GST Compliance Roadmap for First-Year Startups

By Filing Buddy . 07 Feb 26

The GST Wake-Up Call Every First-Year Startup Needs

Imagine, you just launched your startup, your first sales are coming in… and suddenly you receive a GST notice demanding lakhs you never knew you owed.

Sounds scary? It happens more often than you think.

Even established companies like Tata Steel and BHEL have faced multi-crore notices because of overlooked GST compliance issues. Now, picture the same risk for a first-year startup: limited resources, no full-time tax team, and a dozen other priorities on your plate.

That’s exactly why we created this 30‑60‑90 Day GST Compliance Roadmap for First-Year Startups. In this guide, you’ll learn how to register correctly, file returns on time, reconcile ITC without stress, and stay audit-ready, all while keeping your cash flow safe. Think of this as your step-by-step buddy system, ensuring your compliance is sorted so you can focus on growing your startup without nasty surprises.

Why You Can’t Afford to Ignore GST in Your First Year

Starting a business is thrilling, but first-year startups often underestimate how quickly GST issues can pile up. One late filing, one misclaimed Input Tax Credit (ITC), or even a small mismatch in invoices can turn into penalties that hit your cash flow and distract you from growth.

Small Mistakes, Big Consequences

Even big players aren’t safe.

Reliance Industries Limited (RIL) received a GST penalty order of ₹57.07 crore (reported alternatively as ₹56.44 crore) from the Commissioner (Appeals), CGST, Ahmedabad, relating to alleged misclassification of services for vessel hiring on a time‑charter basis between July 2017 and January 2018.

If a corporate giant with a full-time tax and compliance team can slip up on such transactions, it’s easy to see how a first-year startup could get caught off guard.

For startups, the impact is immediate:

- Penalties and interest add up quickly, eating into your limited cash flow.

- Missed deadlines can lead to blocked ITC, delaying payments to vendors or payroll.

- Non-compliance can create unnecessary stress, taking your focus away from growing the business.

The good news? Knowing the risks is half the battle. And the next step is to tackle GST proactively, starting with the first 30 days of your startup.

In the next section, we’ll walk you through the 30-Day Compliance Blueprint, covering how to register correctly, set up your GST systems, and file your first return without mistakes. Think of it as the starter kit for stress-free GST management.

30-Day Compliance Blueprint: Start Right

The first 30 days of your startup are crucial, not just for sales and product launches, but for laying the foundation of GST compliance.

Completing the GST registration process in India correctly during this phase sets the base for everything that follows. Start strong, and you’ll avoid mistakes that could lead to blocked ITC, penalties, or notices later.

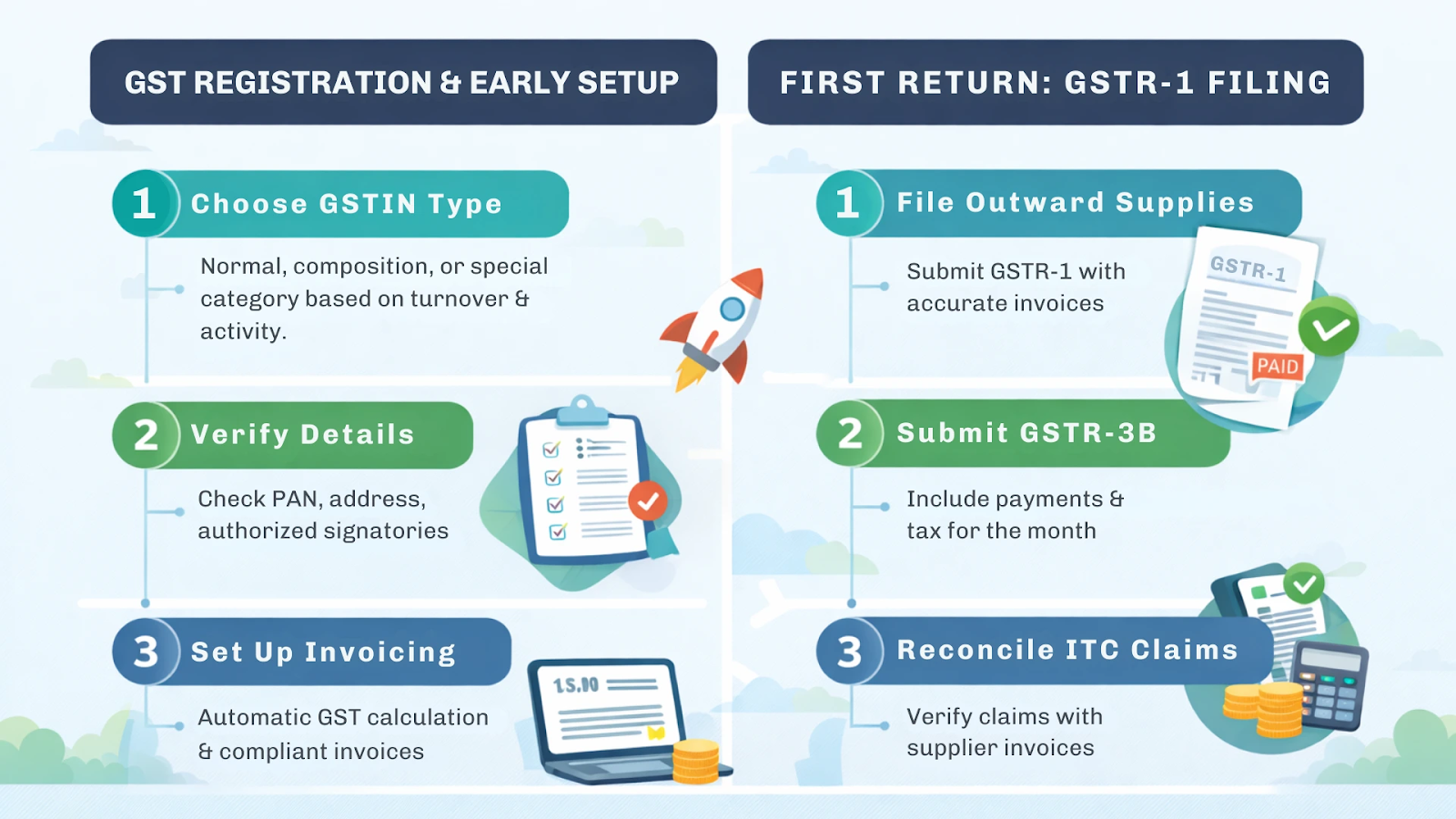

GST Registration & Early Setup

- Choose the correct GSTIN type (normal, composition, or special category) based on your turnover and business activity.

- Double-check all business details: PAN, address, and authorized signatories, to ensure smooth future filings.

- Set up accounting or invoicing systems that automatically calculate GST and generate compliant invoices.

Tip: Even small errors in HSN/SAC codes can create mismatches when filing returns.

First Return: GSTR-1 Filing

Here’s how startups manage GST for startups filings like GSTR-1 and GSTR-3B.

- File GSTR-1 for outward supplies first, ensuring every invoice is accurate.

- Submit GSTR-3B with payment details for the month.

- Reconcile your ITC claims with supplier invoices to catch discrepancies early.

Mini Tip: Keep digital copies of all invoices. This makes audits and reconciliations easier and faster.

By the end of these 30 days, your startup will have a strong GST foundation with registration completed, systems set up, and your first returns filed accurately.

Once these basics are in place, the next step is all about reconciling your Input Tax Credit (ITC), cross-checking supplier invoices, and reviewing your cash flow to make sure nothing slips through the cracks, the focus of the 60-Day compliance phase.

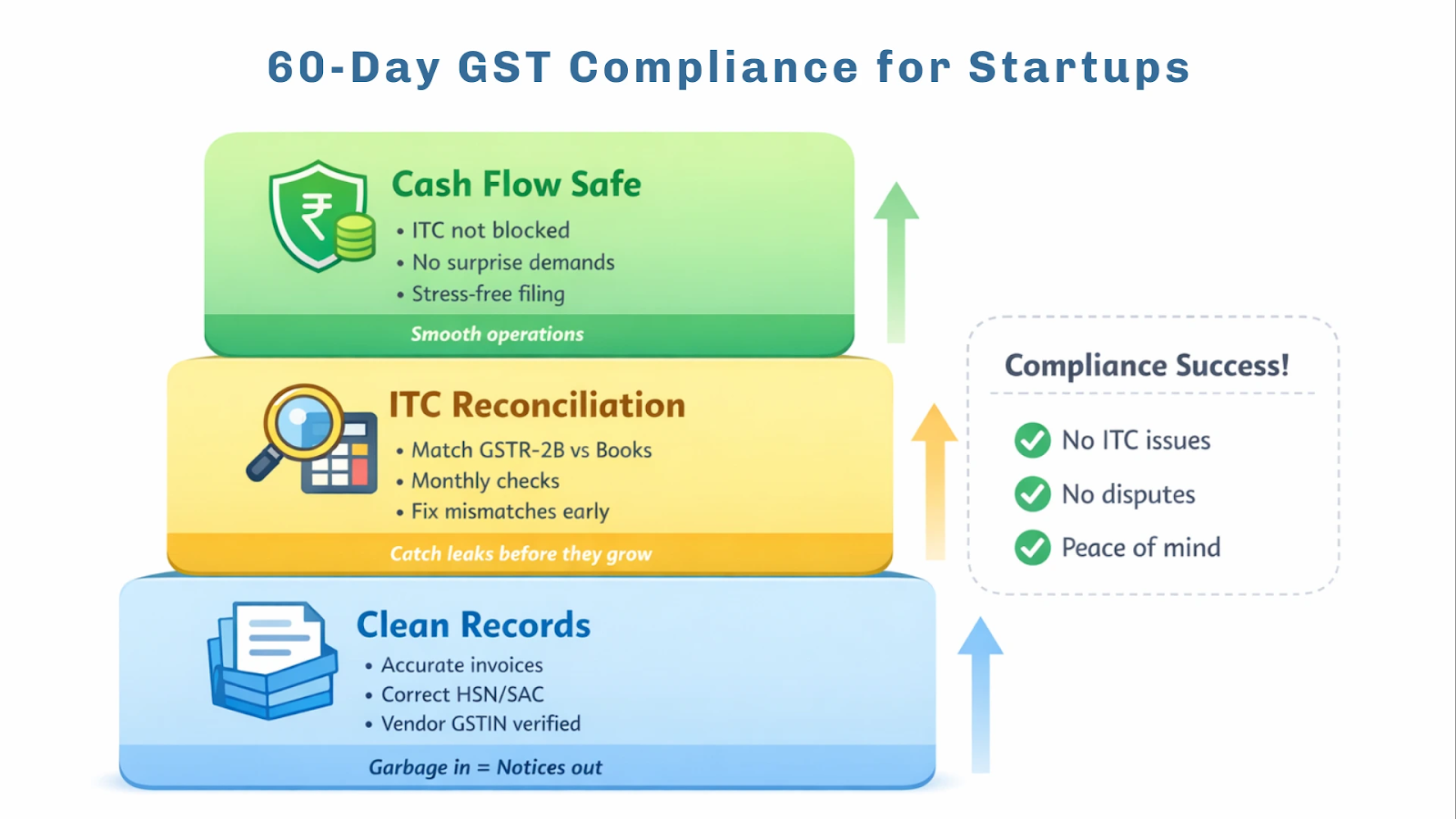

60-Day Compliance Playbook: Reconcile & Review

Once your GST registration is complete and your first returns are filed, it’s time to make sure your records actually match what you report. This phase is critical, unmatched ITC claims or small invoice errors can quickly turn into penalties if left unchecked.

ITC Reconciliation Routine

- Go through your supplier invoices and match them with GSTR-2B every month. This ensures that the Input Tax Credit you claim is valid and verifiable.

- Every ITC claim under GST must match your supplier filings, otherwise authorities may reverse the credit.

In FY2021‑22, the Multi Commodity Exchange of India (MCX) received a ₹3.84 crore GST notice because some of their ITC claims didn’t match the suppliers’ filings. Even a tech-enabled service platform like MCX faced scrutiny, showing that ITC mistakes aren’t limited to manufacturing or product-based businesses.

Mini Tip: Maintain a simple reconciliation sheet or use software to track matched versus unmatched ITC, it prevents last-minute surprises.

Cash Flow Protection

- ITC that isn’t reconciled properly can block your credit, directly affecting vendor payments and payroll.

- Regularly monitor your receivables and payables linked to ITC claims to ensure nothing is overdue.

Tip: Resolve mismatches immediately instead of waiting for the filing deadline, it keeps your cash flow healthy and operations smooth.

By the end of these 60 days, your startup will have clean ITC records and a better grasp of cash flow, reducing the risk of notices and giving you confidence in your compliance.

The next phase focuses on audits, maintaining proper documentation, and responding to any GST notices, which is the core of the 90-Day Compliance Plan.

90-Day & Beyond: Avoid Notices & Scale Confidently

After reconciling your ITC and securing your cash flow, the next step is to put systems in place that make your startup notice-proof. This phase isn’t just about filing returns, it’s about building processes that protect your business from costly GST mistakes.

Internal Audit & Documentation SOP

- Maintain digital records of all invoices, e-way bills, and RCM liabilities.

- Conduct weekly or monthly reconciliation of your books to catch errors before they turn into notices.

BHEL (Bharat Heavy Electricals Limited) faced ₹586.43 crore in GST show cause notices from the Telangana Commercial Tax Department. The notices were issued due to multi-year lapses in documentation and reconciliation of Input Tax Credit, affecting multiple divisions and operations. This shows that even large, well-resourced companies can face massive penalties if proper documentation isn’t maintained consistently.

Tip: Adopt a standard operating procedure (SOP) for internal audits, even if it’s simple, it keeps records organized and reduces compliance risk.

Responding to GST Notices

- Download any notice from the GST portal immediately and review the discrepancies flagged.

- Consult a tax professional within a few days to assess and respond accurately.

- Respond via the portal before the deadline, and retain copies of all correspondence.

Mini Tip: Treat notices as a signal to tighten your processes, not as a reason to panic. Early action can prevent penalties from escalating.

By putting these practices in place, your startup will have robust documentation, timely responses, and confidence that GST compliance won’t derail operations. With audits managed and notices handled efficiently, you’re ready to focus on growth while staying fully compliant, which brings us to the final section of practical tips and lessons from big companies.

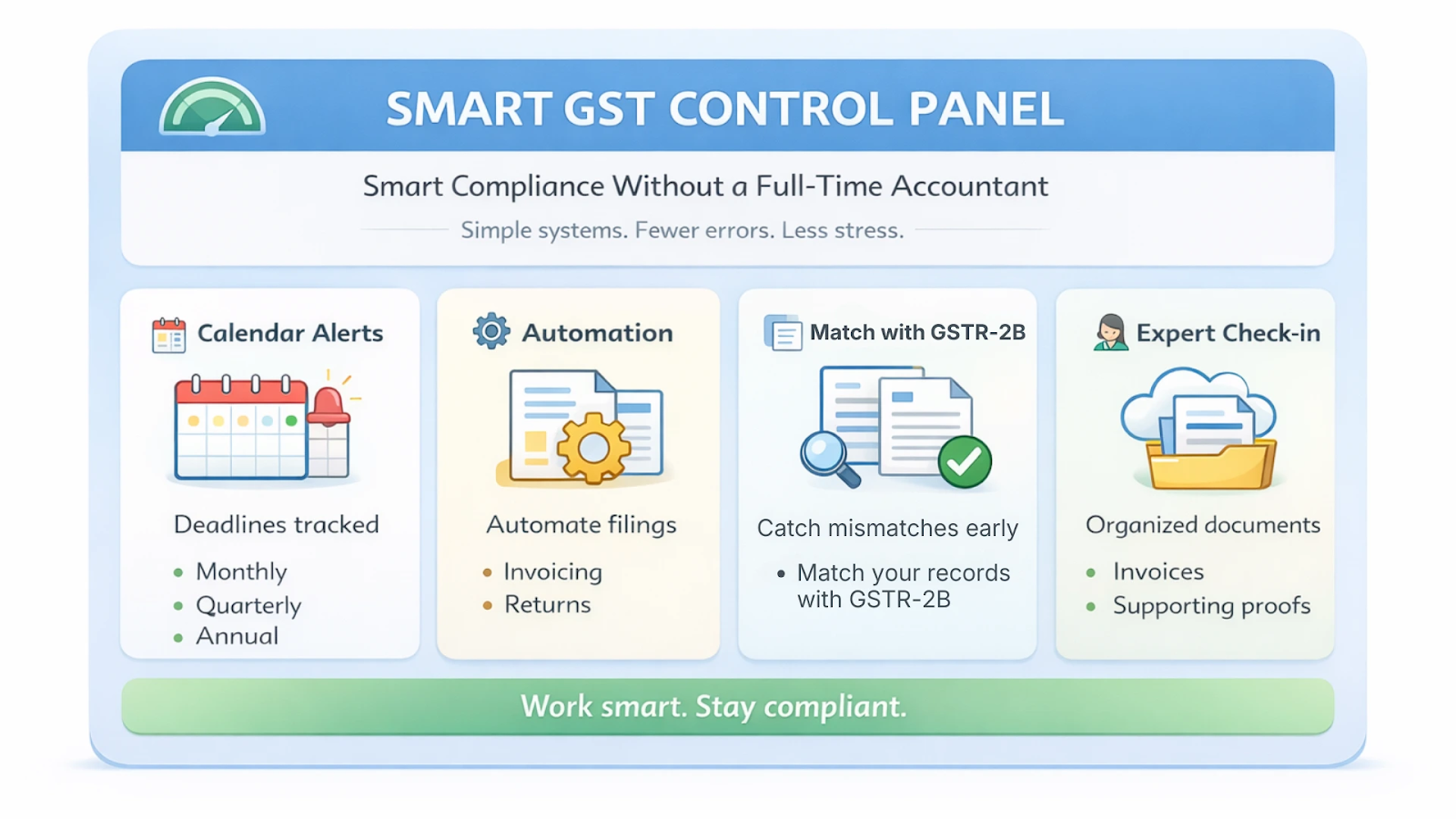

Tips & Tricks: Smart Compliance Without a Full-Time Accountant

Even if your startup doesn’t have a dedicated tax team, there are practical ways to stay on top of GST compliance and avoid costly surprises. With the right systems and habits, you can manage GST efficiently without getting overwhelmed.

Tips

- Set up calendar alerts for all GST deadlines: monthly, quarterly, and annual.

- Automate invoicing and return filing where possible to reduce manual errors.

- Match your records with GSTR‑2B before submitting returns to catch mismatches early.

- Quarterly reviews with a compliance expert can help identify issues before they escalate, this doesn’t require a full-time accountant, just a proactive approach.

Tip: Keep all invoices and supporting documents digitally organized. It makes reconciliation, audits, and notice responses much faster.

Lessons from Big Names

Tata Steel received a ₹1,007 crore show cause notice covering multiple financial years (FY2018‑19 to FY2022‑23) for irregular Input Tax Credit claims across various units. Even a company of this size, with dedicated tax and compliance teams, faced scrutiny.

- GST compliance isn’t just paperwork, it’s about consistent monitoring, accurate filing, and reconciling every transaction, no matter how small.

How this applies to startups:

You don’t need a huge tax department to stay compliant. By leveraging structured processes, digital tools, and occasional expert support, founders can prevent mismatches, blocked ITC, and unnecessary stress. Think of it as having a compliance buddy system that keeps your GST in check while you focus on growing the business.

With these tips and lessons in place, your startup can stay compliant, reduce risk, and build a solid foundation for scaling, rounding out the 90-day roadmap we’ve covered.

Stay Compliant, Grow Confidently

GST compliance may feel overwhelming in your first year, but with a clear plan, it doesn’t have to be. Here are the three key takeaways from this roadmap:

- Start Strong in the First 30 Days: Proper registration, system setup, and accurate first returns lay the foundation for hassle-free compliance.

- Reconcile and Review in Month 2: Regular ITC reconciliation and cash flow monitoring prevent penalties and blocked credits before they become a problem.

- Stay Audit-Ready in Month 3 and Beyond: Maintaining documentation and knowing how to respond to notices protects your startup from surprises, even if you’re a lean team.

Remember, GST compliance isn’t just a legal obligation, it’s a way to safeguard your cash flow, reputation, and growth potential. Follow this 30‑60‑90 day roadmap, stay organized, and you’ll spend less time worrying about notices and more time building your business.

Stay compliant, avoid surprises, and run your startup confidently with Filing Buddy by your side.

Frequently Asked Questions (FAQs)

1. What is GST compliance for startups?

GST compliance means registering under GST, filing returns on time, reconciling ITC, maintaining documents, and responding to notices to avoid penalties.

2. When should a startup register for GST?

Startups must register for GST before raising tax invoices if their turnover crosses the threshold limit or if they engage in inter‑state sales.

3. What are GSTR‑1 and GSTR‑3B?

GSTR‑1 reports outward supplies (sales), and GSTR‑3B is a summary return filed monthly/quarterly with tax payment details.

4. How often should startups file GST returns?

Most startups file monthly for GSTR‑1 and GSTR‑3B, but small businesses with lower turnover may opt for quarterly filing where applicable.

5. What is Input Tax Credit (ITC)?

ITC is the credit startups claim for GST paid on business purchases, which offsets their tax payable on outward supplies.

6. Why is ITC reconciliation important?

Reconciling ITC with GSTR‑2B ensures your claimed credits match supplier filings, reducing the risk of blocked ITC and GST notices.

7. What happens if GST returns are filed late?

Late filing attracts daily penalties and interest, potentially blocking ITC and triggering compliance notices.

8. How do GST show cause notices work?

A show cause notice asks a business to explain discrepancies or justify its GST filings/ITC claims before authorities demand penalties or reversals.

9. Can large companies receive GST notices?

Yes, even large firms like Tata Steel and BHEL received multi‑crore GST notices, showing compliance is critical for all.

10. What is an e‑way bill?

An e‑way bill is a document required for the movement of goods above a certain value, integrated with GST to track logistics compliance.

11. How can startups protect their cash flow from GST issues?

Reconciling ITC monthly, resolving mismatches early, and maintaining organized records help avoid blocked credits that hurt cash flow.

12. What documents should startups keep for GST audits?

Keep digital invoices, GSTR return copies, e‑way bills, purchase orders, and reconciliation reports for audit readiness.

13. What are common GST mistakes by startups?

Common mistakes include wrong HSN/SAC codes, missing invoices, late filing, incorrect ITC claims, and poor reconciliation.

14. Should startups use compliance tools or professionals?

Yes, tools and expert guidance streamline GST filing, help identify issues early, and reduce errors without hiring a full‑time accountant.

15. How does Filing Buddy help with GST compliance?

Filing Buddy guides startups through registration, return filing, reconciliation tips, and notices with clear steps, making GST manageable even with limited tax resources.

Contact Us

An expert will call you within 24 hours. No payment required to get started.

Related Post

How should a start-up complete ITR filing

Business entities must file their ITR annually to comply with the tax laws of their respective countries. It helps the government assess and collect the appropriate amount of income tax from taxpayers and ensures proper accountability of financial activities.

. 3 Mins.png)

5 step checklist for GST compliance in Indian Startups

Learn about how GST works. The basics of GST along with its compliances. Uncover what your business needs to keep in mind concerning GST rules and GST compliance.

. 3 min read.png)

₹20 Lakhs and Beyond: Understanding GST for Freelancers in India

Are you a freelancer or aspiring to be one? In this blog, uncover the basics of freelancing and requirements involving GST. Learn about all the exemptions, obligations, and compliances of GST for freelancers in india.

. 5 min read