Suspense Account in Tally: Tax & GST Risks

By Filing Buddy . 19 Feb 26

Introduction

Think of the Suspense Account in Tally Prime as a "black box" that might seem like a convenient waiting room for mystery transactions, but to Indian tax authorities, it’s a major red flag for hidden income or financial mismanagement. While it keeps your books balanced in the short term, leaving entries there is a "ticking time bomb" because the Income Tax Act and Companies Act require total transparency; if you can't explain a mystery deposit, the government can tax it at a massive rate of 60% or more plus penalties. Cleaning these entries isn't just about being a neat bookkeeper; it’s about protecting your business from legal trouble and ensuring your financial "heartbeat" stays healthy, clear, and audit-ready.

The Conceptual Framework: What is a Suspense Account

Think of a Suspense Account in Tally as a "Mystery Folder" on a busy desk where you temporarily park transactions that you can't immediately identify. For example, if you receive a ₹10,000 bank deposit but don’t know which customer sent it, you can't just ignore it or guess where it belongs without throwing your records off. Because accounting follows a "Double-Entry" rule, where every deposit must have a matching explanation, this account acts as a vital placeholder or "clearing house." By crediting the Suspense Account, you keep your books perfectly balanced and your Tally Trial Balance error-free, allowing you to keep working while you play detective to find the true source of the funds.

The Technical Nature of the Account in Tally

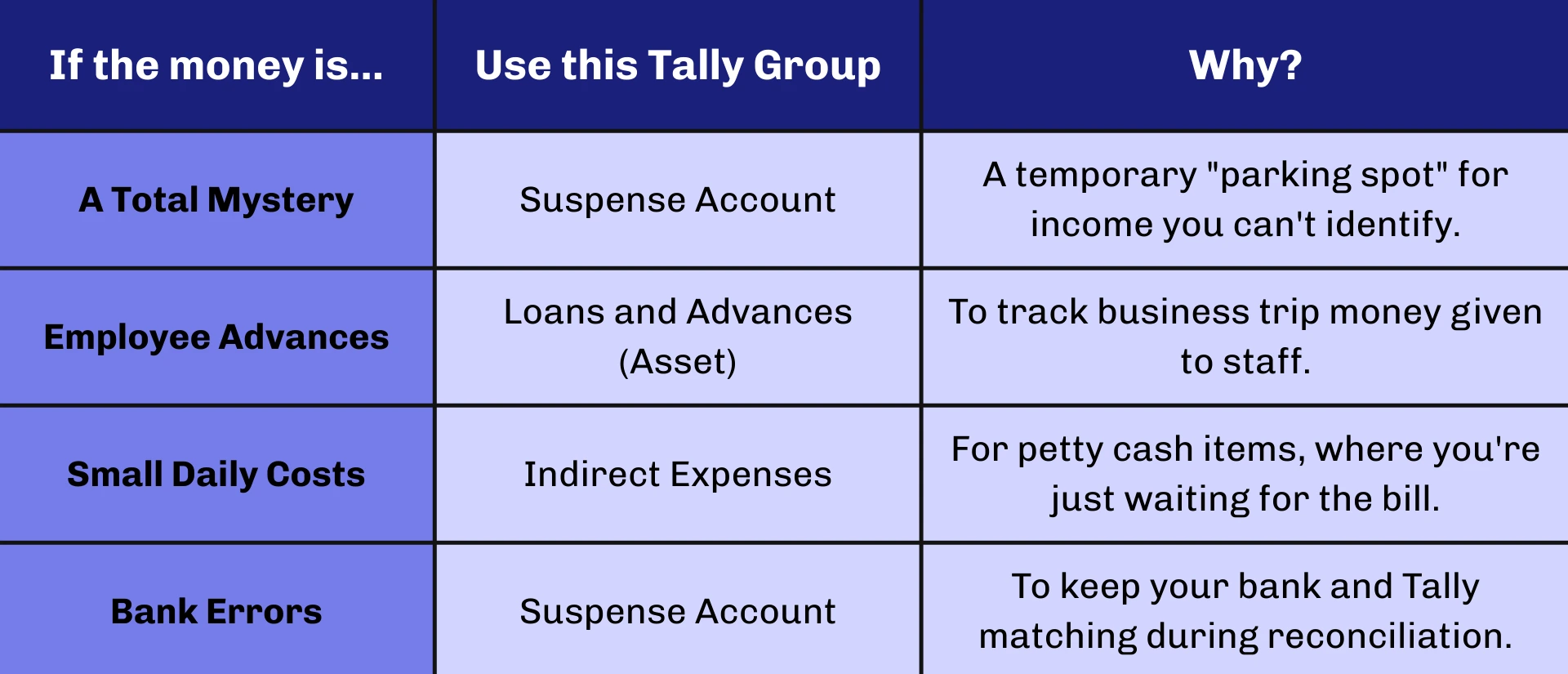

Inside Tally Prime, the "Suspense Account" is a pre-set folder in your Chart of Accounts. It lives on your Balance Sheet, acting as a temporary placeholder for money that is either an asset or a liability, not yet an expense or income. While Tally gives you the flexibility to use this group for various "unknowns," it’s important not to use it as a dumping ground for everything. For example, money given to employees for business trips should be labeled as "Loans and Advances" rather than Suspense, so your books stay transparent. Similarly, if you have small daily costs waiting for bills, they should be tucked under "Indirect Expenses" so your Profit and Loss statement stays accurate and doesn't mix up mystery cash with actual business spending.

Why Transactions Land in Suspense

Transactions typically find their way into the suspense account due to a lack of immediate documentation or timing mismatches. In the Indian SME sector, the rapid adoption of digital payments like UPI has increased the volume of "mystery" entries. A business might see a credit of ₹15,000 on a Monday morning with a cryptic narration like "UPI CREDIT" and no customer name. Rather than guessing which customer paid, the accountant uses the suspense account to park the entry.

Other common triggers include partial payments where a client pays an amount that does not match any specific invoice, causing confusion about how to allocate the funds. Additionally, data entry errors, such as typos in amounts or transposed digits, can create imbalances that are temporarily pushed into suspense during a hurried month-end closing. The underlying theme is always the same: a temporary lack of clarity that requires future investigation.

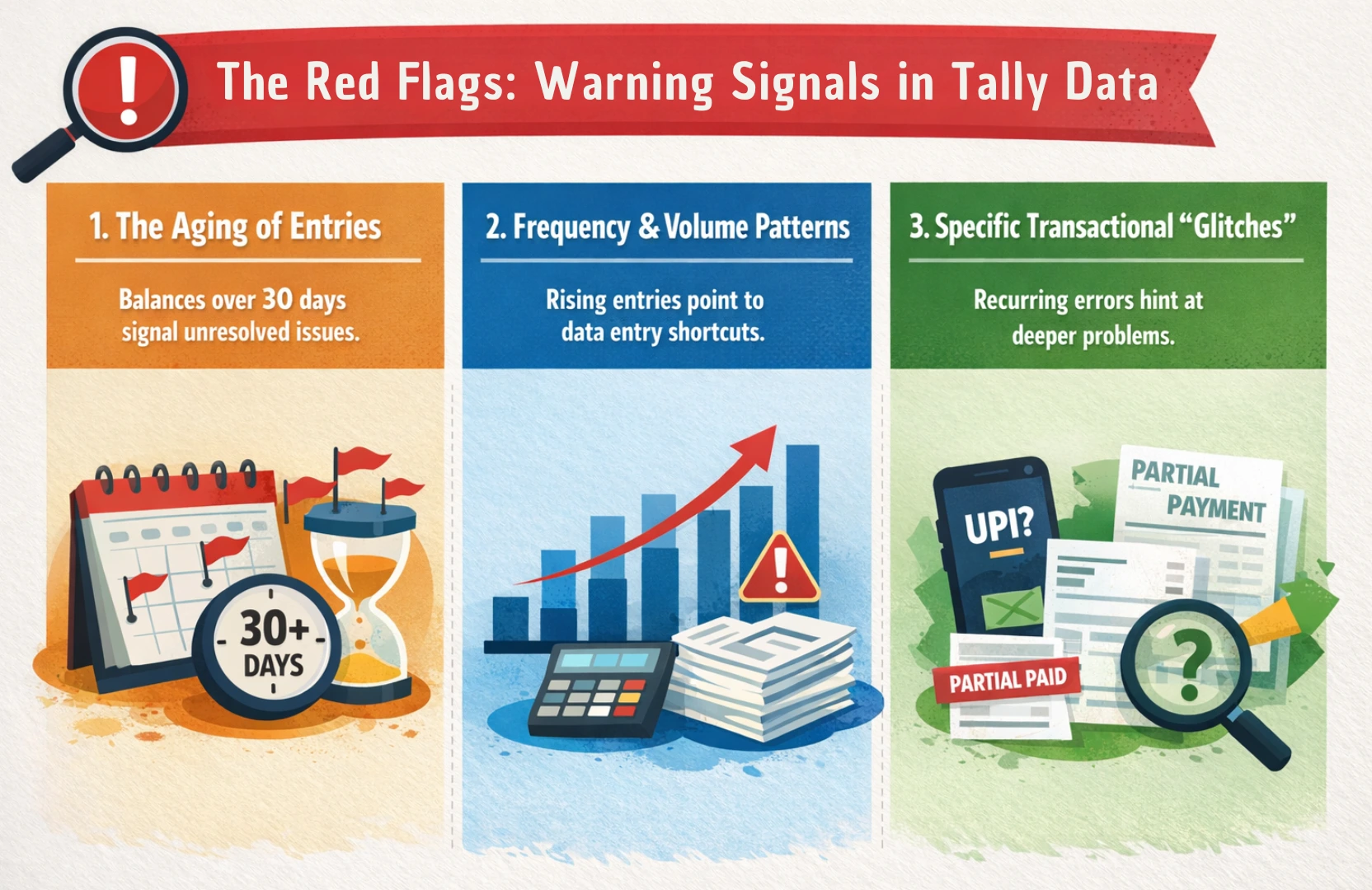

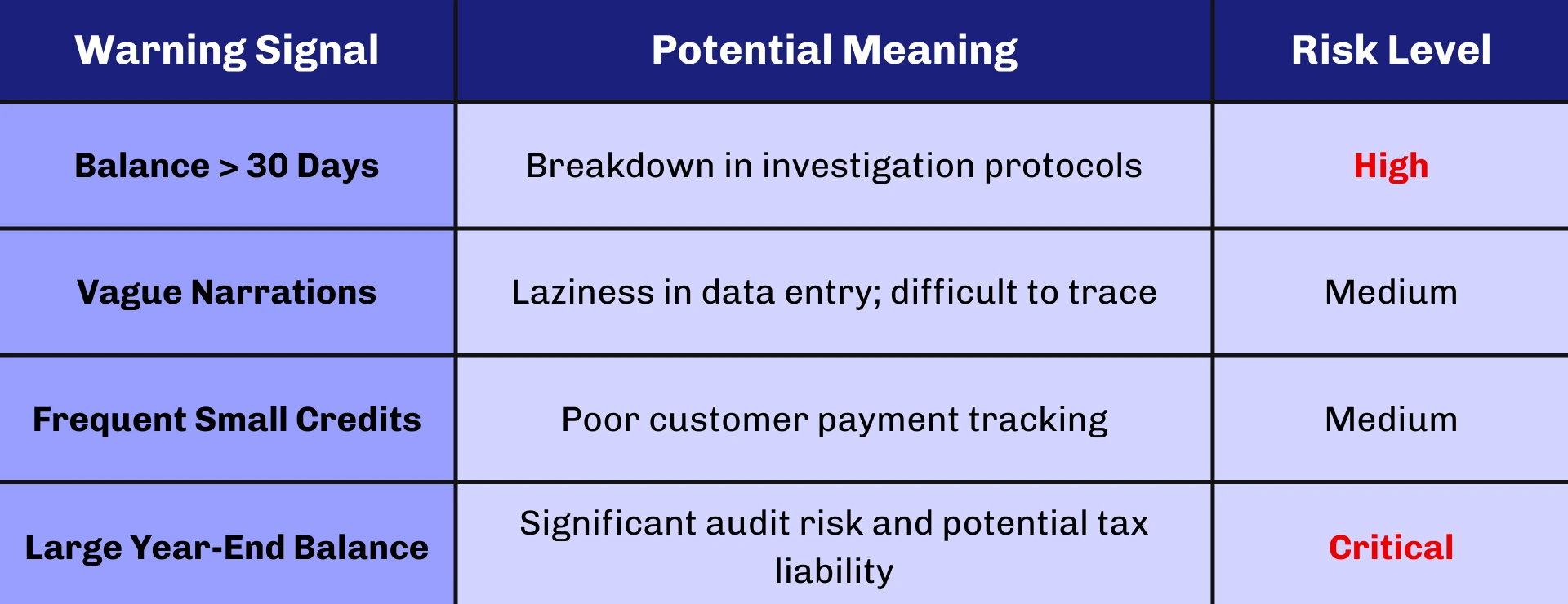

The Red Flags: Identifying Warning Signals in Tally Data

A suspense account is not a problem in itself; it is a solution for imperfect timing. However, when the "temporary" parking lot becomes a "permanent" dumping ground, it sends warning signals to management, auditors, and regulators. Recognizing these red flags early is essential for maintaining a clean set of books and avoiding the "month-end panic" that reigns when accumulated unmatched transactions force a frenzied investigation.

1. The Aging of Entries

The most significant warning signal is the age of the balance. A healthy suspense account should ideally return to zero on a regular basis as transactions are researched and moved to their permanent homes. If a balance persists for more than 30 days, it indicates a failure in internal communication or a lack of follow-up with customers and vendors. In many Indian businesses, these accounts are ignored during the month, allowing errors to compound over time.

2. Frequency and Volume Patterns

If the number of entries into the suspense ledger is increasing relative to total transactions, it suggests that the accounting team is prioritizing data entry speed over accuracy. While using a suspense account can help avoid delays during high-volume periods or audits, a habitual reliance on it signals that the company's standard operating procedures for capturing payment advice or maintaining invoice records are breaking down.

3. Specific Transactional "Glitches"

Certain patterns of errors often signal deeper systemic issues. For example:

- Recurring Unknown UPI/NEFT Credits: This suggests the sales team is not instructing customers to provide proper transaction references.

- Consistent Partial Payments: This may indicate a dispute with a customer or a recurring error in the billing system that causes clients to withhold specific amounts.

- Unidentified Expenses: Regular payments made without supporting documents suggest a lack of control over cash disbursements and a potential risk of unauthorized spending.

- Trial Balance Mismatches: If the suspense account is frequently used to force the trial balance to match, it indicates that one-sided errors, such as forgetting to record the second half of a journal entry, are common in the manual bookkeeping process.

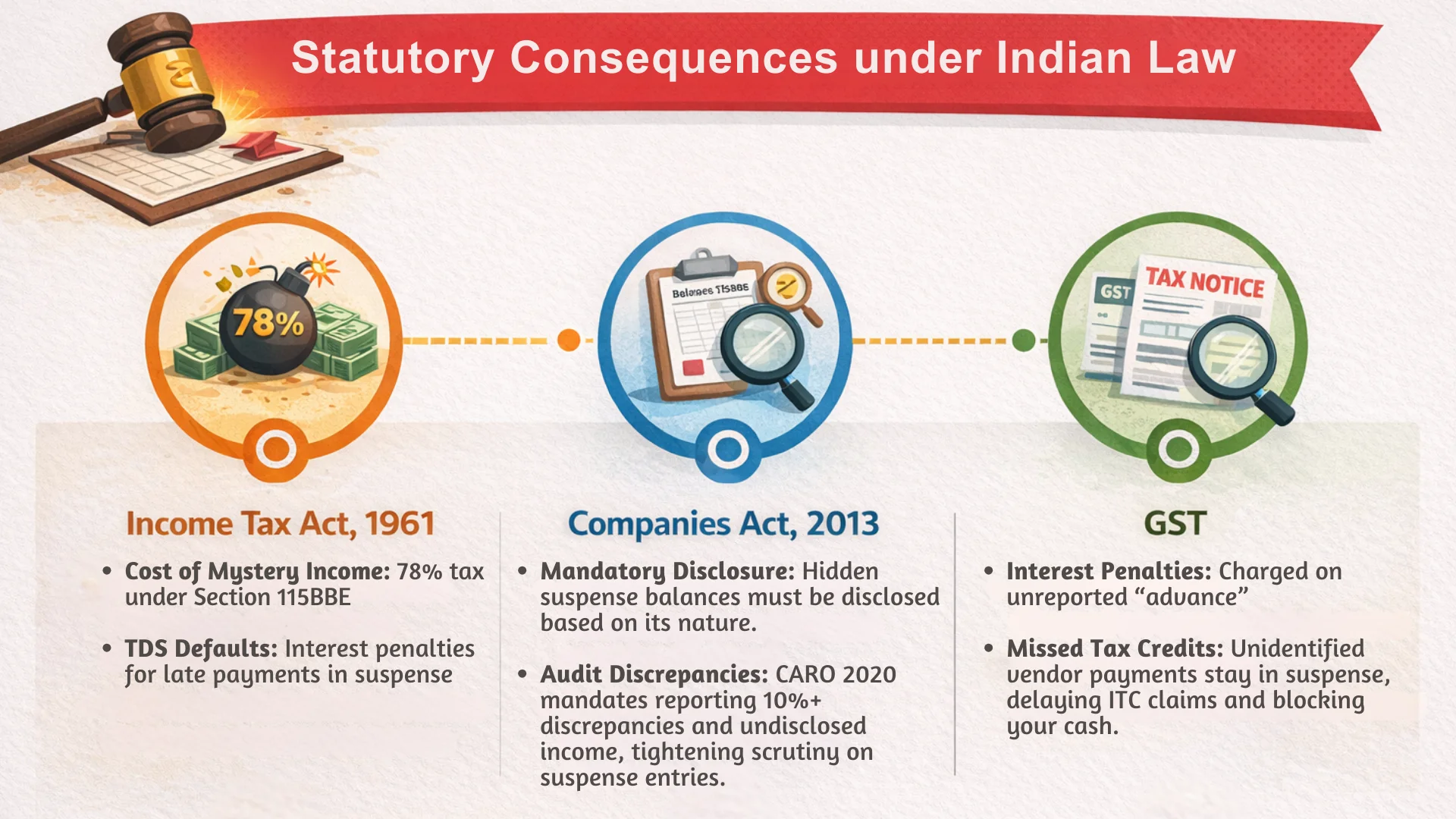

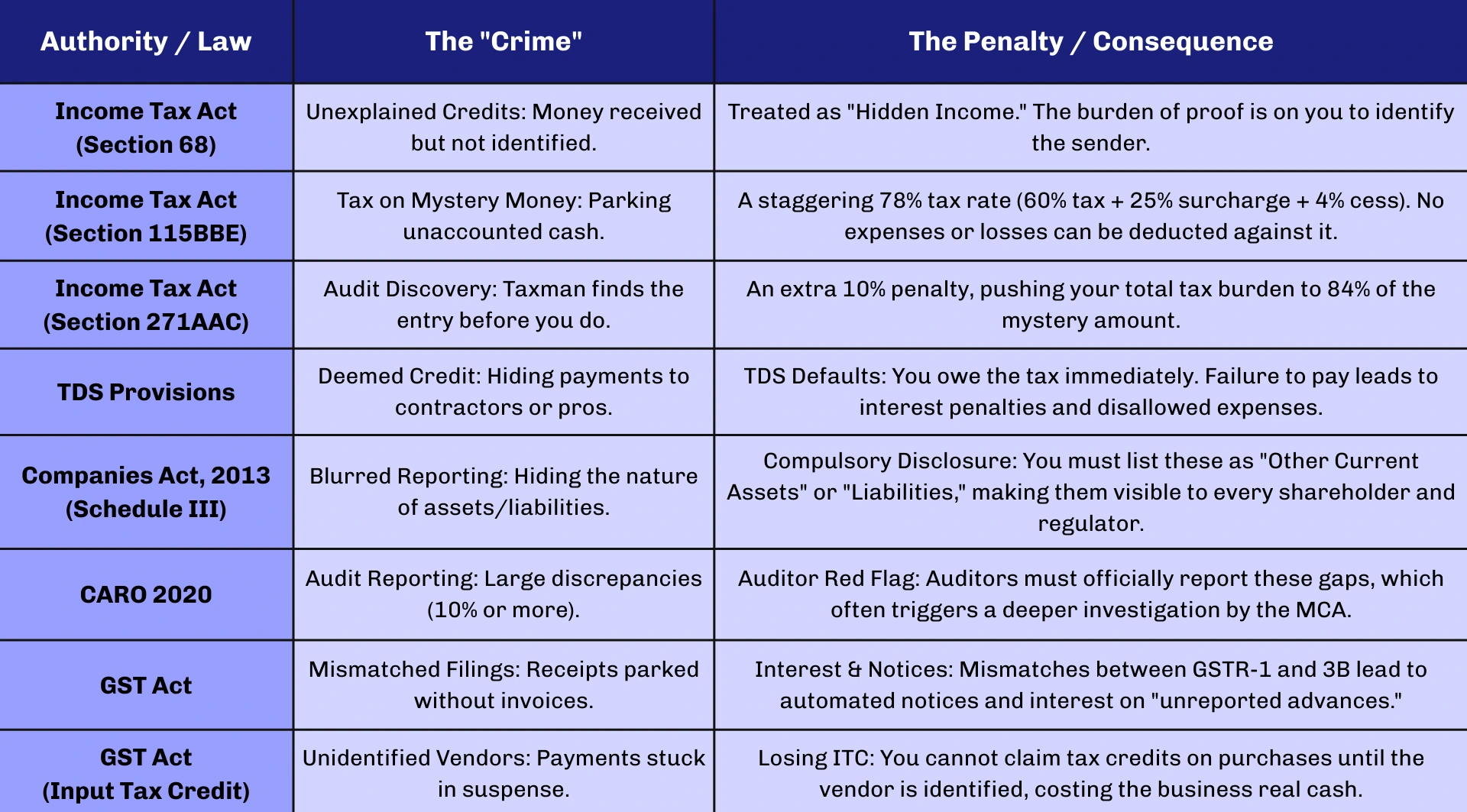

The Legal Hammer: Statutory Consequences under Indian Law

In the Indian regulatory environment, an uncleared suspense account is more than just "messy bookkeeping"; it is a legal liability. The Ministry of Corporate Affairs (MCA) and the Income Tax Department have intensified their focus on financial transparency, leaving little room for "unexplained" figures.

The Impact of the Income Tax Act, 1961

Leaving uncleared money in a Suspense Account is like leaving a ticking tax bomb in your Tally data. Under Section 68 of the Income Tax Act, the government assumes any "mystery money" you can't explain is hidden, illegal income. The burden is entirely on you to prove who gave you the money and that they actually had the means to pay it; if you can't, the Assessing Officer can simply add that amount to your taxable income. To make matters worse, you can't dodge TDS (Tax Deducted at Source) by hiding payments in Suspense, the law says if you've set the money aside for someone, you owe the tax immediately, or you'll face heavy interest and penalties.

The Real Cost of "Mystery Money"

If the Tax Department finds unexplained credits in your books, the financial punishment is brutal under Section 115BBE:

- The 78% Tax Trap: Instead of your usual tax rate, this income is hit with a flat 60% tax, plus a 25% surcharge and 4% cess, bringing the total to a staggering 78%.

- No Discounts: You aren't allowed to claim any business expenses or losses against this "hidden" income to lower the bill.

- The 84% Penalty: If the taxman finds the entry during an audit before you report it, an extra 10% penalty kicks in, meaning you could end up paying ₹84 to the government for every ₹100 left in suspense.

- TDS Defaults: Parking payments to contractors or professionals in a suspense account doesn't pause your tax obligations; you will still be charged interest for late TDS payments.

The Impact of the Companies Act, 2013

For companies, Schedule III of the Companies Act, 2013, provides the mandatory format for the Balance Sheet. A suspense account cannot be hidden; its balance must be disclosed based on its nature.

- Debit Balance: Recorded as a "Current Asset" under "Other Current Assets," implying money has gone out but hasn't been classified yet.

- Credit Balance: Recorded as a "Current Liability" under "Other Current Liabilities," representing money received that is yet to be allocated.

The Companies (Auditor's Report) Order, 2020 (CARO 2020), has further raised the stakes. Auditors are now required to report on material discrepancies of 10% or more in inventory or other assets. If such discrepancies are "properly dealt with in the books," it often means they have been moved from a suspense account to a permanent head after investigation. Additionally, the auditor must now check if the company has surrendered any "undisclosed income" during tax assessments that was not previously recorded, a common fate for neglected suspense accounts.

The Impact of the GST

In the world of GST, a messy Suspense Account isn't just a headache; it’s a magnet for government notices. Because GST works on strict monthly deadlines, "parking" a transaction in a mystery folder can throw your entire tax filing out of sync.

The GST "Matching" Trap

GST authorities constantly compare two things: what you say you sold (GSTR-1) and the tax you actually paid (GSTR-3B). When you leave a customer's payment in a Suspense Account, you often forget to create the tax invoice for it. This creates a gap in your records, leading to:

- Interest Penalties: If you received an "advance" but didn't report it in the same month, the GST portal will eventually catch it and charge you interest.

- Missed Tax Credits: If you can't identify which vendor you paid because the invoice was in a regional language or had a slight name variation, that money sits in Suspense. Every day it stays there is a day you fail to claim your Input Tax Credit (ITC), essentially losing your own money.

Summary of Impact of the Different Laws

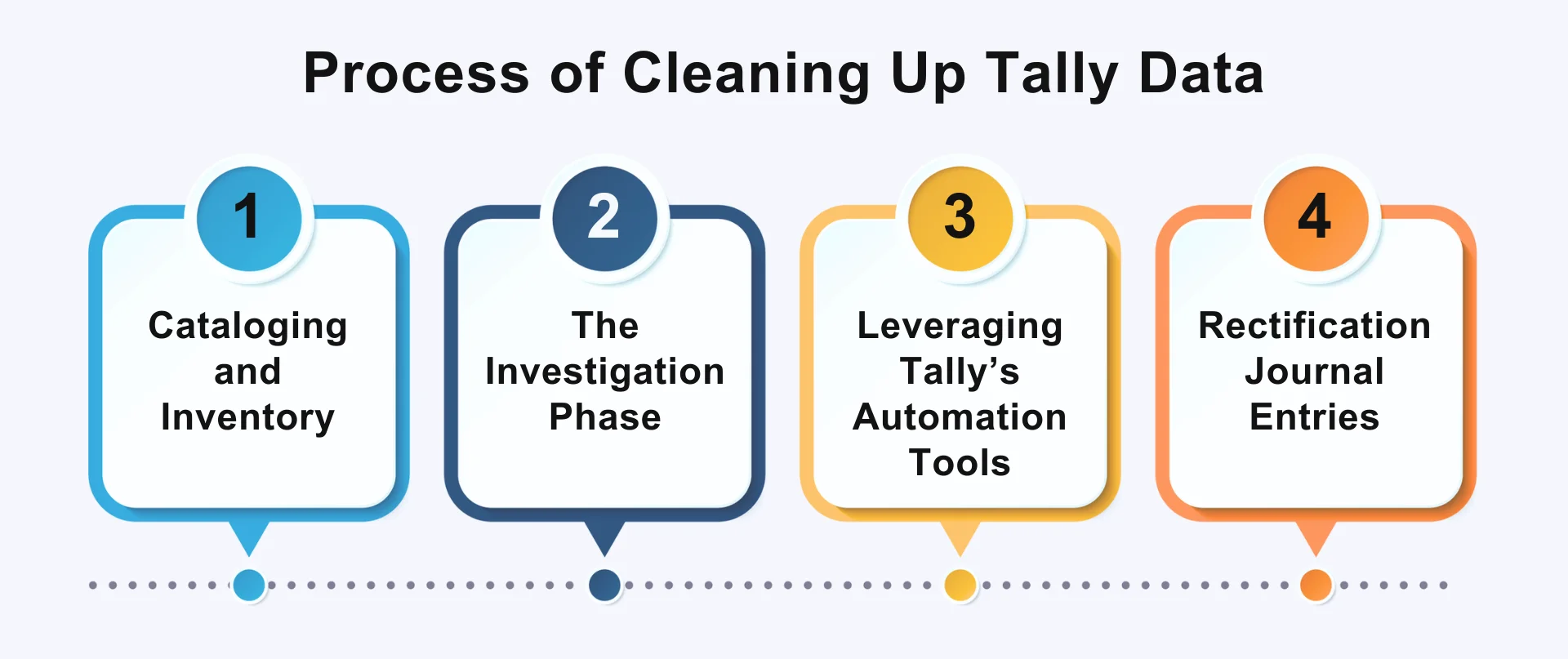

Cleaning Up Tally Data: The Expert's Cleanup Protocol

Cleaning a suspense account is a systematic process of transformation, moving from confusion to clarity. It requires more than just making journal entries; it requires an investigative mindset and a mastery of Tally’s internal tools.

Step 1: Cataloging and Inventory

The first priority is creating visibility. The accountant should initiate by cataloging every entry in the suspense ledger, recording dates, amounts, and any available clues from narrations. TallyPrime allows you to export this data into Excel for easier manipulation (Gateway of Tally > Display More Reports > Account Books > Ledger > Suspense Account > Export).

Step 2: The Investigation Phase

Cross-referencing is the heart of the cleanup. This involves:

- Bank Statement Deep Dive: Reviewing bank statements for "UPI IDs" or "IMPS Reference Numbers" that might not have been fully captured in Tally's manual entry.

- Stakeholder Outreach: Contacting clients to match unidentified deposits to open invoices or asking department heads to verify missing expense receipts.

- 48-Hour Escalation: For critical amounts, a company should use an escalation matrix, first attempting email contact, then phone calls, and finally involving senior management if the item remains unresolved.

Step 3: Leveraging Tally’s Automation Tools

TallyPrime offers several features to speed up this reconciliation and slash the time required by up to 90%.

Auto Bank Reconciliation (BRS)

By importing digital bank statements (Excel/CSV), TallyPrime can auto-match book transactions with bank entries based on amount, date, and instrument number. For more than 450 banks in India, Tally supports pre-configured formats that identify "Exact Matches" and "Potential Matches," significantly reducing manual work for Chartered Accountants during audit seasons.

On-the-Fly Voucher Creation

If a transaction appears in the bank statement but is missing in Tally (or is currently sitting in a generic suspense entry), the accountant can use the "Create Voucher" (Alt+J) option directly from the reconciliation screen. This allows for the immediate recording of bank charges, interest, or identified customer payments without exiting the report, ensuring the "Reconciliation Difference" reaches zero.

Step 4: Rectification Journal Entries

Once an entry is identified, it must be moved out of suspense using proper double-entry bookkeeping.

- Identified Customer Payment: Debit Suspense Account, Credit Accounts Receivable (Sundry Debtors).

- Identified Expense: Debit the specific Expense Ledger (e.g., Office Rent), Credit Suspense Account.

- Trial Balance Correction: If the suspense was created due to an error in a previous entry (like a transposition error where ₹5,000 was entered as ₹500), the corrective journal fixes the specific ledger and clears the suspense balance.

Preventive Precautions: Fortifying the Accounting System

Prevention is always more cost-effective than a year-end cleanup. Implementing robust internal controls ensures that the suspense account remains a temporary tool rather than a chronic symptom of poor management.

1. Segregation of Duties

A fundamental principle of internal control is that the person responsible for bank deposits should not be the same person who handles the bookkeeping for those deposits. This segregation reduces the risk of fraud where money could be diverted into a "suspense account" to cover up a shortfall in cash or a theft of funds.

2. Standardized Documentation and "Tone at the Top"

The leadership of a company sets the "tone at the top" regarding financial integrity. If the CEO creates a culture of "don't ask questions" or puts excessive pressure on the accounts team to meet deadlines without proper documentation, the suspense account will inevitably mushroom. Precautions should include:

- Mandatory Narrations: Configuring Tally to require narrations for every voucher, ensuring no entry is left without a "story".

- Advance Management: Using the "Loans and Advances (Asset)" group for traveling advances instead of the general suspense group, which provides better tracking of employee-wise outstanding amounts.

- Regular Spot Checks: Managers should conduct unscheduled spot checks of bank reconciliations and suspense ledger aging to ensure the "temporary" rule is being followed.

3. Tally Security and Configuration

TallyPrime offers several features to restrict the misuse of suspense accounts:

- User Rights: Restricting the ability to create new ledgers in the "Suspense Account" group to senior personnel only.

- Audit Trail: The "Edit Log" feature in TallyPrime (mandatory for Indian companies as of April 2023) tracks every change made to a voucher, preventing accountants from "hiding" older entries by simply altering their dates to keep them from appearing in aging reports.

- Effective Dates: Using the "Effective Date" feature allows transactions to be recorded on the day they occur but analyzed based on when they truly take effect, ensuring more accurate aging analysis of overdue payments.

Conclusion: Achieving Financial Clarity

The suspense account in Tally represents a transition, a bridge between the unknown and the known. While it serves a vital functional purpose in ensuring the continuity of the accounting cycle, its mismanagement poses severe risks under the Companies Act and the Income Tax Act of India. A lingering balance in this account is a warning signal of weak internal controls, potential audit failures, and a looming tax liability that can reach as high as 78% of the unclassified amount.

Cleaning up Tally data is not merely an exercise in moving numbers; it is a commitment to financial transparency. By leveraging Tally Prime’s automated bank reconciliation tools, implementing strict aging protocols, and maintaining a robust system of internal controls, businesses can transform their suspense accounts from "mystery boxes" into streamlined clearing channels. In the end, a clean suspense ledger is the hallmark of a healthy enterprise, one that is prepared for scrutiny, focused on accuracy, and compliant with the highest standards of Indian corporate law.

FAQs

1. What is a suspense account in Tally?

A suspense account is a temporary ledger used to record transactions when complete details are unavailable. It allows accounting to continue while discrepancies are investigated and corrected later.

2. Why does a suspense account get created?

It is created when there is incomplete information, mismatched trial balances, unidentified receipts, or posting errors during bookkeeping.

3. Is a suspense account an asset or liability?

It can appear under assets or liabilities depending on the nature of the transaction. However, it should always remain temporary and cleared promptly.

4. How long should entries stay in a suspense account?

Entries should be cleared as soon as possible. Ideally within the same accounting period to avoid audit issues and compliance risks.

5. What are red flags in a suspense ledger?

Aging entries, increasing balance, frequent unexplained postings, and repeated adjustments are major warning signals.

6. Can suspense accounts indicate fraud?

Yes. Long-pending entries or unexplained adjustments may signal fund diversion, misappropriation, or internal control weaknesses.

7. How do auditors treat suspense accounts?

Auditors review aging, supporting documents, and material discrepancies. Large or unexplained balances may attract qualifications or adverse remarks.

8. What happens if suspense entries are not cleared before audit?

Unresolved balances can lead to audit observations, compliance risks, tax scrutiny, or reputational damage.

9. How do you clear a suspense account in Tally?

Identify the correct ledger, pass rectification entries, attach supporting documents, and reconcile with bank or vendor records.

10. Can suspense accounts affect GST compliance?

Yes. Unidentified vendor payments may delay Input Tax Credit (ITC) claims and cause GST reconciliation mismatches.

11. Does CARO 2020 impact suspense accounts?

Indirectly, yes. Material discrepancies and undisclosed income reporting requirements increase scrutiny on unexplained balances.

12. What internal controls prevent suspense misuse?

Segregation of duties, mandatory narrations, regular ledger review, and restricted ledger creation rights help prevent misuse.

13. How often should suspense ledgers be reviewed?

Ideally monthly during bank reconciliation and again at quarter-end to prevent year-end accumulation.

14. Can suspense accounts impact financial statements?

Yes. Persistent balances distort assets or liabilities and reduce the reliability of financial reporting.

15. Is it normal for small businesses to use suspense accounts?

Yes, temporarily. However, consistent or large balances indicate weak accounting systems that require corrective action.

Contact Us

An expert will call you within 24 hours. No payment required to get started.

Related Post

How should a start-up complete ITR filing

Business entities must file their ITR annually to comply with the tax laws of their respective countries. It helps the government assess and collect the appropriate amount of income tax from taxpayers and ensures proper accountability of financial activities.

. 3 Mins.png)

5 step checklist for GST compliance in Indian Startups

Learn about how GST works. The basics of GST along with its compliances. Uncover what your business needs to keep in mind concerning GST rules and GST compliance.

. 3 min read.png)

₹20 Lakhs and Beyond: Understanding GST for Freelancers in India

Are you a freelancer or aspiring to be one? In this blog, uncover the basics of freelancing and requirements involving GST. Learn about all the exemptions, obligations, and compliances of GST for freelancers in india.

. 5 min read