Mandatory Annual Compliances for a Private Limited Company | Checklist

By Filing Buddy . 30 Dec 25

The Compliance Reality Most Founders Discover Too Late

Most founders think annual compliances are something you deal with only when your company starts making money.

No revenue? No transactions? Then surely there’s nothing to file… right?

That assumption is one of the most common and expensive compliance mistakes Private Limited Companies make.

In reality, once a company is incorporated, annual compliances don’t pause, even if business activity does. Miss a filing, delay a form, or assume “we’ll do it later,” and the consequences quietly start adding up, penalties, blocked filings, even director-level issues. And the worst part? Most of this doesn’t happen because founders are careless, but because the compliance landscape feels confusing, scattered, and overly technical.

That’s exactly why this guide exists.

In this blog, we’ll walk you through mandatory annual compliances for a Private Limited Company in a clear, practical way, what they are, who they apply to, what needs to be filed, when it needs to be done, and what happens if you miss something. You’ll also learn about common misconceptions, frequent mistakes companies make, and simple ways to stay compliant without stress.

Think of this as a complete, no-fluff checklist which is explained the way a compliance buddy would, not buried in legal language. And if at any point compliances start feeling overwhelming, platforms like Filing Buddy exist for exactly this reason: to help founders stay compliant, confident, and focused on growing their business.

Let’s break it down, step by step.

What Are Annual Compliances for a Private Limited Company?

Annual compliances are the mandatory legal and tax-related filings that every Private Limited Company must complete every financial year, irrespective of profit, loss, or business activity.

Once your company is incorporated and active on government records, these compliances become a recurring responsibility, not a one-time task.

Think of them as a yearly health check for your company. They confirm that your business is:

- Legally active

- Financially transparent

- Properly governed

What Do Annual Compliances Include?

Annual compliances aren’t a single filing. They’re a set of connected obligations spread across the year, including:

- Conducting mandatory meetings

- Preparing and auditing financial statements

- Filing returns with regulatory authorities

- Updating director and company information

Each compliance serves a specific purpose, but together they keep your company credible and compliant.

Which Authorities Are Involved?

A Private Limited Company reports to multiple regulators, not just one. This is where many founders get confused.

Annual compliances usually involve filings with:

- Ministry of Corporate Affairs (MCA): for company law compliances

- Registrar of Companies (ROC): for annual returns and financial statements

- Income Tax Department: for income tax returns and audits

- GST Department: if the company is registered under GST

Missing a filing with any one of these can still make your company non-compliant.

Who Must Follow Annual Compliances?

This applies to every Private Limited Company, including:

- Newly incorporated companies

- Companies with no revenue or no transactions

- Loss-making companies

- Companies that are temporarily inactive but not closed

If your company exists on the MCA portal and hasn’t been legally struck off, annual compliances apply. Business activity does not determine applicability.

Why Do These Compliances Exist?

Annual compliances are meant to ensure:

- Transparency in financial reporting

- Accountability of directors

- Accuracy of public company records

From a business perspective, timely compliance helps you:

- Avoid penalties and notices

- Maintain clean regulatory records

- Approach audits, funding, or due diligence with confidence

How Are Annual Compliances Usually Handled?

Most companies manage annual compliances by:

- Closing books after the financial year

- Completing statutory audits

- Filing ROC and tax returns post-AGM

This is also where structured support helps. Platforms like Filing Buddy track deadlines, manage filings, and reduce the risk of missing critical compliances, without founders having to micromanage forms or portals.

In the next section, we’ll address an important question most founders ask early on:

Does this apply to your Private Limited Company, or are there exceptions?

Does This Apply to Your Private Limited Company? Let’s Clear the Confusion

This is one of the most searched and misunderstood questions:

“Do annual compliances really apply to my company?”

If your company is registered with the Ministry of Corporate Affairs (MCA) and hasn’t been legally closed, the answer is yes, regardless of revenue, activity, or stage.

Annual compliances are tied to legal existence, not business performance.

When Annual Compliances Are Mandatory

Annual compliances apply if your company is:

- Incorporated under the Companies Act

- Active, inactive, or temporarily paused

- Generating revenue, losses, or nil turnover

They do not apply only when the company is:

- Legally struck off

- Dissolved after formal closure

As long as your company exists on the MCA portal, compliances apply.

Applicability Based on Company Status

Here’s a simple way to understand how different company situations are treated:

The law doesn’t evaluate how busy your company was.

It only checks whether it exists on record.

“We Haven’t Started Operations Yet”, Does That Change Anything?

This is another common misconception.

Even if:

- Business hasn’t commenced

- No bank transactions happened

- No contracts were signed

Your company still needs to:

- Prepare basic financial statements

- Conduct statutory audit

- File annual returns with ROC

- File Income Tax Return

The filings may be simpler, but they cannot be skipped.

What About Start-ups and Small Companies?

Company law doesn’t scale compliances based on size or age.

For core annual filings:

- Startups and large companies are treated similarly

- There is no blanket exemption for small companies

- Reduced penalties may apply in some cases, but filing obligations remain

So yes, even early-stage startups must stay compliant from year one.

How Do You Know Exactly What Applies to You?

While the obligation to comply is universal, the exact set of filings can vary based on factors like:

- GST registration

- Turnover thresholds

- Loans, deposits, or MSME relationships

This is where founders often feel stuck, not because compliances are optional, but because applicability differs slightly from company to company.

Having a clear checklist or structured support from platforms like Filing Buddy helps ensure you’re filing what applies to your business, not everything under the sun.

If you’re still wondering whether “no activity” gives you any leeway, the next section addresses the most expensive assumption founders make and why it causes more trouble than expected.

“We Didn’t Do Any Business”: The Most Expensive Assumption

This line sounds harmless. Logical, even.

No sales, no invoices, no activity, so what’s there to comply with?

This assumption is where many Private Limited Companies quietly slip into non-compliance.

The truth is, company law doesn’t track effort or activity.

It tracks existence.

The moment a company is incorporated, certain responsibilities apply every year, whether or not business actually happened.

Here’s why this assumption becomes costly:

- Annual filings are still expected, even with nil transactions

- Financial statements still need to be prepared (even if numbers are zero)

- Audits and returns still need to be filed within timelines

Founders usually realise this much later, when late fees have piled up, DINs are blocked, or a simple filing suddenly turns into damage control.

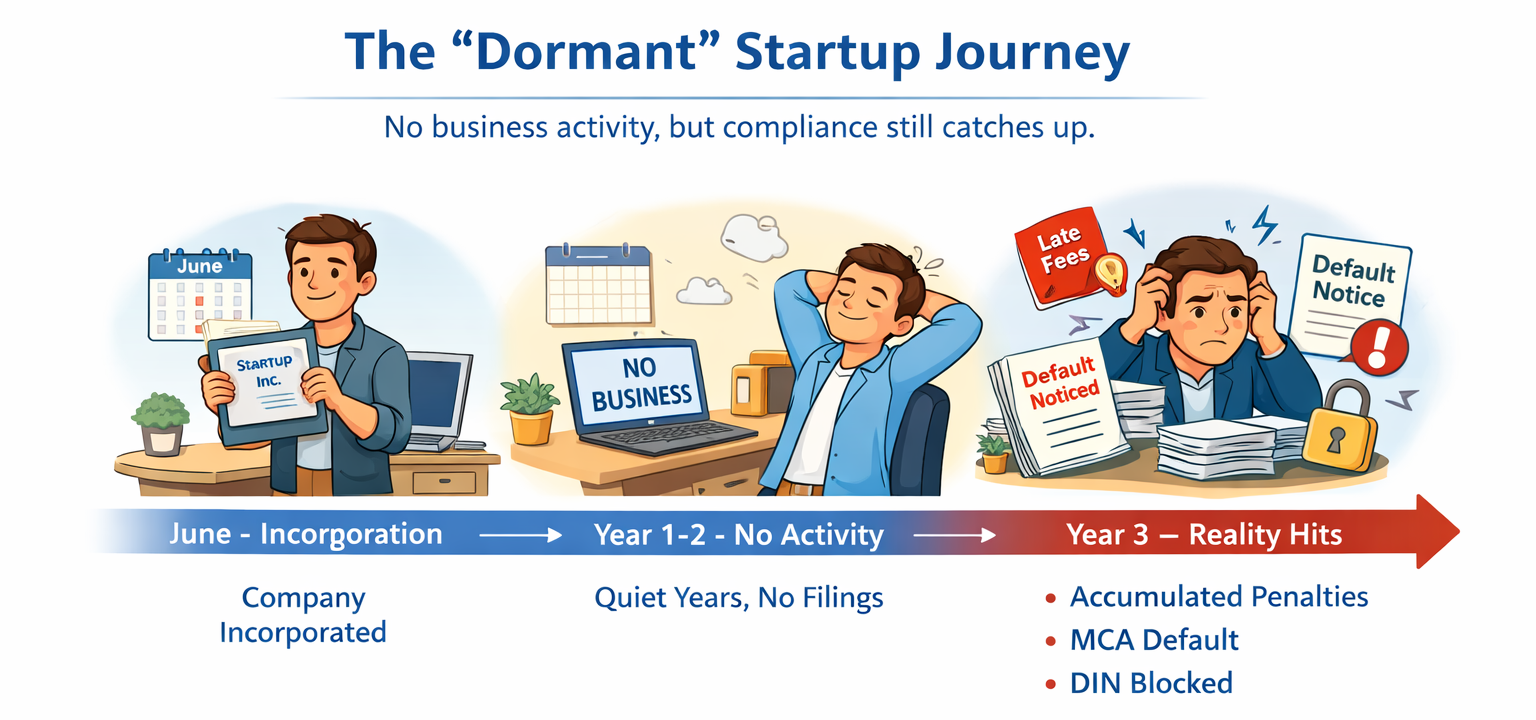

Example: The “Dormant” Startup

A tech startup incorporated in June planned to start operations after fundraising.

No product launch. No revenue. No bank transactions.

The founders assumed compliances could wait.

Two years later, when they tried to regularise filings:

- Late fees had already accumulated automatically

- MCA records showed continuous default

- Directors faced compliance restrictions

What could’ve been routine filings turned into a costly clean-up.

As your compliance buddy would say:

It’s not the lack of business that creates trouble, it’s the delay in accepting that compliances don’t wait.

Catching this early keeps things simple. Ignoring it is what makes it expensive.

Now that we’ve addressed the most common misconception, let’s look at what compliance actually looks like in practice: the filings, timelines, and steps every Private Limited Company must follow each year.

Mandatory Annual Compliance Checklist & Filing Cycle for a Private Limited Company

This is the heart of annual compliance, the “what to file and when” part.

If compliances ever felt overwhelming, it’s usually because the filings are spread across the year and across departments.

So instead of treating them as isolated tasks, it helps to see them as a single annual cycle that repeats every financial year.

Let’s walk through that cycle step by step.

How the Annual Compliance Cycle Works (Big Picture)

Every year, a Private Limited Company follows this broad flow:

- Financial year ends (31st March)

- Books of accounts are prepared

- Statutory audit is conducted

- Annual General Meeting (AGM) is held

- ROC forms and tax returns are filed

Once you understand this sequence, compliances stop feeling random.

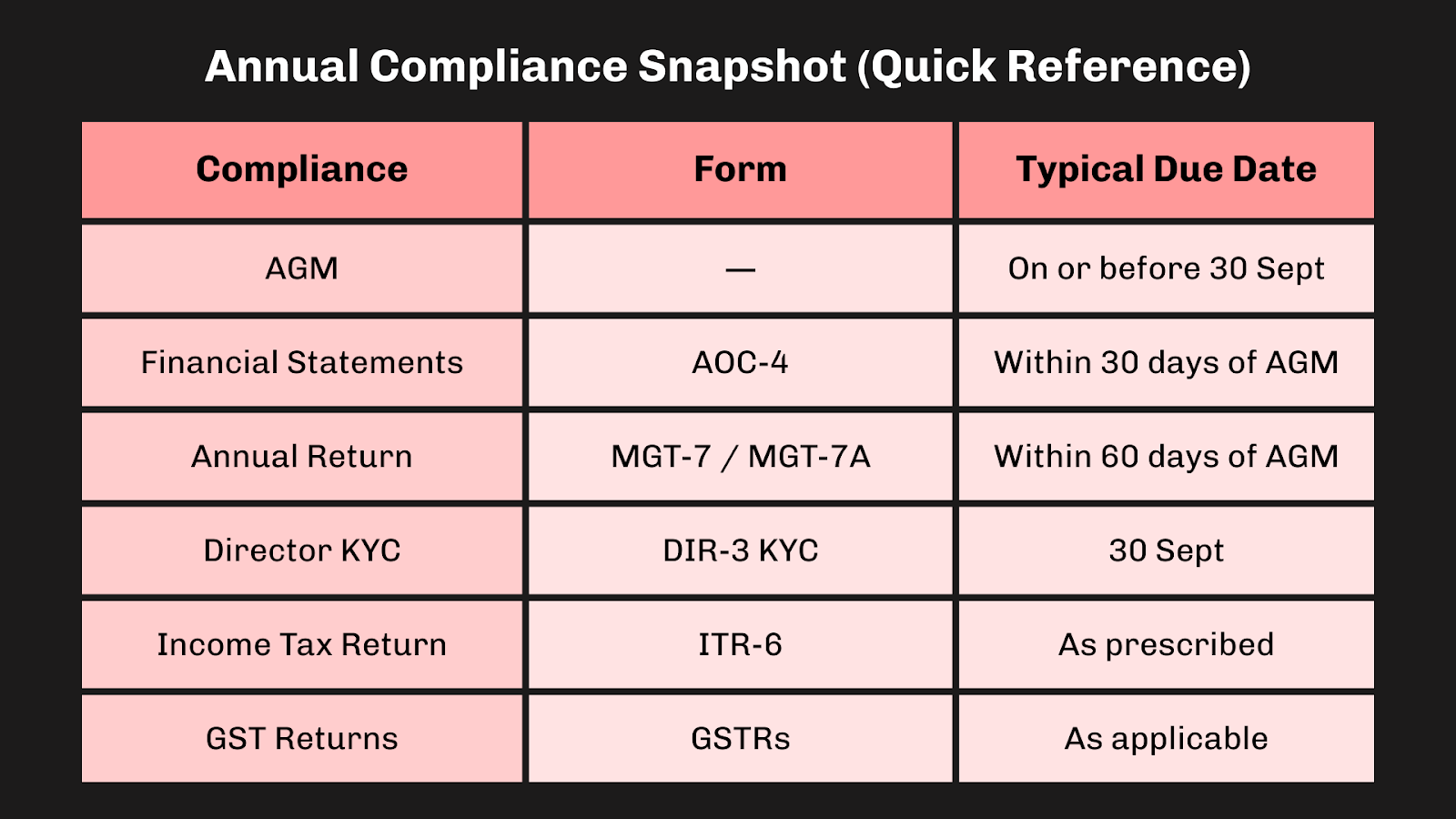

Key Annual Compliances You Must Complete

1. Annual General Meeting (AGM)

Every Private Limited Company must hold an AGM to formally approve its annual affairs.

Key points to know:

- First AGM: Within 9 months from the end of the first financial year

- Subsequent AGMs: On or before 30th September

- Gap between two AGMs should not exceed 15 months

In the AGM, shareholders approve:

- Financial statements

- Auditor’s report

- Company’s overall performance

No AGM means the entire filing cycle gets affected.

2. Preparation of Financial Statements

After the financial year ends, the company must prepare:

- Balance Sheet

- Profit & Loss Account

- Notes to Accounts

- Cash Flow Statement (in most cases)

Even if there was no business activity, these statements are still prepared with just nil or minimal figures.

3. Statutory Audit

Statutory audit is mandatory for every Private Limited Company, irrespective of turnover or profit.

Important points:

- Conducted by a Chartered Accountant

- Audit report is compulsory for ROC filings

- Applies even to nil turnover or loss-making companies

“No income” does not mean “no audit.”

4. Filing of AOC-4 (Financial Statements)

Once the AGM is completed, financial statements must be filed with the ROC.

Details:

- Form: AOC-4

- Due date: Within 30 days of AGM

- Includes financials, auditor’s report, and director’s report

Late filing attracts daily penalties, so timelines matter here.

5. Filing of MGT-7 / MGT-7A (Annual Return)

This filing captures the legal snapshot of your company.

Details:

- Form:

- MGT-7 (most Private Limited Companies)

- MGT-7A (for OPCs)

- Due date: Within 60 days of AGM

It includes:

- Shareholding pattern

- Director details

- Registered office information

This form tells the ROC that your company is legally in order.

6. Director KYC (DIR-3 KYC)

Every individual holding a DIN must complete KYC every year.

Key points:

- Due date: 30th September

- Applies to all directors, active or inactive

- Non-filing leads to DIN deactivation

If a director’s DIN is blocked, the company cannot complete ROC filings.

7. Income Tax Return Filing

Private Limited Companies must file income tax returns annually.

Key points:

- Mandatory even for losses or nil income

- Audit-linked due dates usually apply

- Filing is separate from ROC compliance

This keeps your company compliant with the Income Tax Department.

8. GST Annual Compliances (If Registered)

If your company is registered under GST:

- Monthly or quarterly returns must be filed

- Annual return may be applicable depending on turnover

Nil turnover does not automatically remove GST filing obligations.

9. Other Conditional Annual Filings

Some compliances apply only if certain conditions are met, such as:

- DPT-3 (loans or deposits)

- MSME Form I (pending MSME payments)

- ADT-1 (auditor appointment confirmation, where applicable)

These aren’t required for everyone, but missing them when applicable still counts as non-compliance.

Seen as a cycle, annual compliances become far more manageable.

And this is exactly where having a system or support from platforms like Filing Buddy helps founders stay on track without constantly worrying about deadlines.

Knowing the checklist is one thing. Getting it wrong is another. Up next, let’s look at where companies usually slip and the real impact of those mistakes.

Common Annual Compliance Mistakes and Their Real Business Impact

Most compliance issues don’t happen because founders are careless.

They happen because compliances are assumed to be routine, low-risk, or postponable.

On paper, these mistakes look minor. In reality, they quietly affect credibility, timelines, and future decisions.

Here are the most common places where Private Limited Companies slip and what it actually costs them.

1. Skipping Filings Because There Was “No Business Activity”

As discussed earlier, assuming “no business means no compliance” is one of the most damaging misconceptions. Beyond that, many companies still make avoidable execution errors even when they know filings are required.

2. Missing Statutory Deadlines

Many companies file, but not on time.

Annual compliances follow a strict calendar under the Companies Act and Income Tax Act. Missing deadlines, even by a few days, triggers daily penalties.

Real impact:

- Daily late fees with no waiver

- DIN deactivation risk for directors

- Weak compliance history during audits or due diligence

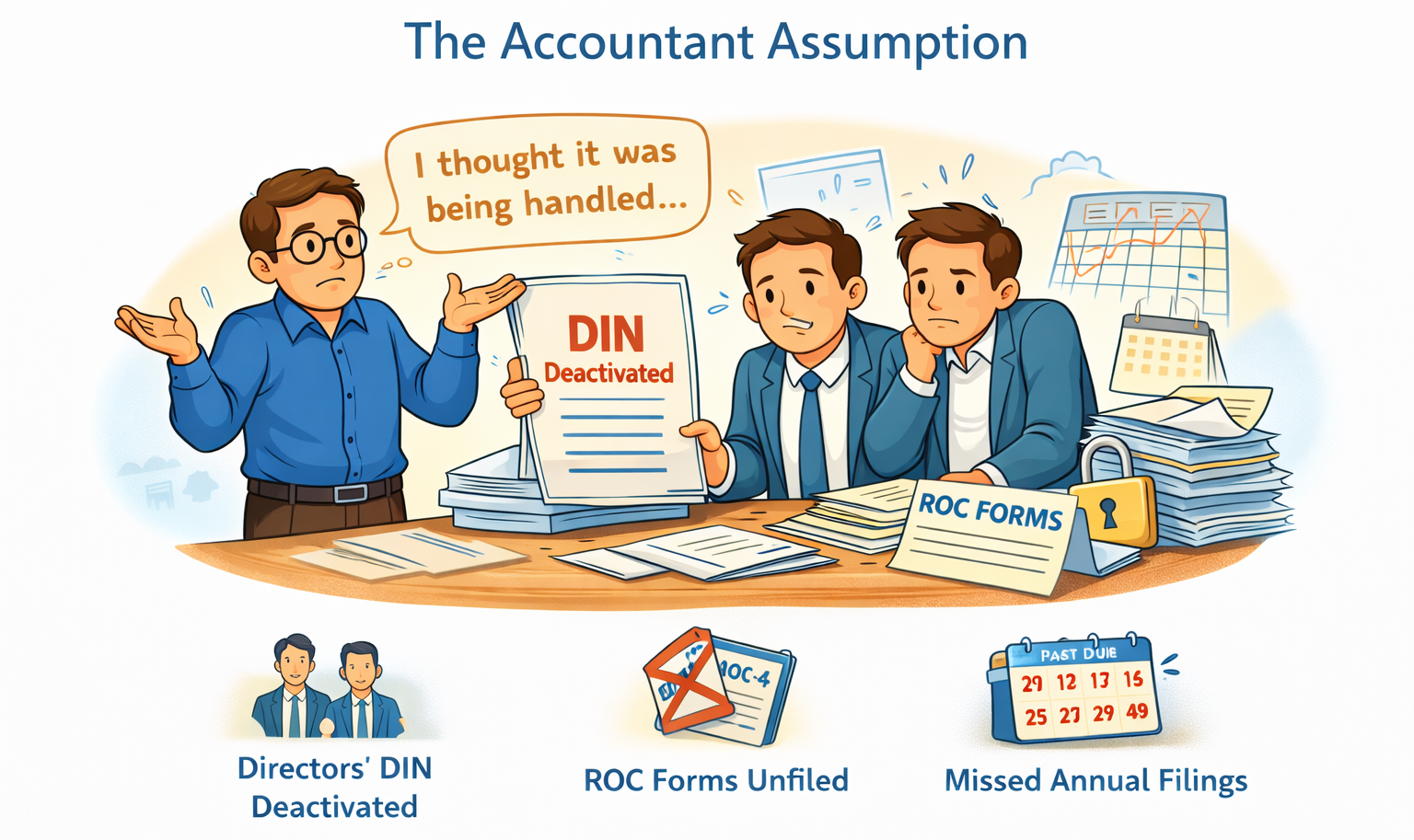

This is often where another issue quietly creeps in: assumed ownership.

In one services company, accounting was done regularly and books were maintained. The founders believed compliance was “being handled” internally. But director KYC wasn’t actively tracked, ROC filings weren’t reviewed, and deadlines were assumed to be managed.

The problem surfaced suddenly. A director’s DIN was deactivated. ROC forms couldn’t be filed. Annual filings stalled across the board.

Nothing went wrong due to intent or effort.

What failed was clarity.

Compliance didn’t break because of one missed form, it broke because responsibility was assumed, not defined.

3. Treating Compliance as a “Year-End Task”

Compliance isn’t a once-a-year activity, it’s a cycle.

When accounting, documentation, and statutory records aren’t maintained throughout the year, filings become rushed and error-prone.

Real impact:

- Inaccurate or inconsistent filings

- Increased chances of notices

- Higher professional fees to fix avoidable errors

4. Ignoring Director-Level Responsibilities

Many founders assume compliance is only a company-level obligation.

In reality, directors are personally accountable for certain defaults.

Real impact:

- Director penalties under the Companies Act

- Disqualification risk for repeated defaults

- Personal credibility impact in future ventures

5. Relying on Incomplete or Informal Advice

Templates, online forums, or “someone told me this” often replace professional guidance.

Compliance laws change frequently and what worked last year may not work today.

Real impact:

- Wrong filings or incomplete disclosures

- Revisions, additional filings, and notices

- Loss of time fixing mistakes instead of building the business

The Bigger Picture

Compliance mistakes rarely shut a company down overnight.

They accumulate silently until funding, expansion, or closure is on the table.

Staying compliant isn’t about memorising rules.

It’s about having clarity, consistency, and systems that prevent small gaps from turning into big problems.

Up next, we’ll look at what these mistakes legally and financially lead to when they’re not corrected in time.

Penalties & Consequences of Non-Compliance

While mistakes explain where companies slip, this section explains what those slips actually lead to if they aren’t corrected in time.

Missing annual compliances rarely feels urgent.

There’s no instant shutdown or immediate notice.

But non-compliance works quietly, penalties accumulate, records get flagged, and consequences surface when you least expect them.

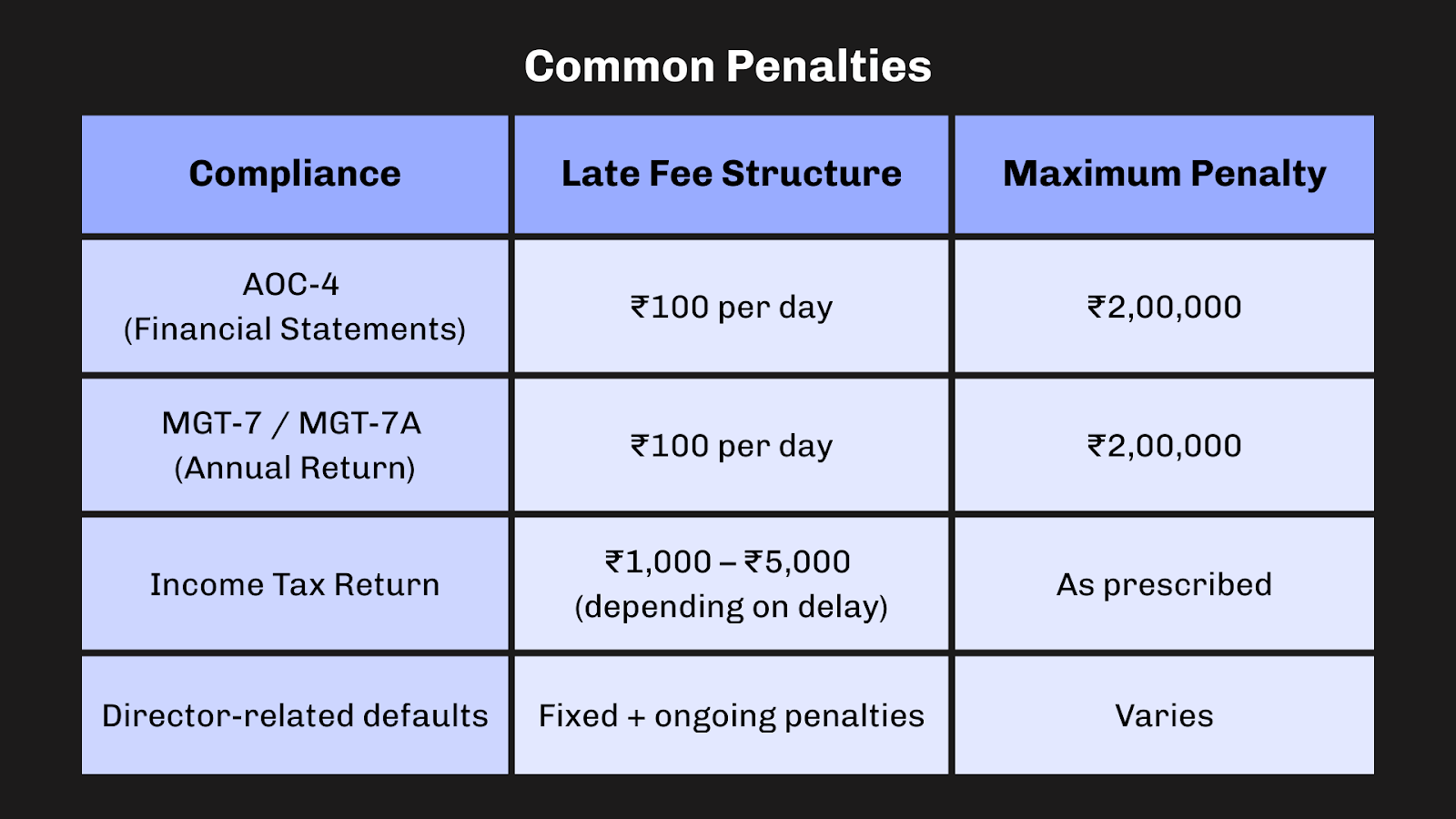

1. Monetary Penalties That Keep Adding Up

Most annual filings under the Companies Act attract per-day late fees.

This means the longer you delay, the more expensive it becomes, automatically.

Here’s a simplified view of common penalties:

The key point: late fees are system-driven.

There’s no negotiation later.

2. Director-Level Consequences (Often Overlooked)

Non-compliance doesn’t stop at the company level.

Directors carry personal responsibility under the Companies Act.

Common consequences include:

- DIN deactivation for continuous defaults

- Restrictions on signing future filings

- Risk of director disqualification in severe or repeated cases

For founders planning future ventures, this can quietly block opportunities.

3. MCA & Regulatory Red Flags

Repeated non-compliance reflects directly on your company’s public records.

This can lead to:

- Increased scrutiny during future filings

- Difficulty in regularising past defaults

- Higher chances of notices and clarifications

These flags don’t disappear easily, they follow the company.

4. Impact Beyond Paperwork

This is where non-compliance hurts the most, outside paperwork.

It often shows up during:

- Investor due diligence

- Bank loan processing

- Mergers, acquisitions, or closures

Example: The Fundraising Delay Nobody Planned For

A D2C brand had been operating smoothly for two years and was in talks with an angel investor.

Revenue was decent. Growth looked promising.

During due diligence, the investor’s team flagged something unexpected:

- One year’s MGT-7 filing was delayed

- AOC-4 was filed late with penalties

- MCA records showed a compliance gap

Nothing illegal. Nothing fraudulent.

But the investor paused.

The result?

- Funding was delayed by several months

- Legal clean-up costs increased

- The founder had to justify a compliance lapse instead of pitching growth

The lesson:

Non-compliance doesn’t always stop your business, it slows down the opportunities that matter most.

Even small compliance gaps can:

- Delay deals

- Reduce valuation

- Force costly clean-up exercises

What could have been a routine filing quietly turns into a credibility discussion and those discussions often cost time, momentum, and focus.

5. Stress, Time Loss & Unplanned Costs

Beyond penalties, non-compliance creates:

- Last-minute panic

- Higher professional fees to fix past mistakes

- Time lost explaining preventable issues

As your compliance buddy would put it:

It’s rarely the penalty alone that hurts, it’s the mess around it.

The Practical Takeaway

Penalties are just the visible part.

The real cost of non-compliance is lost control, delayed growth, and avoidable stress.

That’s why companies that treat compliance as a system, not a yearly task, stay ahead without firefighting every year.

How Smart Companies Stay Compliant Without Stress

The difference between companies that constantly fight compliance issues and those that stay relaxed about it isn’t luck, it’s structure.

Smart companies don’t try to remember every rule or chase deadlines at the last minute. They build simple systems that keep compliances running quietly in the background.

Here’s what that looks like in practice.

1. They Treat Compliance as a Year-Round Process

Annual compliances are the outcome of what happens throughout the year.

Smart companies:

- Maintain books regularly

- Track compliance status periodically

- Avoid year-end rush and reactive filings

This keeps errors and penalties away.

2. They Maintain Clean and Updated

Accurate records make compliance boring and that’s a good thing.

This includes:

- Properly maintained financial statements

- Updated statutory registers

- Clear documentation for board meetings and resolutions

When records are in order, filings become predictable and smooth.

3. They Set Clear Ownership and Accountability

Compliance doesn’t work well when “someone” is responsible.

Smart companies:

- Clearly assign compliance ownership

- Ensure directors understand their responsibilities

- Avoid assumptions that the CA or accountant is handling everything

Clarity here prevents gaps and miscommunication.

4. They Use Systems, Reminders, and Professional Support

Calendars and reminders help, but they aren’t enough on their own.

Smart companies rely on:

- Structured compliance calendars

- Professional review before filings

- Support that understands both legal requirements and business realities

This reduces dependency on memory and avoids avoidable mistakes.

5. They Fix Small Gaps Before They Become Big Problems

Small delays are easier to fix than accumulated defaults.

Smart companies:

- Regularise minor non-compliances early

- Act on notices immediately instead of postponing

- Treat compliance warnings as signals, not interruptions

This keeps the compliance track record clean over time.

The Calm Advantage

When compliance is handled systematically, it fades into the background.

No panic. No last-minute rush. No unpleasant surprises.

That’s how companies protect credibility, avoid penalties, and stay focused on growth.

Conclusion

Annual compliances can sometimes feel like a background task that keeps interrupting your real work. But they’re not just forms and deadlines, they’re what quietly protect your company from penalties, surprises, and future roadblocks.

Every missed filing is more than a compliance lapse. It’s a risk to your credibility, your plans, and your peace of mind. When compliances are handled on time and done right, they fade into the background, exactly where they belong.

Feeling unsure about what needs to be filed or when? Let Filing Buddy take care of your annual compliances, so you can focus on building your business without the constant compliance stress.

FAQs

Mandatory Annual Compliances for a Private Limited Company

1. Are annual compliances mandatory for a Private Limited Company with no business activity?

Yes. Annual compliances apply as long as the company exists legally, even if there is no turnover or transactions.

2. What happens if a Private Limited Company misses annual compliances?

Late fees accumulate, company records get flagged, and directors may face DIN deactivation or penalties.

3. Is statutory audit mandatory for nil turnover companies?

Yes. Every Private Limited Company must undergo statutory audit irrespective of income or activity.

4. What are the main annual ROC filings for a Private Limited Company?

AOC-4 for financial statements and MGT-7/MGT-7A for annual returns.

5. What is the due date for filing AOC-4 and MGT-7?

AOC-4 is due within 30 days of AGM, and MGT-7 within 60 days of AGM.

6. Is AGM mandatory every year for a Private Limited Company?

Yes. AGM is compulsory, except in limited cases like OPCs, as per the Companies Act.

7. What is DIR-3 KYC and why is it important?

DIR-3 KYC is an annual director verification. Missing it leads to DIN deactivation.

8. Can penalties for late filing be waived?

Generally no. Most penalties are system-driven and cannot be negotiated once triggered.

9. Does a startup get any exemption from annual compliances?

No blanket exemption exists. Startups must follow core annual compliance requirements like any other company.

10. What is the penalty for late filing of AOC-4 or MGT-7?

₹100 per day, subject to a maximum of ₹2,00,000 per form.

11. Are income tax returns mandatory for loss-making companies?

Yes. Filing income tax returns is mandatory even if the company reports losses.

12. What happens if a director’s DIN is deactivated?

The director cannot sign or file ROC forms until the DIN is reactivated.

13. Do GST-registered companies have additional annual compliances?

Yes. They must file GST returns and annual GST filings as applicable, even for nil turnover in some cases.

14. How can companies track annual compliance deadlines easily?

By using structured compliance calendars or professional platforms that monitor deadlines centrally.

15. How does Filing Buddy help with annual compliances?

Filing Buddy helps track deadlines, prepare filings, and ensure companies stay compliant without last-minute stress.

Contact Us

An expert will call you within 24 hours. No payment required to get started.

Related Post

How to Obtain a Company Registration Number in India

Understanding Corporate Identification Numbers (CINs) and How to Obtain Them in India

. 2 mins.png)

Difference between Udyog Adhaar and Udyam Certificate

Want to get registered for Udyog Aadhar and Udyam Certificate? Here is their registration processes. Also, know about their differences. Explore their features, benefits, and processes to register online for each, helping you to choose the right option as per your need.

. 3 min read.png)

Changing Your Bank Signatory? Here are the Y Documents Required by Most Banks in India

Learn how bank signatory is important for financial workflow. Know why bank signatories are important and discover the documents required to change signature of your signatory.

. 5 min read