Section 17(5) Blocked Credits Explained | ITC Guide

By Filing Buddy . 09 Feb 26

What is Section 17(5)?

In simple terms, it is the Blocked Credit list.

Usually, GST works on a continuous chain: you pay tax on purchases and offset it against the tax you collect on sales. However, Section 17(5) breaks this chain. Even if an expense is 100% for your business, if it falls under this section, you cannot use the tax paid as a credit. It becomes a cost to your company rather than an asset.

Why does it exist?

The government blocked these specific items to:

- Prevent personal expenses being passed off as business expenses (like luxury cars or food).

- Avoid "leakage" of revenue on items that are consumed and don't contribute directly to a further taxable sale.

List of blocked input tax credits under Section 17(5) by its specific clauses

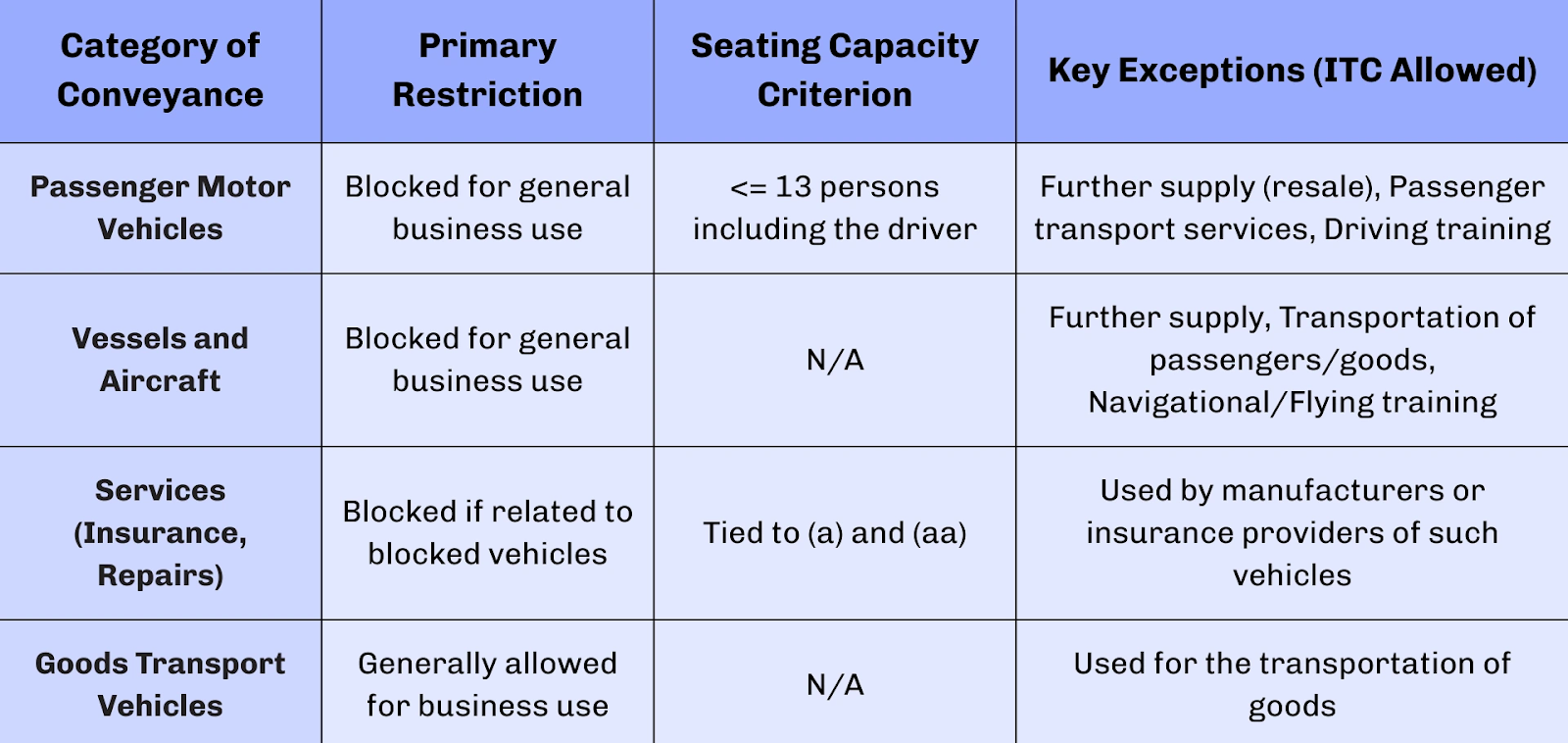

1. Conveyance & Transportation

- 17(5)(a): Motor Vehicles for Passenger Transport

- Blocked: Vehicles with a seating capacity of <= 13 persons (including the driver).

- Exceptions (ITC Allowed): If used for further supply (car dealers), transportation of passengers (cabs/buses), or imparting driving training.

- 17(5)(aa): Vessels and Aircraft

- Blocked: Generally blocked for business use.

- Exceptions (ITC Allowed): If used for goods transportation, further supply, passenger transport, or training (navigating/flying).

- 17(5)(ab): Related Services

- Blocked: General insurance, servicing, repair, and maintenance for the vehicles/vessels/aircraft mentioned above.

- Exceptions (ITC Allowed): If the vehicle itself is eligible for ITC, or if received by a vehicle manufacturer/general insurance provider.

Here is the Summary related to Conveyance & Transportation:

2. Personal Services & Employee Benefits

- 17(5)(b): Food, Beverages, and Lifestyle

- Blocked: Food and beverages, outdoor catering, beauty treatment, health services, cosmetic and plastic surgery.

- Blocked: Life insurance and health insurance.

- Blocked: Membership of a club, health, and fitness center.

- Exceptions (ITC Allowed):

- If it is obligatory for an employer to provide these to employees under any law.

- If used for making an outward taxable supply of the same category (e.g., a restaurant buying food items).

3. Travel Benefits

- 17(5)(b)(iii): Employee Vacation Travel

- Blocked: Travel benefits extended to employees on vacation such as Leave Travel Concession (LTC) or Home Travel Concession (HTC).

- Exception: Allowed only if it's a statutory obligation for the employer.

4. Construction & Real Estate

- 17(5)(c): Works Contract Services

- Blocked: When supplied for the construction of immovable property (other than plant and machinery).

- Exception: Allowed if it is an input service for a further supply of works contract service (sub-contracting).

- 17(5)(d): Self-Construction

- Blocked: Goods or services received for construction of immovable property on own account (even if used for business).

- Note: ITC is allowed for "Plant and Machinery" (apparatus/equipment fixed to earth), but not for buildings or civil structures.

5. Specific Taxpayers & CSR

- 17(5)(e): Composition Scheme

- Blocked: Goods or services on which tax has been paid under the Composition Levy (Section 10).

- 17(5)(f): Non-Resident Taxable Person

- Blocked: Goods or services received by a non-resident.

- Exception: ITC is allowed on GST paid on imported goods.

- 17(5)(fa): CSR Expenditure (Newer Amendment)

- Blocked: Goods or services used for activities relating to Corporate Social Responsibility (CSR).

Composition Scheme, Non-Residents, and Enforcement: Clauses (e, f, i)

Specific categories of taxpayers and enforcement actions are subject to fundamental ITC restrictions.

- Composition Taxpayers (Sec 10): These taxpayers pay tax at a fixed rate on their turnover and are strictly prohibited from claiming any ITC on their purchases.

- Non-Resident Taxable Persons (NRTP): NRTPs cannot claim ITC on domestic purchases. However, they are permitted to claim ITC on the Integrated Goods and Services Tax (IGST) paid on the import of goods.

- Personal Consumption (Sec 17(5)(g)): If goods or services are used for the personal consumption of owners or employees, ITC is strictly disallowed. If an asset is used for both business and personal purposes, credit is restricted to the business portion based on common credit formulas.

- Enforcement Actions (Sec 17(5)(i)): ITC is blocked on any tax paid due to non-payment or short payment of tax, excess refund of tax, or credit utilized fraudulently or through willful misstatement. This includes taxes paid following confiscation and seizure of goods under Sections 74, 129, and 130.

Personal Use & Lost Goods

- 17(5)(g): Goods or services used for personal consumption.

- 17(5)(h): Goods lost, stolen, destroyed, written off, or disposed of by way of gift or free samples.

- 17(5)(i): Any tax paid due to fraud, wilful misstatement, suppression of facts, or seizure of goods (under Sections 74, 129, and 130).

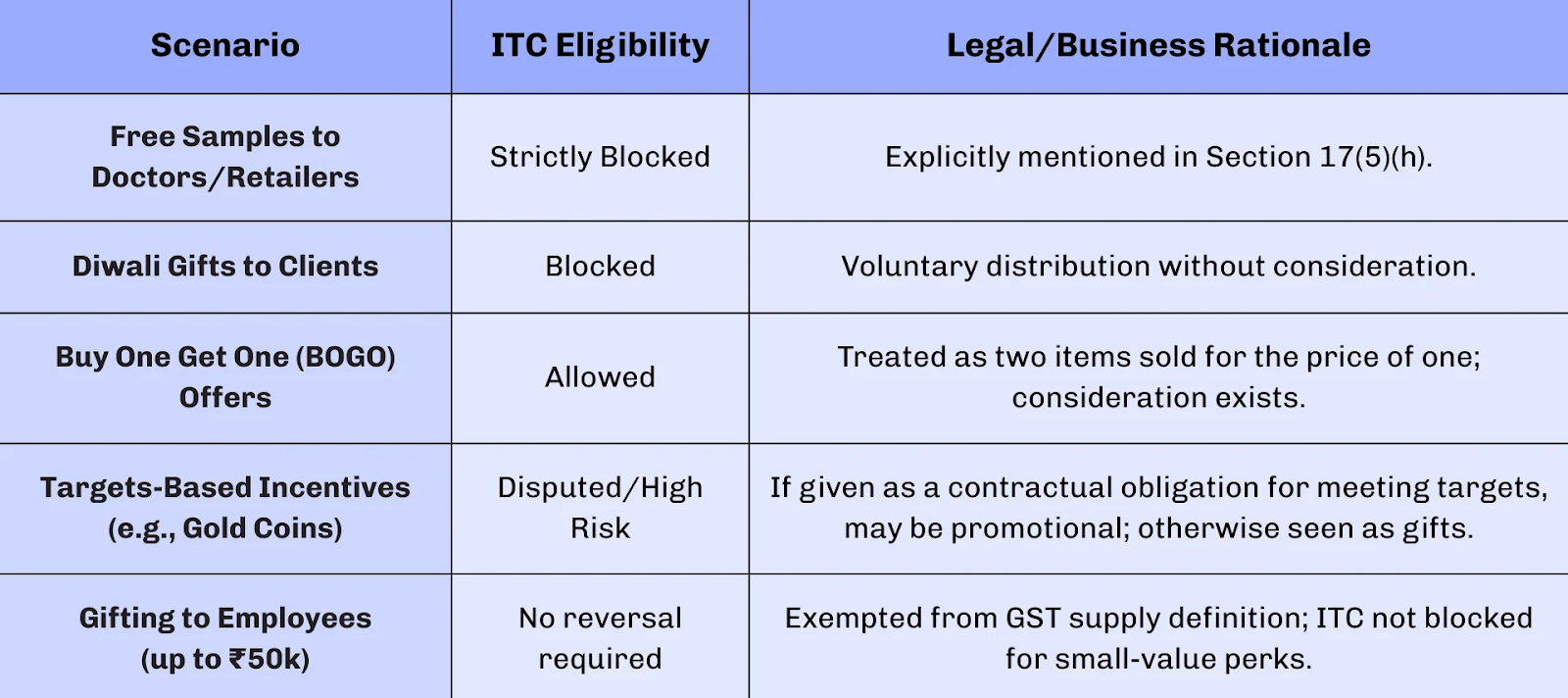

Gifts, Promotional Items, and Free Samples: Clause (h)

Section 17(5)(h) blocks ITC on goods lost, stolen, destroyed, written off, or disposed of by way of gift or free samples. This provision is rooted in the rationale that if no tax is payable on the output supply (because the goods are taken away from the business without consideration), no ITC should be available on the inputs.

The "Gift vs. Business Promotion" Distinction

The definition of a "gift" is central to this clause. A gift is commonly defined as a voluntary transfer of property without any consideration or contractual obligation. In common parlance, a gift is made out of love or affection and cannot be demanded as a right.

The Madras High Court recently intervened in a case where the department refused ITC under Section 17(5) without specifying the reason or the exact clause attracted. The Court set aside the order, emphasizing that the taxpayer must be made aware of the specific matter needing fulfilment, thereby reinforcing the principle of natural justice in ITC disputes.

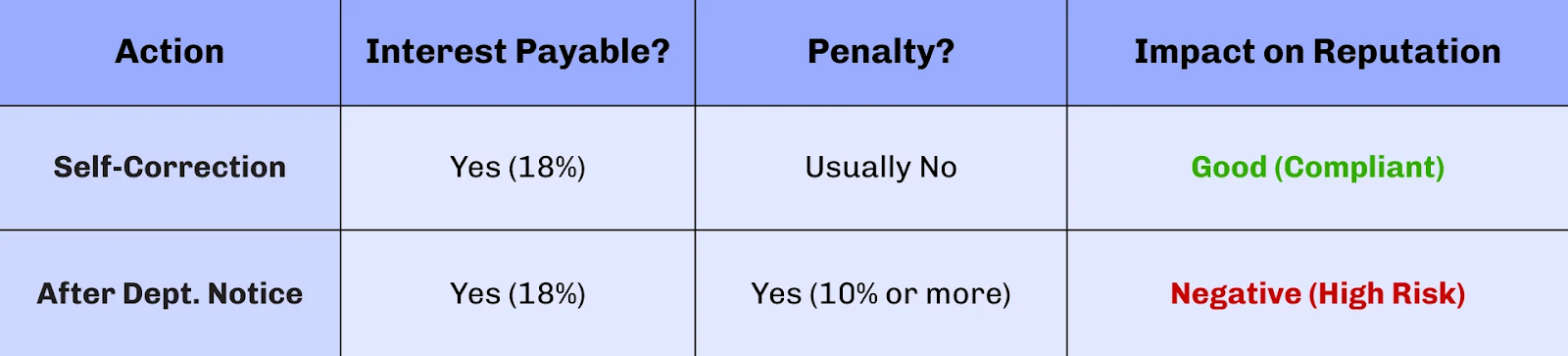

Consequences of Taking Blocked Credit

If you claim blocked credit and get caught during an audit or scrutiny:

- Reversal of ITC: You must pay back the full amount of credit you claimed.

- Interest: You will be charged interest at 18% per annum from the date the credit was utilized until the date it is paid back.

- Penalty: * Normal Case: 10% of the tax amount or ₹10,000 (whichever is higher).

- Fraud Case: If the department proves you did it intentionally, the penalty can go up to 100% of the tax amount.

Red Flags: Repeatedly claiming blocked credit increases your "Risk Profile," making your business more likely to face a GST audit.

Remedies available to correct mistake

If you realize you have wrongly claimed blocked credit, follow these steps immediately:

A. Voluntary Reversal (Best Option)

Don't wait for a notice. If you find the error yourself:

- Reverse the credit in Table 4(B)(1) of your next GSTR-3B filing.

- Pay the applicable interest through the Electronic Cash Ledger. Doing this voluntarily usually saves you from heavy penalties.

B. Use DRC-03

If the financial year has already ended or you want to settle the liability specifically:

- File Form DRC-03 on the GST portal.

- Select the reason "ITC mismatch" or "Voluntary." This acts as a formal "confession" and payment, which protects you from further legal action.

C. Accounting Adjustment

- Pass a journal entry in your books to move the amount from the "GST Input" account to the "Expense" account or "Profit & Loss" account. Since you can't get the credit, it becomes a cost to your business.

Strategic Summary for Taxpayers and Professionals

Treat Section 17(5) as a Mandatory Audit Checkpoint every month.

1. Expense Tagging: In your accounting software (like Tally or SAP), create a specific ledger called "Ineligible ITC - Section 17(5)".

- Strategy: Instead of trying to remember the rules at the end of the year, tag these expenses as they happen. If you buy a car for a director, the GST should go directly to the "Vehicle Cost" or "Expense" ledger, not the "GST Input" ledger.

2. The "Statutory Obligation" Loophole: * Strategy: Periodically review labor laws and health/safety regulations. If a law (like the Factories Act) mandates that you provide a canteen or insurance to workers, the "Blocked" credit suddenly becomes "Eligible." Keeping a copy of that specific law in your tax file is your best defense during an audit.

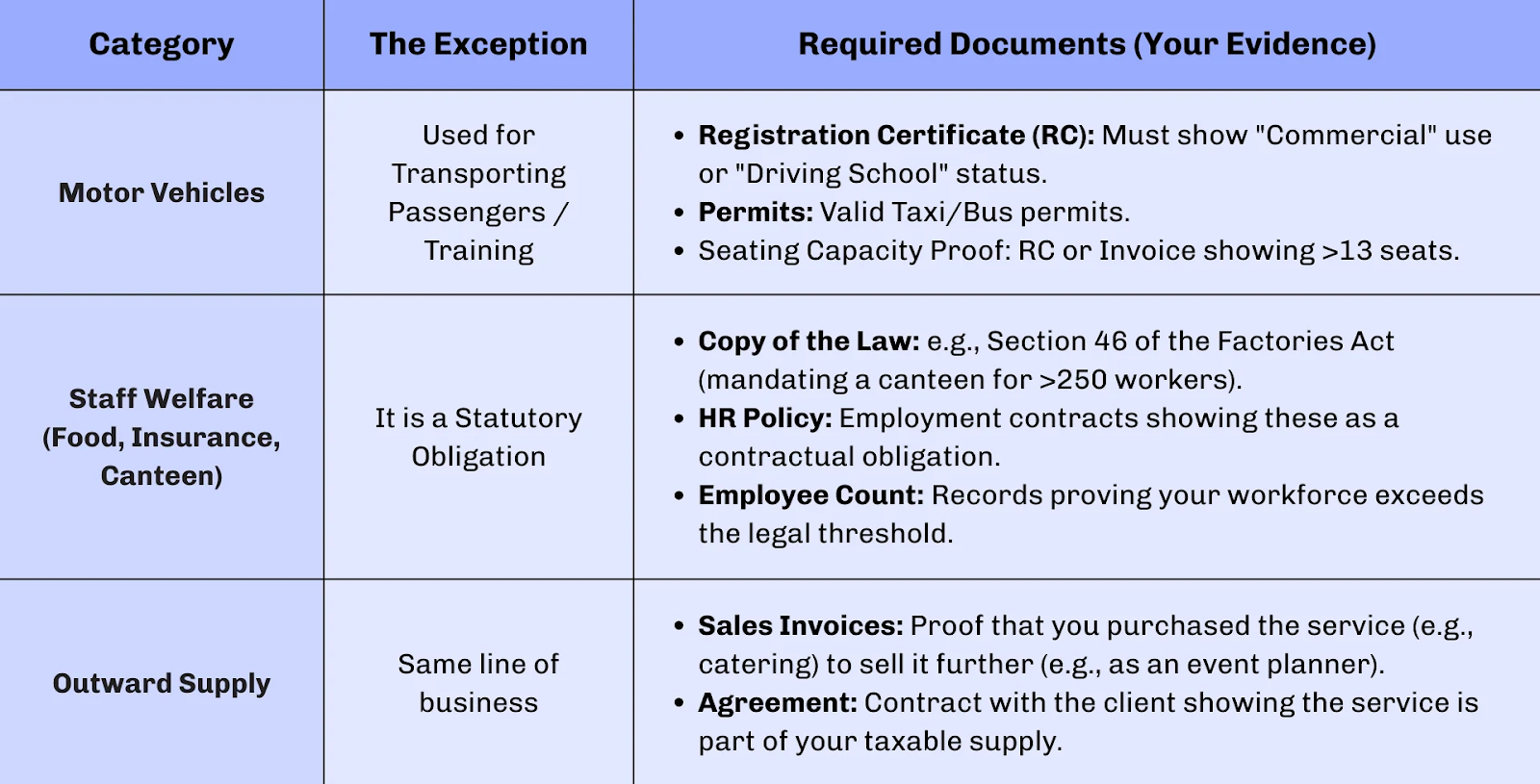

In 2026, the GST department uses AI to find mismatches. If you claim an exception keep these Documents with you –

Frequently Asked Questions on Section 17(5) and 2026 Compliance

1. Can ITC be claimed on the renovation or repair of an office building?

Generally, no. Section 17(5)(d) blocks ITC on goods or services used for the construction of immovable property on own account. This includes renovation, additions, or repairs to the extent they are capitalized in the books of accounts. If these repairs are charged as revenue expenditure (i.e., not capitalized), ITC may be claimed if they are in the course or furtherance of business.

2. Is ITC available on corporate event catering or restaurant bills for business meetings?

No. Section 17(5)(b)(i) explicitly blocks ITC on food and beverages and outdoor catering services. This applies even if the expenses are incurred for legitimate business meetings or corporate events. The only exceptions are when the business is in the same line of activity or if it is a statutory obligation (like the mandatory canteen under the Factories Act).

3. How does the 13-seater rule apply to company buses?

If a company provides a bus for employee transportation with a seating capacity of more than 13 persons (including the driver), ITC is generally available. The restriction only applies to passenger motor vehicles with a seating capacity of up to 13 persons.

4. Can I claim ITC on branded gifts given to dealers who achieve sales targets?

This is a highly litigated area. If the items are given voluntarily as "gifts" without any contractual obligation, ITC is blocked under Section 17(5)(h). However, if the distribution is part of a sales promotion scheme where the dealer has a right to the item upon meeting a target, it may be argued as a "business promotion expense" rather than a gift. Keeping clear records of marketing policies and dealer agreements is crucial to defend such claims.

5. What is the current status of ITC on CSR expenses in 2026?

ITC is strictly blocked on goods or services used for CSR activities as per Section 17(5)(fa) introduced in 2023. This is a prospective block. For the period before October 1, 2023, businesses may have a valid legal argument to claim credit, although the department is likely to litigate these cases.

6. Is ITC available on gym memberships or club subscriptions for executives?

No. ITC is blocked on memberships of a club, health, and fitness centre under Section 17(5)(b)(ii). These are considered personal consumption or perks rather than business inputs.

7. Can an NRTP claim ITC on any domestic purchases?

No. A non-resident taxable person is restricted from claiming ITC on any goods or services procured domestically. They can only claim credit for the IGST paid on the import of goods.

Contact Us

An expert will call you within 24 hours. No payment required to get started.

Related Post

How should a start-up complete ITR filing

Business entities must file their ITR annually to comply with the tax laws of their respective countries. It helps the government assess and collect the appropriate amount of income tax from taxpayers and ensures proper accountability of financial activities.

. 3 Mins.png)

5 step checklist for GST compliance in Indian Startups

Learn about how GST works. The basics of GST along with its compliances. Uncover what your business needs to keep in mind concerning GST rules and GST compliance.

. 3 min read.png)

₹20 Lakhs and Beyond: Understanding GST for Freelancers in India

Are you a freelancer or aspiring to be one? In this blog, uncover the basics of freelancing and requirements involving GST. Learn about all the exemptions, obligations, and compliances of GST for freelancers in india.

. 5 min read

3.png)