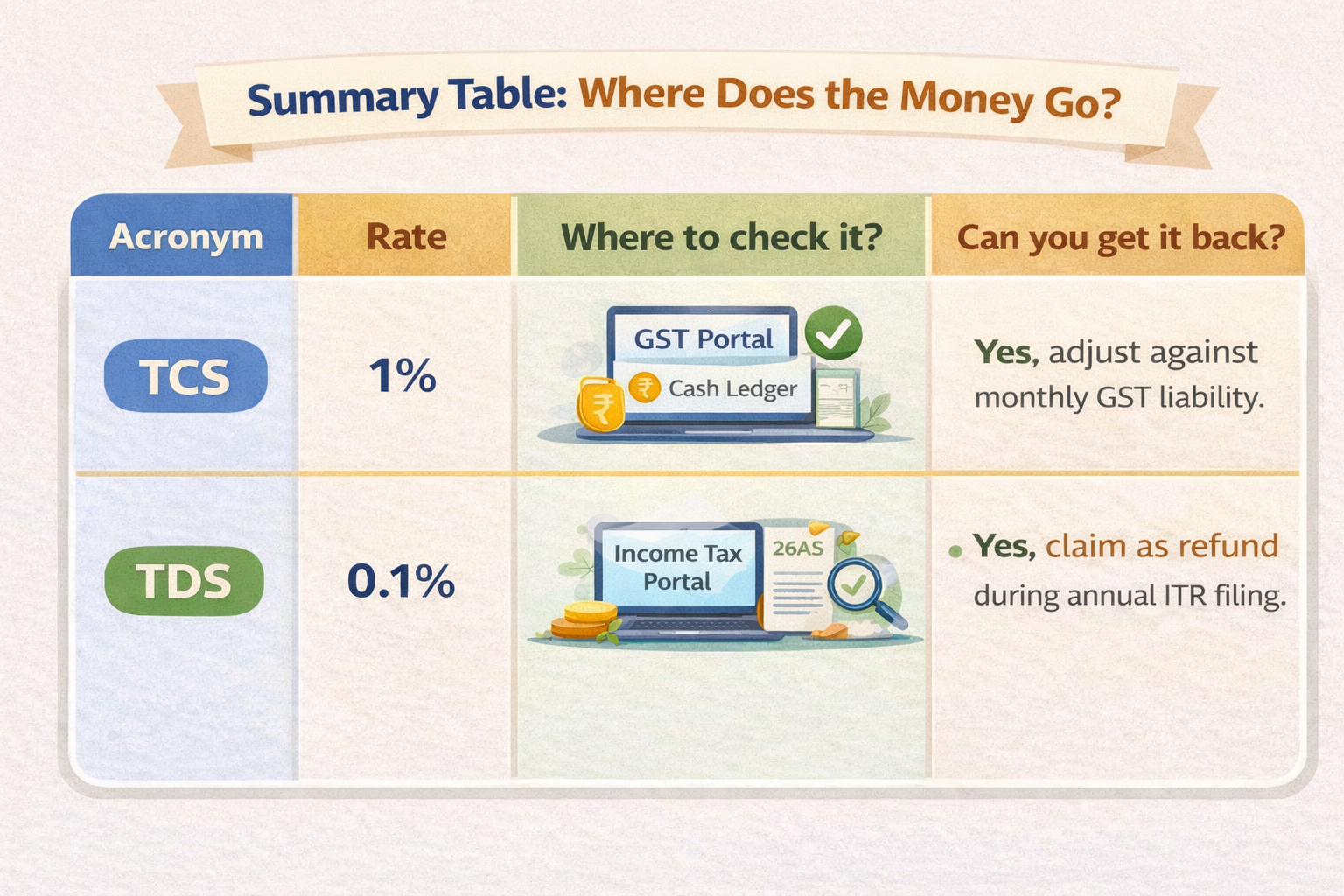

Understanding TCS and TDS

(Why is Amazon taking money from my payout?)

This is the part where most new sellers panic. You sell a product for ₹1,000, but when you check your bank account, you receive less than you expected. You immediately think, "The platform is robbing me!"

Relax. They aren't robbing you; they are just following the government's orders to keep you honest. Let’s decode the two acronyms that mess with your cash flow.

1. TCS (Tax Collected at Source) - The GST Sibling

Think of TCS as a "security deposit" that Amazon or Flipkart collects on behalf of the government.

- The Rule: Every time you make a sale, the platform deducts 1% of the taxable value (0.5% CGST + 0.5% SGST) before sending you your money.

- The "Good News": This money is NOT a cost to you. It doesn't vanish. It goes straight into your Electronic Cash Ledger on the GST portal.

- Real-Life Example:

Rahul sells a smartwatch for ₹2,000 on Flipkart. Flipkart deducts ₹20 (1%) as TCS. When Rahul files his monthly GST return, he will see that ₹20 waiting for him in his dashboard. He can use it to pay his final tax bill.

2. TDS (Tax Deducted at Source) - The Income Tax Cousin

This one comes from the Income Tax Department (Section 194-O), and it used to be a massive headache because it locked up a lot of working capital.

- The Rule: E-commerce operators must deduct a percentage of your gross sales as Income Tax.

- The "Great News" (2024 Update): For years, this rate was a painful 1%. But, starting from October 1, 2024, the government slashed this rate down to just 0.1%

(This is a huge win for your daily cash flow!) - The Benefit: Just like TCS, this isn't lost money. It’s advance tax paid in your name. When you file your annual Income Tax Return (ITR), you can claim this entire amount as a refund if your total profit is below the taxable limit.

The Compliance Calendar: What to File and When

Once you have that GST number, you have entered a long-term relationship with the government. And like any relationship, communication (filing returns) is key.

Here is your simple cheat sheet to staying out of trouble:

1. Registration (The First Date):

- Form: GST REG-01

- When: Before you start selling (unless you are exempt!). This is your one-time entry ticket to the club.

2. Monthly / Quarterly Returns (The Regular Check-ins):

- GSTR-1 (The Sales Report): This is where you tell the government, "Hey, I sold this much stuff."

- Due Date: 11th of the next month (or 13th if you are on the Quarterly QRMP scheme).

- GSTR-3B (The Payment Slip): This is the important one where you calculate your tax, subtract your Input Tax Credit (ITC), and pay the remaining cash.

- Due Date: 20th, 22nd, or 24th of the next month (depending on your state).

3. Annual Return (The Year-End Review):

- Form: GSTR-9

- Who files it? Only if your annual turnover is > ₹2 Crores. (If you earn less, you can skip this headache!).

- When: 31st December of the following financial year.

4. The "Secret" Reconciliation (Don't Skip This!):

- The Task: Match your own sales data with what Amazon/Flipkart has reported.

- Where to look: Check your GSTR-2A (TDS/TCS Credit received) tab.

- Why: Amazon files a return called GSTR-8. The data from their GSTR-8 flows into your GSTR-2A. If Amazon says they collected ₹500 TCS but your books say ₹600, you have a mismatch to fix!

Common Mistakes E-Commerce Sellers Make

GST isn't just about filing forms; it's about not making silly errors that eat into your profit margins. Here are the four biggest blunders we see sellers make and how to avoid them.

1. Leaving Money on the Table (Ignoring TCS Credits)

Remember that 1% TCS Amazon deducts? It doesn't just magically appear in your bank account.

- The Mistake: Many sellers think the deduction is automatic and forget about it.

- The Fix: You have to log in to the GST portal, go to the "TDS and TCS credit received" tile, and manually click "ACCEPT." If you don't click that button, that cash sits in limbo forever. It’s literally free money, don't leave it there!

2. The "Bill To" vs. "Ship To" Trap (Dropshippers, Listen Up!)

This is the most confusing part for anyone doing dropshipping.

- The Scenario: You (in Mumbai) buy goods from a vendor (in Delhi) and ask them to ship directly to your customer (in Bangalore).

- The Mistake: If the vendor puts the customer's details in the "Bill To" section, you lose the Input Tax Credit (ITC).

- The Fix:

- "Bill To": YOUR Company (So you get the tax credit).

- "Ship To": Your Customer (So they get the package).

- Always double-check the invoice your supplier generates!

3. HSN Code Roulette

HSN codes determine your tax rate. Guessing them is a dangerous game.

- The Mistake: Using a generic code for "clothing" (5%) when you are actually selling "leather apparel" (which might be 12% or higher).

- The Risk: If the taxman catches you undercharging, you will have to pay the difference plus interest plus a penalty out of your own pocket. Use a proper HSN search tool, not your intuition.

4. Ghosting the Government (Not Filing Nil Returns)

So, you took a break? Maybe you didn't sell a single item in February.

- The Mistake: Thinking, "No sales = No filing needed."

- The Reality: GST is a needy partner. If you don't file, they slap you with a late fee (starting at ₹20-₹50 per day).

- The Fix: File a "Nil Return." It takes literally 30 seconds via SMS or the portal. Just tell them you made zero money so they don't fine you.

5 Tips for Smooth GST Compliance

(Work smarter, not harder)

You didn't start a business to become a full-time accountant. To keep your sanity intact and the taxman happy, follow these five golden rules.

1. Ditch the Excel Sheets (Use Automation): Manual data entry is so 2010. Trying to copy-paste thousands of Amazon orders into a spreadsheet is a recipe for disaster (and carpal tunnel).

- The Tip: Use accounting software that syncs directly with Amazon Seller Central or Flipkart. It pulls your sales data automatically so you can file returns in a few clicks, not a few days.

2. Don't Mix Pizza Money with Business Money: It is tempting to use your personal savings account for everything, but please don't.

- The Tip: Open a Separate Current Account for your business. It makes reconciling your 1% TCS credits infinitely easier. Plus, your CA will thank you for not making them sort through your Swiggy orders to find business expenses.

3. Watch the Speed Limit (Monitor Your Enrollment ID): If you are enjoying the "GST Exemption" (selling only goods intra-state), remember it has a ceiling (usually ₹40 Lakhs).

- The Tip: Keep a hawk-eye on your turnover. If you cross ₹39.9 Lakhs and don't upgrade to a full GSTIN, you instantly become non-compliant. Don't let success become a penalty trap!

4. Claim Everything (Maximize Input Tax Credit): Most sellers claim ITC on the goods they buy, but they forget the invisible expenses.

- The Tip: You pay GST on packaging materials, Facebook/Google Ads, office rent, and even broadband bills. Make sure these invoices have your GST number on them. That is all the money you can claim back!

5. When in Doubt, Call a Buddy: Google is great for recipes, but dangerous for tax advice. One wrong interpretation of a "Notification" can cost you thousands in fines.

- The Tip: Don't guess. Use a dedicated platform like Filing Buddy. Whether it's getting that initial registration or handling a tricky notice, having an expert in your corner is cheaper than paying a penalty later.

Conclusion: GST isn't a Wall, It's a Door

We know, GST feels like a lot of paperwork. It’s easy to look at the rules, the returns, and the acronyms and think, “Maybe I’ll just stick to selling via WhatsApp.”

But here is the truth: GST is your passport to scale.

Without it, you are a local shop. With it, you are a national brand. It unlocks the doors to Amazon, Flipkart, and millions of customers from Kashmir to Kanyakumari. It gives your business legitimacy, lets you claim tax refunds on your expenses, and proves to banks that you are serious when you apply for a loan.

So, don't look at GST as a barrier. Look at it as the growing pain of building something big.

Still feeling a little overwhelmed?

You focus on finding the best products and making your customers happy. Let us worry about the government portals.

Confused by the new exemption rules or need help filing your first GSTR-1?

Filing Buddy is here to handle the paperwork while you focus on growing your brand.

[Sign Up for a Free Consultation with Filing Buddy]

Frequently Asked Questions (FAQs) on GST for E-Commerce

1. Is GST mandatory for selling on Amazon or Flipkart?

Yes and No. If you sell to customers outside your state (Inter-state), GST registration is mandatory regardless of your turnover. However, if you sell goods only within your own state (Intra-state) and your turnover is below ₹40 Lakhs, you are exempt from standard GST registration but must obtain an Enrollment ID.

2. What is the minimum turnover limit for GST registration for e-commerce sellers?

For inter-state sellers, the limit is zero (registration is mandatory). For intra-state sellers of goods, the limit is ₹40 Lakhs (or ₹20 Lakhs in special category states). Service providers generally have a threshold of ₹20 Lakhs.

3. Can I sell online without a GST number?

Yes, but only if you are an intra-state seller of goods with a turnover below the threshold (₹40 Lakhs/₹20 Lakhs). In this case, you do not need a GSTIN, but you must apply for an Enrollment ID on the GST portal to list your products on marketplaces like Meesho or Amazon.

4. What is the difference between TCS and TDS for e-commerce?

TCS (Tax Collected at Source) is a 1% levy collected under GST law by the platform (like Amazon) which you can claim back in your GST cash ledger. TDS (Tax Deducted at Source) is a 0.1% levy (updated rate) deducted under Income Tax law, which you can claim as a refund when filing your annual Income Tax Return.

5. Can e-commerce sellers opt for the Composition Scheme?

Yes. Under the new rules (Oct 2023), sellers of goods can opt for the Composition Scheme (paying a flat 1% tax) provided they sell only within their state. If they make even one inter-state sale, they are ineligible.

6. Do I need to file GST returns if I have zero sales in a month?

Yes. You must file a Nil Return for GSTR-1 and GSTR-3B even if you had zero sales. Failure to file will result in late fees and could lead to your GST number being suspended.

7. What is an Enrollment ID in GST?

An Enrollment ID is a simplified registration number for small, intra-state e-commerce sellers who are exempt from full GST registration. It allows them to onboard onto e-commerce platforms without a full GSTIN.

8. Who pays GST for services like Urban Company or Swiggy?

For specific services like passenger transport, housekeeping, or restaurant services sold via an app, the E-commerce Operator (the App) is liable to pay GST under Section 9(5) of the CGST Act. The individual service provider (e.g., the driver or plumber) does not need to pay GST on these transactions.

9. How do I claim the 1% TCS deducted by Amazon?

To claim TCS, log in to the GST Portal, navigate to Services > Returns > TDS and TCS credit received. You will see the amount deducted by the platform. Select the record and click "Accept" to transfer the amount to your Electronic Cash Ledger.

10. What is the GST rate for dropshipping?

The GST rate depends on the HSN code of the product you are selling (e.g., 18% for electronics, 5% for apparel). In dropshipping, ensure you bill the customer with the correct tax type (IGST for inter-state, CGST+SGST for intra-state) based on the "Place of Supply."

11. Can I use a virtual office for GST registration?

Yes. E-commerce sellers who operate from home but don't want to make their address public often use a Virtual Office address for GST registration. However, you must have valid proof of address (Rent Agreement + NOC) for that location.

12. What documents are required for e-commerce GST registration?

You typically need:

- PAN Card of the business/owner.

- Aadhaar Card.

- Proof of Business Address (Electricity bill/Rent agreement).

- Cancelled Cheque/Bank Statement.

- Photograph of the owner.

13. What happens if I don’t register for GST but sell online?

If you are required to register and don't, you face a penalty of 100% of the tax due or ₹10,000, whichever is higher. Additionally, e-commerce platforms will block your account as they are legally required to ensure seller compliance.

14. Is e-invoicing mandatory for e-commerce sellers?

E-invoicing is currently mandatory only for businesses with an annual turnover exceeding ₹5 Crores. If your turnover is below this limit, you do not need to generate IRN (Invoice Reference Numbers) for your B2B invoices.

15. Can I get a GST refund if my business shuts down?

Yes. If you have excess balance in your Electronic Cash Ledger (from TCS or excess payments) when you cancel your GST registration, you can apply for a refund using Form GST RFD-01. However, accumulated Input Tax Credit (ITC) generally lapses upon closure.

Contact Us

An expert will call you within 24 hours. No payment required to get started.

Related Post

How should a start-up complete ITR filing

Business entities must file their ITR annually to comply with the tax laws of their respective countries. It helps the government assess and collect the appropriate amount of income tax from taxpayers and ensures proper accountability of financial activities.

. 3 Mins.png)

5 step checklist for GST compliance in Indian Startups

Learn about how GST works. The basics of GST along with its compliances. Uncover what your business needs to keep in mind concerning GST rules and GST compliance.

. 3 min read.png)

₹20 Lakhs and Beyond: Understanding GST for Freelancers in India

Are you a freelancer or aspiring to be one? In this blog, uncover the basics of freelancing and requirements involving GST. Learn about all the exemptions, obligations, and compliances of GST for freelancers in india.

. 5 min read